Readers,

We said last night that we were going to be choppy if we stayed in last weeks value area, 402-396.26. Look where we closed…

We saw 398.78 after playing ping pong between two low volume area’s. The play of the day was once we consolidated inside the low volume node at 398.84 to 399.07. You could of marked the high and low of that range 398.65 and 399.28 seen here, look how price comes back and then the selling continues, we were given multiple entries at this zone.

Now we have to see if the bears can put the pedal down and move this price down. Or can the bulls save it? Let’s make the plan.

—3/1 Pre Plan—

Today was the end of February, let’s see how the monthly profile turned out so we can see what the key level to the upside is.

February ended up with a VAL of 401.29, POC at 411.80, and VAH of 417.10. If we stay under 401.29 there is a good chance that we see 390-387. If the bulls can take that VAL back, we might be able to rotate back up to 412-417 (not 0dte).

Im getting tired of looking at this chart above, but this is the value area that we have been watching and we are close to breaking it to the downside.

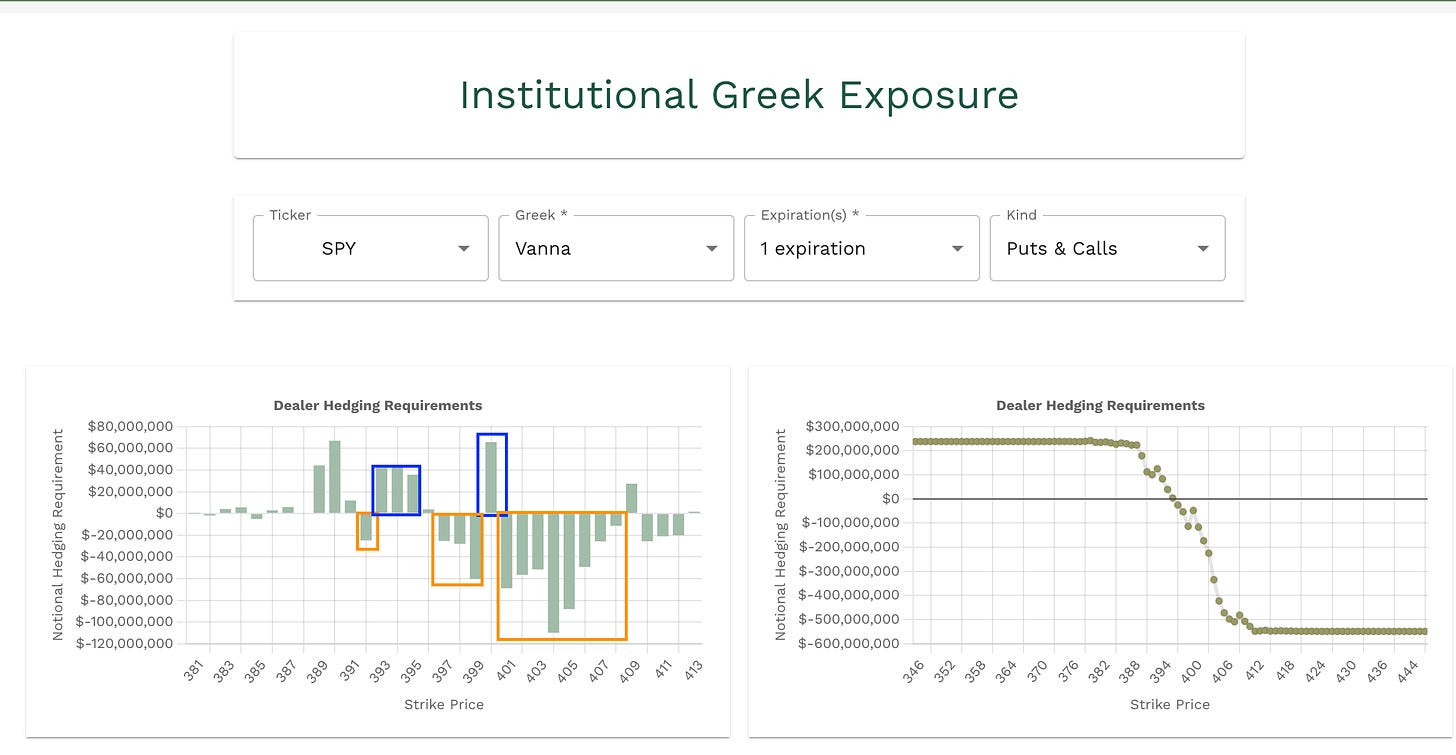

When looking at the Volland data for tomorrow we are seeing a little different picture. 400 is positive (could be a magnet), we still have the negative vanna up to 409 and from 397-399. We have a positive cluster from 393-395, and another positive cluster under 392. With the negative vanna blocking 400 I think that rallies into 397-399 might be sold. And 392 could offer support.

—3/1 Trade Plan—-

I still don’t have much confidence in the bulls, for me personally I’m not interested unless we can close above 402 longer term. If the bulls can hold this 396 area I can see them wanting to retest 397.50-400 but this could present another put opportunity. The R/R to the upside doesn’t make sense to me, maybe I am wrong but I want to see a 1D close above 402 if I am going to become a bull.

Bullish scenario

Above 396.26 target 396.75, 397, 397.40, 397.80, 398.85, 399, 400

These levels could be good short entries with the negative vanna, keep an eye on VIX, if it is rising and we are trading at these levels, it could make for a good put play.

Bearish scenario

Below 396.26 target 395-394.77, 393.23-392.36, 391.41-391, 390-387

Notice how the 396-402 area is getting very congested/choppy (consolidation) so the volume profile is getting “filled” I think the less choppy action comes if we get a move down. If the bears can keep us under 396.26 I think that we can run for 392-390 and maybe 388. 392 is negative vanna so if we come into that area we could maybe expect a bounce.

These areas can also become good scalp long entries. Be nimble if you are scalping, if you are swinging make sure you buy yourself some time and know what your targets/stops will be if you enter into a position.

I know I keep harping on last weeks value area but it really is the key to if we can reach these downside targets, I think that the longer we stay inside the 396-402 zone, the bulls will end up pushing out. Bears in my opinion are in control if we can get past 396 tomorrow, just my .02.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.