4/3-4/6 SPY Weekly Trade Plan

Good Friday, short week

Readers,

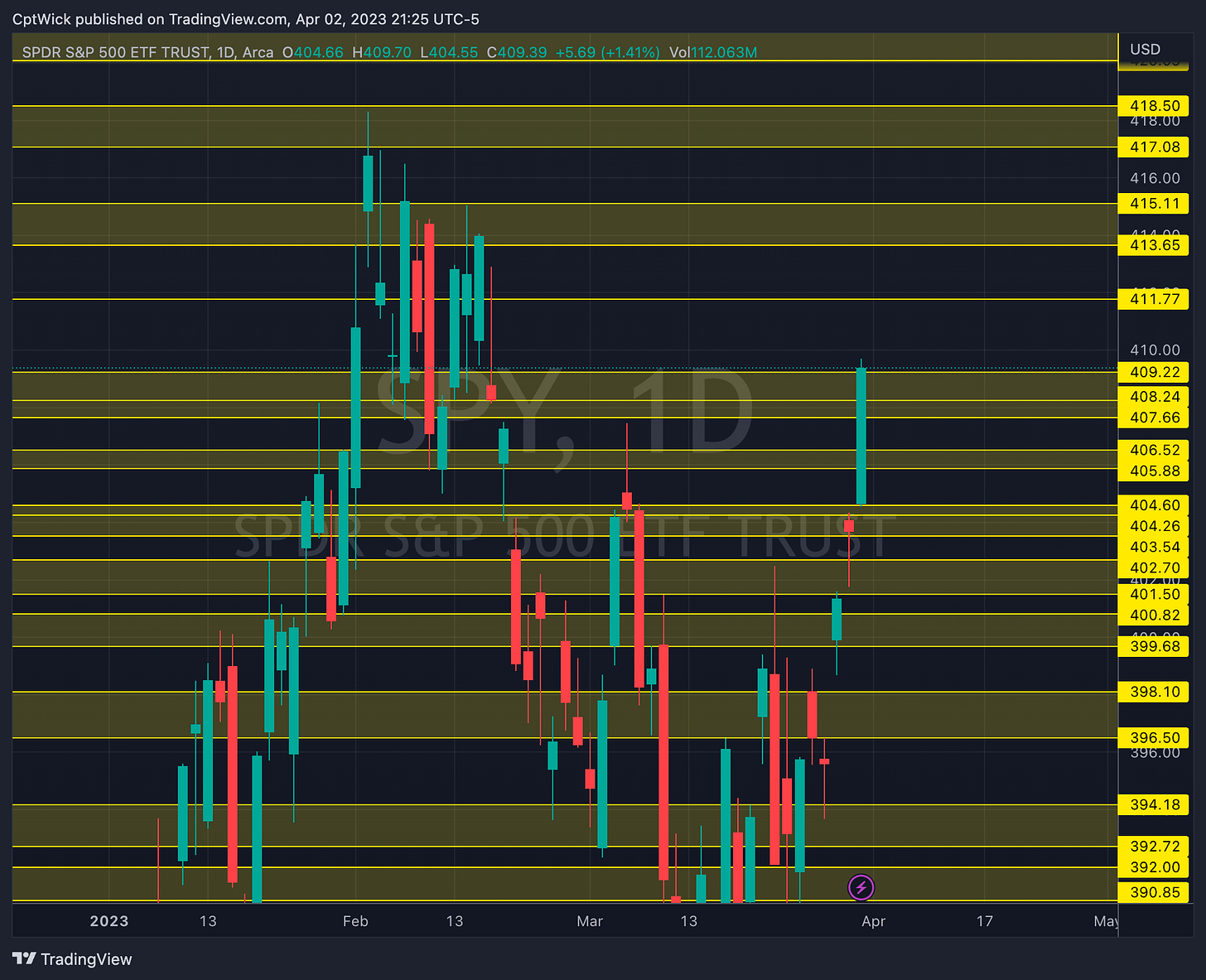

Monumental week for the bullish scenario from last weeks plan! If you have been following along we have been watching how price reacts in our key zones. Our main method here for the SPY trade plan is using the weekly and monthly volume profiles to highlight the key supply and demand levels.

This chart set the tone for the week on this bullish move up. We were watching to see if the value area from 391.57-385.24 was going to hold. We also knew that 393 would have been a strong level based on greeks and that it was the current POC.

The low on the week was 393.69 and it didn’t look back. We ha a short pause at 403.29 which was the bigger VAH of the range that we have been trading in, so it was a huge level. We rallied into it, based and rallied to the next value area at 409.22.

I have been telling you that these value areas are like bus stops. We leave one area and head to the next. Does it always happen like this? No, but when we put it all together we have a pretty high probability rate of going zone to zone, if you have been following along you know that this is usually true. If you don’t believe me, go ahead and do yourself a favor and go read some of the previous plans. Or set these volume profiles up on your charts and backtest it. You’ll be amazed, I promise.

