Readers,

This week has been kinda slow. Levels have been good, and respected but not much movement. Let’s see if tomorrow brings us anything.

From our weekly levels let’s recap, our bullish plan said,

We took out the POC at 411.77 and only climbed to 411.92. Our bearish plan said,

Today we finally broke down under 407.66 and the low of the week so far is 405.88. Although the data was not suggesting a bounce here, supply and demand ultimately won, as we rallied back to 407.66 but we closed under. I think it’s possible that tomorrow we have some more downside, but we need to do our homework.

—4/6 Pre Plan—

Remember, the MMs have a weekly expected move to either 415.66 or 403.12. I would think that the close under 407.66 and being closer to the MMs downside target, it might be likely for us to see 403. It just seems like the safer bet.

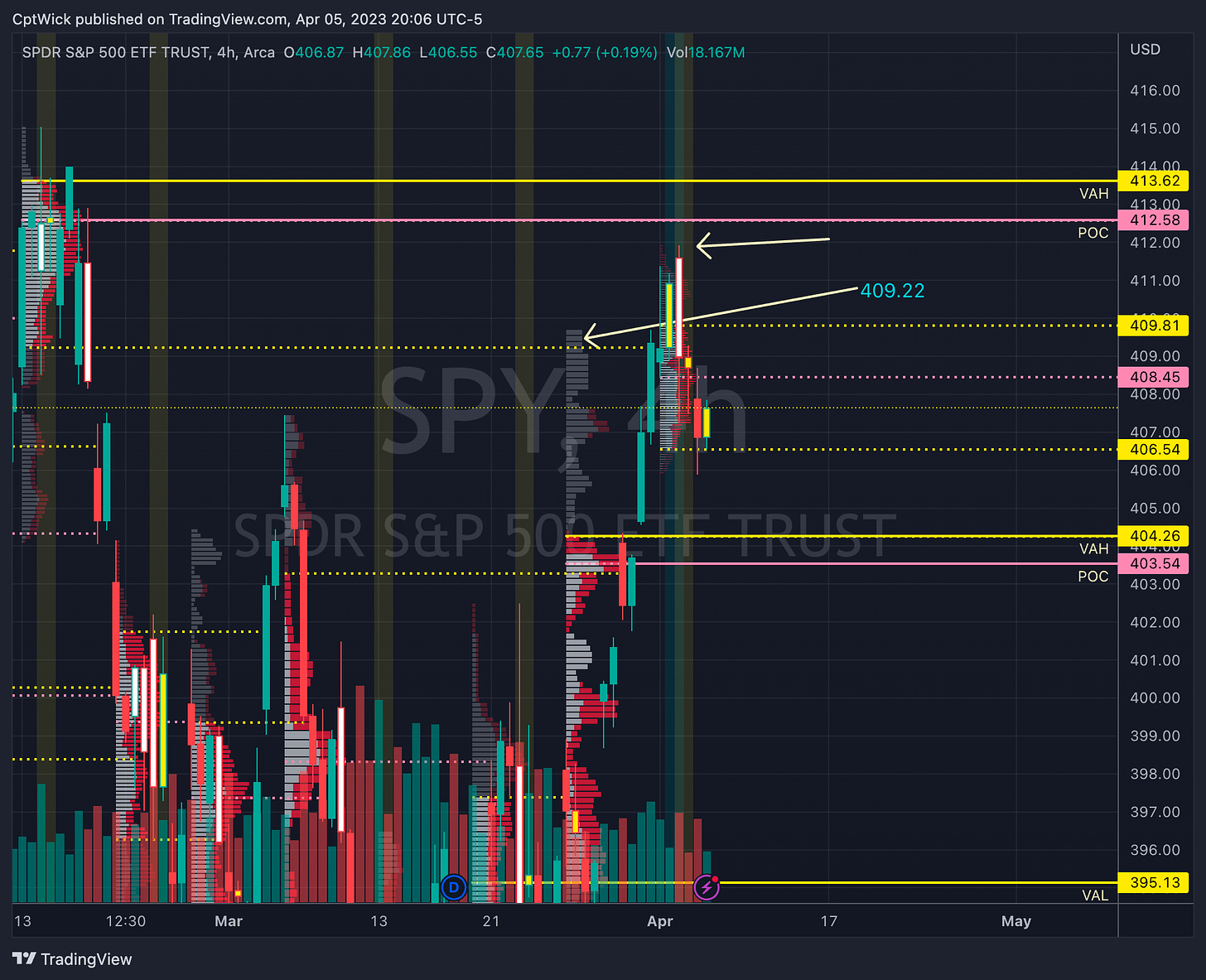

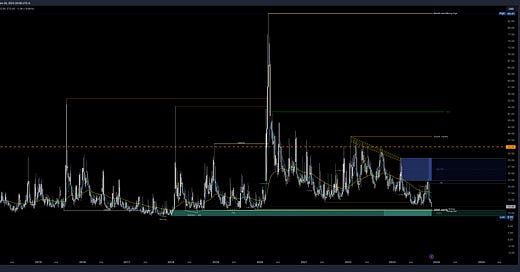

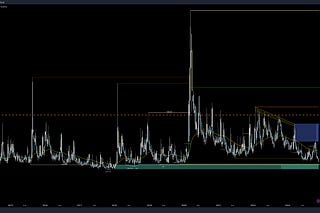

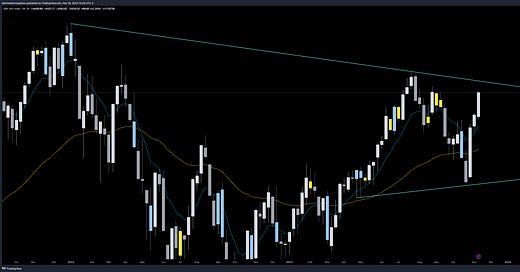

Check out this weekly volume profile. We busted into value at 409.22, we then made an attempt to get to the naked POC at 412.58 (we also were fighting a bigger POC in 411.77 (Feb’s POC)). This value area got rejected because we fell back out of value, we could be headed down to 404.26-403.54, Under 403.54 we could get more selling pressure towards 395.13 (not 0dte). Unless the bulls can take back 408.45 (this POC is dynamic, meaning it can change tomorrow if we get heavy volume).

