Readers,

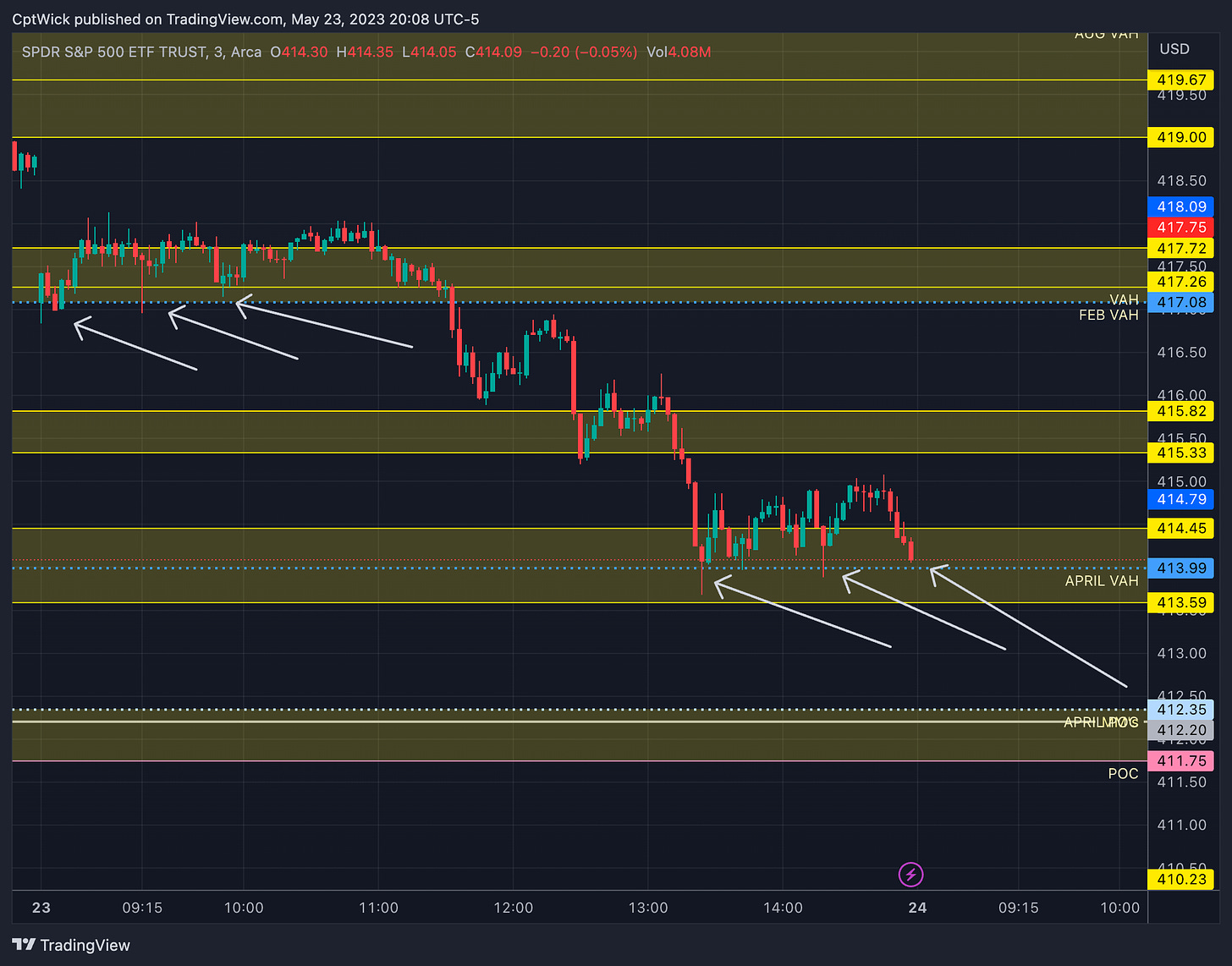

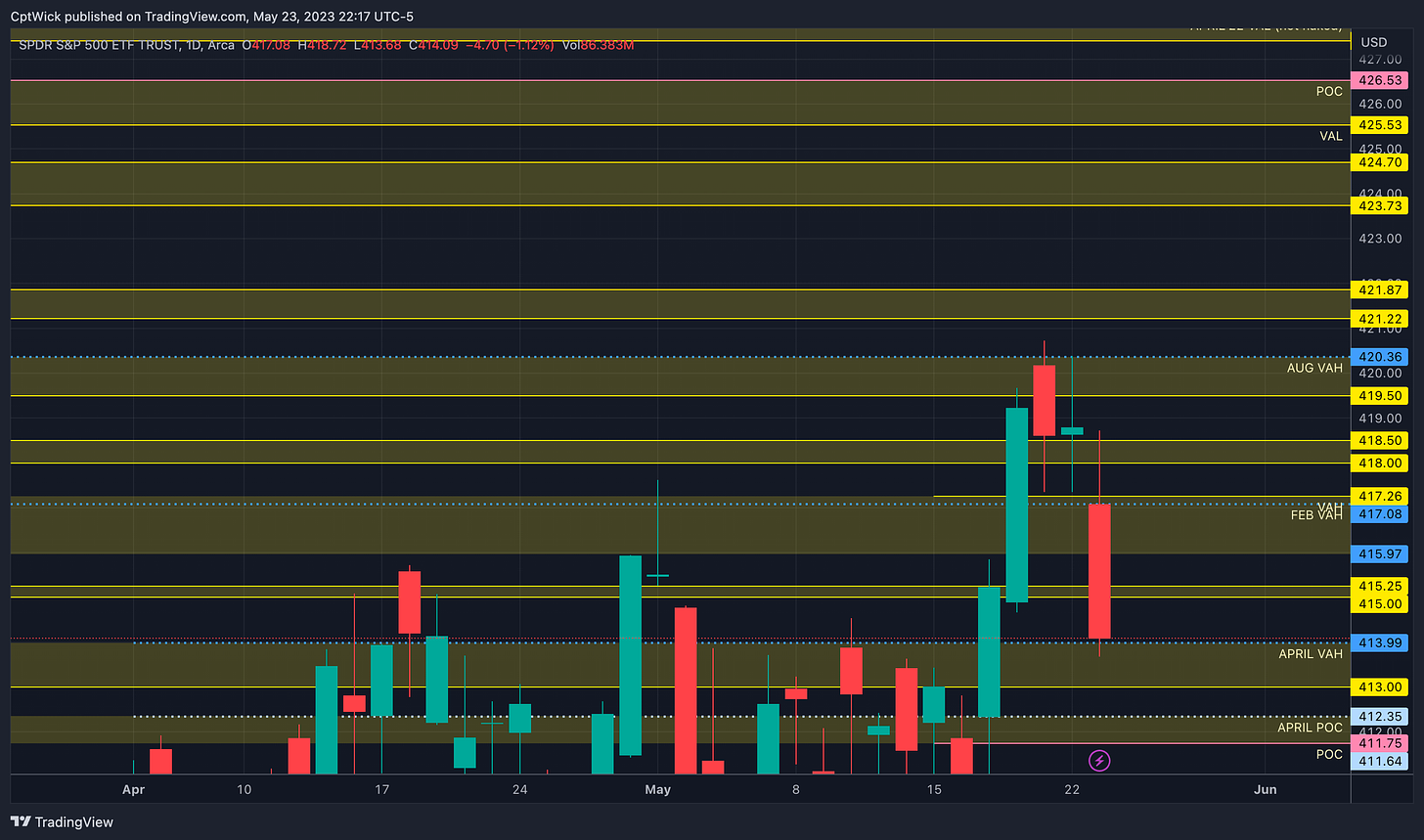

We NAILED that zone. In the most recent plan for 5/22 I said that we were watching what levels? 420.36 and 417.08! I also said that if 417 broke I wanted to see what would happen at 414. Here we are… closed at 414.09, I do believe that this level will be the most important going forward, does it hold and we see 425? Or does it fail and we go to 403.50? We will have to wait and see but I will help guide you with this letter.

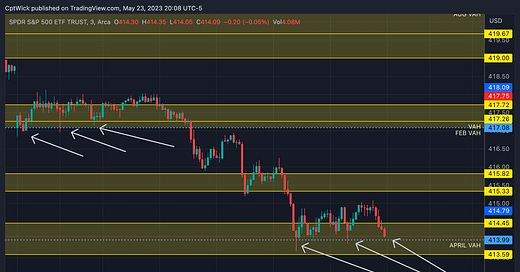

At the open today the bulls had to work HARD to defend that 417.08 level (all that level is a previous (February) monthly VAH). It finally broke around 11:30am CST and it broke hard. We almost retested but the bulls ran out of steam. We proceeded down to 414 just as I expected. Here is what I said.

