Readers,

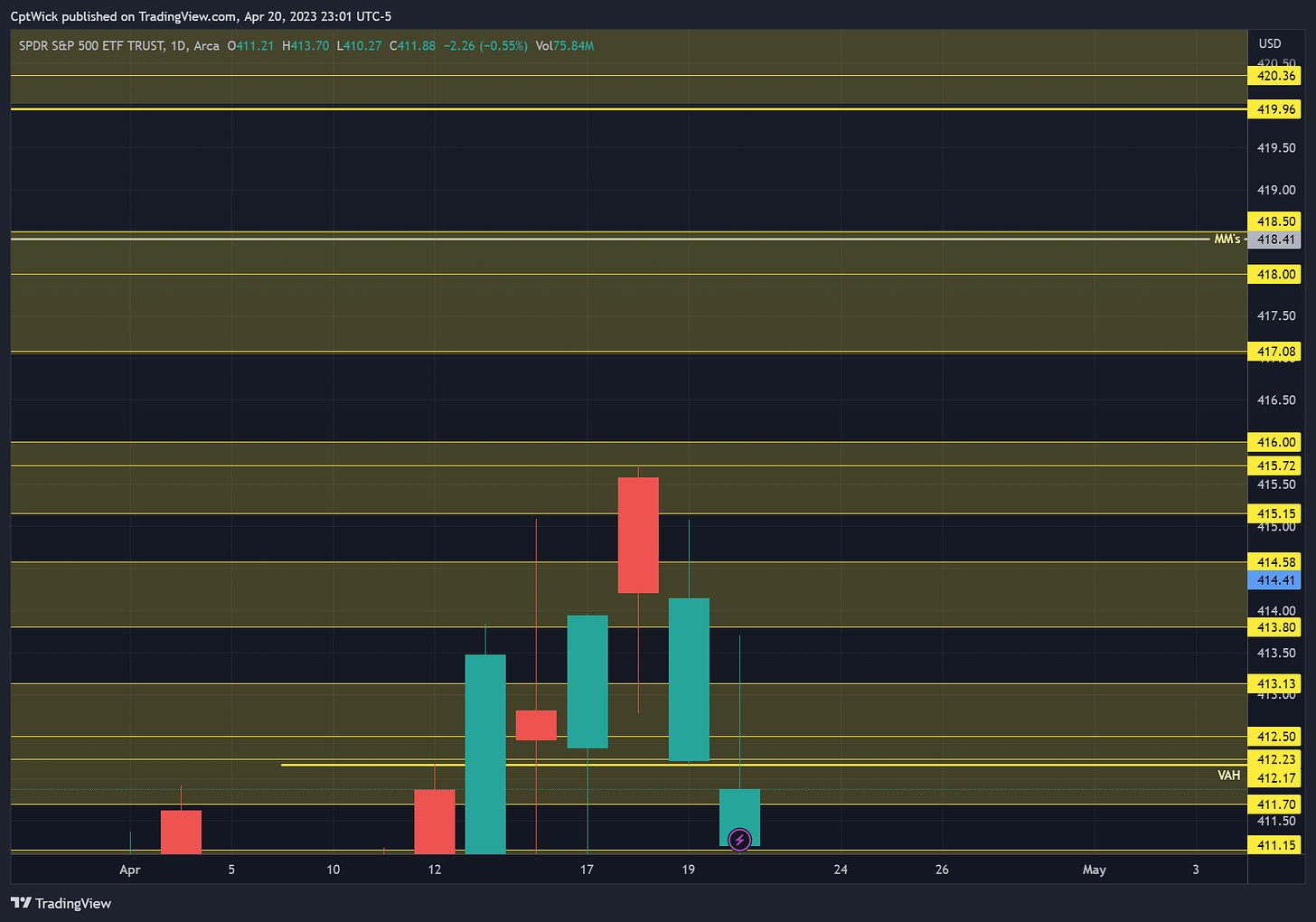

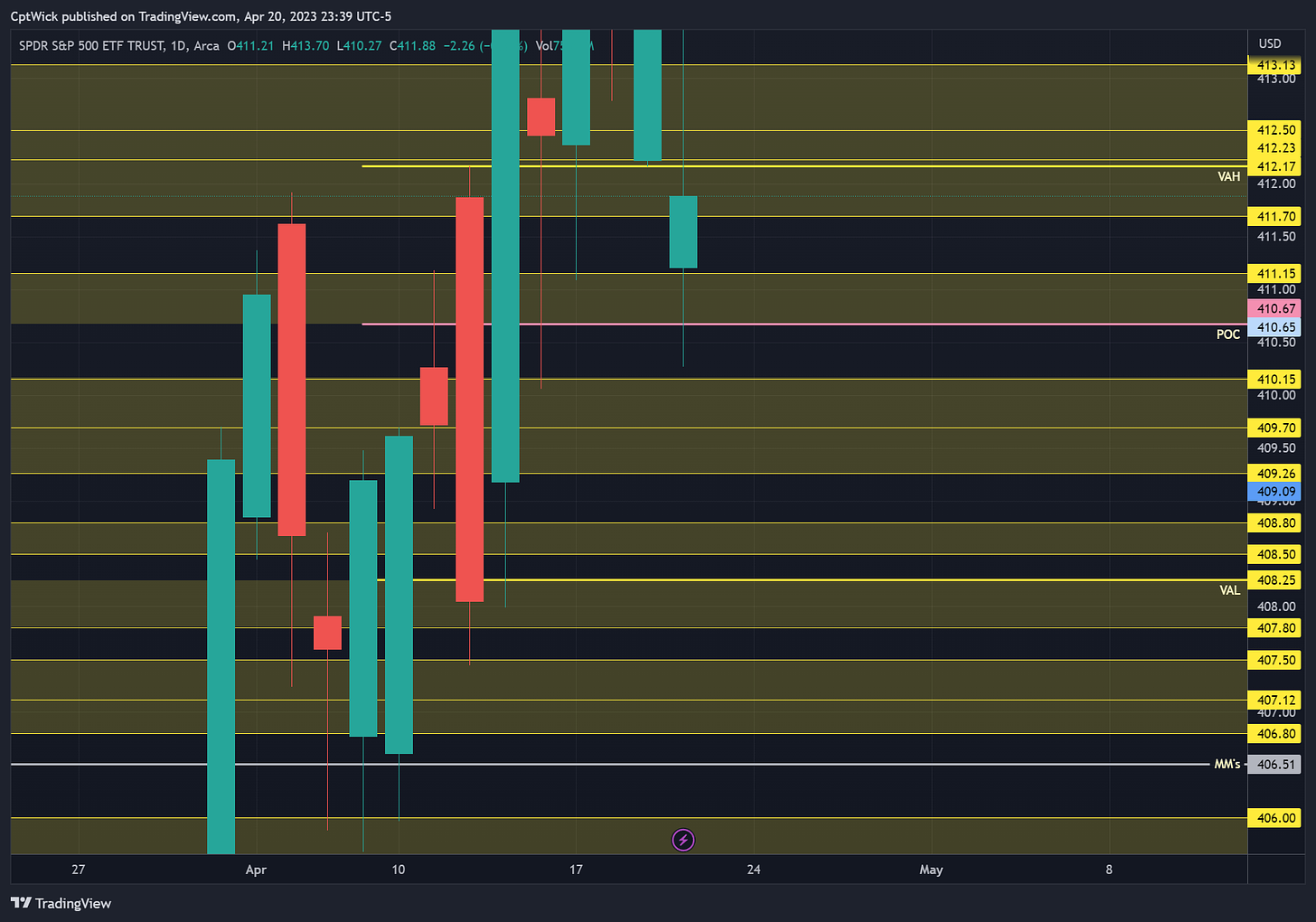

Heading into Friday lets get up to date on a few things. Look at the monthly profile, we are building value at the same POC as February. A move away from this area in either direction is what we need, this is turning into a chop zone, but the levels have been respected and has made for some good trading. The current VAH sits at 414.41, VAL is 409.09, and POC at 410.65.