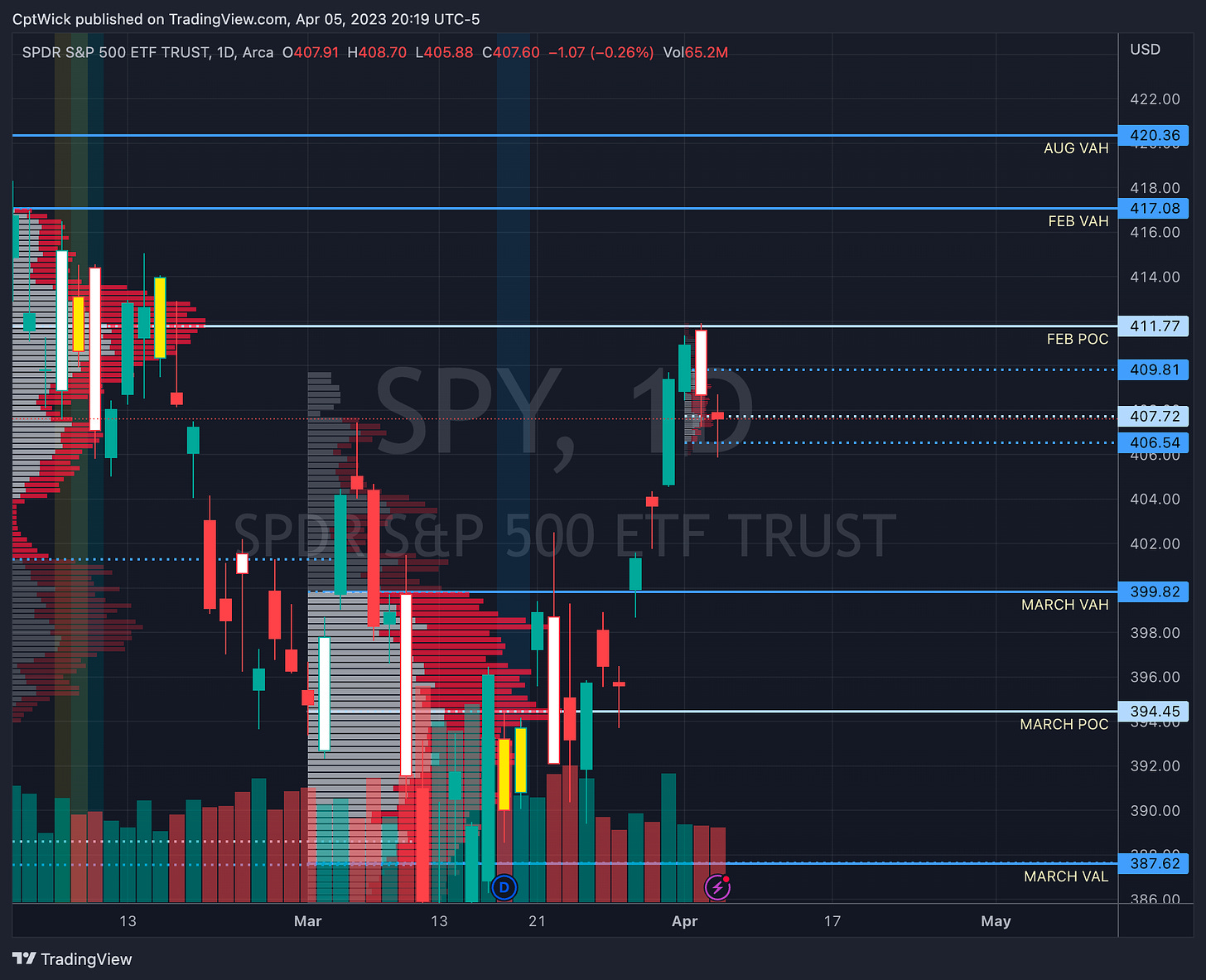

The monthly profile, we had a pretty strong rejection at the POC 411.77. We have some strong demand zones down around 403, right above the February VAL. I will highlight these later.

The data is looking roughly the same as it did on Sunday. We have positive gamma at 407 and under that we have no positive values until 388. Above 407 we have positive at 411(its very tiny), and 414.

Vanna is negative at 409, 412, 413, 415, with a bigger cluster of positive vanna below spot price down to 389-388.

This is a very similar look to Sunday night going into Monday’s session. If this is true, I would look for 407 to hold and for them to pin us somewhere between 407-414, maybe around 410-411, I will not be taking a trade based on this Information alone. I will play it primarily via volume and price. But I will be extra caution in my decisions around 407.

