Readers,

Last week our levels were respected and they closed us under the market makers weekly expected move at 397.77, and our major demand at 380.50 held the lows. If you want to go read it here is a link!

—Weekly Pre-Plan—

This week we have another week of news this week and the Market Makers are expecting a even bigger move this week, their weekly expectations are $12.03. That gives the upper range a target of 402.02, and a lower range target of 377.96.

Looking at the weekly volume profile, last weeks value area is going to be key for what happens this week I think. The profile formed a b, this could be a sign of weak sellers. If the bulls can defend this area there is a good chance we take out the POC at 398.31 and try to push up into 403. If the bears can push us down under 385 we should target 379-378.

The monthly profile is trying to hold on as well. See how we are holding January's POC and VAL. Very important area for both sides.

Here is the monthly supply/demand I am watching -

Here are some weekly supply/demand -

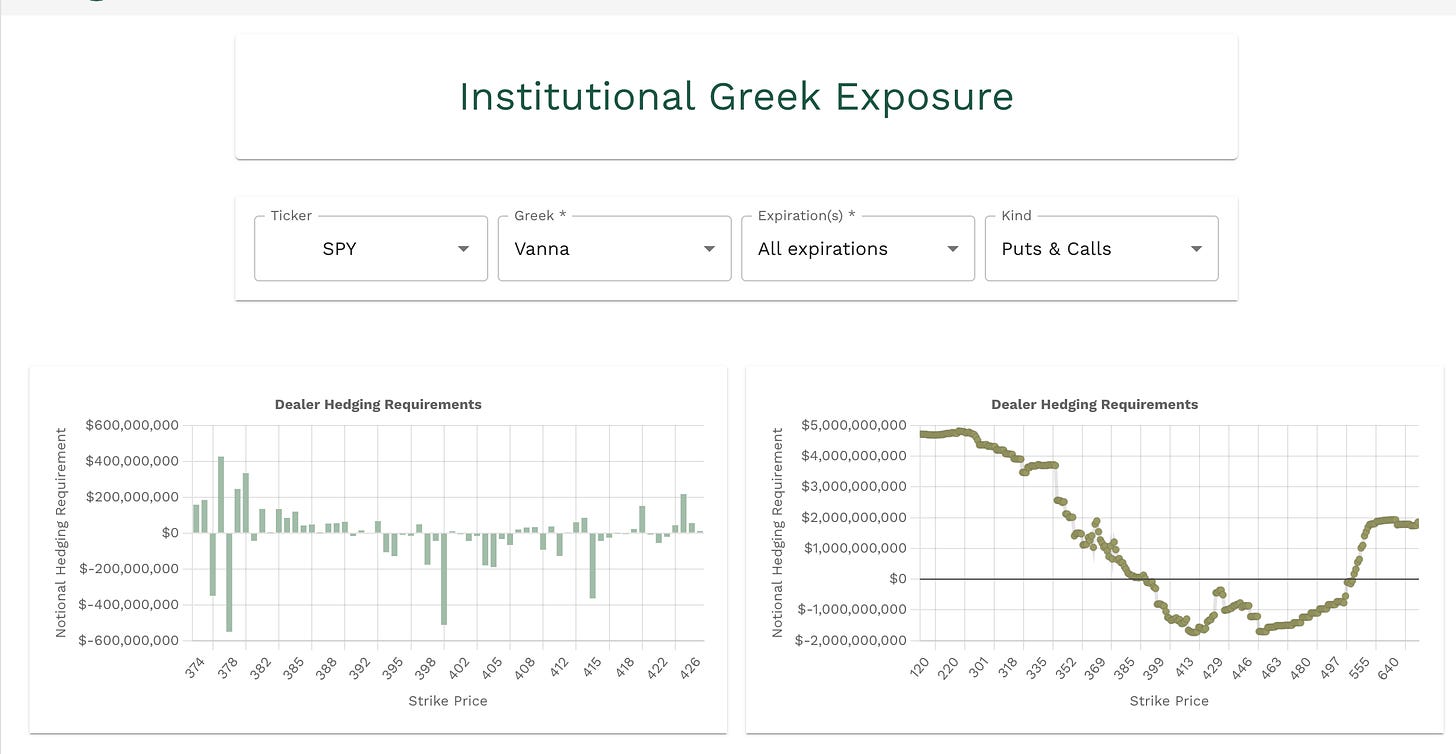

Using Volland we can try to find some correlation with these levels. The aggregate vanna is showing negative at 378, 381, 391, 394-397, 398-400.

