Readers,

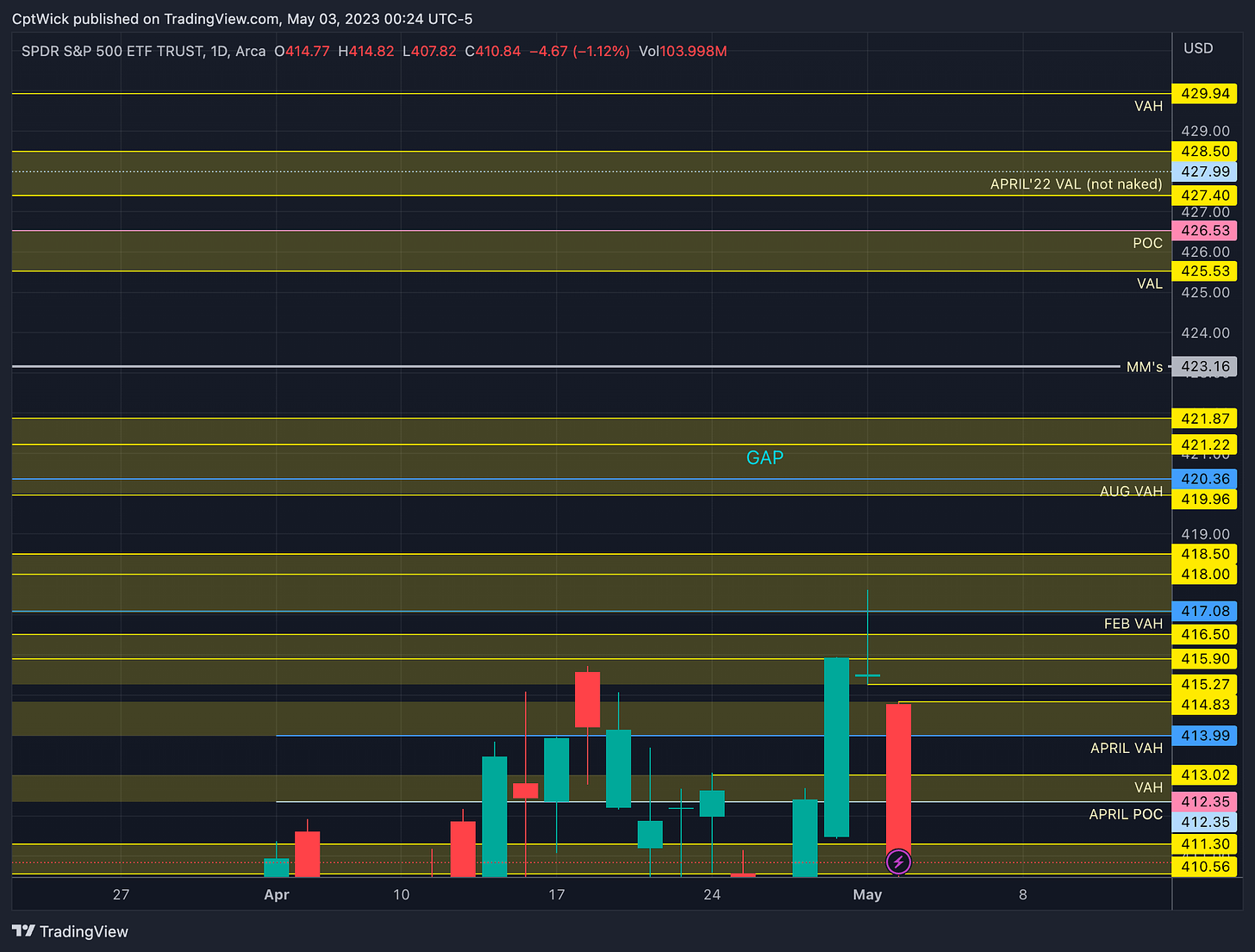

Today was a little insane, a little FOMC tease maybe? Today had two amazing setups based on our levels from the previous plan. Puts at 1 (not 1pm but the first circle) early in the session when we starting creating lower lows and basing under April’s VAH, was a good entry for puts to target the POC. When we got the POC we based under and we sold down to the MMs expected low and the April VAL. This then created the 2nd (2) trading opportunity with calls.

I was having a conversation with DarkMatter and a few others a little before 10:00am CST and I said we just tested April’s VAL and the weekly MMs expected move to the downside, and it’s Tuesday.

So I was thinking we could get long here. Now is it possible to move past the MMs expectations? Absolutely, but we had other reason’s to have conviction on a bounce, we had April’s VAL and I said in the previous plan that we didn’t have any Gamma support under 412, until 403 and that it could get nasty, and I think it would of if that VAL would of failed. Two minutes after this comment I decided to take a shot on a call position that ended up working, but I got in a little early but it ended up working.

This is what it looked like when I entered, and if you scroll up to the first chart you can see that we eventually made it back to the 410.85-411.30 zone where I planned on exiting the position.

