3/2 SPY Trade Plan

Readers,

Today was a good day in terms of our levels from last night. 396.26 was still strong resistance as we pointed out with our volume profile analysis and we almost reached 393.23, came within .15 but we kangaroo'd between our levels. If you want to read it here is a link, there is a lot of good information in that post that came true, so far the bearish scenario is playing out just how I thought it would, it highlights why we couldn’t get over 397 today.

—3/2 Pre Plan—

The volume profile is shaping up nicely for the bears, we have had a few key things happen. Here is what the monthly is looking like.

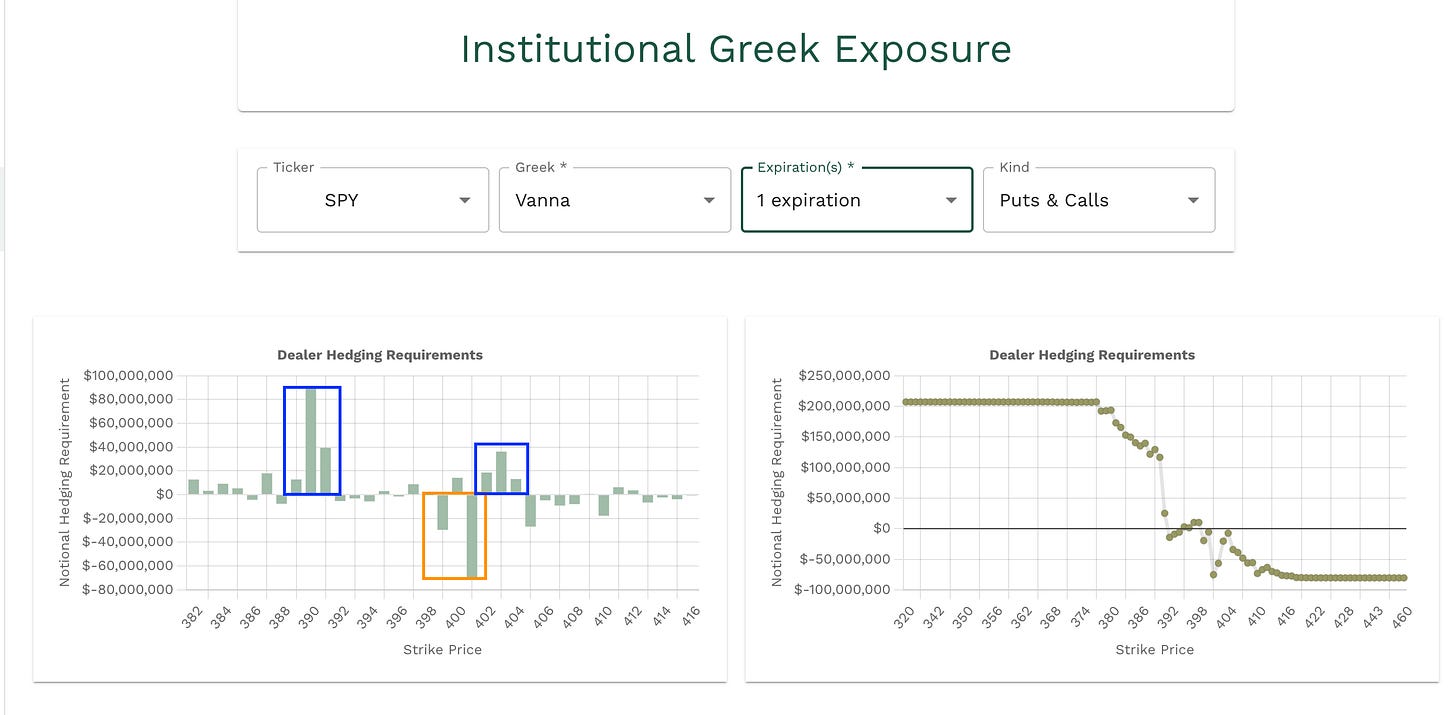

Does this mean price HAS to hit 388? No, but the probability is there. Lets see if the Volland data supports this. First off the aggregate vanna above us is negative, this means that at current IV levels this should push down to the positive vanna cluster around 390-385. This does support our volume profile analysis.

Again, does this mean that we are 100% going to see 390-388 before we see that other positive vanna above us at 410? No, but the majority of the signs are leading us down to 390.

The vanna for the 3/2 expiration is showing a similar trend. The negative vanna above us should push price down towards the 391-389 positive cluster. We have a noticeable gap in vanna here around current spot price so I want to check gamma and see if there is anything there.

The gamma is positive the notable levels are 394-395 we also have some positive at 397. These are going to become key levels for tomorrow. above 395 this level might be good support, and below it could be strong resistance.

—3/2 Trade Plan—

Bullish scenario

Above 395.50 target target 396.26-397, if the bulls can push up past 397 we could see 400. Need a big VIX drop for this to happen.

If we test these areas and fail to push higher, and VIX is increasing these could be good put entries.

Bearish Scenario

Below 394 target 393.23-392.36, 391.41-391, 390-388

We have been targeting 390-388 now for awhile. 392 is starting to lose some of this negative vanna which means the positive magnet at 390 could be strong if we get a VIX increase.

As a gentle reminder. These levels once breached can flip, meaning if we break support and we come back to it, it can flip to resistance, stay nimble, keep a eye on VIX and watch for candles with bigger wicks around this levels, volume and price will tell the story.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.