Readers,

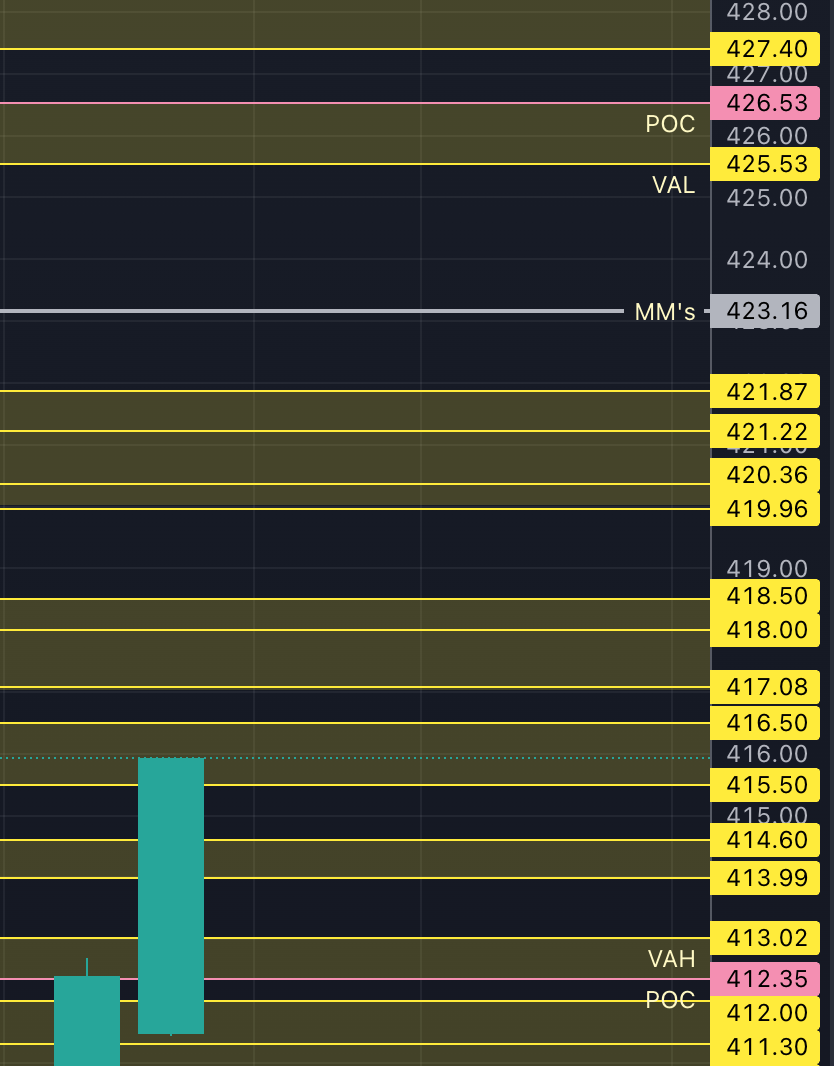

This week the MMs (market makers) are expecting a weekly move of $7.23 on SPY and a $7.54 move on QQQ. The range on SPY as of Fridays close of 415.93 would be 408.70 to 423.16. The range on QQQ from Fridays close of 322.56 would be 315.02 to 330.10.

