Readers,

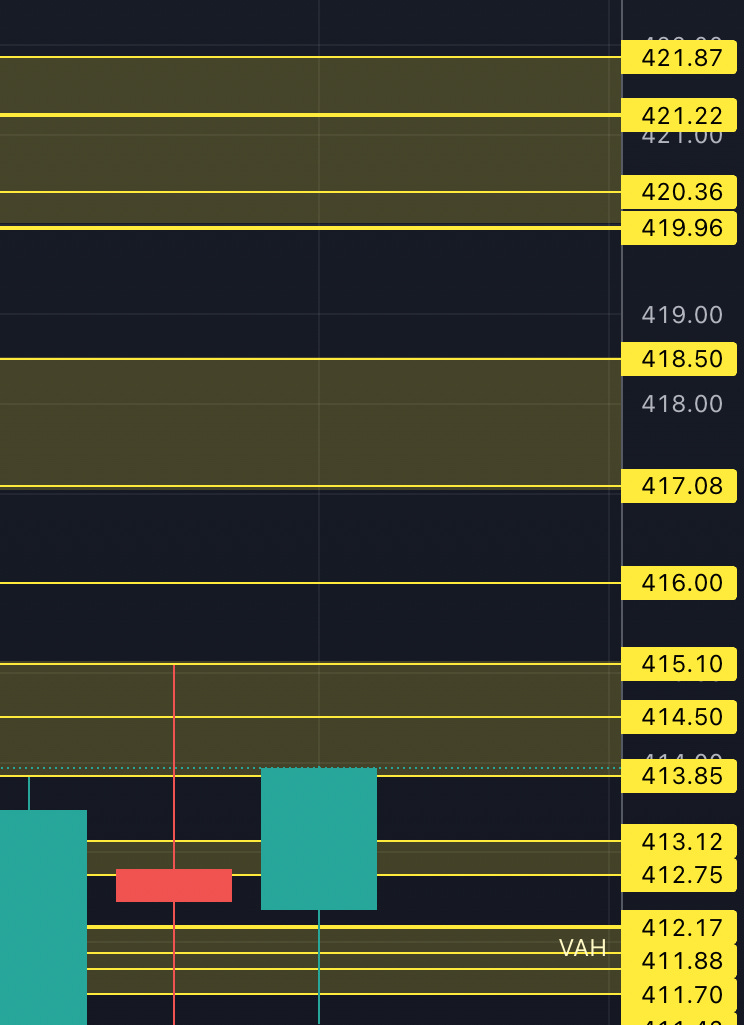

Today our levels were respected fairly well. We opened just above last weeks value area (412.17, last weeks VAH) and we ran into a wall a few times at the 413.12 area. We then sold down under 412.17 but found support around our 411.42 level.

We will talk about this when we go over the volume profile but we dipped back into last weeks value area and rallied back out closing above it. Also note we never hit 410.67, the POC for that profile. They might be saying see you later 412, but let’s not take this as a bullish signal just yet, the 1D closed as a inside bar so we still have a battle going on.

