Readers,

Last weeks short week is followed by CPI and more Fed. The MMs are expecting a weekly move of $7.63, the upper range is 416.82, and the lower range is 401.56.

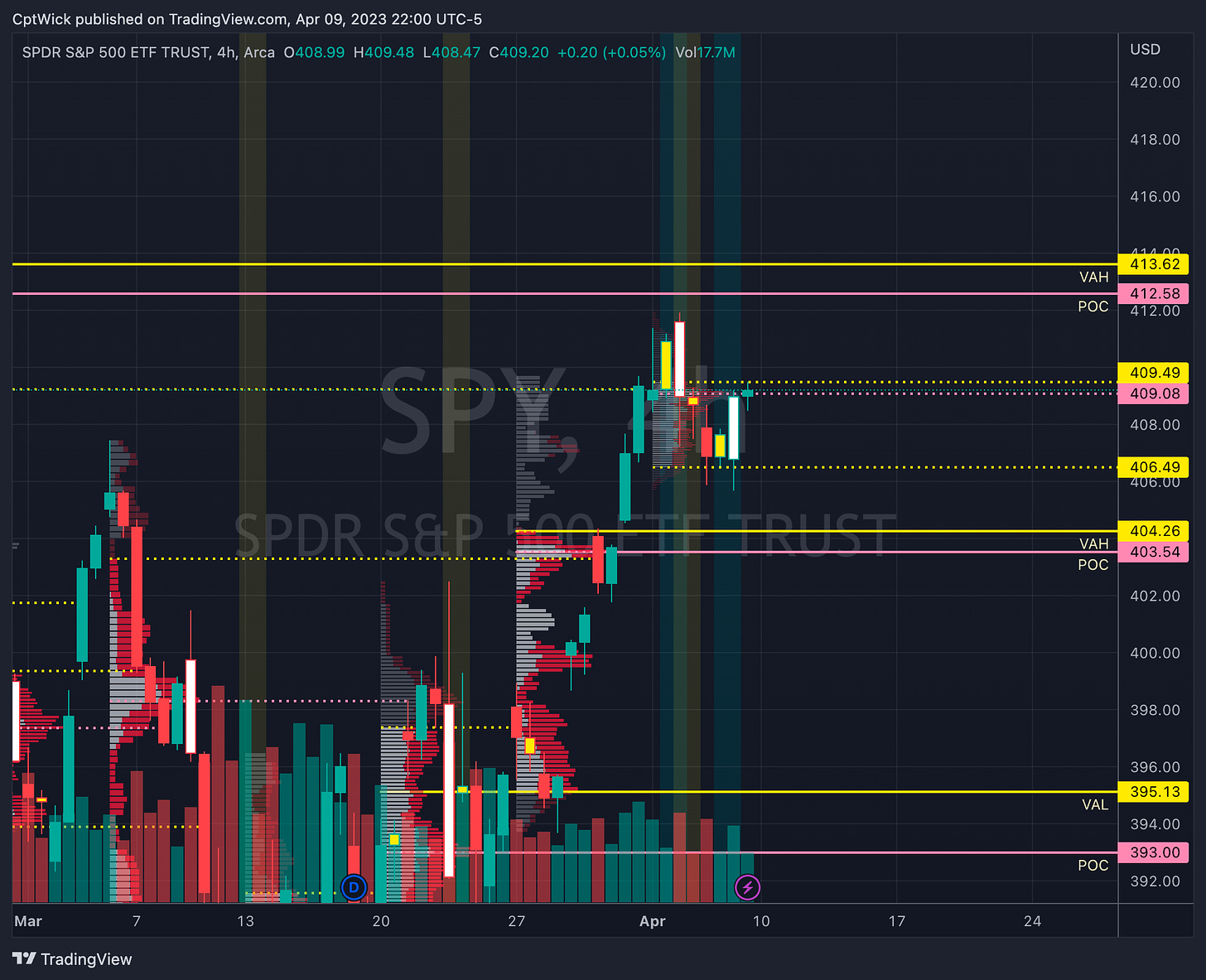

On the monthly volume profile we still have the rejection at February's POC 411.77, it is critical for the bulls to reclaim this if price is going to move higher. Last weeks plan I said that it was likely to balance under 408 and we tested the waters at 405.88 but they bought the dip. We are also balanced on the month, we want to see a move above 409.55 or 406.55.

Looking at the weekly profile we are balance between two naked POC’s. Bulls want to see a move up over 409.49 for a test of 412.58 potentially. Under 406.49 we would want to target 404.26-403.54. The market could potentially see some more balancing under 406.50 and possibly down to into 400-398.

If we look at the Volland data we can see that we have bigger positive clusters at 402 to 395. We have negative vanna at 412 that could act as resistance, this lines up with February's POC rejection at 411.77. We also have negative vanna at 392, if we get a VIX rally and price can not get through 412 we could retest sub 400 soon possibly down to 392 based on the current vanna look.

