Readers,

Insane week so far. We are trading well above the weekly market makers expected range. The weekly expected high was 437.03 and we ended Thursday’s session at 442.60. It’s possible they might try and close it back within that range but we will need to look at a few other things before we make that decision.

I did not have time to do a post for 6/15 but look at what happened. I said in 6/14’s plan that I was watching for a gap fill to the downside and that the key level to chase 445 was 436.01.

During FOMC we knifed down to the gap, price then fought and reclaimed that 436.01 level and we closed at 442.60, do we hit those POC’s at 445.46/446.48?

On the monthly profile we are still at an imbalance to the upside on our current monthly profile and we are closing in on April 22’ POC.

On the weekly profile it's the same thing, we are at a weekly imbalance to the upside. bulls want to see the current VAH hold at 339.92. We have that naked weekly POC at 445.36 that we have been chasing but under 439.92 opens the door to 436.69-432.23

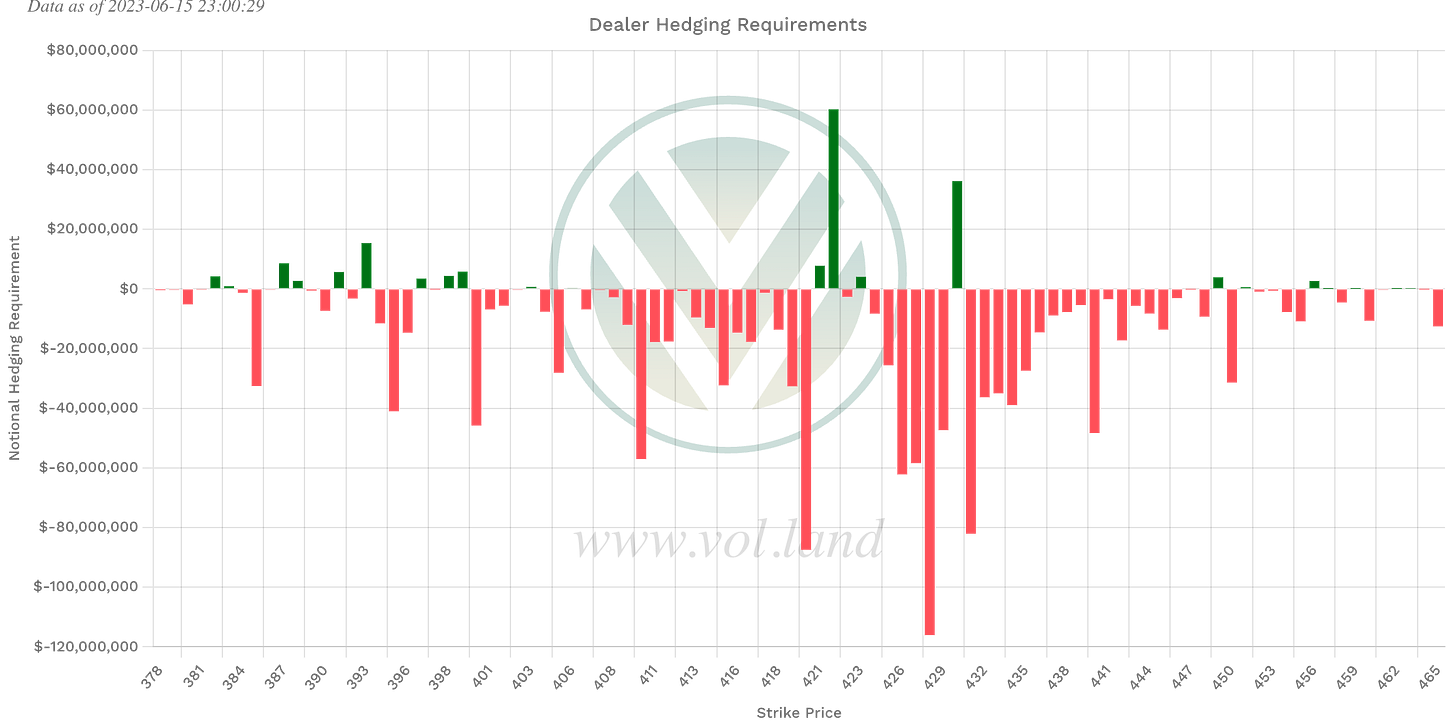

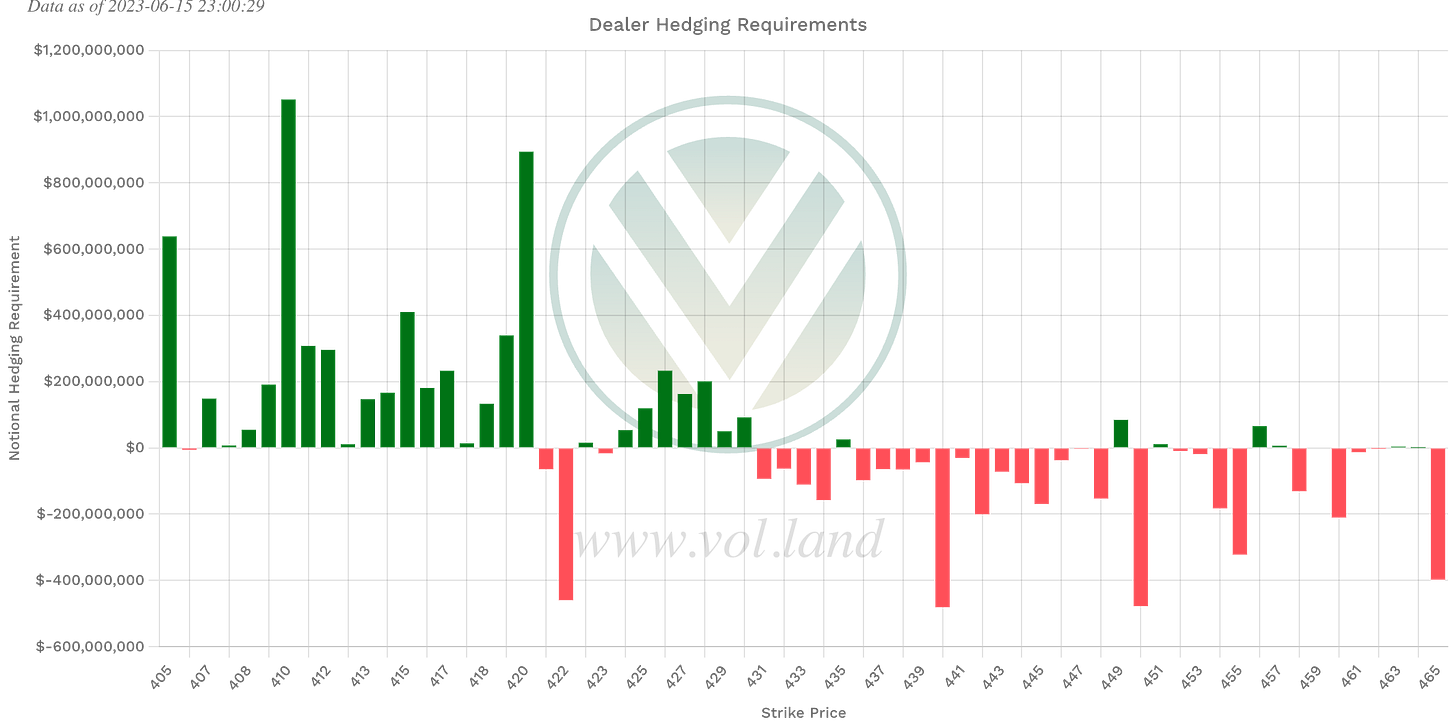

Positive Gamma

421, 422, 423, 430, 449

Majority of the positive Gamma is below spot price at 430 and 422.

Negative Vanna

421, 422, 431-434, 436-448

Vanna is heavily positive below us and we are sitting in negative Vanna right now. VIX is also at lows, in order to keep pushing up we need to see vix continue lower. If VIX picks up and rallies, those positive levels below us could be strong magnets sub 430.

Key levels above

Key levels below

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.