Readers,

My apologies for not issuing a plan for 3/16, the real world took a toll on me, but let’s look at what happened today. I sent out a tweet before the open with some key levels I was watching and I said that 389 was key for the bulls to get above, but if we couldn’t I was looking for a move down to 382, well 389 broke with vengeance and our bullish levels from the weekly plan came into play.

IV also got crushed today helping that pushing into the negative vanna.

—3/17 Pre-Plan—

Tomorrow is OPEX, we are also closing in on the MMs weekly expected move from the Sunday post, here is where we are currently.

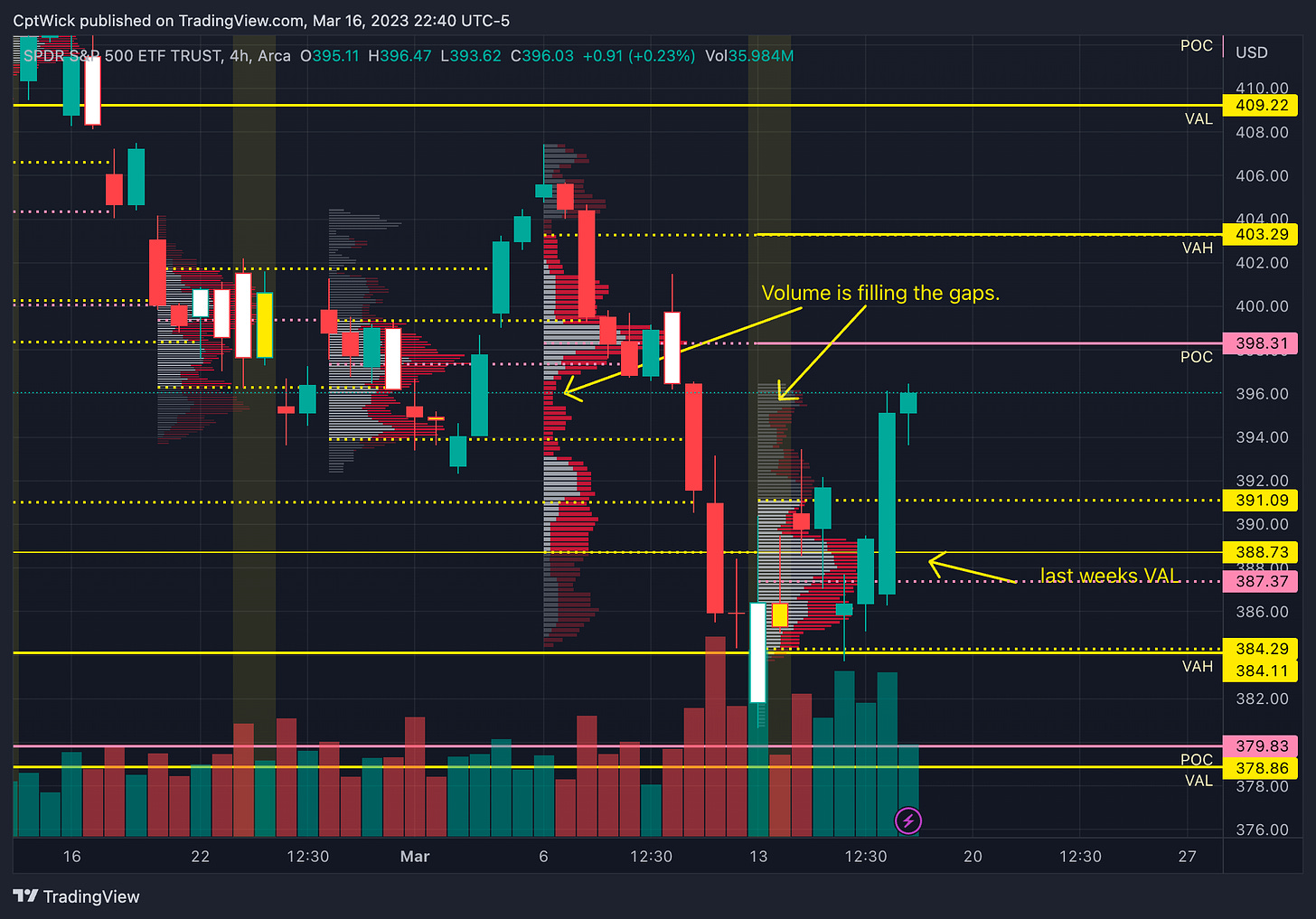

Price made a strong move up inside of last weeks value area and it appears that it is trying for the POC at 398.31 and above that we could revisit the VAH at 403.29. This week’s current POC is sitting at 387.37 and VAH is at 391.09 (these levels are dynamic until tomorrows close, but if I am a bull, I ultimately want to see last weeks VAL 388.73ish to hold. If we lose 384 we can target the naked POC down at 379.83.

