Readers,

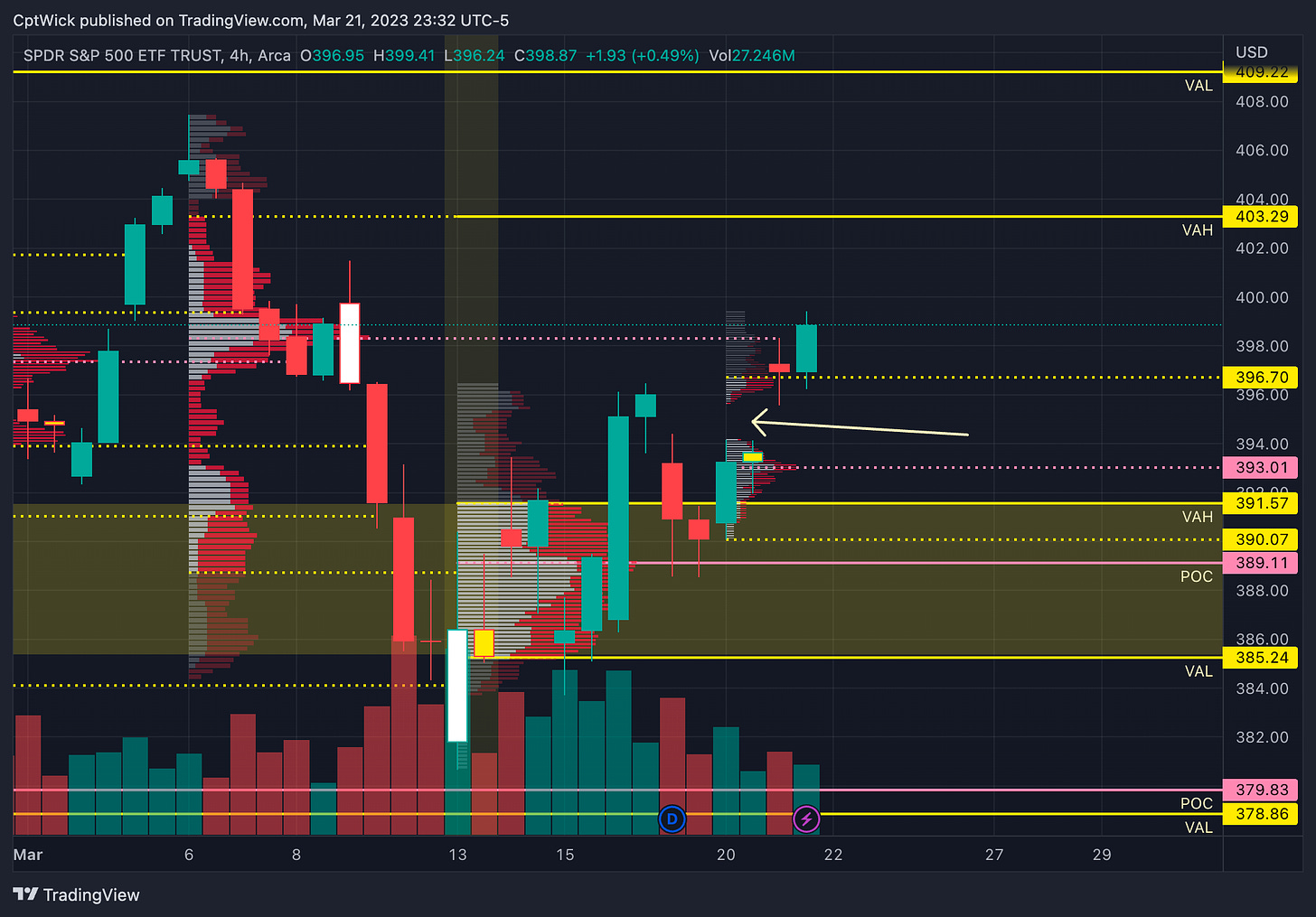

Last nights levels worked very well. We gapped up right into the 397.50 vanna magnet, we then rallied up and took out the naked POC from Sunday’s plan at 398.31. We sold down and played ping pong for a bit between 396.50 and 395.40 (LOD was 395.58) to then eventually rally to our next upside target at 399.16 (HOD was 399.41).

