Readers,

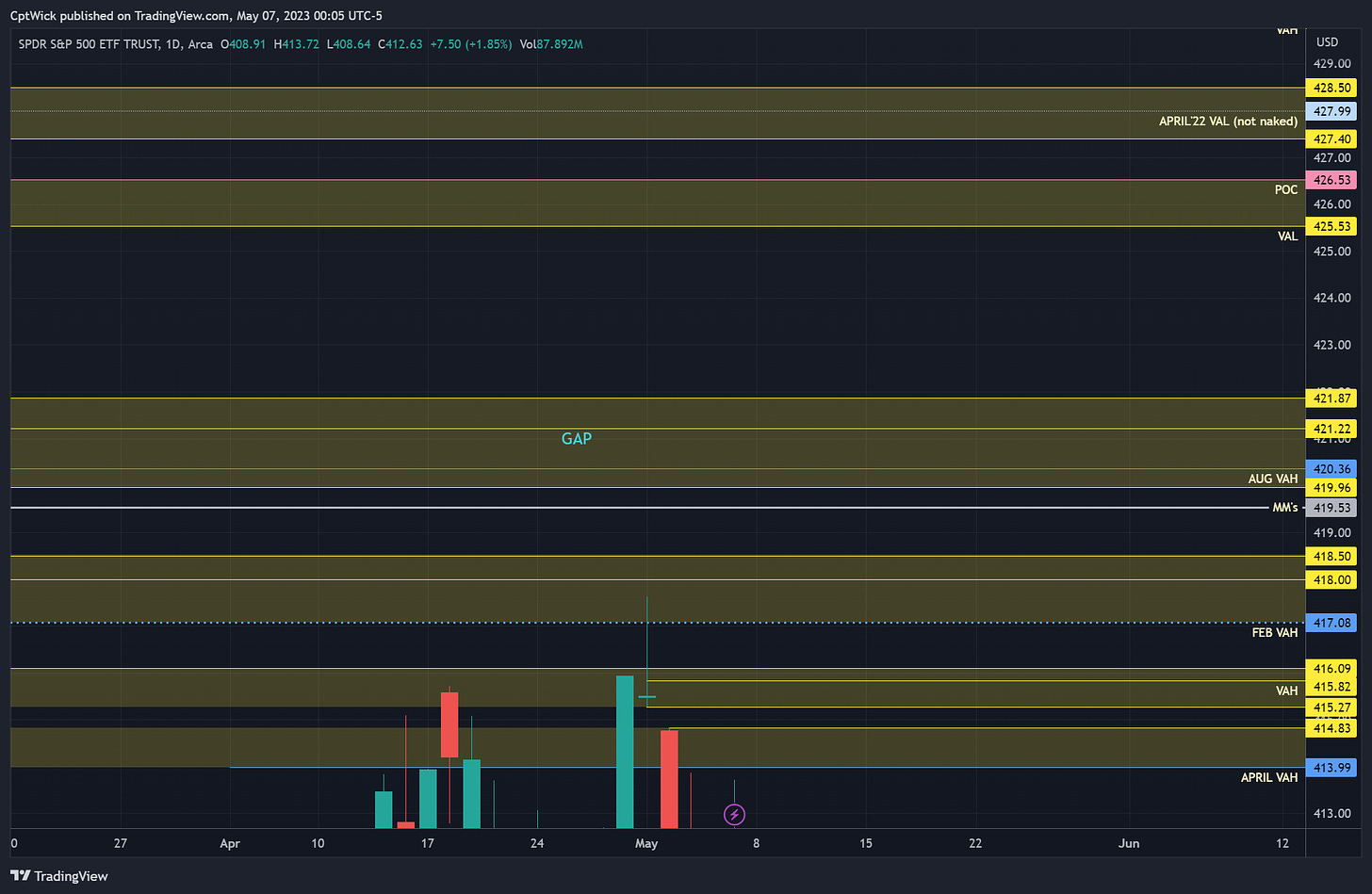

This week the market makers are expecting a range of $6.90, giving us a upper range of 419.53 and a lower range of 405.73.

