Readers,

Price respected our levels from last nights plan. We gapped up right into our major supply zone and pushed up above but the bulls could not push is above our supply zone at 393-394.34 (negative vanna) and we then sold down past the open but found support at demand/negative vanna at 387.75. This is how we bring conviction to these zones.

—3/15 Pre-Plan—

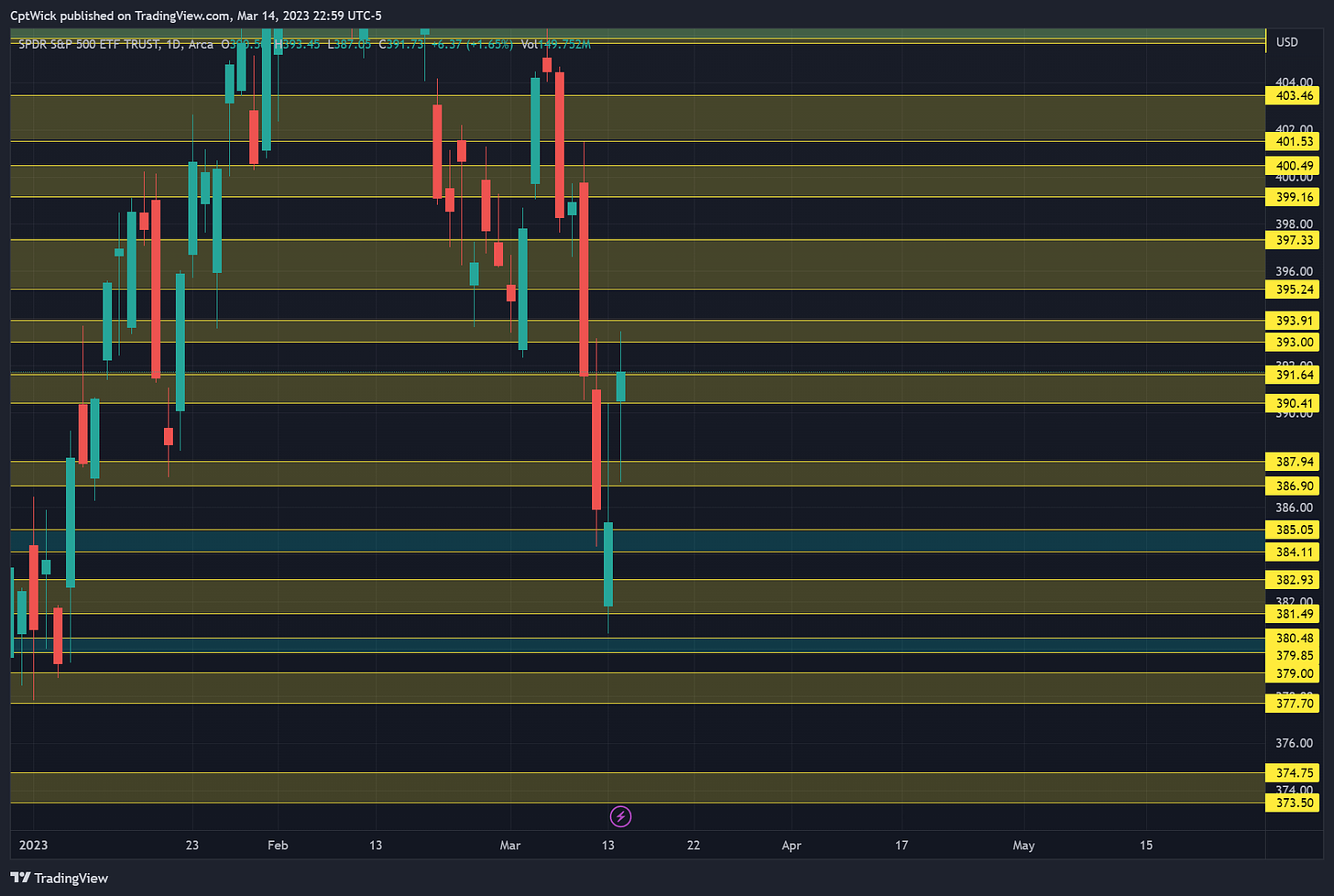

Let’s look at the weekly volume profile, notice how last weeks VAL and this weeks POC are .20 apart, and we pushed up away from that area. If we can hold 388 I think we can make a run at last weeks POC 398.31. If we lose 388 we need to target 386-384 and then down to 380-379.

Vanna for tomorrow is showing negative above 392 and positive below 390, if we are going to push over 392 and make our way through this negative vanna we need IV to come down, PPI is released tomorrow so this could help get past it, if IV stays the same or if it increases the negative vanna will drive price down into the positive cluster, there is some negative vanna down at 379, so this could be a area of support if we were to trade there tomorrow.

The gamma for tomorrow is positive at 390, 391, 392. So we are looking for price to get away from this level up or down for a possible trade.

Here are my key zones for tomorrow

—3/15 Trade Plan—

PPI is released tomorrow and it could cause a pre market move just like today but I will give the plan of the close on 3/14 (391.73)

Bullish Scenario

Above 391.64 target 393-393.91

Remember we have positive gamma at 390-392 but we also have negative vanna above 392, so we need IV to come down for a bullish move above these levels, PPI could help this.

Above 393.91 target 395.24-397.33

398.31 is last weeks POC so keep this level in mind.

Above 398.31 target 399.16-400.50, 401.50, 403.29

403.29 is last weeks VAH.

Bearish Scenario

Below 390.41 target 387.94-386.90

Touching on the positive gamma again, under 390 could spark a move to the downside with all the positive vanna down there as well.

388.91 is also this weeks current POC, important for the bears to get price below this.

Below 386.90 target 385-384, 382.93, 381.50, 380.50-379.85

379.83 is a old weekly naked POC, meaning it has not been tested. It is also negative vanna so it could be support.

Below 379 target 377.70, 374.75-373.50

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

Forgot to add my zones... Adding them quick.

Hey

Thank you very much !!!

I would like to know why you are using 1 expiration ? why not the third Friday of the week (17)

Let me know :)

BEst regards,

Thomas