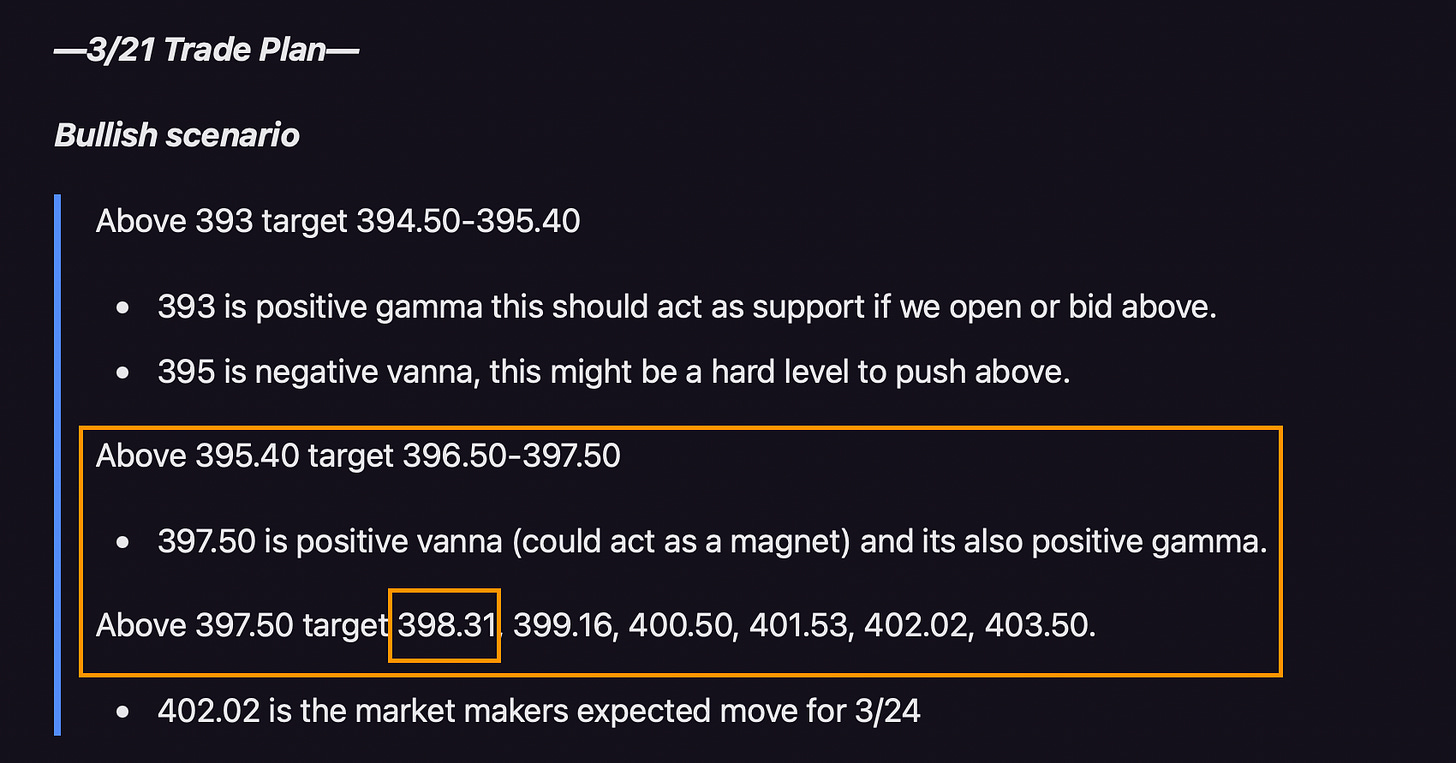

—3/21 Pre-Plan—

Tomorrow we have FOMC, the move can be violent and they are going to try and fake you out. I will do my best to give you what I think are key levels going forward for the rest of the week. There is a chance that price will blow past some of these levels fast, but we are going to be looking for a few key things that can maybe help us not get faked.