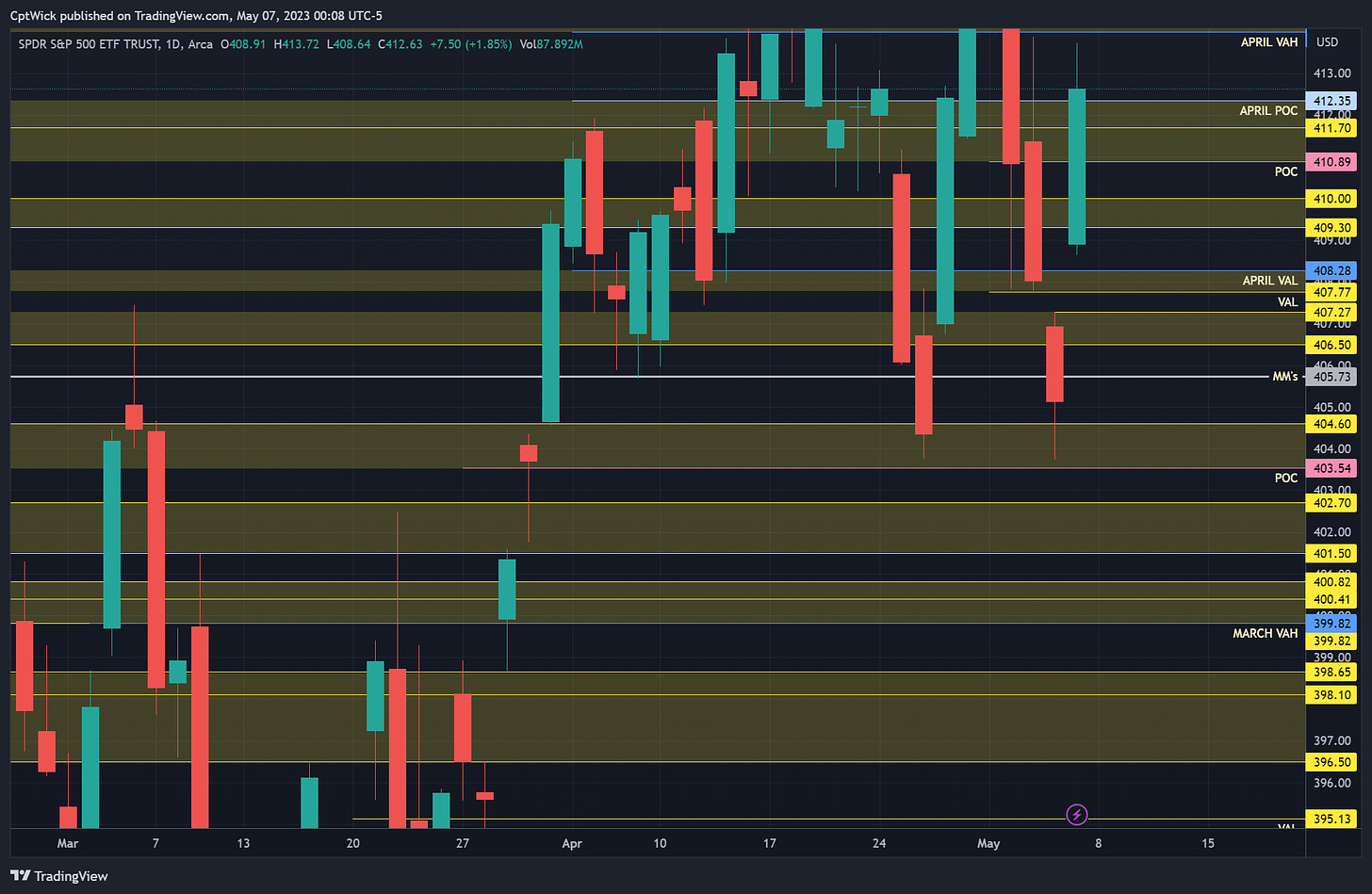

On the monthly profile, we are still pinned inside April and Feb’s value area and we closed on Friday right above April and Feb’s POC but didn’t quite reach April’s VAH. The current May POC is 410.75, VAL is 407.77, and VAH at 415.68. The bulls did a good job of bringing price back to value once we broke the VAL on Thursday.

The weekly profile ended with similar values as the monthly, makes sense right? First week in May. The values are POC 410.89, VAL 407.77, and VAH 415.82. We still have a naked POC at 403.54 and up at 426.53, which one will trade first?