SPY

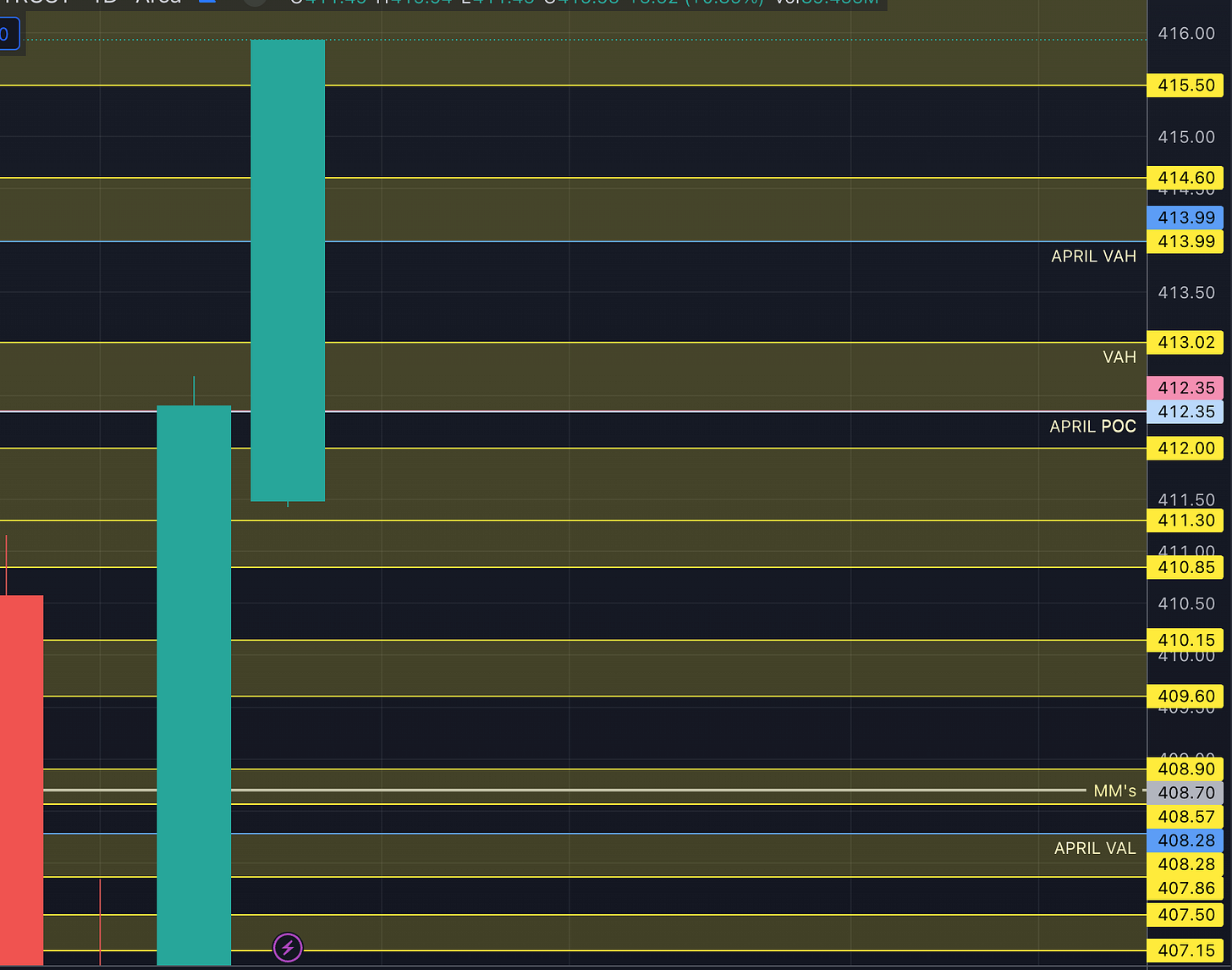

Let’s start with our SPY analysis, Monday is the start of a new week and new month. Here is how April’s volume profile (VP) ended up. The VAH is 413.99, POC is 412.35, and VAL is 408.28.

A key take away from this profile is this; Overall the profile is inside February's value area and we are getting closer to Feb’s VAH at 417.08. We also closed above the VAH (of April) at 413.99. April’s POC is very similar to Feb’s (if you remember, it was 411.77). The bulls want to see April’s VAH and/or POC hold, if we retest this area and it supports price, we should see Feb’s VAH. We will breakdown the supply and demand levels later in the post, but under 412.35 it could get ugly for the bulls.

