Readers,

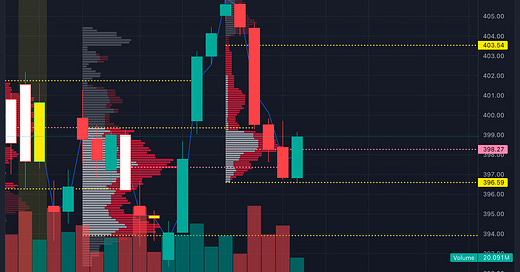

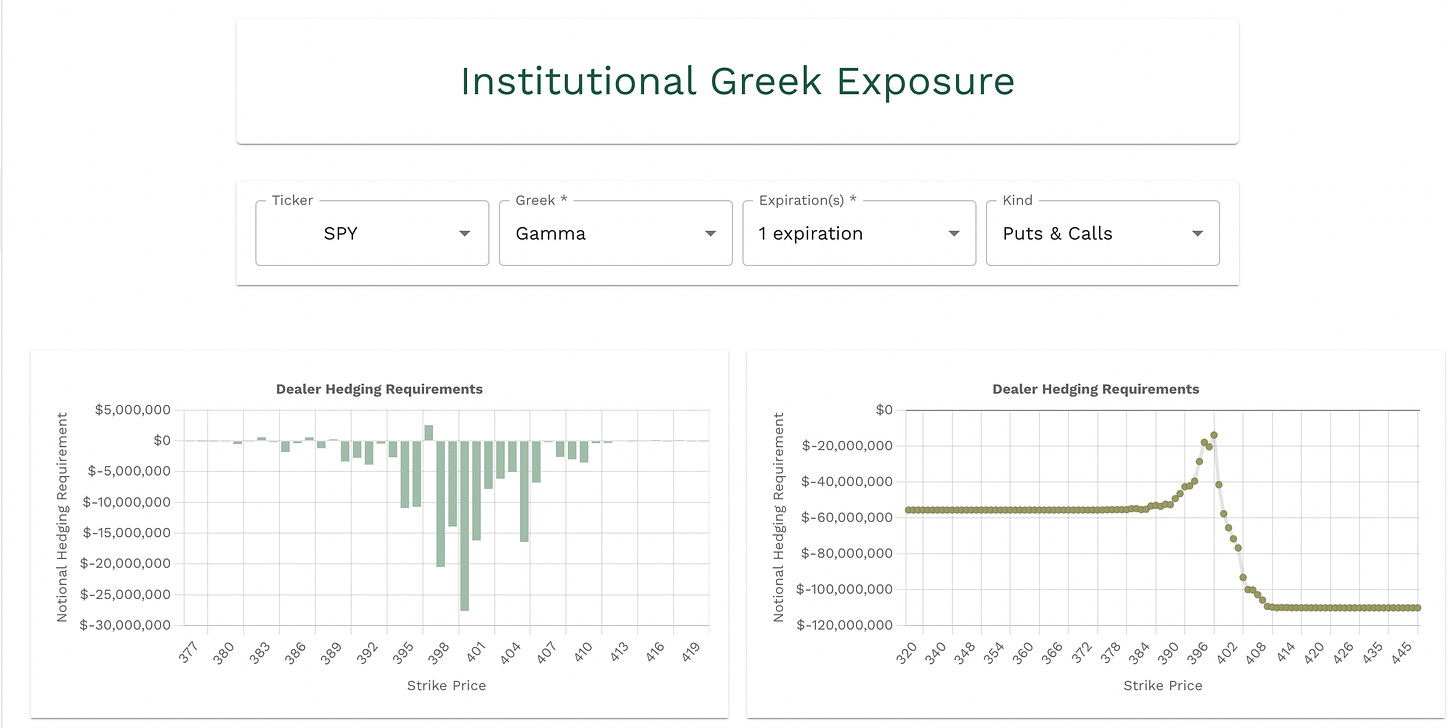

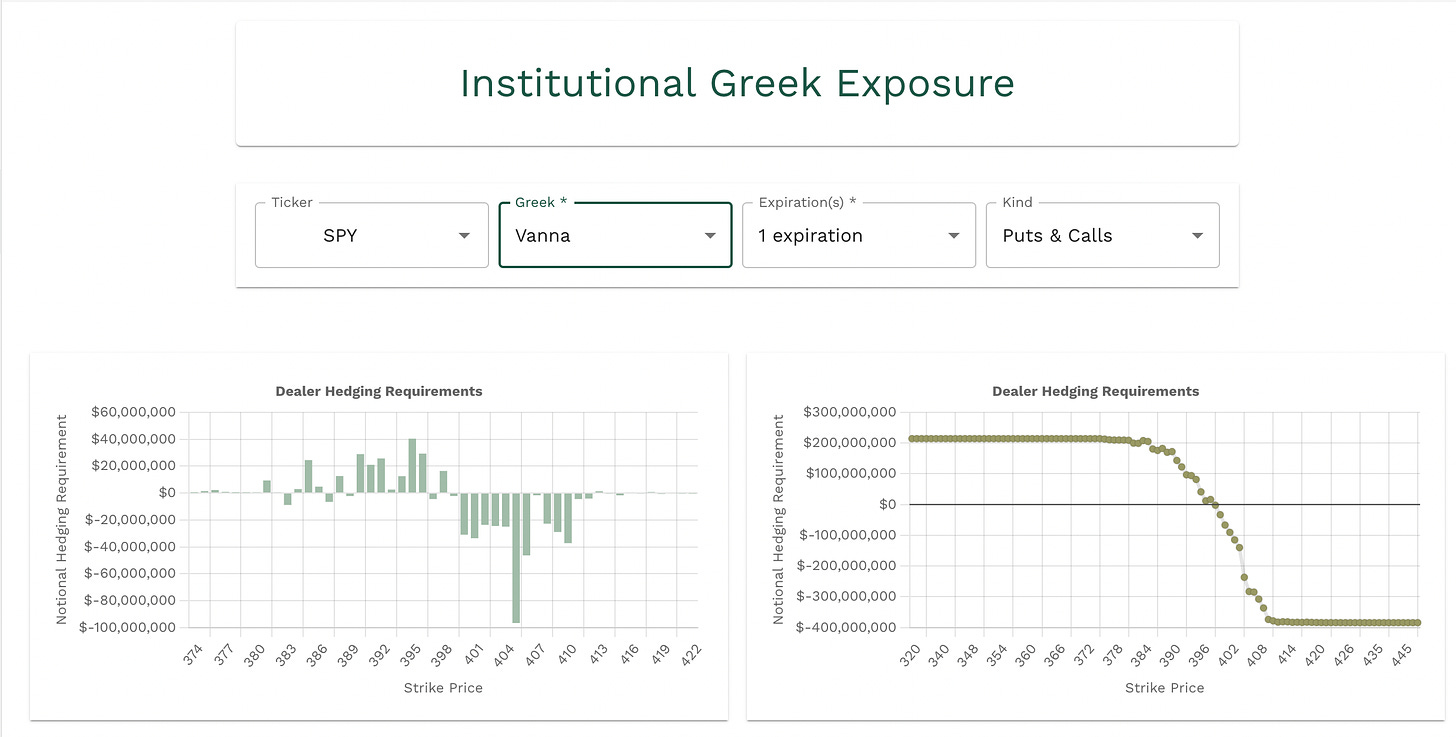

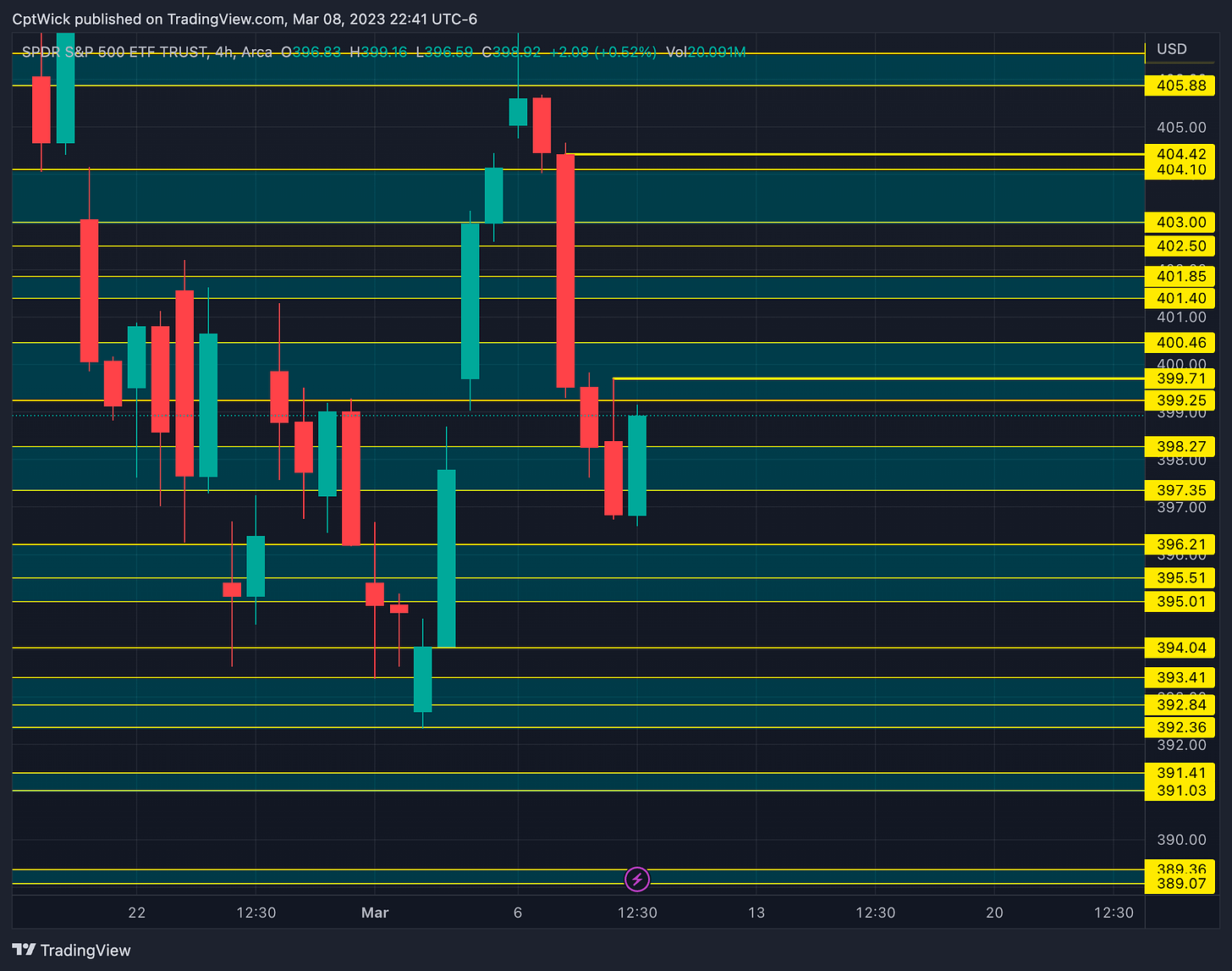

Today was a tough day in the market, if you came out green kudos to you! Both of our scenarios from last nights plan didn’t really play out like we had hoped. The positive gamma and negative vanna kept us pinned between 396 and 400.

We bounced around between these two supply and demand zones and didn’t have any follow through on either side.

Our monthly demand zone did hold though so it will be interesting to see what they do the rest of the week, let’s see what we can come up with.