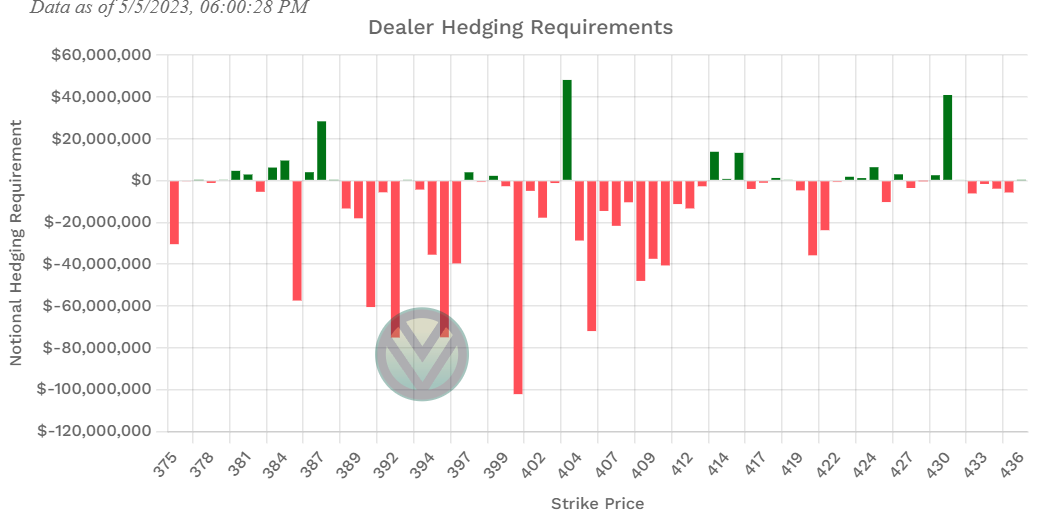

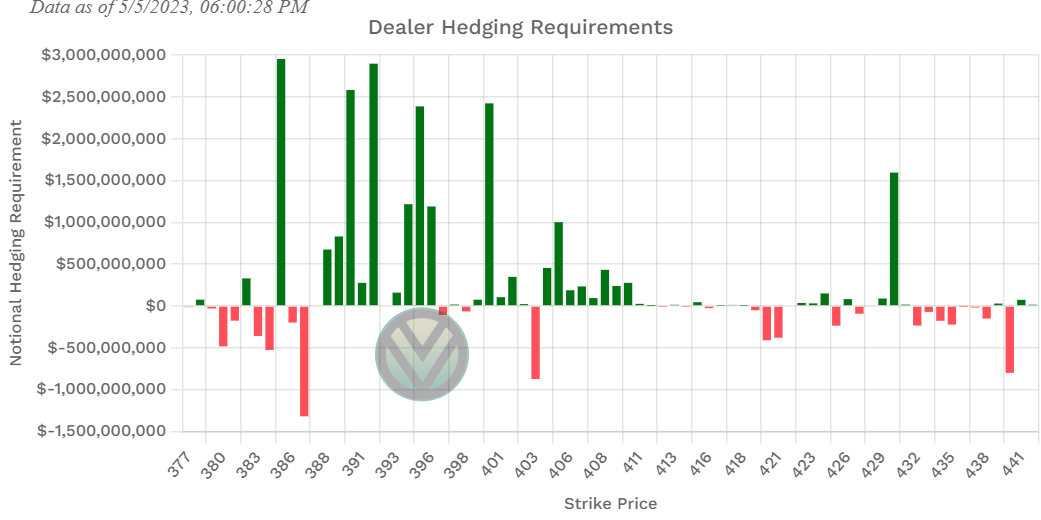

Positive Gamma

424, 415, 413, 403, 398

413 and 415 are going to be key for Monday.

Negative Vanna

425, 421, 420, 419, 416, 403, 398

Key Levels Above (previous close - 412.63)

413.99 - 414.83

413.99 is April’s VAH

413/415 are positive Gamma (this could be the key level on the week, if we come up to this level and reject it could mean far lower prices, but if we break it, we could see 420+)

415.27, 415.82, 416.09

We have a gap in volume from 414.83 to 415.27

415.82 is last weeks VAH

415 positive Gamma

416 negative Vanna

417.08, 418, 418.50

417.08 is Feb’s VAH (still a key level) a break of this can send us higher.

419 negative Vanna

419.53, 419.96, 420.36, 421.22, 421.87

We have a gap in volume from 419.96 to 421.22

419.53 is the MMs weekly high target.

420.36 is Aug 22’ VAH

420/421 negative Vanna

Key Levels Below (previous close - 412.63)

412.35, 411.70, 410.89

412.35 April’s POC

410.89 last weeks POC

410 - 409.30

Demand

408.28 - 407.77

408.28 April’s VAL

407.77 last weeks VAL

407.27 - 406.50

We have a gap in volume from 407.77 to 407.27 could be strong demand.

405.73, 404.60, 403.54

405.73 is the MMs weekly downside target

403.54 is a naked weekly POC

403 is negative Vanna and positive Gamma (stronger support)

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.