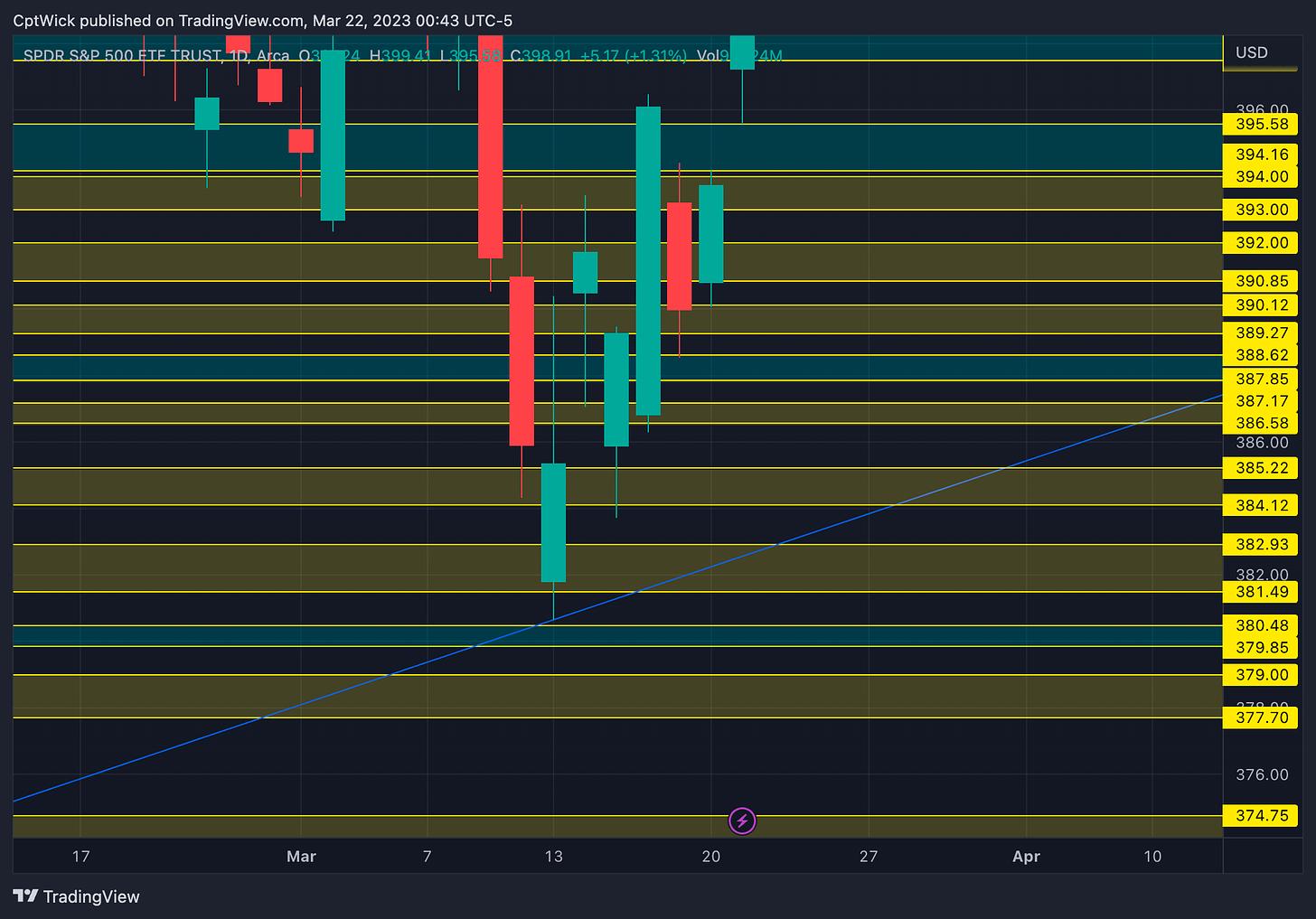

Let’s start with some volume analysis. Looking at the big picture we have a interesting look on the monthly profile. We gapped up above the double inside bar and we closed at a monthly imbalance to the upside. The POC stayed the same but the VAH came up from 395.93 (its currently at 396.73. Notice how this gap up left us with a LVN (Low Volume Node), this is now a critical demand zone. Ideally I think we want a retest of this level to see if they want to go higher, or if we want to test the waters back around 385.