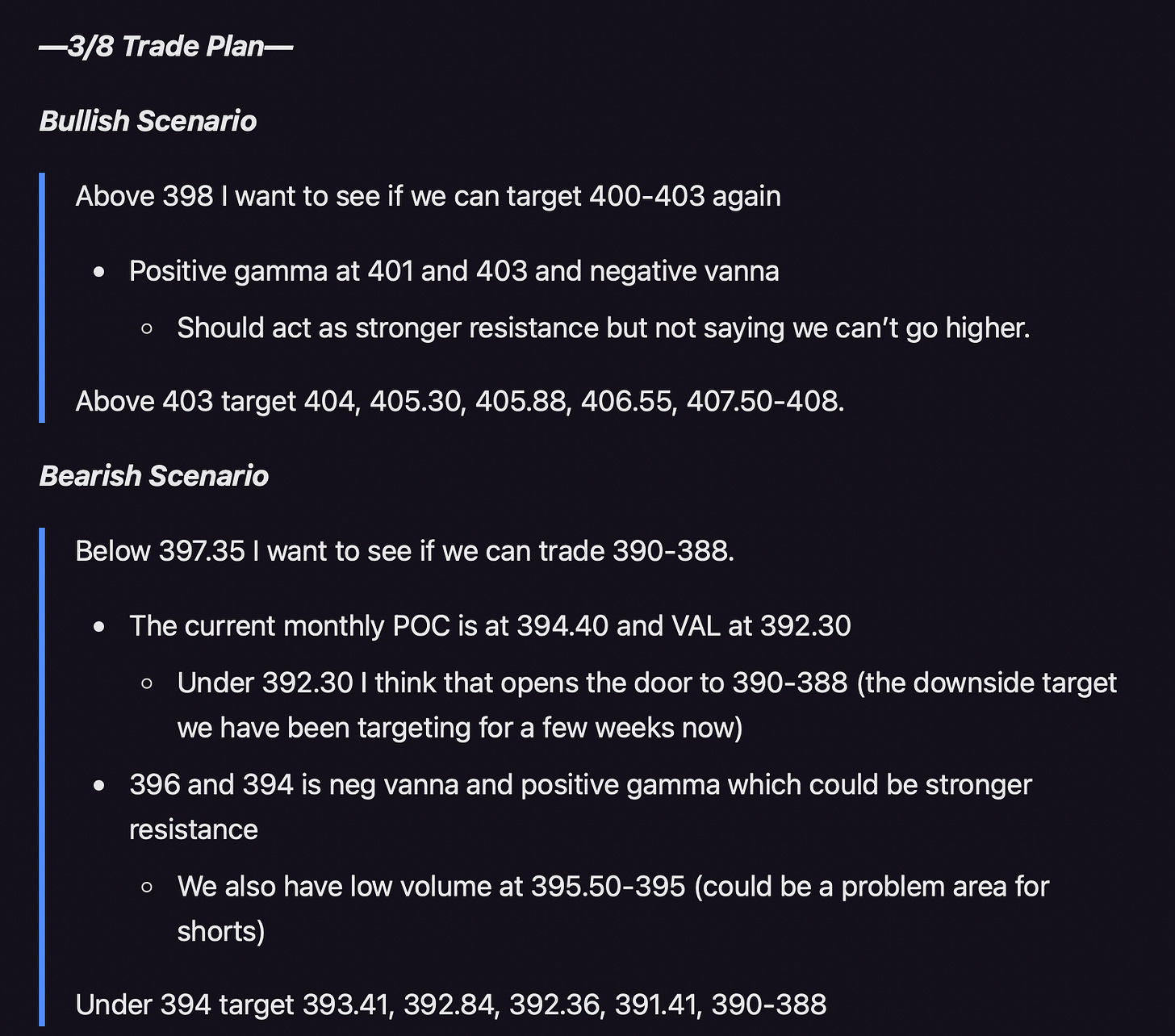

—3/8 Pre Plan—

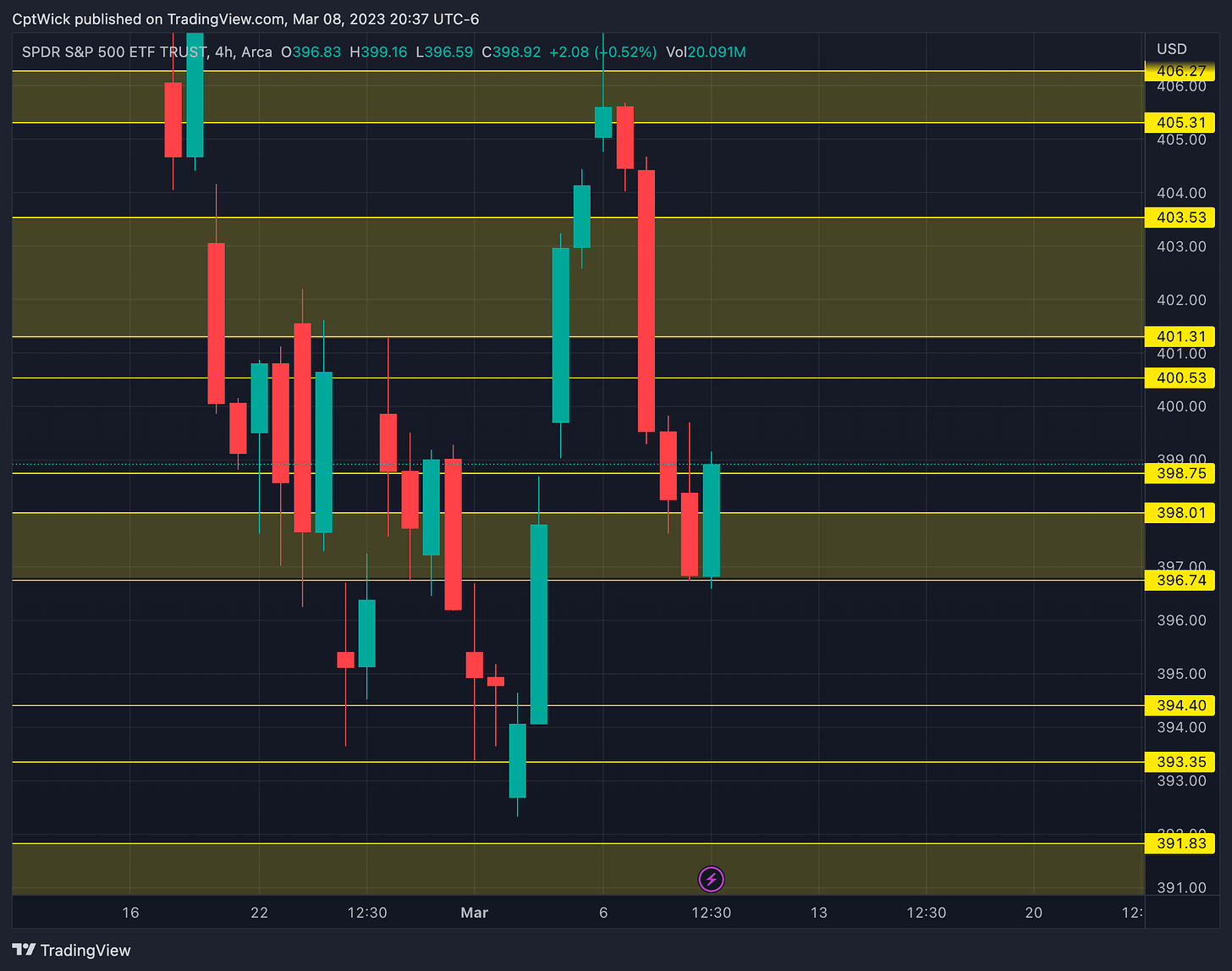

The weekly volume profile closed above the POC at 398.27, so as long as this area holds I would look for a move up to the VAH at 403.54, If the VAL at 396.59 can’t hold I’ll look for a move around 394 or lower.

Looking at the 1D we can see that we are near the downside MMs expected weekly move and the bulls closed us above the POC of 398.30, I think that if the bulls can break above 399.71 (yesterdays high) and 401.25 (VAH) we can test 404.40 again. If break to the downside 396.34 (MMs move) we can see 394-393.40.