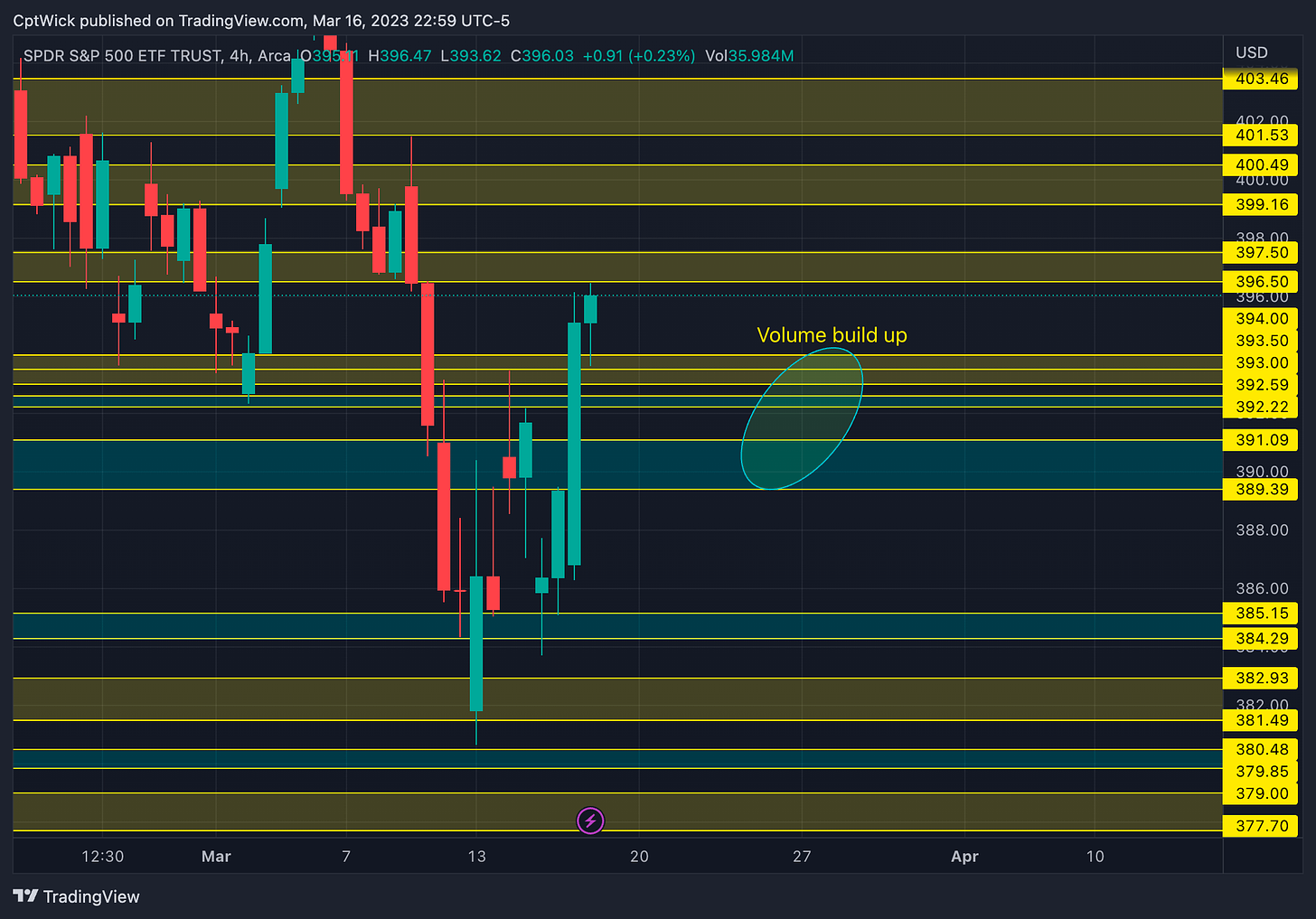

We are seeing some volume build up here from about 389-394, If we are bullish on SPY we ultimately need this area to hold.