The weekly profile is showing a similar look. There is no volume here because of the gap. Again, this is a key area that we need to be watching.If it holds we can see 403+

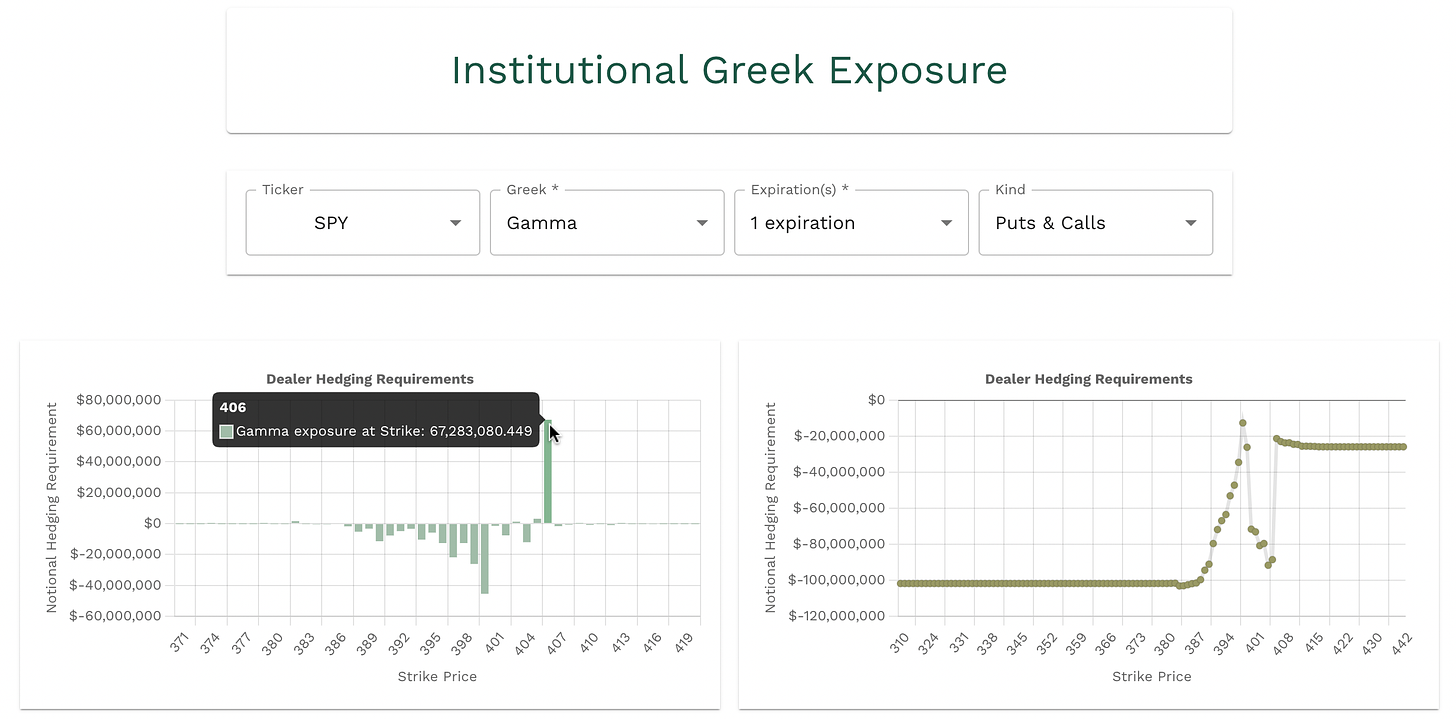

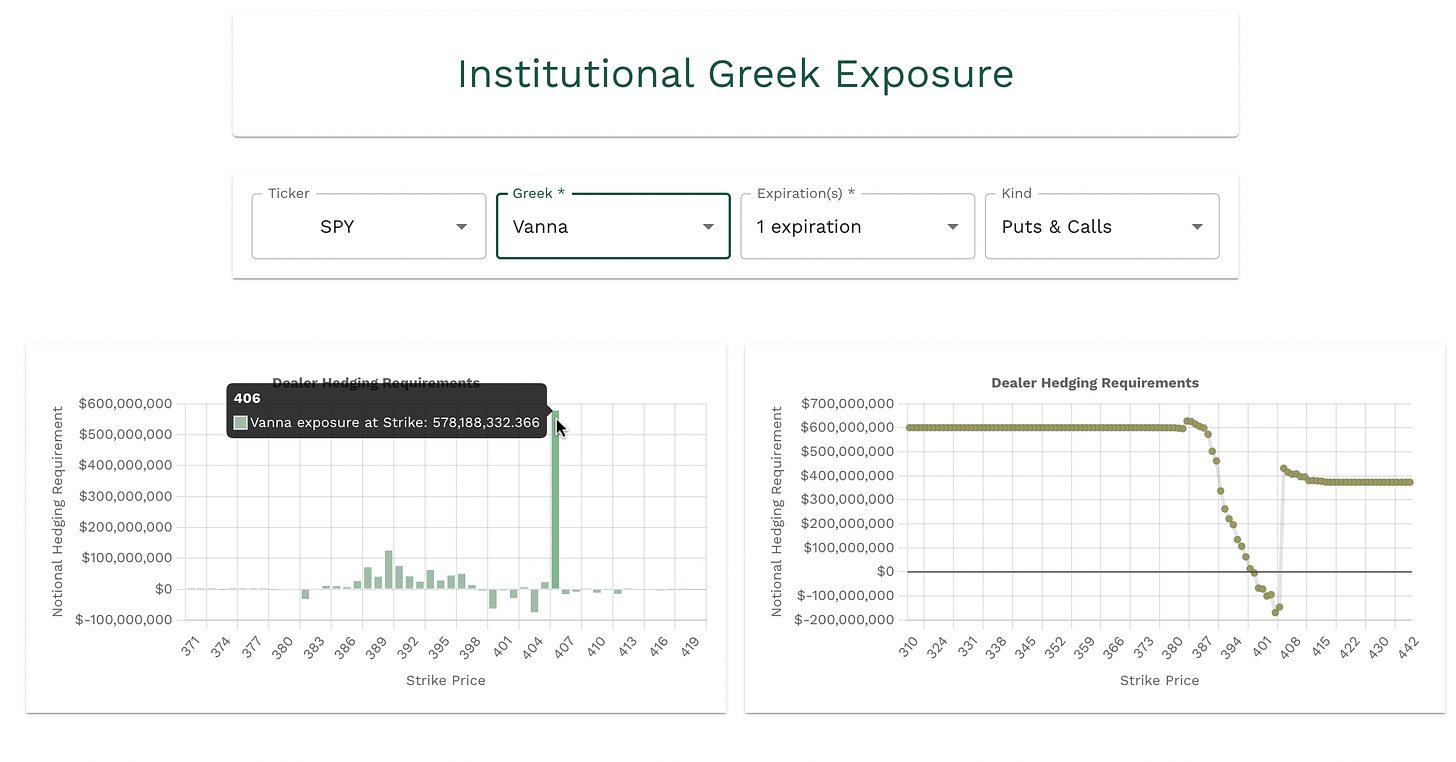

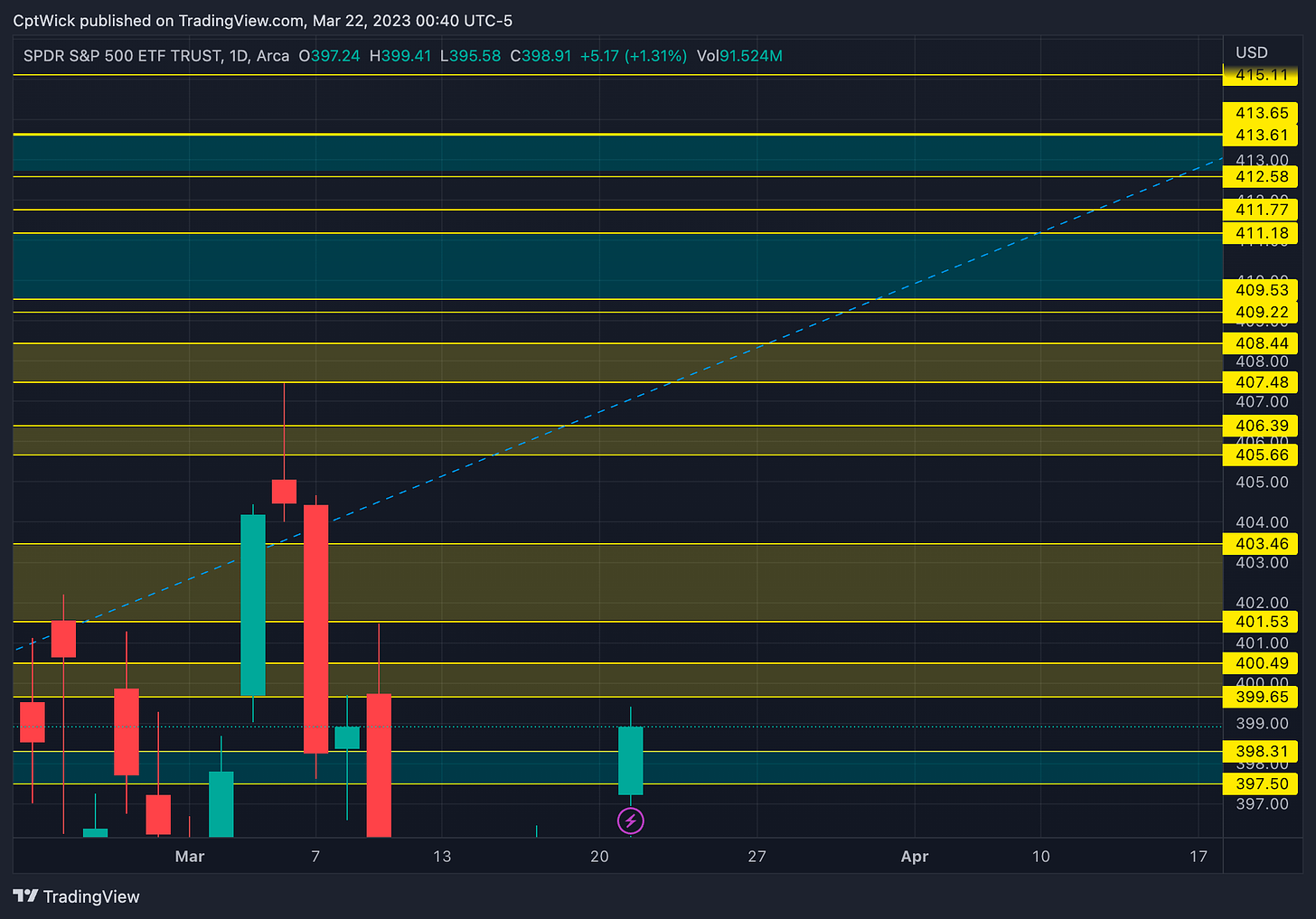

Looking at Volland, let’s make a note of some key vanna/gamma levels and see if we can use this to our advantage.

Key Vanna Levels

Negative- 376, 378, 381, 389, 393, 400, 404, 405, 407, 410

Positive- 377, 379, 380, 383, 385, 387, 390, 394, 397, 406

Key Gamma Levels

Positive - 367, 376, 378, 381, 386, 389, 393, 397.50, 406

Just for fun I want to include the vanna and gamma for just tomorrow, FOMC, I am not putting much weight on this based on these charts, but for science I want to include it.

The vanna/gamma is showing one dominant level in 406