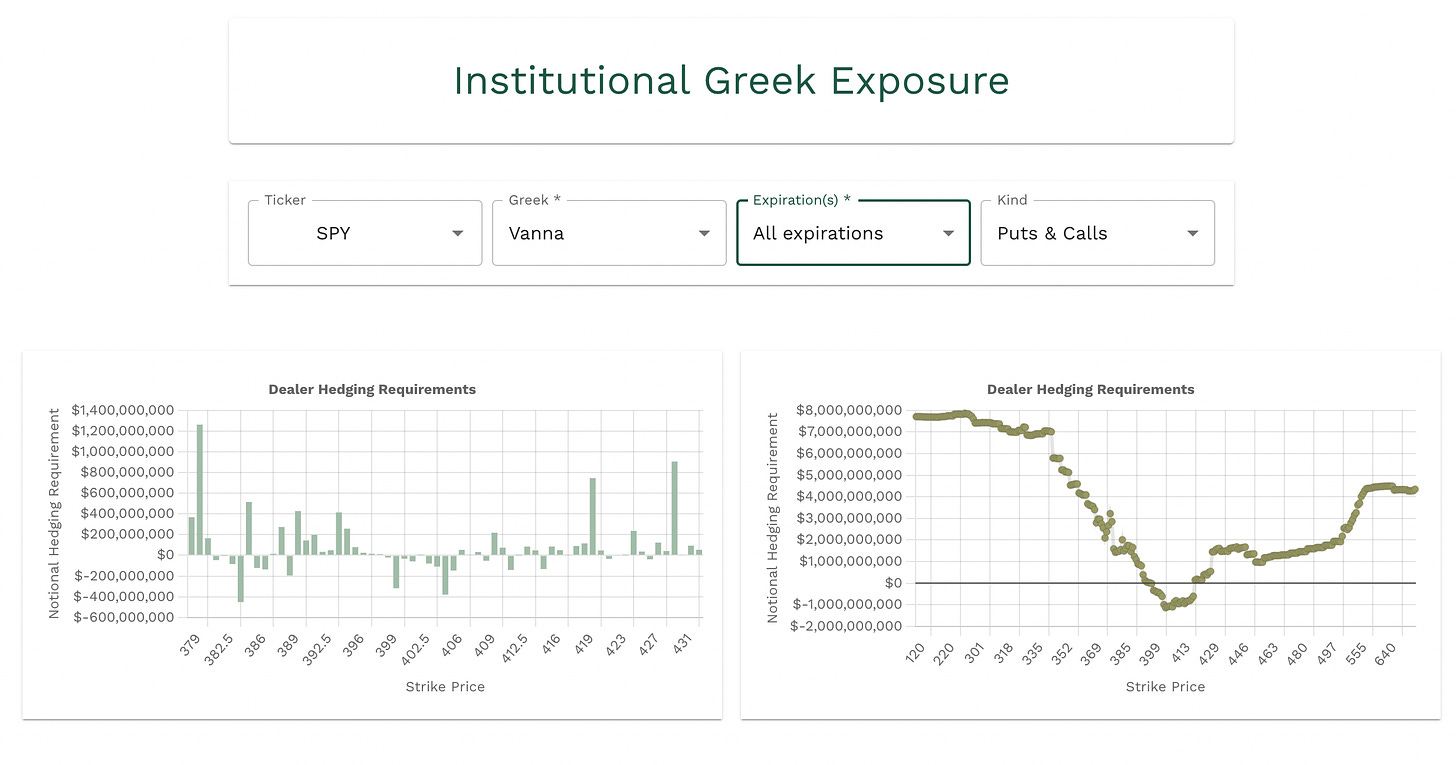

The aggregate vanna is showing the same, we have the negative vanna above from 400 to 406. Positive vanna from 396-390, and up around 407-410. This tells me that the negative vanna above us will try to push us down to the positive vanna at 396 and lower.

The gamma is negative from 389-407, and tomorrow we have positive gamma at 397, so 397 is going to play a big role for tomorrow above or below.

The vanna for tomorrows expiration is showing the same, we have the negative above and the positive below, I think that this data is showing advantage to the bears. The negative vanna will try and push us down, but this does not mean we full port puts.

—3/9 Trade Plan—

Bullish Scenario

Above 398.27 we could try for 399-404

Negative vanna around 400 might act as resistance we need VIX to play along if we want to push up above.

Above 400.50 target 401.40-401.85, 402.50, 403-404.40

Bearish Scenario

Below 397.35 I want to target 396-390

The positive vanna below 396 will try and pull price down.

Below 396.21 target 395.50-395, 394, 393.40, 392.36, 391.41-391, 390-388

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.