Readers,

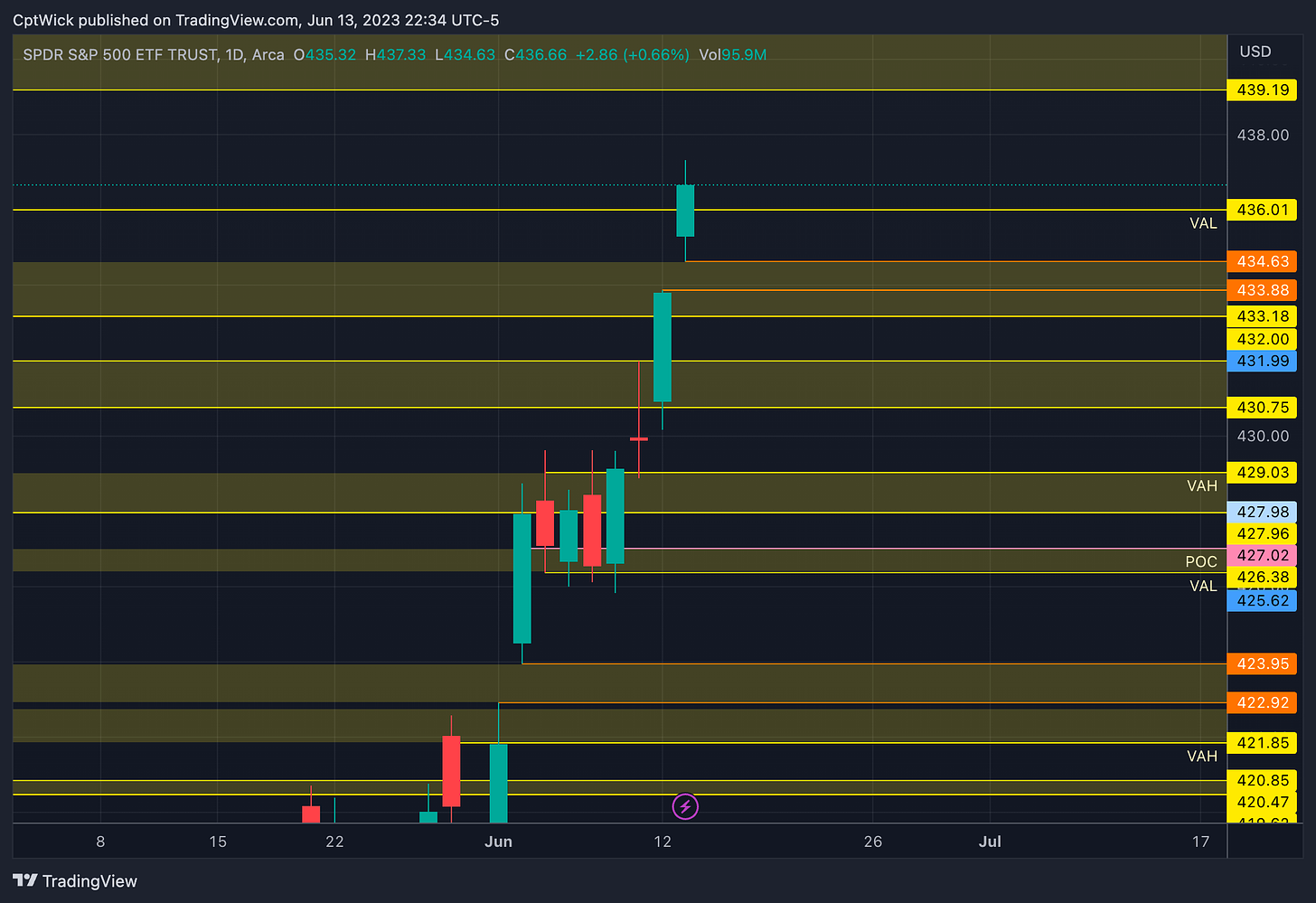

In Monday’s plan we highlighted the MMs weekly expected move of $7.13, well that was achieved today with the MMs weekly expected high at 437.03.

Does this mean we cannot go higher? No! But that level did act as resistance multiple times during today’s session.

Two things happened at the close. First thing that I noticed was we closed below that market maker level of 437.03. The second thing I noticed was that we closed inside a new weekly value area that has a VAL of 436.01, POC of 445.46 and a VAH of 447.55. So, as long as price is trading above 436.01 we should target the POC of 445.46.