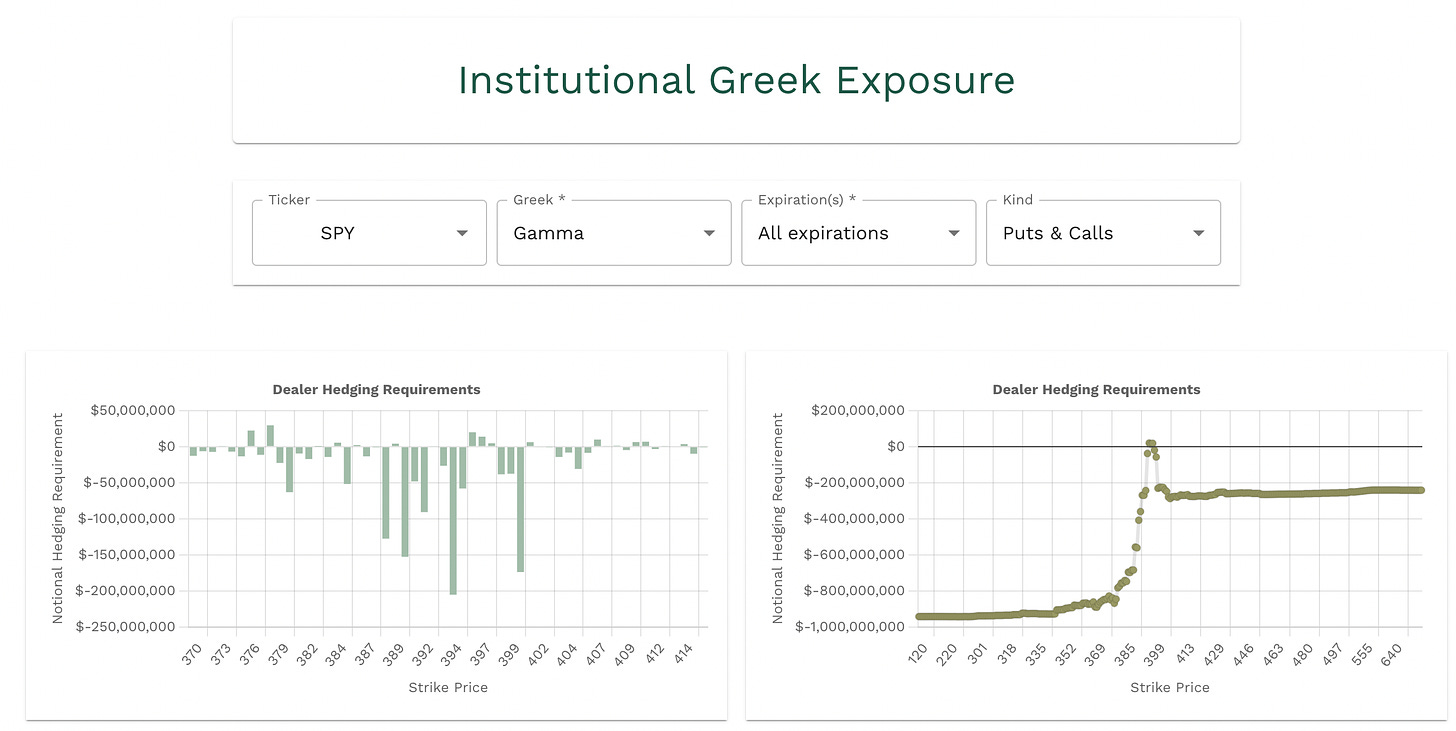

Looking at vanna on a aggregate level we have a notable negative value at 400 and a bigger cluster of positive down below 395. 390 and 388 are notable positive levels. We will be watching the 400 level if we start getting close for a rejection (assuming we do). If we open or bid below 395 we will look for downside levels.

We have positive gamma at 389, 396, 397, 397.50, 401. These values will be considered stronger support and/or resistance.

