Readers,

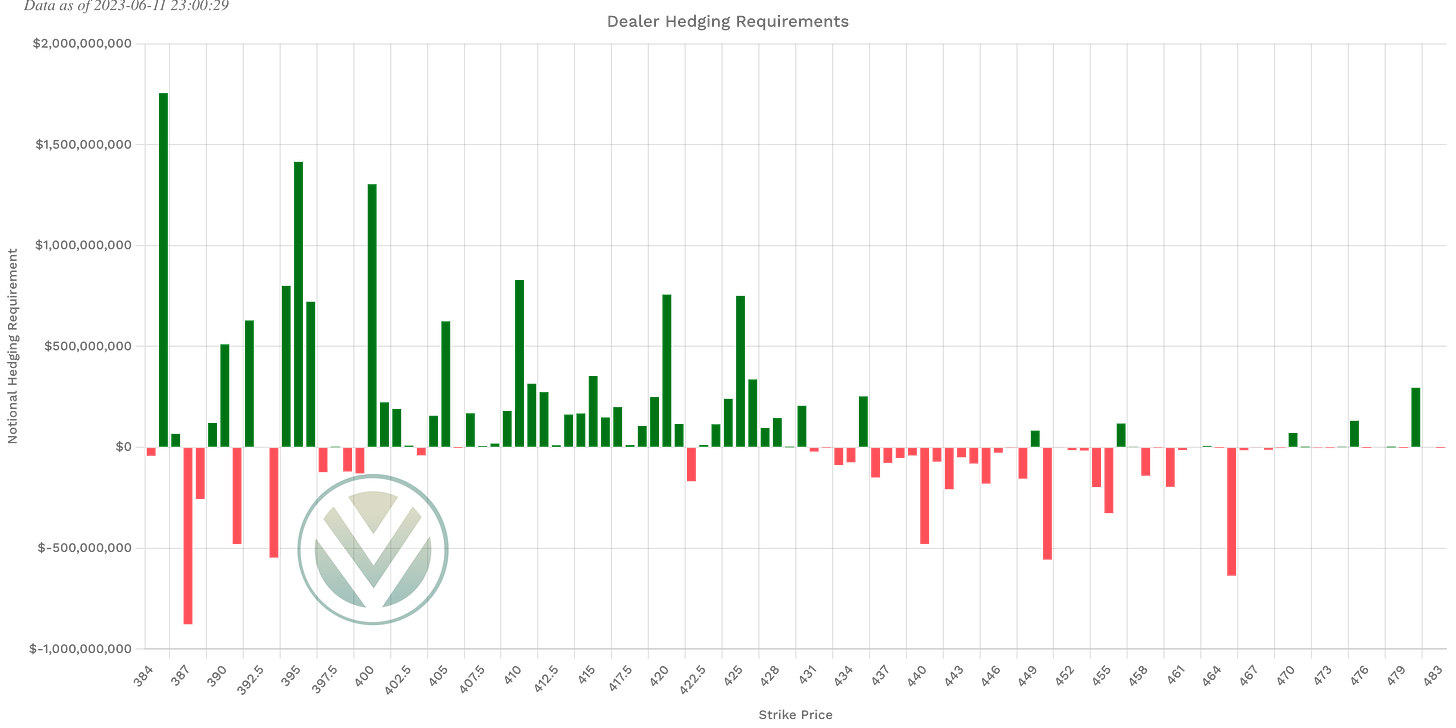

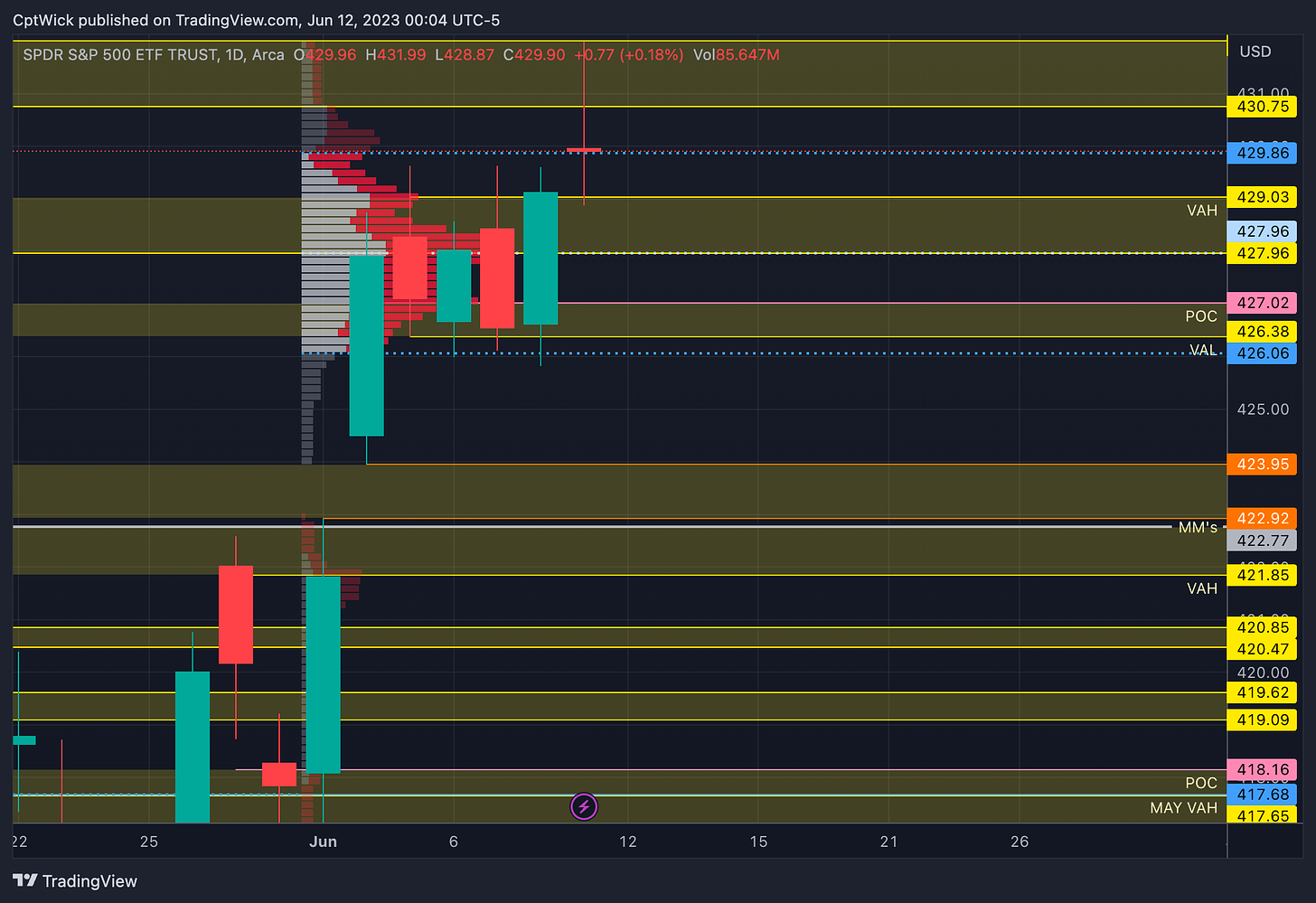

Last week was a dud, but our levels were respected, the bears failed to send us under our zone at 426.53-425.53, and the bulls couldn’t surpass 431.23. The market makers were successful in keeping us within the weekly expected range. Things are shaping up for another bull leg? We have a massive week ahead with cpi, fomc, and opex, anything can happen.

The MMs are expecting a weekly move of $7.13 in SPY by June 16th. Giving us an upper range of 437.03 and a lower range of 422.77.