On the monthly profile, we have now closed at an imbalance to the upside above this months current VAH of 431.99 and we are inside April 22’s value area with he next naked level at 445.48.

On the weekly profile we closed within value just above the POC. The profile is still young, but it is currently showing a P profile. This typically signals weak buyers, but we are only two days into the trading week so a lot can happen. A key take away from this profile is this, we closed above a new VAL at 436.01 and that POC is up at 445.46. As long as price stays accepted above 436.01 we should target 445+

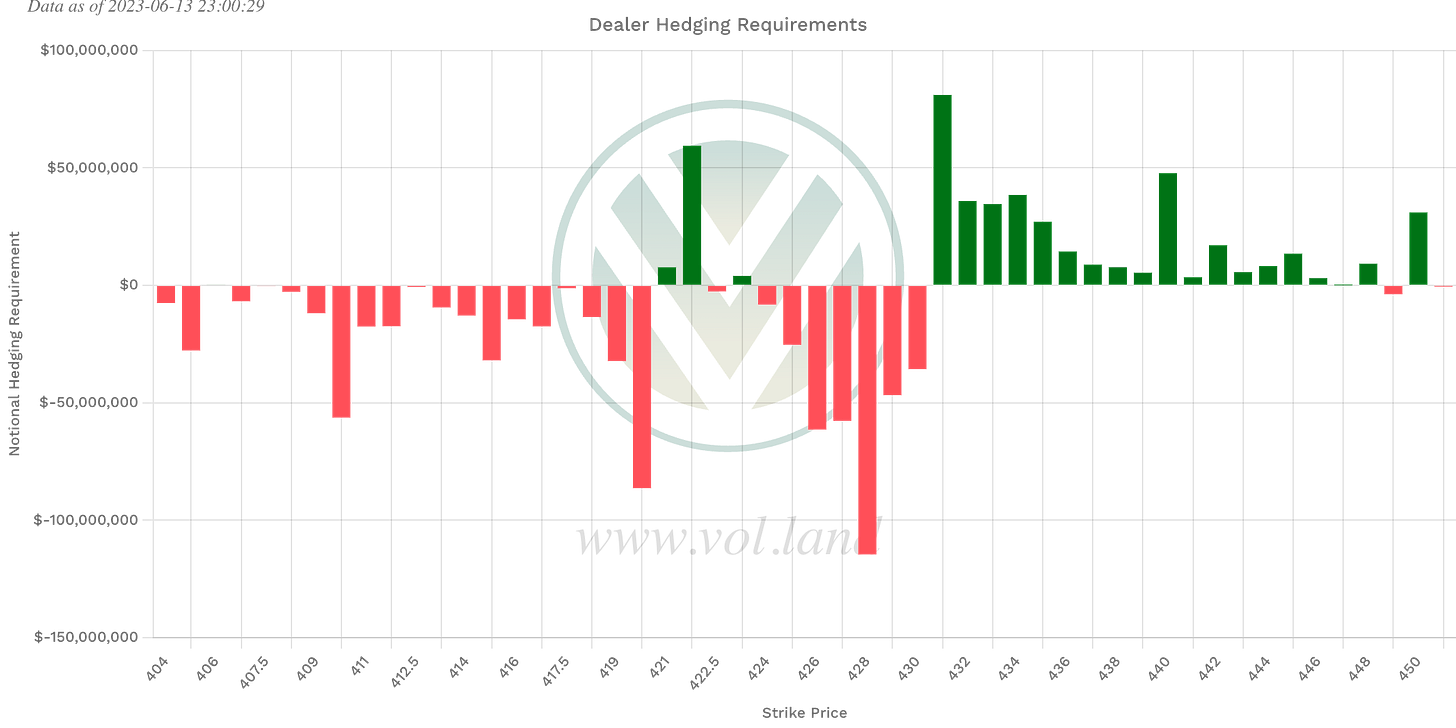

Positive Gamma

421, 422, 423, 431+

423-422 is a key area based on a few things. #1 the positive Gamma exposure is pretty high at 422 and #2 its a gap fill. I would love to see this area trade again. If it does and we rally out of it, I would be confident taking longs.

Negative Vanna

421, 422, 423, 431-434, 436-448

421, 422, 423 are also negative Vanna, bringing more conviction to that level. We need to keep an eye on these levels as time passes. If the Gamma and Vanna exposure stays, I think we could potentially fill the gap around 423-422.

We have two gaps to fill below current spot price, one is at 434.63-433.88 and one at 423.95-422.92. These are key areas I am watching.

Key levels above

Key levels below

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.