Hello team. Today was just a major choppy trading day where price would go one way ad then immediately retrace. If you didn’t lock in profits early you were potentially greeted with a red PnL.

As I tweeted in the morning that this price action didn’t excite me either ways and I typically avoid trading days like this so I stayed out…I #paytiently waited and entered in SPX and QQQ puts before the end of day selloff. I even tweeted about it here…

Depending on your entry you easily could have scaled out and walked away with some profits and reduce your risk on any runners. Let’s see what tomorrow brings our way.

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

Key news events will determine the markets trend pre and post market open…

5am est - BOE Gov Bailey Speaks

9am est - FOMC Member Kashkari Speaks

10am est - ISM Manufacturing PMI

For more information on these news events, visit the Economic Calendar

SPX Notes:

SPX tried to retest the purple trendline from the October 2022 lows, but never got to it before selling off.

Orange - This is now our resistance trendline

Purple - This trendline is from our October 2022 lows

White - this trendline is the down trendline from the ATH’s in January 2022

We have one gap to fill at 4071

Our gap at 3971 was closed today

Weekly Option Expected Move

SPX’s weekly option expected move is ~77.06 points. SPY’s expected move is ~7.65. Remember over 68% of the time price will resolve it self in this range by weeks end.

There was a nice spike of puts at the end of the day - note I am one hour ahead - over $100M in put premium on the ask side. Worth an eye to watch and see where price goes. See the below screenshot courtesy of Quant Data…

Again, let’s not predict, let’s jump into the data and build a trading plan reacting level to level.

SPX/ES/SPY Trade Plan:

Remember you can use this SPX trade plan to trade ES or SPY.

Bullish bias:

Above 3970 target 3985

I would be cautious of any longs above 3985 - IF we were to even get there - the R/R is high risk and not worth it - instead look for key breakdowns that fail