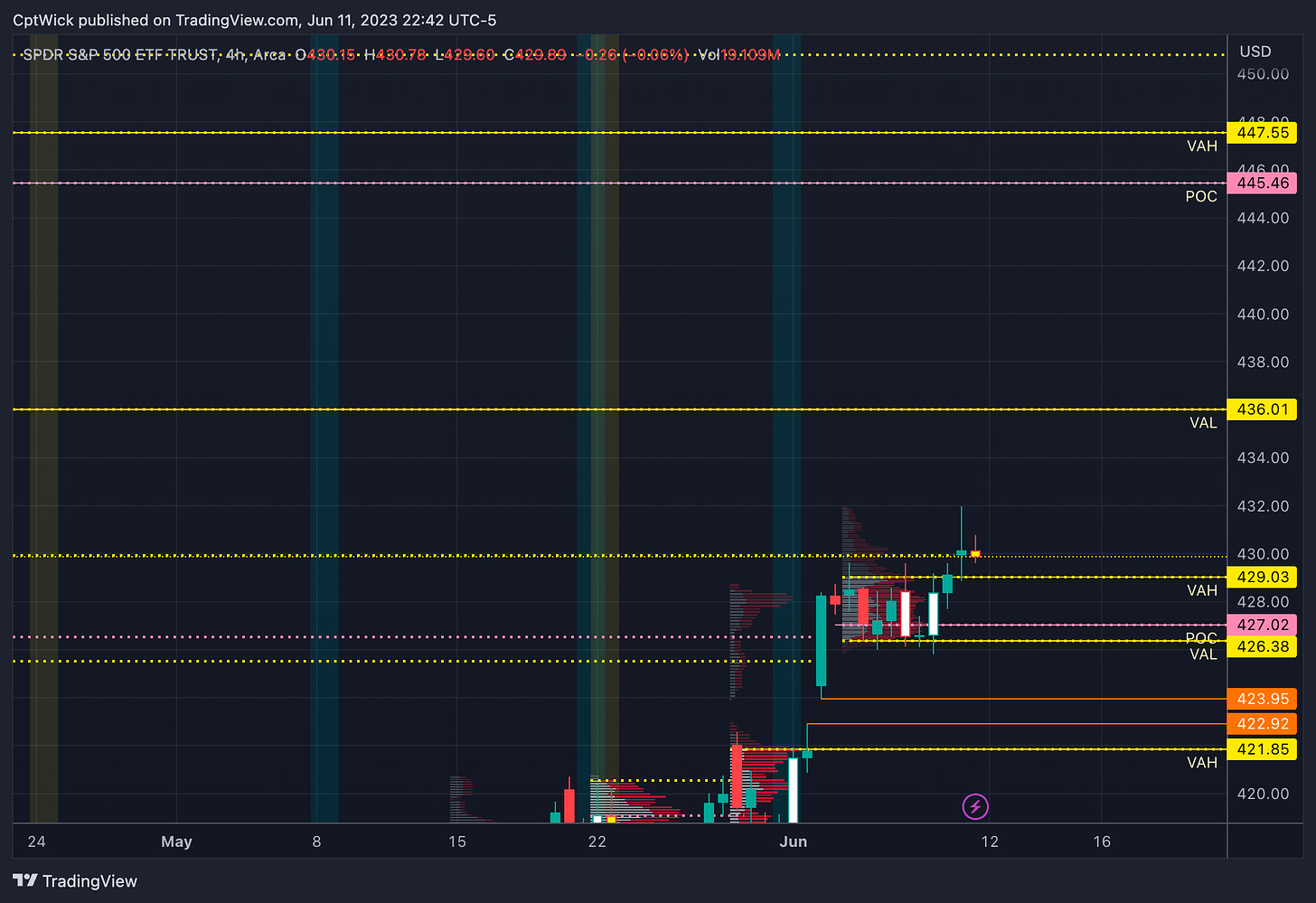

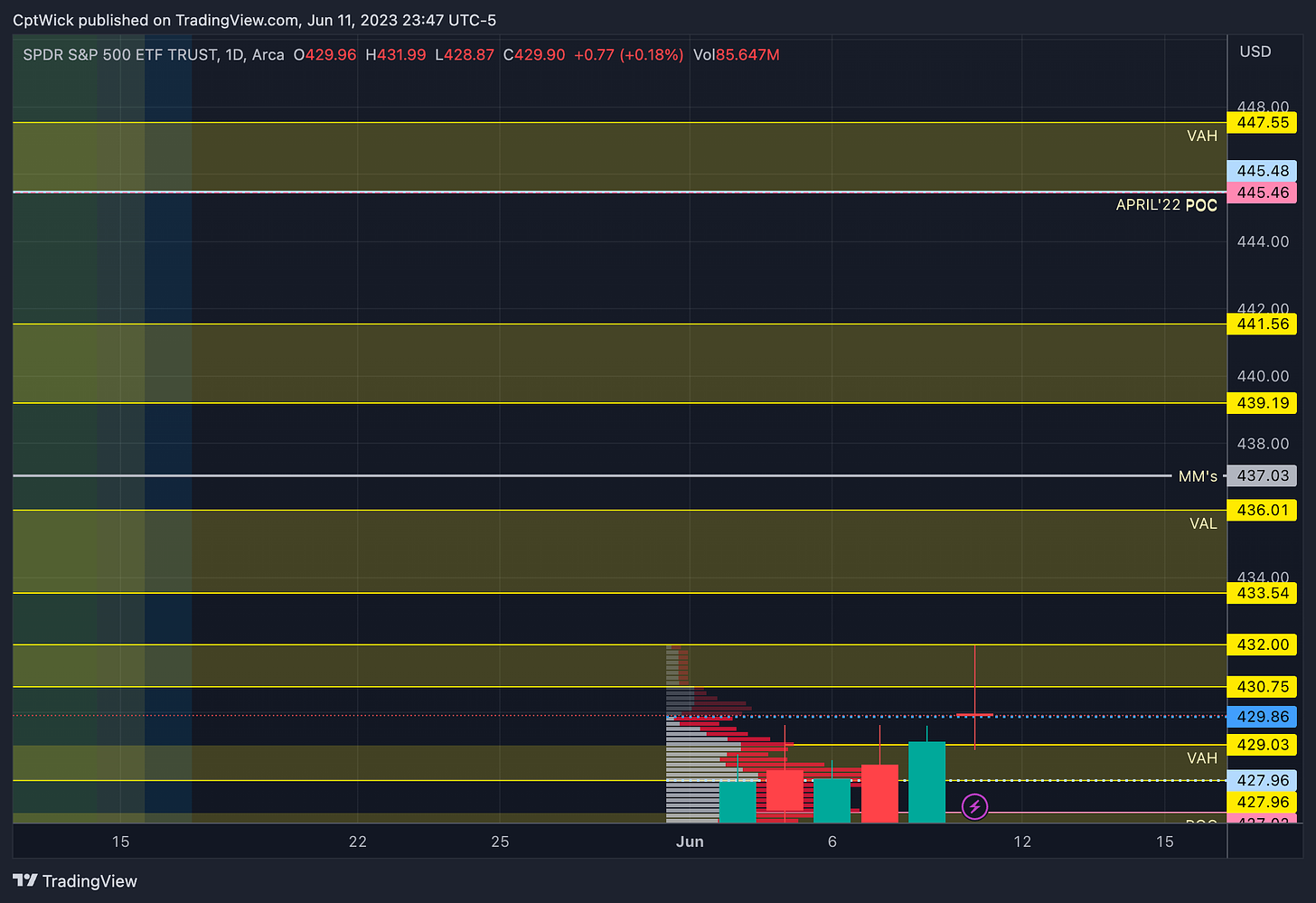

On the monthly profile we are building value here at 430. If price can stay above 428-430 I think there is a chance that we see April 22’ naked POC. Right now on this profile we are trying to stay accepted into that April 22’ value area at 428 (this area has been tested before but has failed to stay above. If the bulls can defend 428 I think 445 comes next. We need to break it down on a smaller timeframe to see if there are any other stops along the way.

On the weekly profile we can see that we close last week at an imbalance to the upside. Last weeks VAH is 429.03, POC is 427.02, and VAL sits at 426.38. A pullback into this area could be health for a move to 436.01-445.46. We still have a gap that has not been filled yet at 423.95-422.92.