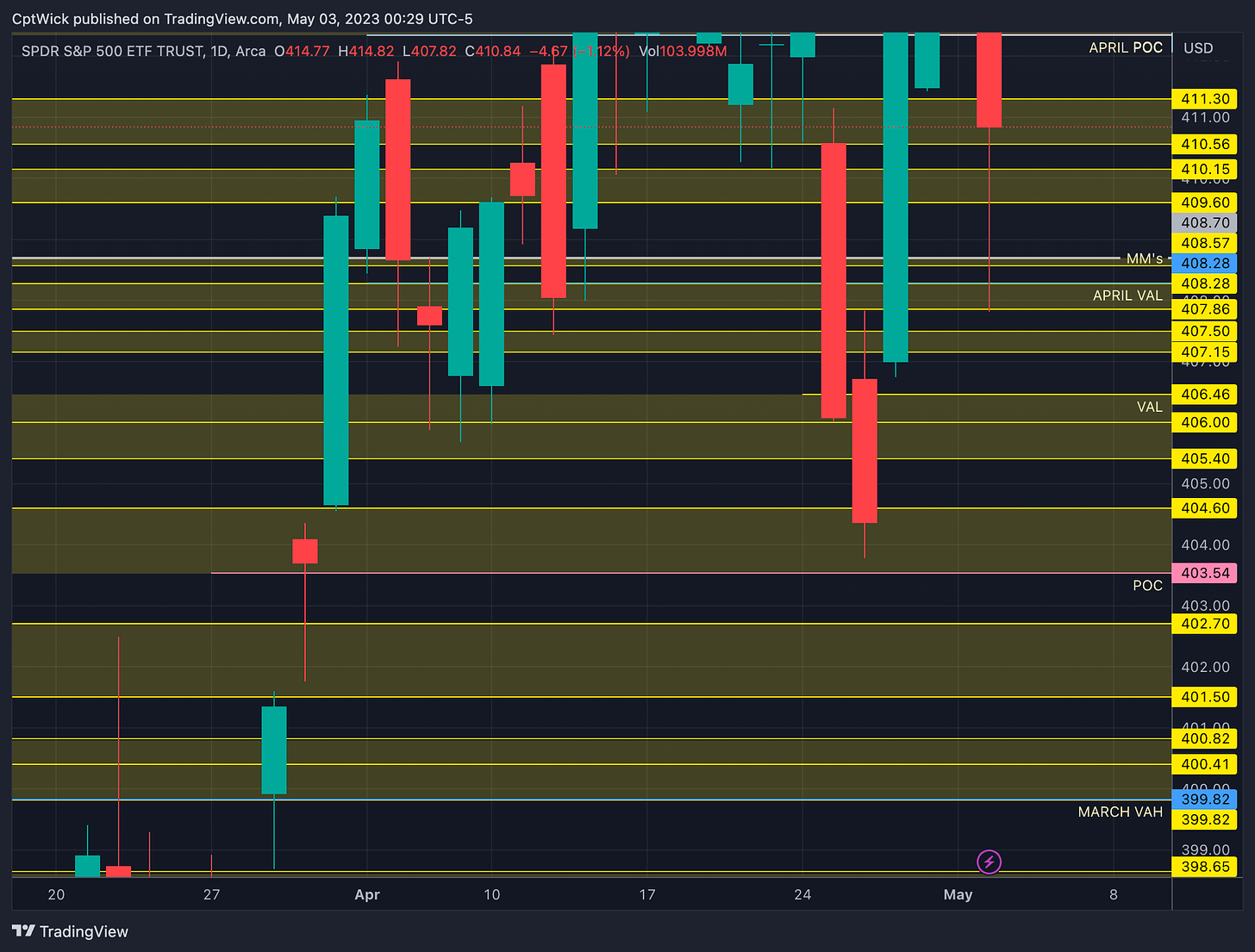

Here is a current look at the monthly volume profile, I know that we are only two trading sessions into May, but I am trying to highlight that in just two days we flushed all the way down to April’s VAL. This is also where our current VAL is forming at 407.82

On the weekly profile we have a lot going on that we need to point out. First thing, we gapped down at the open, leaving no volume at 414.83-415.27. Second, we lost the VAH and the POC but found support before testing the VAL. Third, we ended up closing within value (above the VAL at 410.56). if we trade back into the POC and VAH and price is rejected, we could test that VAL at 406.46. If we break back above 413.02 the next area of interest is going to be that gap.

Tomorrow will be interesting that is for sure. They pinned us back around that 411 area where we have Aug 22’, Feb 23’, and April 23' POC’s. This zone is becoming a gamble if you will, or a big chop zone and you can get beat up pretty quick if you do not have a proper plan with entries, stops, or potential targets.

Positive Gamma

403, 430

Not the ideal Gamma look going into tomorrow for me, there are only 2 notable levels.

Negative Vanna

425, 420-412, 403

IF we get a IV increase we could potentially see 403. If IV comes down and we get above 415 we could see 420.

Key Levels Above (previous close - 410.84)

Key Levels Below (previous close - 410.84)

I know there is a lot going on but if we just look at the bigger picture it should make more sense. April’s VAH or 414 is a big level for the bulls tomorrow, if they can reclaim it I think we can make a run at Feb’s VAH again at 417.08 and possibly Aug 22’ VAH. The MMs are only expecting 408.70 as the weekly low and it has been defended so far. If we lose April’s VAL at 408.28 we could see that naked POC at 403.54 and then March’s VAH is at 399.82.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.