We will break down the charts next, why is 414 important? If you have been following along over the weeks you know that 413.99 is April’s (last month) value area high (VAH). You can see from this chart below, how well these levels are respected. The bears defended that Aug 22’ VAH twice and brought price back into balance under the Feb VAH and the current (May) VAH at 415.97. The current Point of control (POC) sits at 411.64 and the VAL is at 408.66. These are very similar levels to April’s value area. Price is either going to use this area (414-411) as support or its going to eventually turn into resistance.

If we look at the weekly profile you can see that we were trying to build value above last weeks VAH at 417.26. The weekly imbalance to the upside was brought back into value. This weeks VAL currently sits at 416.16, that paired with last weeks VAH at 417.26 will become a key level for the bears to defend if they want to send prices lower. We have that naked POC at 403.54 that we need to one aware of.

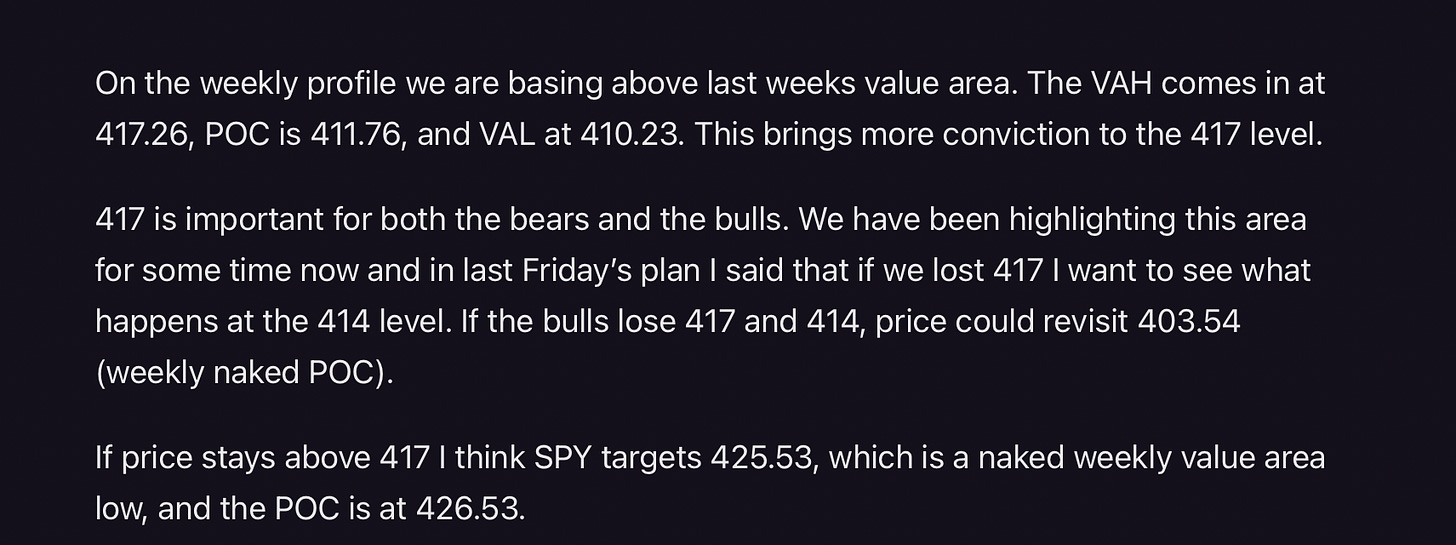

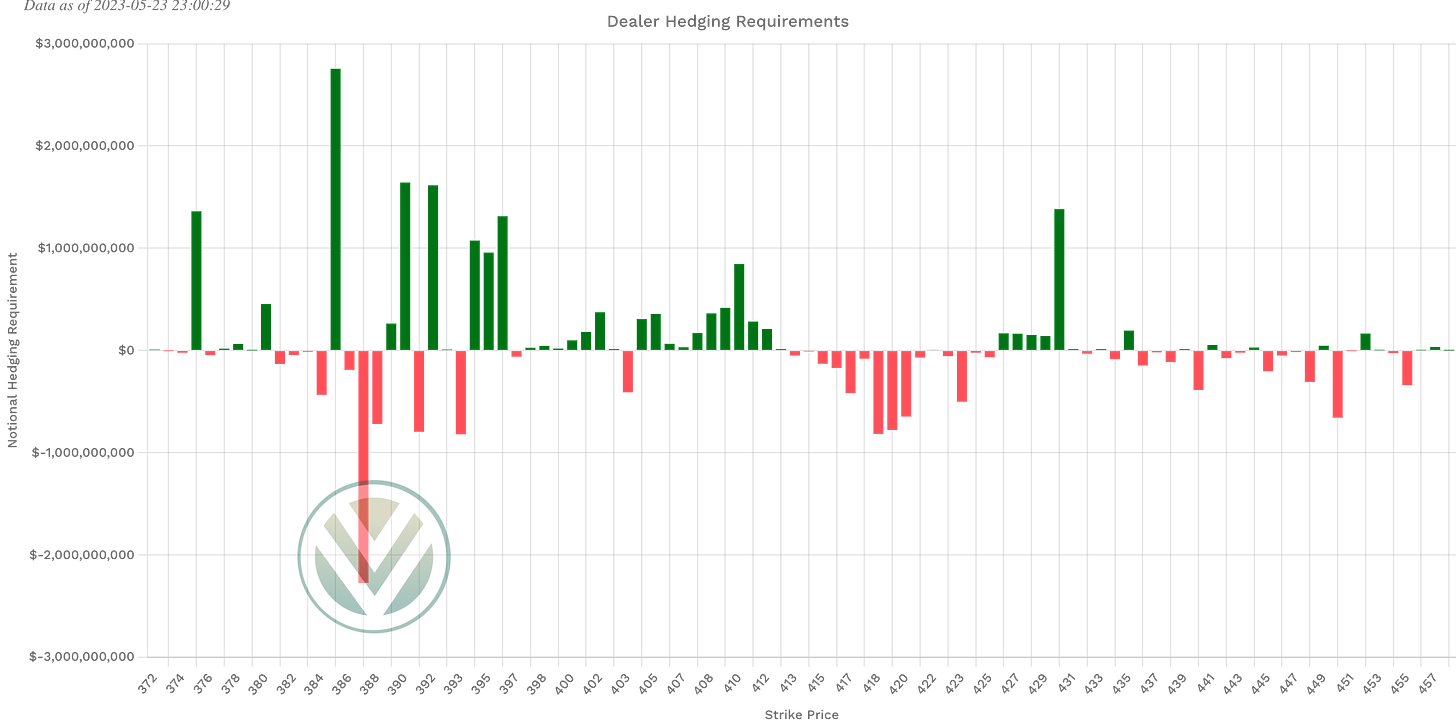

Positive Gamma

403, 413, 426-430

These are the notable positive gamma levels for this area that we are in. Last plan we didn’t have positive gamma below spot until 403, they have been building at the 413 level.

Negative Vanna

393, 403, 413-425

If you go and read 5/22’s trade plan you will see that we didn’t have any negative Vanna at this cluster from 413-425. This might be signaling a move down. Im not going to say it is but if price falls under that 413 level, this negative Vanna should help push price down.

We will need a drop in volatility (VIX) in order to push through this 413-425 zone.

Key levels above (previous close - 414.09)

415-415.25

Supply

415 negative Vanna (resistance)

415.97-417.26

415.97 is the current monthly VAH

417.26 is last weeks VAH

416/417 negative Vanna (resistance)

418-418.50

Supply and negative Vanna

419.50-420.36

Negative Vanna and 420.36 is Aug 22’ VAH (keep in mind that it is no loner naked, its been breached. What happened when 417.08 was breached the first time? it sold off… but on the second attempt we broke above. So watch 420.36 for either a breakout or a “double top”

421.22-421.87, 423.73-424.70, 425.53-426.53

425.53 and 426.53 are naked weekly VAL and POC for a naked value area.

