Readers,

We warned that this current value area that we are in is a big ole chop zone, everyone is in agreement here at 412, everything is balanced. I fell like this is getting very repetitive but yet once again, going into next week our levels are going to be very similar, not much has changed. But where do we go from here?

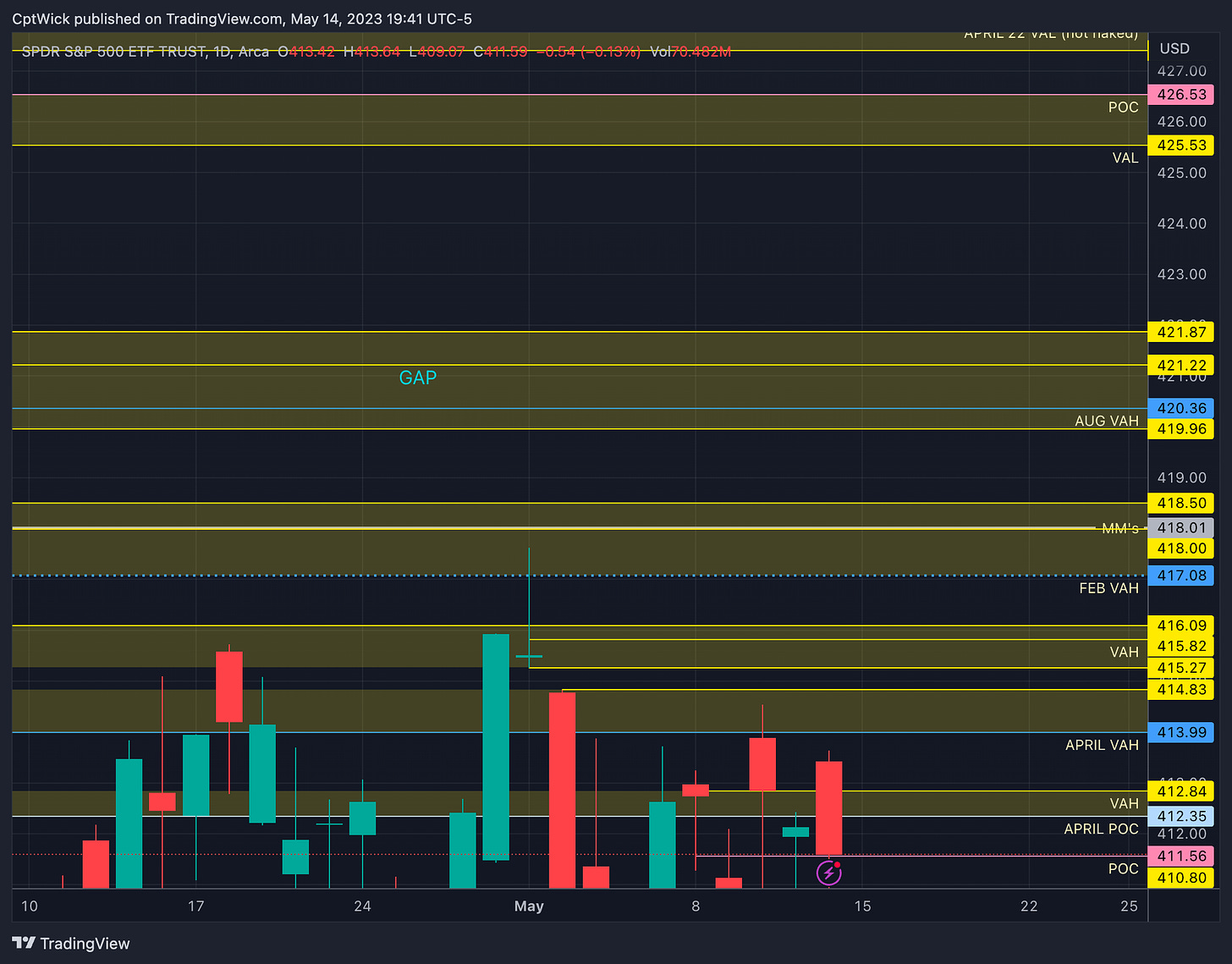

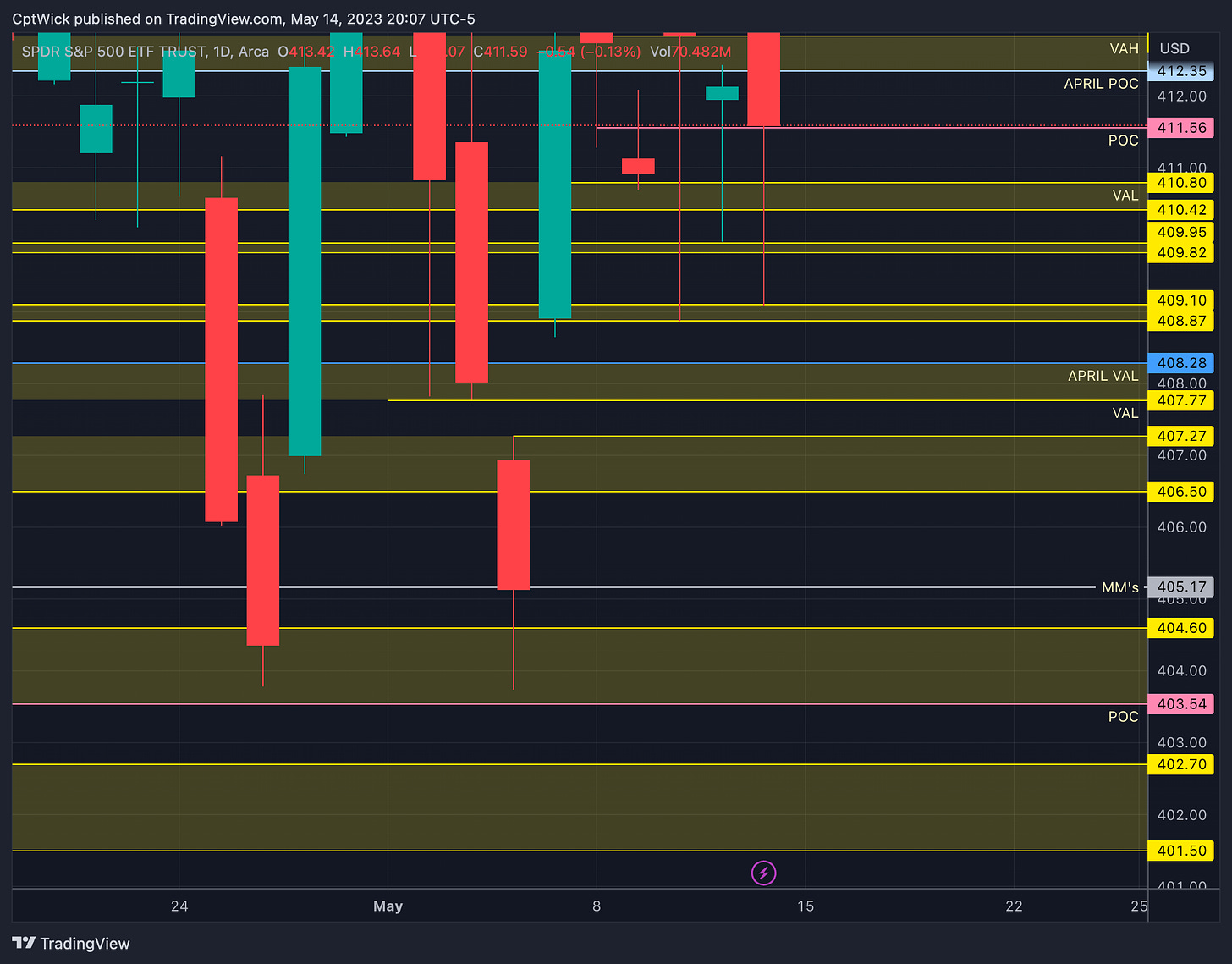

This week the MMs are expecting a weekly move of $6.42, giving us a upper range of 418.01 and a lower range of 405.17.

On the monthly profile you can see that this area is getting very congested. We are inside of Feb’s value area and April’s value area. This highlighted zone is where the bulk of the volume is, this is why we are so choppy. It makes for good scalping, but the entries and exits become harder to identify.

Same thing on the weekly profile, inside week, we continued to build value within value. Normally when this price action happens we tend to have a big reaction away from this area.

Positive Gamma

424, 417- 415, 406, 403

The positive gamma is building above us at 415-417

Negative Vanna

425, 422-418, 414-412, 406, 403

Key Levels Above (previous close - 411.59)

412.35 - 412.84

412.35 is April’s POC and 412.84 is last weeks VAH

Important level for both sides.

412 Negative Vanna (resistance)

413.99 - 414.83

413.99 or lets call it 414 is April’s VAH

413/414 negative Vanna (resistance)

415.27, 415.82, 416.09

We have a gap in volume from 414.83 to 415.27

415.82 a naked weekly VAH

415/416 positive Gamma (resistance)

417.08, 418.01, 418.50

417.08 is Feb’s VAH (not naked)

417 positive Gamma (resistance)

418.01 is the MMs weekly expected high.

418 negative Vanna (resistance)

Key Levels Below (previous close - 411.59)

411.56

Last weeks POC

412 negative Vanna (resistance in this case)

410.80 - 410.42

410.80 is last weeks VAL

409.95 - 409.82

small demand level (worth watching)

409.10 - 408.87

small demand level (worth watching)

408.28 - 407.77

408.28 is April’s VAL

407.77 is a weekly naked VAL

Very important levels.

407.27 - 406.50

We have a gap in volume from 407.77 to 407.27 (stronger demand)

406 is negative Vanna/positive Gamma (strong demand)

405.17

MMs weekly expected low

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.