On the weekly VP we have a similar look. Notice how when we came into the VAH and POC at 404.26 and 403.54 we rallied out of that zone at the close on Wednesday, that was a strong indicator to trust longs above 403.54. We closed above the current weeks VAH at 413.02, the POC came in at 412.35, and VAL at 406.46. Again, bulls need that 412.35 area to hold. Interesting that April’s POC and last weeks POC ended up being the same value. Pro tip, that’s a big level!

The next naked value area above us is at 425.53. We have some other areas of interest, as we know Feb’s VAH at 417.08 and we also have a nice gap to fill that I will cover in our key level section.

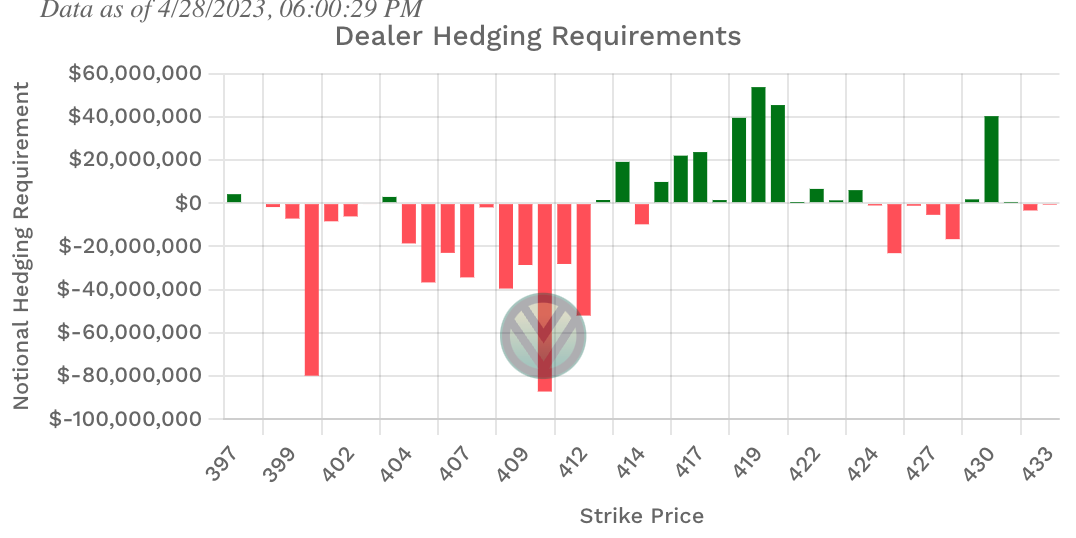

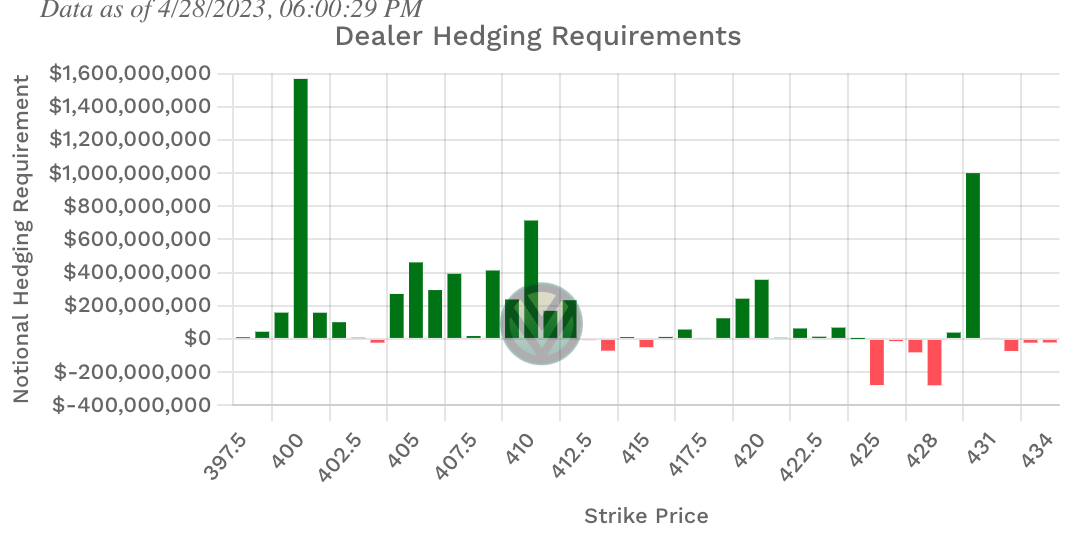

Postive Gamma

423, 422, 420-415, 413, 412, 403

Negative Vanna

428, 427, 425, 415, 413, 403

Key Levels Above (previous close - 415.93)

Ultimately I want to see what happens at 417.08 (Feb’s VAH). I think that above 416.50 we should test 417.08.

417.08, 418, 418.50

417.08 Feb’s VAH (still naked), this is a very important level.

417/418 both are positive Gamma (resistance)

419.96, 420.36, 421.22, 421.87

There is a gap to fill from 419.96 to 421.22.

420.36 is Aug 22’ VAH.

419/420 both are positive Gamma (resistance)

423.16

MMs weekly expected high. Above this the next naked value area is 425.53, Could happen fast.

422/423 with Positive Gamma (resistance)

425 is negative Vanna (resistance)

Key Levels Below (previous close - 415.93)

415.50

415 is negative Vanna and positive Gamma (support)

414.60-413.99

413.99 is April’s VAH

413.02-412.35

413 is negative Vanna and positive Gamma (support)

413.02 is last weeks VAH

412.35 is April’s POC, a pullback to the area if supported could mean we go higher. Very important level.

412, 411.30, 410.85

412 is positive Gamma (support)

We do not have any Gamma support under 412 until 403, so 412 will either be strong support, or it could get nasty under.

410.15, 409.60, 408.90, 408.70, 408.57, 408.28, 407.86

408.70 is the MMs weekly expected downside target.