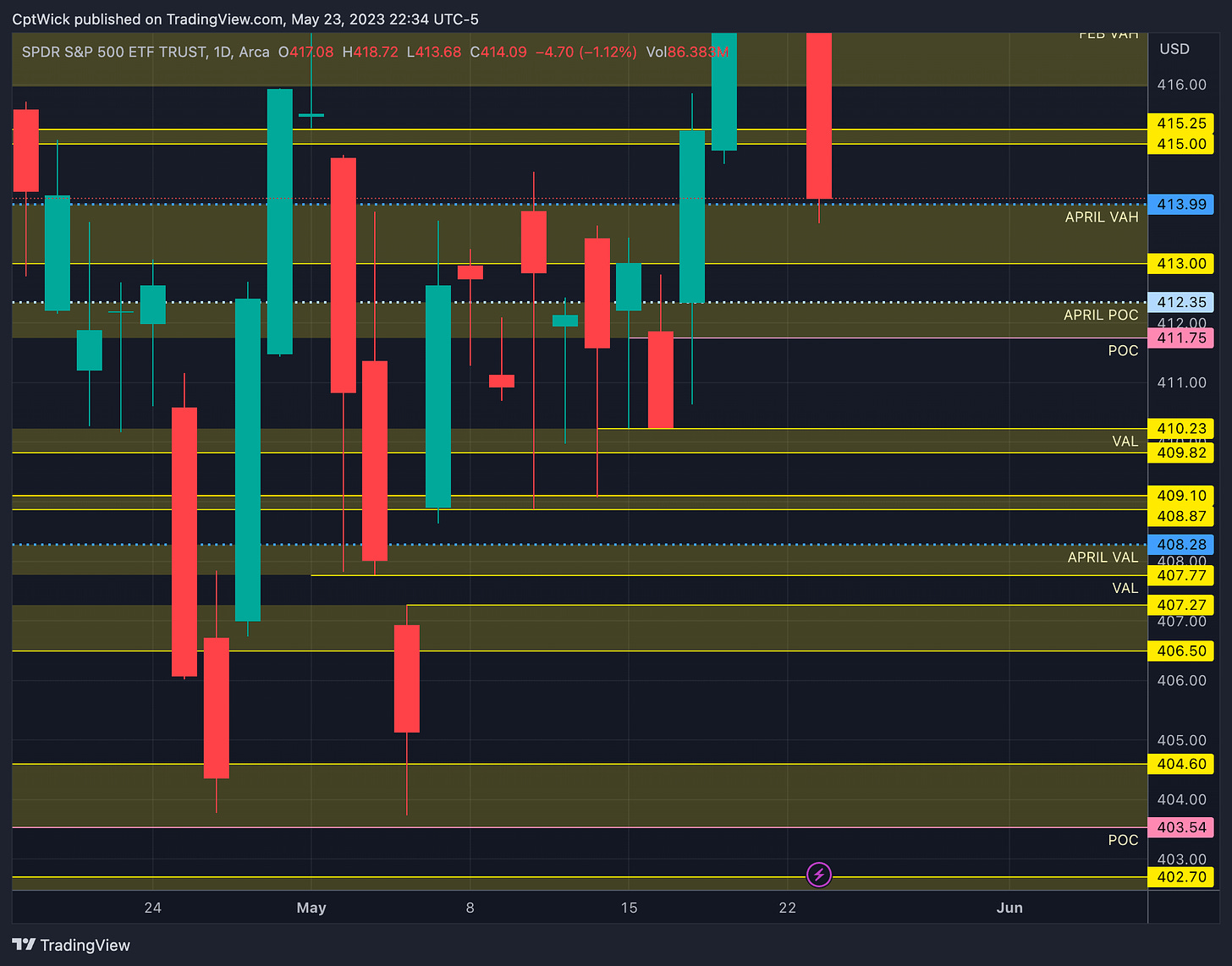

Key levels below (previous close - 414.09)

413.99 (414)-413

April’s VAH and 413 is positive Gamma and negative Vanna

412.35-411.75

412.35 is April’s POC

412.20 is the MMs weekly expected low *see 5/22’s trade plan*

411.75 is last weeks POC (the current monthly POC sits right here as well (411.64)

410.23-409.82

410.23 is last weeks VAL

Demand

409.10-408.87

Demand

408.28-407.77

April’s VAL and 407.77 is a naked weekly VAL

The big take away from this plan is this, if I am a bull here, I want to see 414-412 hold, if we start pushing down towards 408 we run the risk of trading 403. 414 is a MASSIVE level in terms of the volume profile. If they want to full rotate through April’s value area and the dreadful 412 zone…. 408.28 is that VAL. If 414 holds and we can take back 417, I think we might go and test 420.36 again and possibly 425-426. Be safe out there, crazy news can cause a violent move in any direction. I hope you can find value in these plans, I do them for myself and the few I trade with on a daily basis but I upload them here to keep myself accountable! Enjoy!

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.