If there is a failed breakdown of 3950-55 target 3965-70

Below 3970 target 3955

If there is a failed breakout above 3985-3990 target 3970 then 3955

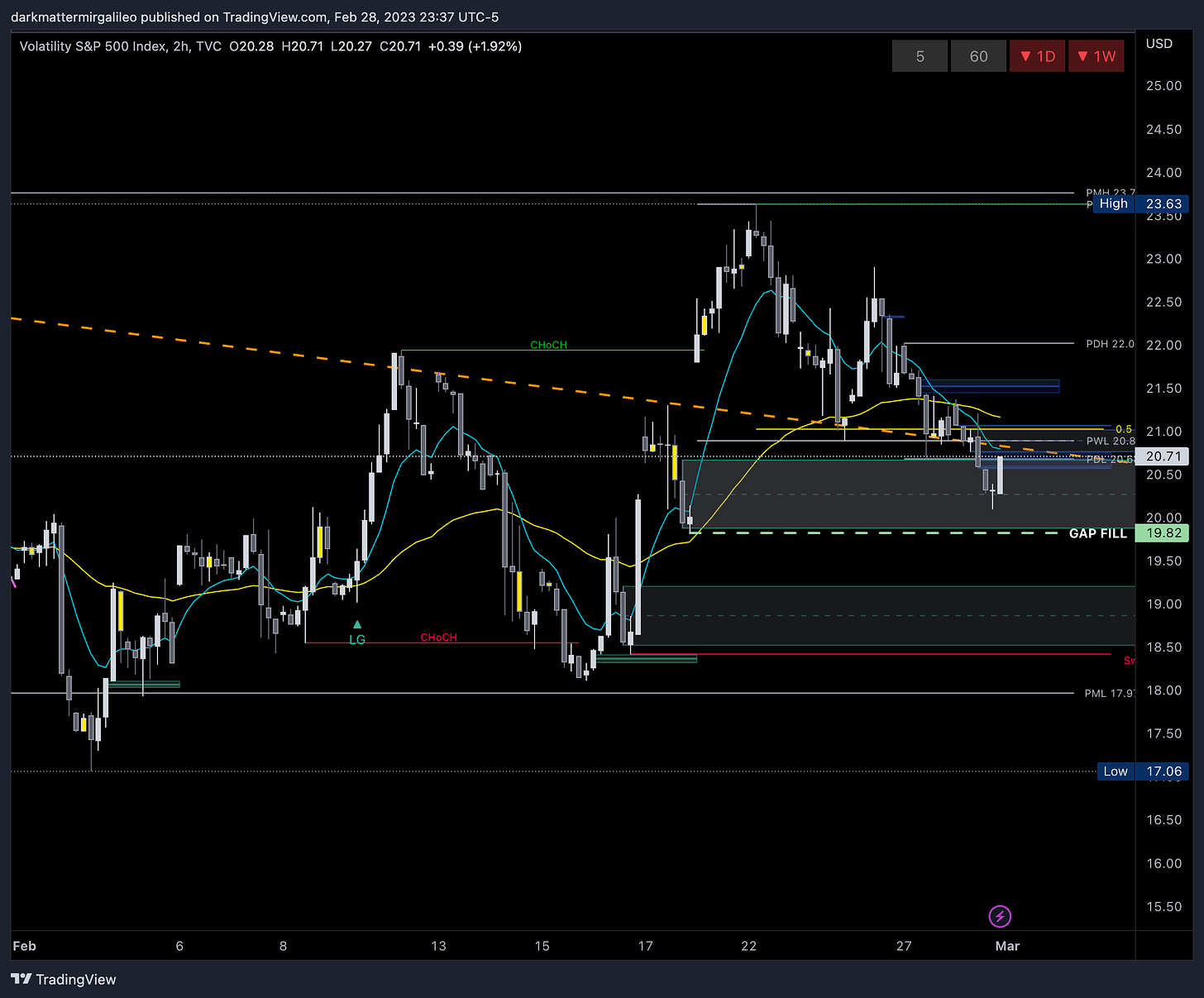

VIX Update

Let’s review the VIX chart. We broke below our trendline, but hit a bullish orderblock or demand where vix began a rally. We are in an interesting area where VIX could retest the trendline and sell from it again or continue its path up. Keep an eye on this one in the morning. VIX futures are up, but let’s see where we open and how it reacts to this demand zone.

If this demand zone doesn’t hold then we may target that gap fill and after that 19.21 and then 18.90 then 18.54.

Remember, typically VIX going down correlates with a uptrend in the market and vice versa for a downtrend in the market.

Vol.land Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repellent VIX and IV must decrease or stay flat. For price to go below spot through a magnet or repellent VIX and IV must increase.

Above Spot:

3970 is a minor negative vanna - acting as repellent

In order to reject this level we need VIX to increase

3975 and 3985 are minor positive vanna’s - acting as magnets

3990-4045 is a cluster of negative vanna’s - acting as repellents

In order to get through this area we need VIX to decrease

4050, 4065, 4100 are positive vanna’s - acting as magnets

In order to get through this area we need VIX to stay decreased

Below Spot:

3960 and 3945 are positive vanna - acting as magnets

In order to reach this area we need VIX to increase or stay increased

3950 is a minor negative vanna - acting as repellent

3940-3910 is a cluster of negative vanna’s - acting as repellents

In order to get through this area we need VIX to increase

3900 is a positive vanna - acting as magnet

Our vanna range could be 3945-3985

My general lean is 3960-3985

4000 continues to be a point of battle between the bears and bulls

Hard to see how Vanna takes the bears below 3940

Hard to see how Vanna takes the bulls above 4000

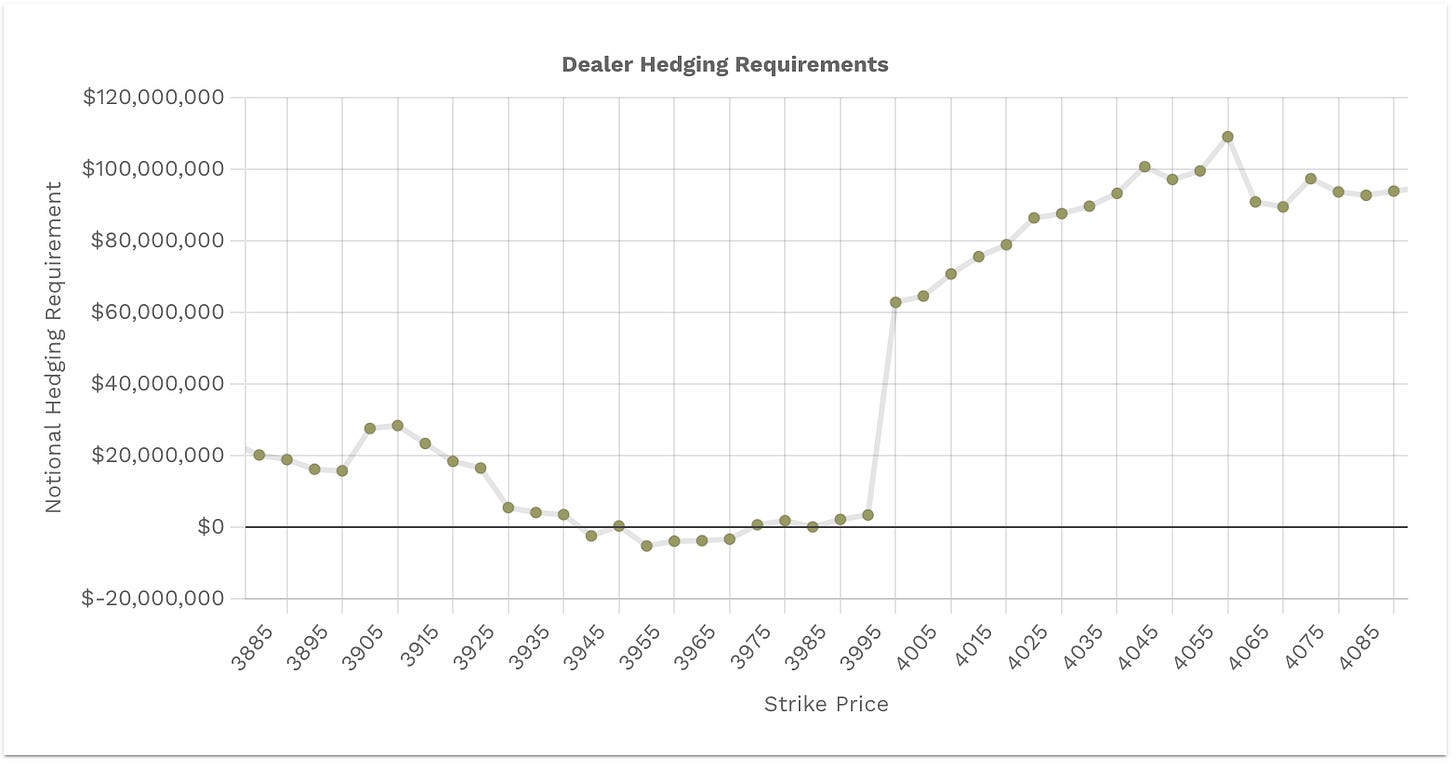

Gamma and Delta-Adjusted Gamma (DAG)

Above Spot:

3985 is a positive Gamma - acting as resistance

4050 is a positive Gamma - acting as resistance

3990-4045 is negative Gamma

Since this zone has no dealer hedging requirements, the market is able to move freely in between it - doesn’t mean it travels up and down freely, just that dealers won’t impact the move

Price above 3975 will increase dealer buying pressure till 3980

Below Spot:

3980-3955 is negative Gamma

Since this zone has no dealer hedging requirements, the market is able to move freely in between it - doesn’t mean it travels up and down freely, just that dealers won’t impact the move

3950 is positive Gamma - acting as support

3940-3910 is a cluster of positive Gamma - acting as support

Price below 3970 will increase dealer selling pressure till 3955

3985 will be a major barrier to get past for bulls

3950 is a major level and below it - difficult to see the bears take it below this level

Gamma suggests more kangaroo style market

Final Take

I think we will have another kangaroo like trading day where price floats one direction, reverses in another direction. The Gamma data is clearly articulating this and one of the key levels at 4050 or 3950 will need to break to set us up for the next sustained run or leg.

Based on the data we should trade within 3955-3985. My general lean is more bearish than bullish.

Remember, typically until tomorrow and it ramps more into next week, Vanna and Gamma play a lesser role in what the market does. Dealers are hedged…so that means whatever the customers (institutional or hedge funds or retail) do the market will freely move until we hit one of those key Gamma levels.

Stay #paytient and react to the key levels - no predictions! Good luck traders.

I am going to share my key rules to intraday trading in the end of the plan moving forward to build better habits and allowing you to grow as a better trader.

My Intraday Trading Rules

I do not trade within the first half hour UNLESS I am in a trade from the prior session and looking to close the trade or we have a major gap or a key level already broken

I let the initial balance do its thing - I am just a small fish in a large ocean of traders so let's let them fight it out

I then wait for key levels targeting one level to the next and taking profits at each one.

If there are key levels that are 10pts apart that is when I have scalping mindset and anything above 10pts I want to give it the room to hit the price target with a 5 pt buffer to take profits once we reach within 5 pts of a target - I also tighten my stop loss once at 10-20% profit with the goal of never allowing trades to go red when I have a nice profit)

I supply options greeks with OB (order blocks) and FVG (fair value gaps) otherwise known as Smart Money Concepts

When I am scalping - ie targeting 10pt trade levels I will take profits and never go more than 10% red. Simple as that, know your trade plan strategy and the risk. When you are wrong you are wrong and reset

For 20pt trade level targets I will increase my stop losses to 20% and allow more of the trade to play in the event I entered too early

I try - key word try ha - avoid trading lunch hours defined as 12pm to 2 pm est. Money for the most part unless you are scalping - is made in the first 2 hours of the trading day and the last 2 hours

I always stick to two EMA’s on my chart and that’s the 10/50 EMA’s

When the 10ema is above 50ema we are bullish

When the 10ema is below the 50ema we are bearish

Go put these on your charts and when you view them on timeframes less than the daily timeframe you will see the power they provide

For scalpers out there the smaller timeframes provide great opportunities to scalp 5-10pt moves

There are more we could discuss including volume profile, low volume nodes that I think are great strategies to compliment option greeks. Maybe in the future we can include more details.

Trading is not for the unprepared. It is critical you abide to a strategy and checklist and walk into every trade with a plan. Without a plan you are simply gambling and have a better chance at the slot machines. There are more nuances to my weekly and daily checklists, but I think this provides a good read for now and we will/can continue adding to it.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.