408.28 is April’s VAL

QQQ

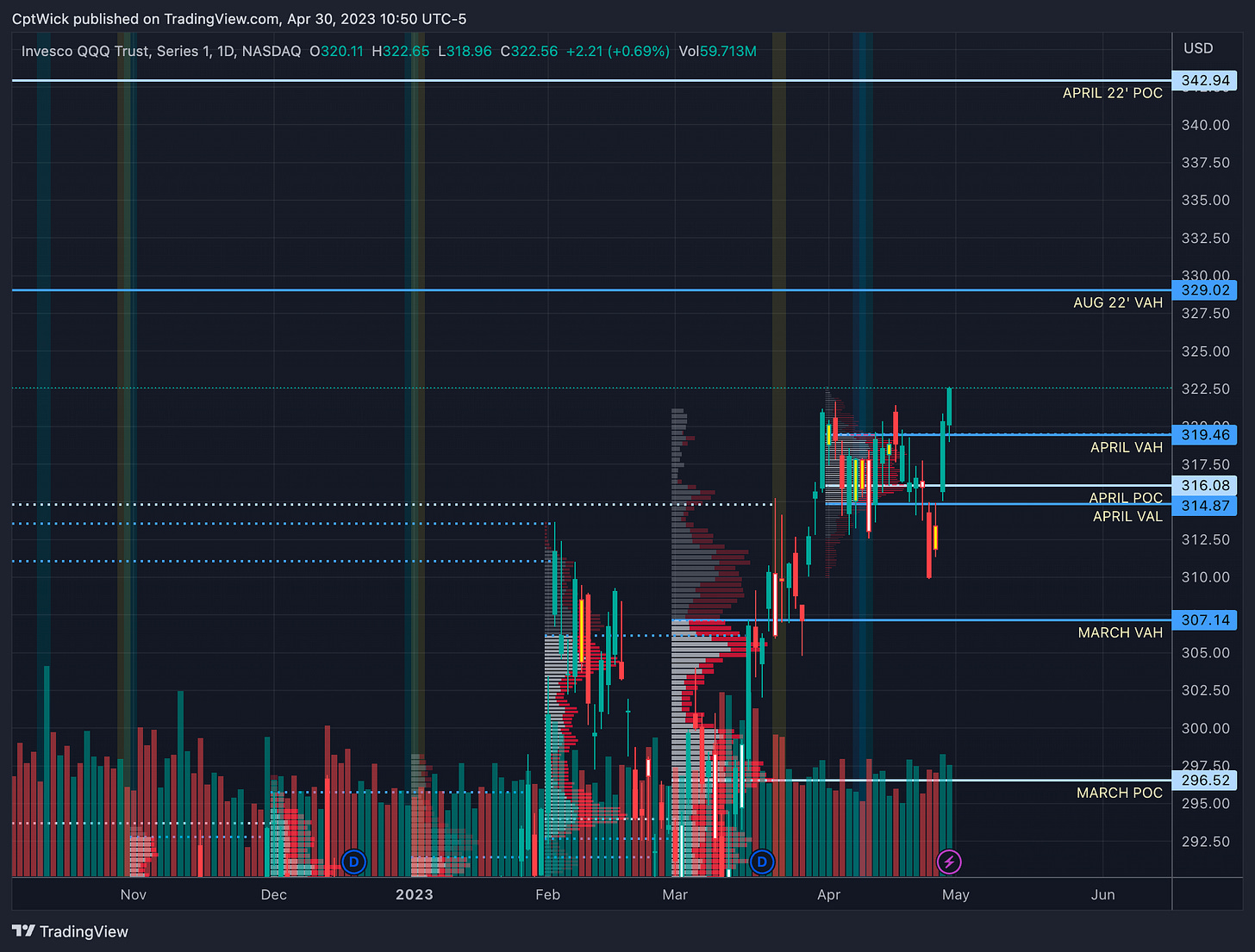

The monthly profile on QQQ is kind of similar to SPY, April’s VAH came in at 319.46, POC at 316.08, and VAL is 314.87. We are currently trading inside of August 20022’s value area and we ended April at a monthly imbalance to the upside. 329.02 (Aug 22’ VAH) is in play as long as we stay trying above April’s value area. These will be keys levels for our plan.

Last week the bears tried to send us below that VAL sitting at 310.35 but bulls defended and we rotated back up closing above that weeks VAH at 321.17.