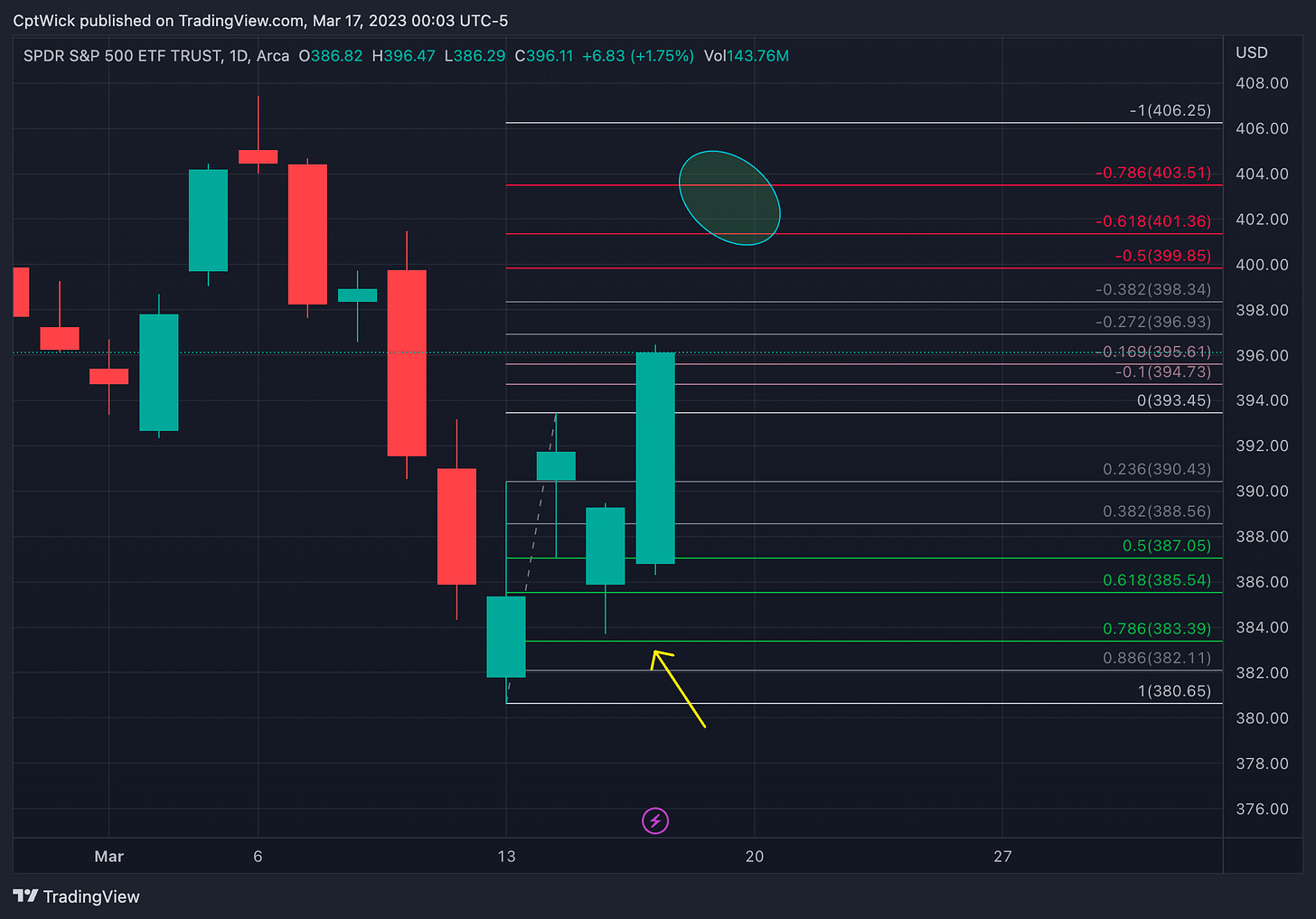

For you Fibonacci fans here is something for you, if we take last Monday’s high and last Friday’s low you can see that we opened this week and continued down but the -.169 held, and now we have retraced 50%. If the bulls can’t push us over this level we could be headed for a -.50 extension down (which would put us at December’s VAL), If the bulls can continue lets say to the .618 or higher, these levels could act as resistance and we could chase their extension.

We need to also look at the bullish possible scenario. If you take the recent swing low at 380.65 to Tuesday’s high, we retraced .618-.786, this would give us a possible extension to 401.36-403.51. Do these levels sound familiar? They should!

Im not saying that one of these two scenarios will play out, but it is something that I am watching and also something that has been backtested for a really long time.

—3/17 Trade Plan—

Bullish Scenario

Above 394 target 396.50

395 is negative vanna, and we have a lot of positive vanna below, 395 could be a problem for the bulls.

Above 396.50 target 397.50

396-397.50 is positive gamma meaning, this could be stronger resistance, very good for bulls if they can take this level.

Above 397.50 target 398.31

We have negative vanna at 398 - 400, and 398.31 is also last weeks POC.

Above 398.31 target 399.16, 400.50, 401.50 - 403.30

398 is big its a POC/.618 down leg retracement/negative vanna

If the bulls push up over 398 I think we could see 400 - 403

Bearish Scenario

Below 394 target 393.50-393

Under 394 we have a bigger cluster of positive vanna and negative gamma, meaning that a selloff could be supported.

Below 393 target 392.60-392.20

This area on the volume profile is pretty key, we have lots of trapped bulls here, it will be supported, or it could accelerate a selloff (vanna/gamma)

Below 392.20 target 391.10-389.40

389 is positive gamma and the next positive level is 384 (also negative vanna)

Positive vanna at 388, this could accelerate a move down to 384.

This is roughly last weeks VAL.

Under 389.40 target 385.15-384.30, 382.93-381.50, 380.50-379, 377.70

378 is negative vanna/positive gamma (strong support)

The MMs expected move down is a long shot at 374.05 so I will just put that level here :)

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.