The weekly profile is interesting here, today we dipped under last weeks VAH and bounced off of the POC at 410.67(which also turned into the current monthly POC (410.65). The bulls made a really strong effort to get price back above 412.17(last weeks VAH). The current VAL on the week is 412.23 therefore we closed at a imbalance to the downside. These are GIANT levels going into tomorrow!

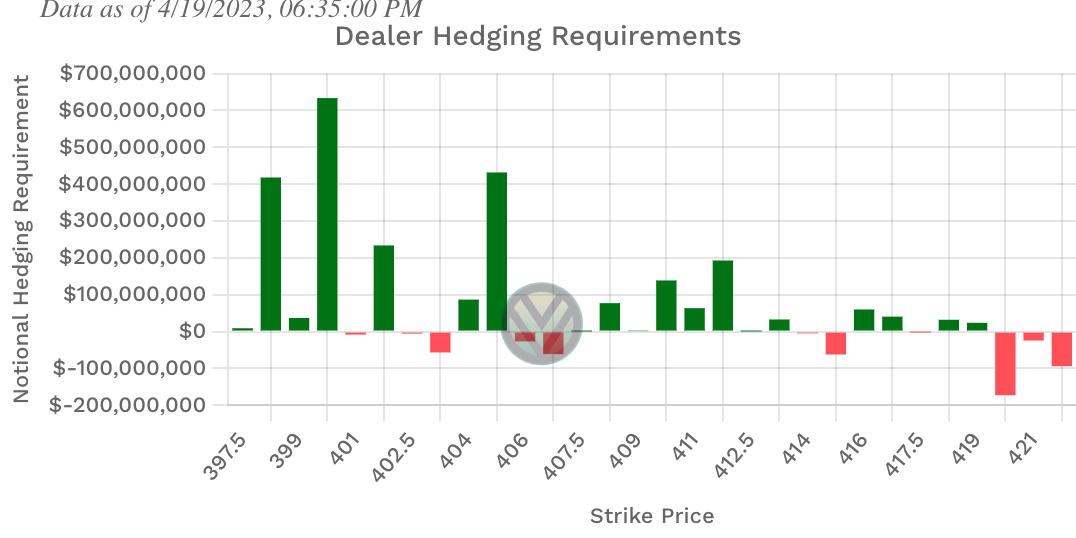

Positive Gamma

418, 417, 416, 407, 403

Negative Vanna

422, 420, 415, 407, 406, 403

We are a good distance away from both of the weekly MMs targets this could make for a fun Friday. Not saying we hit one of these, but they are good to know.

Key Levels Above (previous close - 411.88)

412.17, 412.23, 412.50, 413.13

This area here is getting pretty congested but I think it is the key for tomorrow. Pay attention to where we open in relation to this zone. It might warrant a retest for a continuation.

If we open within this range we could chop around until we breach the top or bottom (411.70, a key level under last sessions close).

412.17 last weeks VAH

412.23 this weeks current VAL

413.80-414.58

Supply

414.41 is this months current VAH

415.15, 415.72, 416

415 negative Vanna (Resistance)

416 positive Gamma (Resistance)

417.08, 418, 418.50

417.08 Feb’s VAH

417/418 positive Gamma (Resistance)

418.41 MMs weekly high expectations

Key Levels Below (previous close - 411.88)

411.70

This level should be lumped into the first level we discussed in the above levels.

411.15 - 410.67

410.67 last weeks POC

410.65 current month POC

410.15, 409.70, 409.26-409.09

409.09 current month POC

408.80 - 408.50

Demand

408.25 - 407.80

408.25 last weeks VAL

407.50, 407.12, 406.80

407 positive Gamma/negative Vanna (Support)

406.51 - 406

406.51 MMs weekly downside expectations

406 positive Gamma (Support)

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.