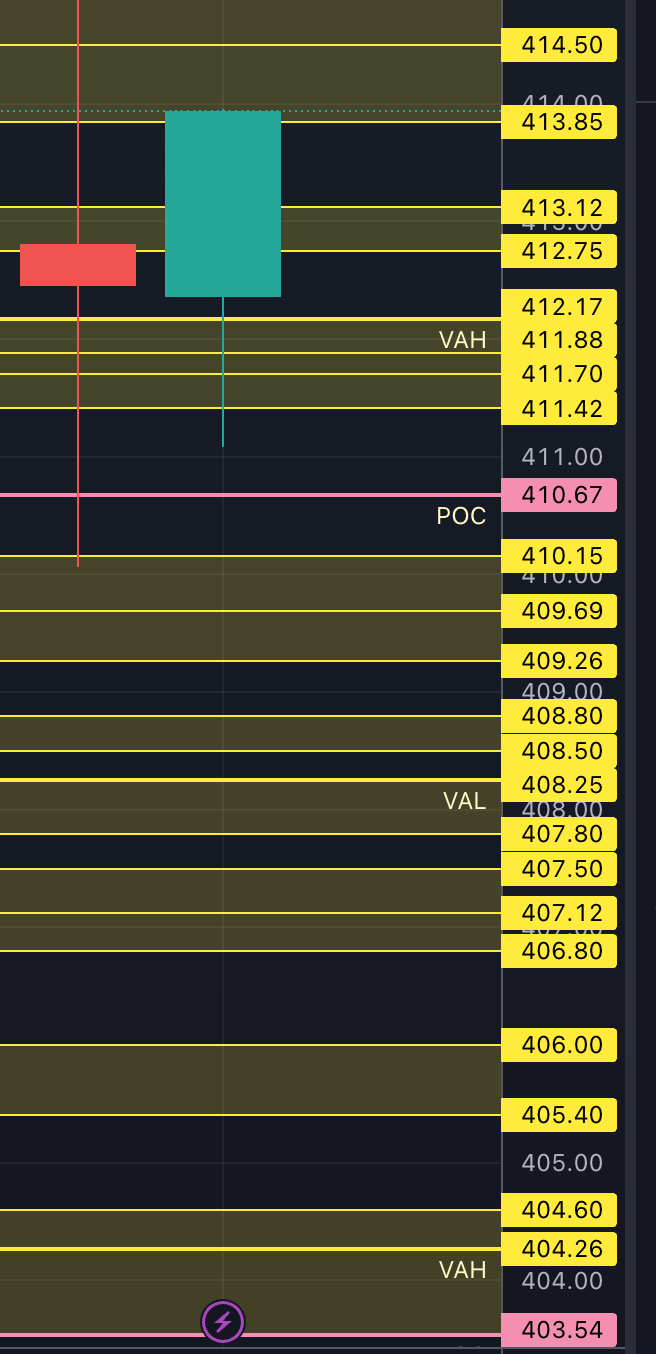

On the monthly profile, this is the 3rd daily close above the current VAH, and we printed a inside bar, meaning we never tested Friday's high or low. Both sides are currently trapped. Do we move up to Feb’s VAH at 417.08? Even though we are trying to build value up above Feb’s POC, our current POC is down at 409.02, keep an eye this if it starts to move up.

Our current VAL is 412.01, POC is 413.08, and VAH is at 413.96. See how price used last weeks value area as support? If you are a bull this is exactly what you want to see. Bears need to drive price back under 412. The next naked value area isn’t until 425.53 as we stated in last nights plan. We also have 417.08 in the February VAH. Im kind of thinking we might be headed in that direction. If price takes off above Feb’s value area be cautious of the gap sitting at 419.96-421.22 on the 4hr chart.

If the bears can push us back under 412, that would open the door to possibly take out 408 again, with the hopes of 404-403. I can’t stress this enough, bulls need to hold last weeks value area if we want to continue higher.

