Readers,

Earlier today before the opening bell I tweeted out to watch 411.11 on SPY as it was last weeks VAL and we were opening below that level. Price did as I expected and came back up to test that value area. It was rejected reaching 411.16 and we never retested that level again during the session.

We basically hit the weekly market makers (MMs) downside target today. We have to see if they want to still keep it within range or if they want to send it lower.

Here is a update on the current monthly profile for April. This is the last trading week for this profile so we need to keep an eye on these values because they are still dynamic (meaning they can change throughout the trading sessions). VAH is 413.81, POC is 411.95, and VAL is at 408.89. We are at a monthly imbalance currently to the downside (under the VAL), so it will be key to see if they want to chase March’s value area or if they want to bring it back into April’s value. Again, the current levels (dotted lines) can and most likely will change as we get closer to the end of April.

Here is a weekly update on how the weekly volume profile is shaping out. The current VAH is 413, POC 412.12, and VAL at 408.63. Last weeks POC 411.59 and VAL 411.11 are no longer naked but I like to keep them on until this week ends. Today we also took out a naked weekly VAL at 408.25. This weeks current VAL at 408.63 is now a key level.

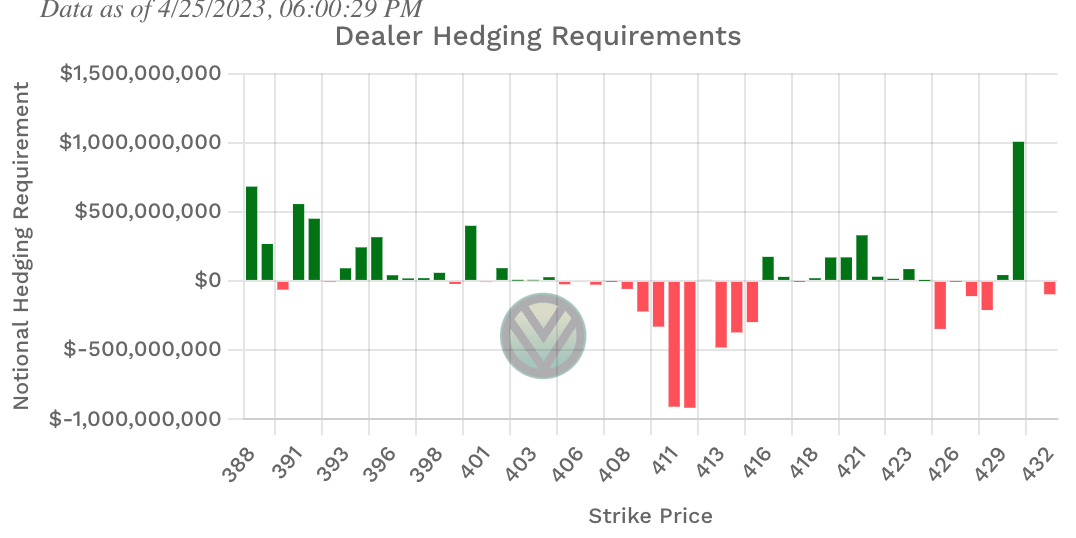

Positive Gamma

419, 416, 403, 401, 399

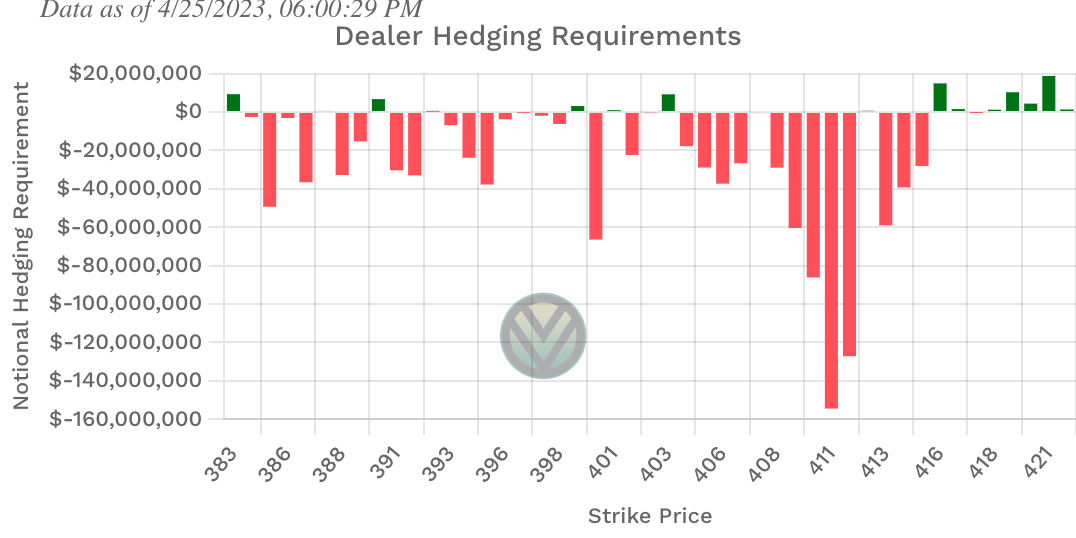

Negative Vanna

We have lots of negative Vanna above (previous close), I don’t know how much of a impact Vanna will have being that OPEX was last Friday. But here is what it looks like.

Key Levels Above (previous close - 406.08)

406.61, 407.60, 408.25

Negative Vanna 406-408

408.50, 408.63, 408.89

408.63 current weekly VAL

408.89 current monthly VAL

408 Negative Vanna

The bulls need to take this area back or we can see lower prices.

409.29, 409.70, 410.15

Negative Vanna

411.11, 411.59, 411.95, 412.12

411.11 last weeks VAL

411.59 last weeks POC

411.95 current monthly POC

412.12 current weekly POC

Negative Vanna

This area is very congested. (Chop zone, will be hared to trade)

412.50, 413.13, 413.61, 413.81, 414.41

Negative Vanna

413 current weekly VAH

413.81 current monthly VAH

Key Levels Below (previous close - 406.08)

406-405.40

Demand

404.60, 404.26, 403.54

Gap fill

404.26 naked weekly VAH

403.54 naked weekly POC

403 Positive Gamma

402.70-401.50

Demand

401 Positive Gamma

400.82, 400.41, 399.82

399.82 March VAH

Bulls need to reclaim the 408-409 level again if we want to grind higher. 404-403 could be strong support being that it is a naked value area high and POC. Vanna is on vacation since OPEX was on Friday. Stay safe out here the levels are getting pretty congested above us until we can get back above 412-413 and under 399.82 opens the door to 395 and lower.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.