—3/22 Trade Plan—

Im not going to do this like I normally do, instead lets go over the key areas of interest with the the volume profile and the Volland data.

397.50 is positive gamma/negative vanna so this area could hold.

400 is negative vanna, same with 404-405 (could be resistance)

406 is positive gamma (this could be hard to overcome).

We also have the gap in volume from 3/21’s gap up from 395.58 to 394

If I want to stay bullish I want to see 393 hold. We have positive gamma and negative vanna at this level, its also right under the VAH and POC on the monthly profile and we have a LVN from 394-393. Under 393 it opens the door to the 390-388 area, 389 is positive gamma/negative vanna, so this could be another strong support area.

Under 389 opens us up to 385 then 381, we have positive gamma at 386 and 381 and 385 is the monthly VAL.

378-376 is stronger positive gamma, this area might be stronger support.

Here are some levels above 3/21’s close that I am watching

Here are some levels below,

What I want to see when FOMC starts is a initial move up or down into one of the key gamma/vanna/supply/demand zones. And then we want to see a big rejection or reaction at that level. If we miss it because chances are we might, we need to watch and see how price moves at our zones.

It all comes down to HOW the market REACTS to FOMC, its going to be a whipsaw that will eventually even out and should pick a direction. I don’t know what the top is and I don’t know what the bottom is I can only react. My suggestion would be, don’t chase, If you miss it you miss it but I wouldn’t chase, wait for a entry.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.