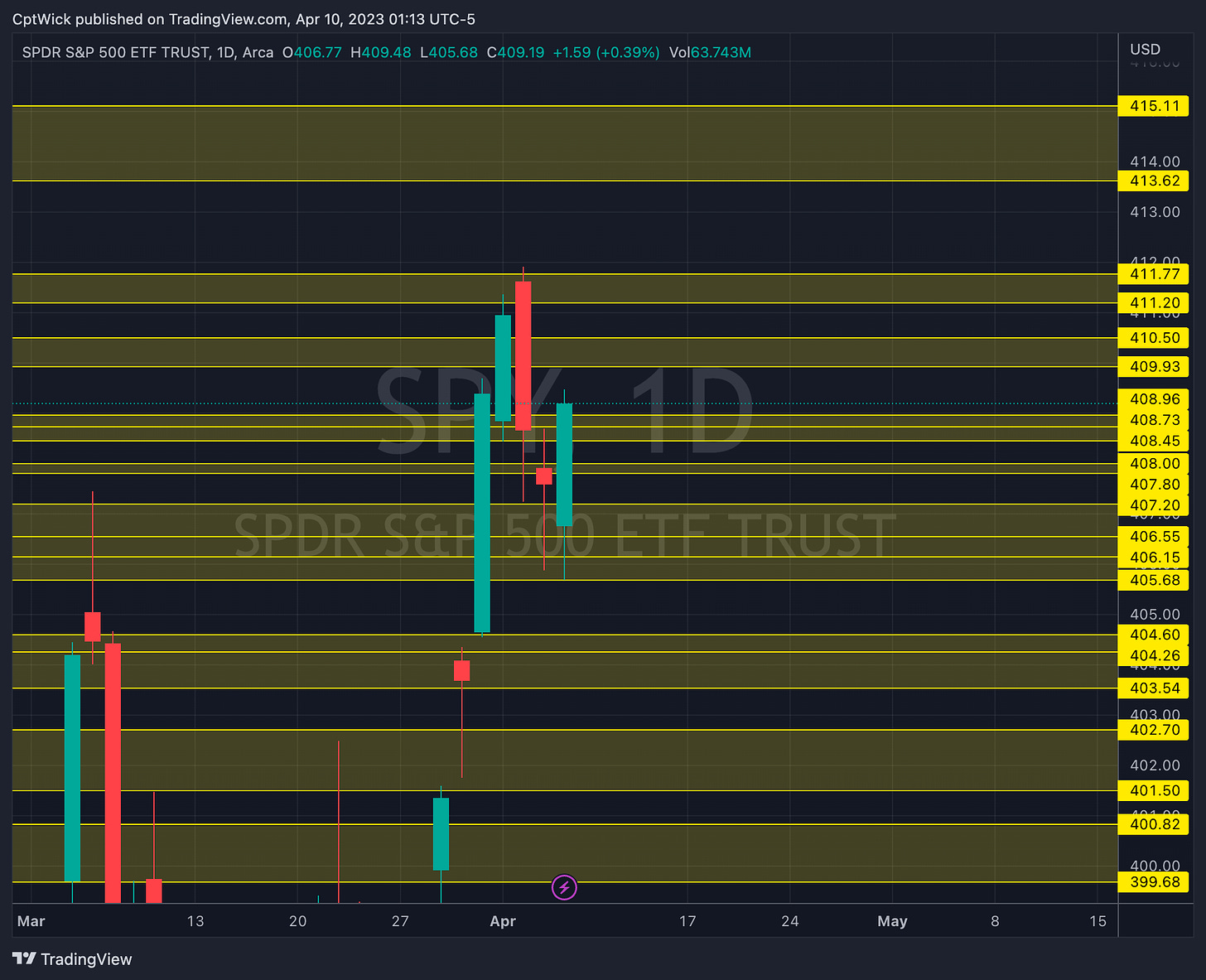

Gamma is showing similar levels, gamma is positive at 407.50, 410, 412.50, 414, 416, and to the downside 392 and 390. That 407 area is going to be key again this week, under 407 the bears can put the pressure on. Above 410 we have a chance to see 414+ based on current gamma.

I want to point out to you some key volume areas in a different perspective than my traditional method. Take a look at the big concentration volume that happened around the February highs. Its not surprising that once we revisited that area, we have a rejection at these levels. This also explains the negative vanna and positive gamma around these levels. It would be a gigantic win for the bulls if price can push past this volume. We also have built a strong base around 400-388, a move down under 388 could be real bad for the SPY. We have news this week with CPI and we have been a nice bear market rally here, if CPI is hot, this could could trigger the start of a selloff towards 392.

—4/10 Trade Plan—

Bullish Scenario

Above 409 target 409.93-410.50

410 is positive gamma, but its also positive vanna, the negative vanna is at 412, so about 410 we could have that push for 412+

Above 410.50 target 411.20-411.77

February POC, Bulls really need to take this out.

Above 411.77 target 412.58, 413.62-415.11

412, 413, 415 is negative vanna

Above 415.11 target 417.08-418.50

417.08 is February's VAH

Bearish Scenario

Below 409 target 408.45, 408-407.80

407.50 is positive gamma, under this we don’t have gamma support until 392 (very similar look to last week, they could pin us between 407.50 and 410 tomorrow, this is a big level.

Below 407.50 target 407.20, 406.55, 406.15, 405.68

Below last weeks low of 405.68, would open the door to 398-394 on a weekly timeframe.

Below 405.68 target 404.60-403.54, 402.70, 401.50, 400.82, 399.68

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.