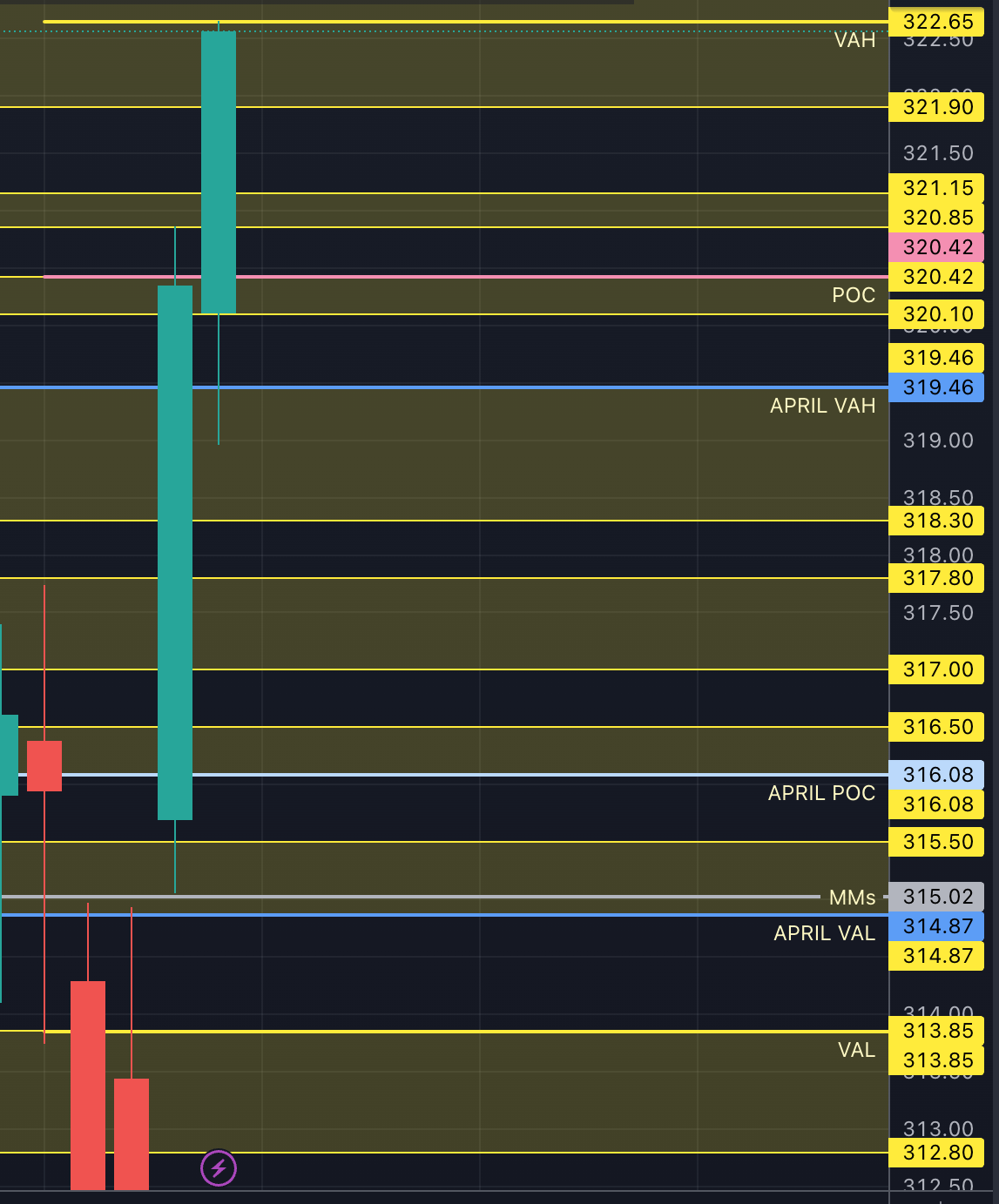

Last weeks VAH came in at 322.65, POC is 320.42, and the VAL is 313.85. 320 is obviously a big deal and we will keep a close watch.

Positive Gamma

330, 327-324, 322, 320, 317, 303, 285

Negative Vanna

335, 332, 329, 328, 320, 317, 303, 301, 285

Key Levels Above (previous close - 322.56)

322.65-323

322.65 is last weeks VAH

322 is positive Gamma (in this case its support)

324.20, 325.25, 327.14

324-327 is positive Gamma (resistance)

327.14 is a naked weekly VAL (the next weekly value area starts here)

328 is negative Vanna (resistance)

329.02, 329.79, 330.10, 330.55, 332.25, 332.69

329 is negative Vanna (resistance)

329.02 is Aug 22’ VAH

329.79 is a naked weekly POC

330.10 is the MMs weekly high expected move.

330 is positive Gamma (resistance)

332 is negative Vanna (resistance)

Key Levels Below (previous close - 322.56)

321.90

322 is positive Gamma (support)

321.15, 320.85, 320.42, 320.10

320 is positive Gamma and negative Vanna (stronger support)

320.42 is last weeks POC

319.46-318.30

Demand

319.46 is Aprils VAH, if this levels trades and we rally back above it, it could mean we go higher.

317.80-317

317 is negative Vanna and positive Gamma (stronger support)

just like SPY’s 412, we do not have any Gamma support on QQQ under 317 until 303. Big level!

316.50-316.08

316.08 is April’s POC

315.50, 315.02, 314.87

315.02 is the weekly MMs downside target.

314.87 is April’s VAL.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.