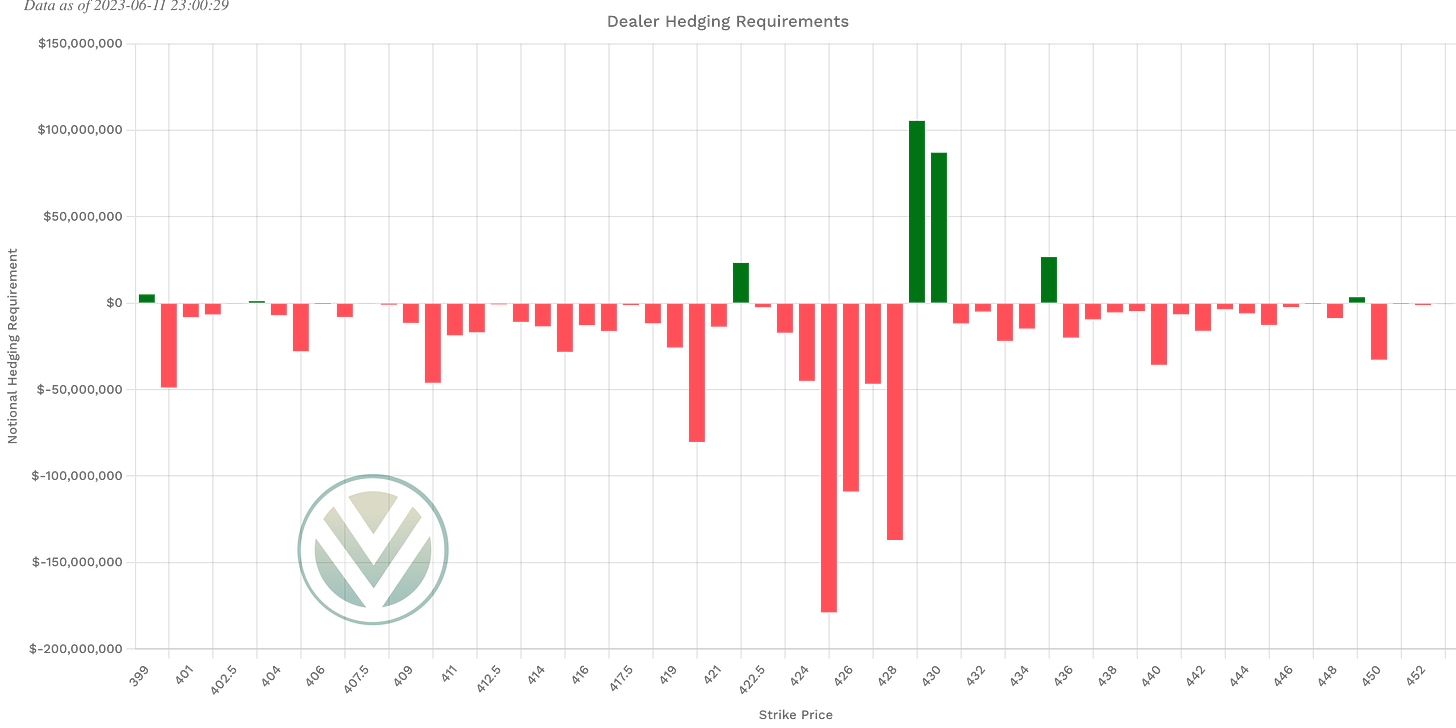

Positive Gamma

422, 429, 430, 435

Negative Vanna

403, 422, 431-434, 436-448

Key levels above (previous close - 429.90)

430.75-432

supply, 430 is positive Gamma and negative Vanna at 431

433.54-436.01.

supply, 433,434,436 are all negative Vanna

435 is positive Gamma.

436.01 is a naked weekly VAL

437.03

Market Makers weekly expected high.

439.19-441.56

supply, negative Vanna.

445.48-447.55

April 22’ naked POC and a naked weekly VAH

Key levels below (previous close - 429.90)

429.86

This month’s current VAH.

429.03-427.96

demand, last weeks VAH and the current monthly POC

429 is positive Gamma

427.02, 426.38, 426.06

Last weeks POC and VAL

426.06 is this months current VAL

423.95-422.92

We have a gap in volume here, if this area trades it will be very important to see if we rally or if we lose it and retest. Eyes on this zone!

422.77-421.85

422.77 is the MMs weekly expected low

421.85 is a naked weekly VAH

420.85-420.47, 419.62-419.09

Demand

418.16, 417.68, 417.11

Naked weekly POC and May’s VAH

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.