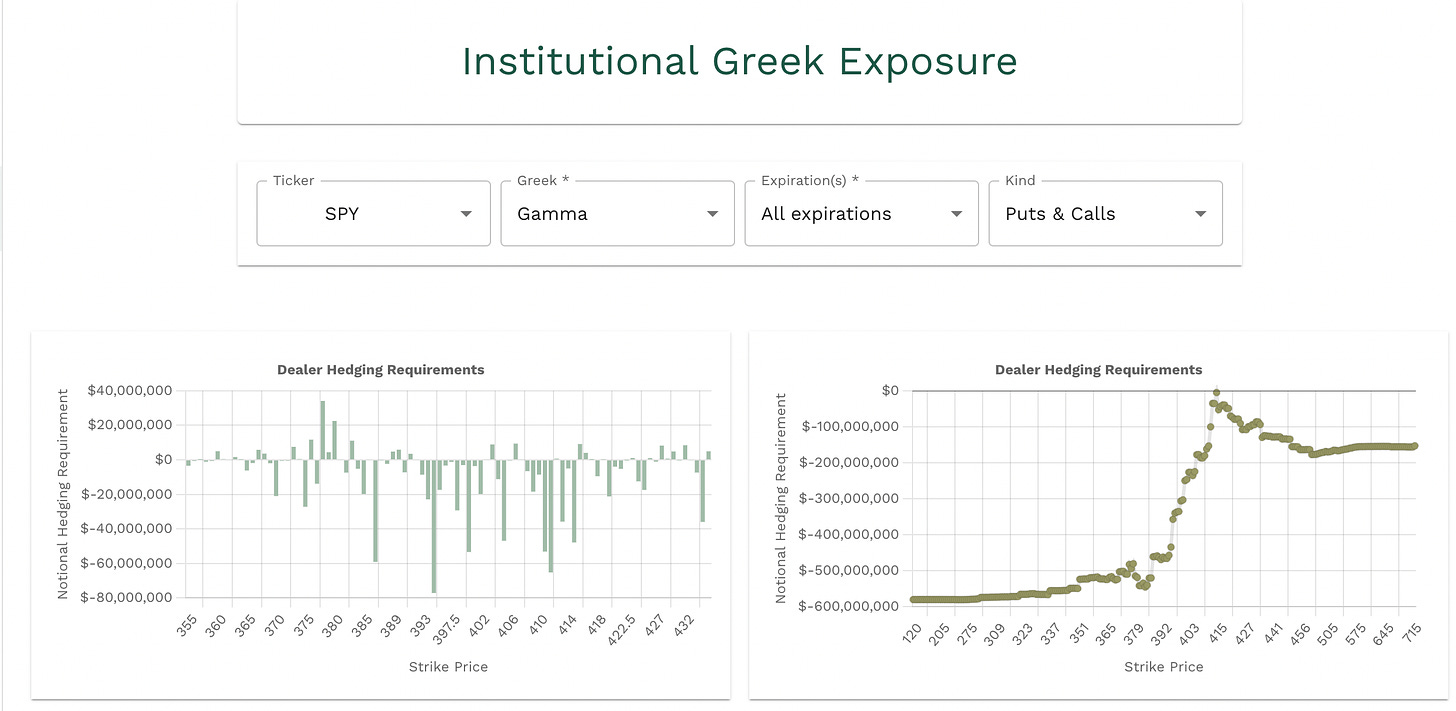

Positive Gamma

423, 422, 417, 416, 412.50, 407, 403

Negative Vanna

425, 424, 422, 420, 418, 415, 407, 403

Our levels are going to be very similar as last nights plan, not much changed, but that makes sense because the session was inside Friday's session.

Key Levels Above (previous close - 413.94)

414.50 - 415.10

415 negative Vanna (resistance)

416, 417.08, 418.50

416 positive Gamma (resistance)

417 positive Gamma (resistance)

417.08 is Feb’s VAH, this is a very important level. Keep a close eye if we trade up here.

418 negative Vanna (resistance)

418.41 is the MMs weekly high expectations

419.96 - 421.22

Potential gap fill.

420.36 August’22 VAH

422 negative Vanna (resistance)

Key Levels Below (previous close - 413.94)

413.85, 413.12 - 412.75

412.50 positive Gamma (support)

412.17, 411.77, 411.42

412.17 is last weeks VAH

411.77 Feb’s POC

410.67, 410.15, 409.69, 409.26

410.67 last weeks POC

409 current monthly POC

408.80, 408.50, 408.25, 407.80

408.25 last weeks VAL

We have a lot of volume that has been traded around these levels as of late. Key area!

407.50 - 406.80

407 positive Gamma/negative Vanna (stronger support)

407.37 current monthly VAL

406.51 is the MMs weekly low expectations

406, 405.40, 404.60, 404.26, 403.54

404.26 is the next naked value area on the weekly profile

403.54 is the POC

403 positive Gamma/negative Vanna (stronger support)

I know that there are “more”levels below the current spot price but that does not mean I am expecting a move to the downside. The reason that we have more levels below is because those levels are “fresh”. As a day trader you have to be nimble and you have to know when one side is in control. Also, these support levels, or resistance levels can flip. Support can become resistance and vice versa.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.