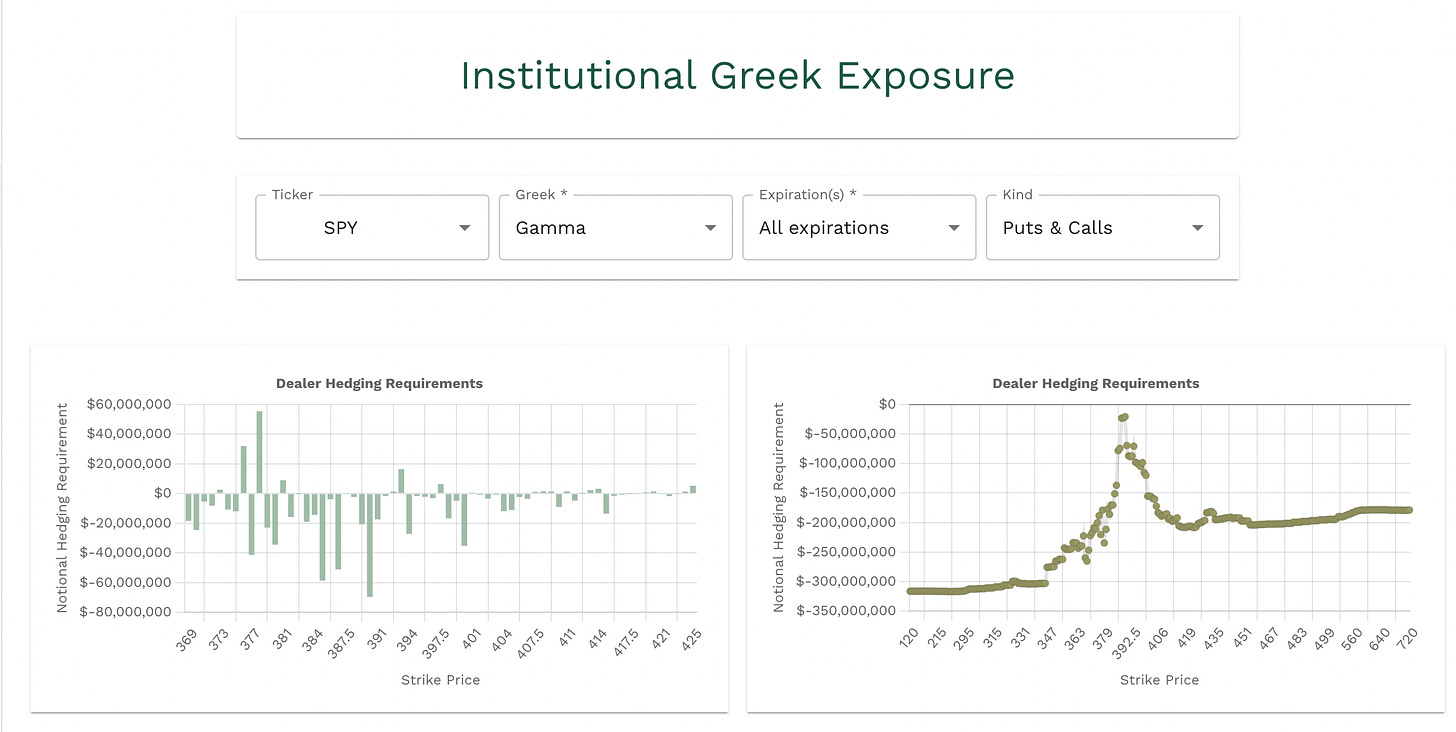

Gamma is showing positive at 378, 381, 393, 397.50, 407.50.

Looking at VIX, 25 is a big level, if we can stay above 25 we can maybe see 28.50-30. Under 25 opens the door to 20-19.

—Weekly Trade Plan—

The market makers are expecting a bigger sized move this week and it is because of FOMC. These things are hard to predict, we can just use this levels and stay true to our plan.

Bullish Scenario

Above 390 target 391.57, 392.58, 393

391 is negative vanna and 393 is positive, if bulls can push above 391 we can see 393. 393 is also positive gamma, could be a issue for the bulls.

Above 393 target 394-395.40

394-395 is negative vanna and its also a key supply zone.

Above 395.40 target 396.50-398.31

397.50 is positive gamma and we have negative vanna from 398-400 (398.31 is also a naked weekly POC), I would expecting selling

Above 398.31 target 399.16-400, 401.53, 402.02, 403.50.

402.02 is the MMs weekly expected move.

Bearish Scenario

Below 390 target 389.11, 388.62, 387.85, 387, 386.50

Under 390 we have a cluster of positive vanna/negative gamma all the way to 381, (381 is also the next positive gamma).

Under 386.50 target 385.25, 384.12, 382.93, 381.50

positive gamma/negative vanna at 381. Could be support.

Under 381 target 380.50, 379.85, 379-377

378-376 is positive gamma/negative vanna, could be a problem for the bears.

I have a demand zone at 374.75-373.50, 373 is also negative vanna/positive gamma. If we trade these levels later in the week I will be sure to inform you on any data changes.

I am focused on last weeks value area as I mentioned above, its the zone from 391.57 to 385.24, above or below this zone will be key for future direction.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.