If 403.29 would have been rejected, I would have been looking for 397 or lower to trade again. We will get to that in the plan coming up.

—Weekly Pre-Plan—

Now we get to the homework, we need to do this all over again, new week, new MONTH, new levels. Let’s jump in!

Let's begin by analyzing the big picture by taking a look at the monthly volume profile. As we move into a new month next week, the March levels become "fresh", and February's POC sits at 411.77. In the 408-400 range, there's a likelihood of some balancing, but we can still continue pushing higher. It's crucial to keep an eye on these levels as they hold significant importance. If we manage to break through the 420 level, there's a possibility of reaching 430-440. I'll provide you with an update once we get there! Additionally, revisiting March's value area might be crucial for the market, as March's profile appears to be resembling a "b", which is an indication of weak sellers. A retest and subsequent bounce from this zone would mean that the SPY could potentially reach higher prices

Moving on with weekly levels, We entered the 409.22-413.62 value area on Friday, this will be key early in the week, also keep in mind that the market is closed on Friday, 4/7 for Good Friday. Earlier in the plan I said that we could have some balancing from 400-408. That might be true this week. I will breakdown the other key zones later on in the post, but I will be watch the 409-408 area to see what price wants to do. If 409 holds, I expect a move into Feb’s POC at 411.77 with a shot at taking out 412.58 and 413.62. Under 409 we might test the 404-395 area. 425.50 is a stretch there are other key factors that we might run into before we see that value area but I wanted to highlight it because its the next “naked” value area to the upside.

Alright here is where it gets good. The data has changed from last week, here is a link if you want to go check. But last week the vanna was negative above spot price and positive below. 410 is positive and 411 is small negative, but the first notable negative vanna level is 413... what do we know about 413? Oh yeah, its a volume profile level, we have a weekly POC and VAH around this area. 415 is also negative, and then its positive until 421. For me personally I like the negative values for my analysis, it tells me when the potential reversal is located.

It’s not pictured here but the next negative value below us is 388. If we trade down in the lower 400s - 390s I will update you with what I am seeing.

When we look at gamma, we want to look for the positive values, when they line up with negative vanna, that helps us determine the stronger areas.

408 and 409 are positive, and under that we don’t have another positive value until 388(we also have negative vanna at 388). If we open under 408, and we can’t rise above it, we could be headed down on the week. If we trade above 409 and we hold, the next notable positive value is at 412, then 414, and positive up to 419.

We will put this all together soon, stay with me. Its a lot of work to put this together but this is everything that I need to know in order to come up with a solid plan.

Did you think I forgot about the weekly expected move? The market makers are pricing in a $6.27 move on SPY by 4/6.

If you recall last week they were expecting a move to 404.90, and once we got above that level on the gap up due to PCE, shorts had to cover and we squeezed another 5 points, usually they keep it within the range about 70% of the time.

Here are the key supply and demand levels I am watching going into the week. I will keep you all updated on any changes.

—Weekly Trade Plan—

Bullish Scenario

Above 408-409 target 411-411.77

408 and 409 are both positive gamma I think this area might even be the key for the week.

412 is positive gamma, aligns with the POC at 411.77.

Above 411.77 target 413.65, 415-415.66

413 is negative vanna and 414 is positive gamma, if we were to push above 413.77 and hold I think we can see 415+

415 is negative vanna.

415.66 is the MMs weekly upside expectations. It’s good to know this level.

Above 415.66 target 417.08

Vanna is positive from 416 to 420.

Gamma is also positive from 416-419.

Hopefully by the time we trade these levels IF we do, the data will change to help paint a better picture.

417.08 is also February's value area high.

Above 417.08 its 418.50-420+

Bearish Scenario

Below 408 target 407.66, 406.52, 405.88

Under 408 we don’t have gamma support until 388.

The vanna is also positive down to 388. Could get nasty under 408 according to the data.

We have to really watch how price reacts under 408, we either get a strong continuation down to we find support and V up.

407.66, 406.52, and 405.88 are all VP levels. The data doesn’t really support a bounce here.

Below 405.88 target 404.60-404.26

404.26 is last weeks VAH if this area trades we need to be cautious of a bounce, simply because we may have left some bulls behind at that bus stop.

Under 404.26 target 403.54-403.12

403.54 is the POC for the 404.26 VAH, and 403.12 is the MMs weekly downside expectations.

Under 403.12 target 402.70-401.50, 400.80, 399.82

399.82 is March’s VAH on a b shaped profile. I think that if we come down into 399-394 that would turn into a do or die for the bears. they would need to push it down under 394 in order for us to potentially see 388.

The key take aways from this post are this,

If you are a bull, you want to see 1 of 2 things. You want to see continued price movement above 409, or you want to see support come in at 404-399, I think if neither of those happen then the bears might take back control.

As always I will do my best to keep you all informed with a some levels. If I don’t have time for a fulll detailed Substack post I will post something on Twitter!

Feel free to reach out to me if you have any questions/suggestions, but lets make sure we are all on the same side of the trade! I hope you all have a great short week of trading!

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.