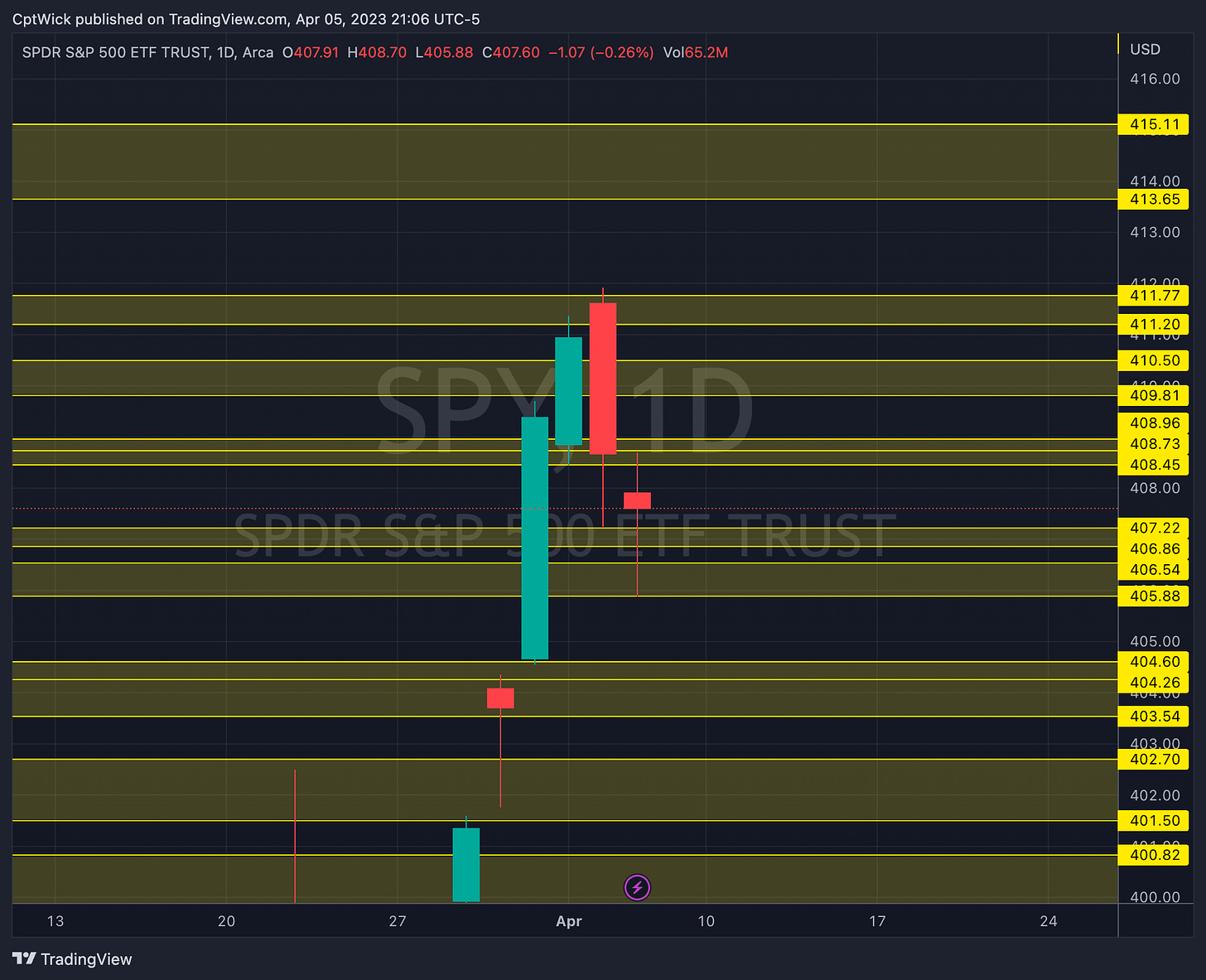

—4/6 Trade Plan—

Bullish Scenario

Above 407.22 target 408.45, 408.73, 408.96

408.45 is the current weekly POC

409 is negative vanna (tiny amount)

Above 409 target 409.81-410.50

410 is positive vanna, but 411-413 is negative vanna

Above 410.50 target 411.20-411.77, 412.58, 413.62, 415.11, 415.66

412.58 is a weekly naked POC and 413.62 is that VAH.

415.11 is the top of a supply zone and 415.66 is the MMs weekly expected high.

Bearish Scenario

Below 407 target 406.54-405.88, 406.60

Small demand zone here, if we lose yesterdays lod at 405.88 that opens us up to 404.60

Under 404.60 target 404.26-403.54, 403.12

404.26 is a weekly VAH and that POC is 403.54

403.12 is the MMs weekly expected downside target.

Under 403 target 402.70-401.50, 400.82-399.68

399.82 is Mach’s VAH, under that it opens the door to 395-394.

Given yesterdays close and the fact that some key volume profile leaves got rejected to the upside I would be leaning on a bearish bias going into tomorrow. But if price hold above 407-407.22 I don’t want to be short. So if you take anything away from this post, it’s bullish above 407, bearish below.

I also think that the demand around 403-400 could spark a good size bullish reversal.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.