Readers,

—2/8 Recap—

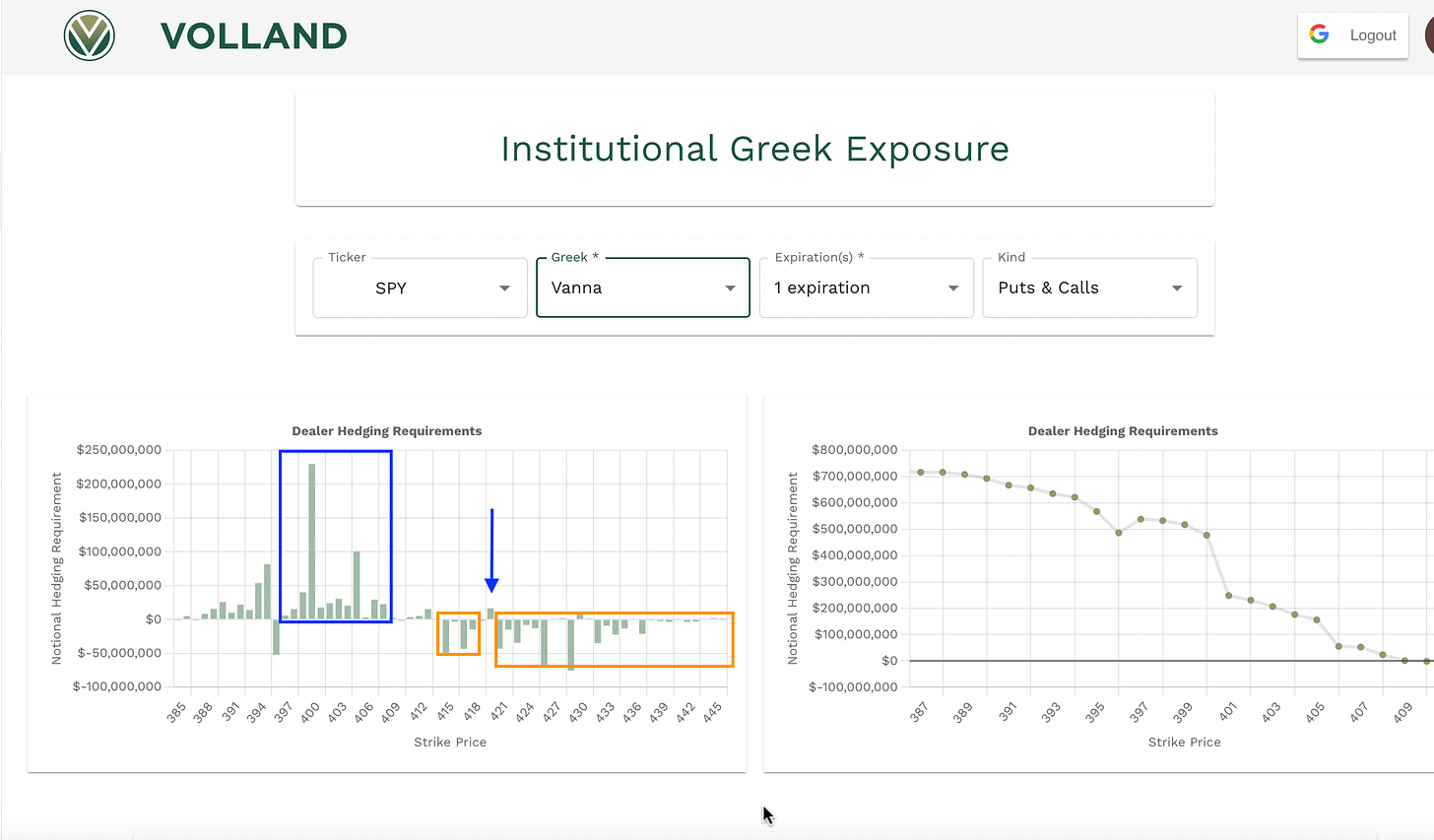

Today was a picture-perfect execution of the plan we put in place last night. The market conditions aligned perfectly with our expectations, with the VIX working in our favor and leading to another successful day. Let's keep the momentum going! By consistently focusing on building, following, and executing our plan, we've consistently achieved our desired outcomes. We opened at 413 and steadily rose to 414 (started a put position at the first test of 414 around 8:45am CST), played ping pong during the initial balance, but 413 gave and we were given another opportunity for reentry at 9:40 am CST. My decision to sell at 10:45 am CST brought us within striking distance of our target, and I'm proud of the outcome. Great job to the entire team! Lets dive into tomorrow’s plan.

KEEP READING FOR TOMORROWS LEVELS

—2/9 Pre Plan—

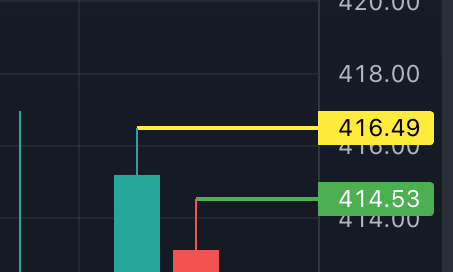

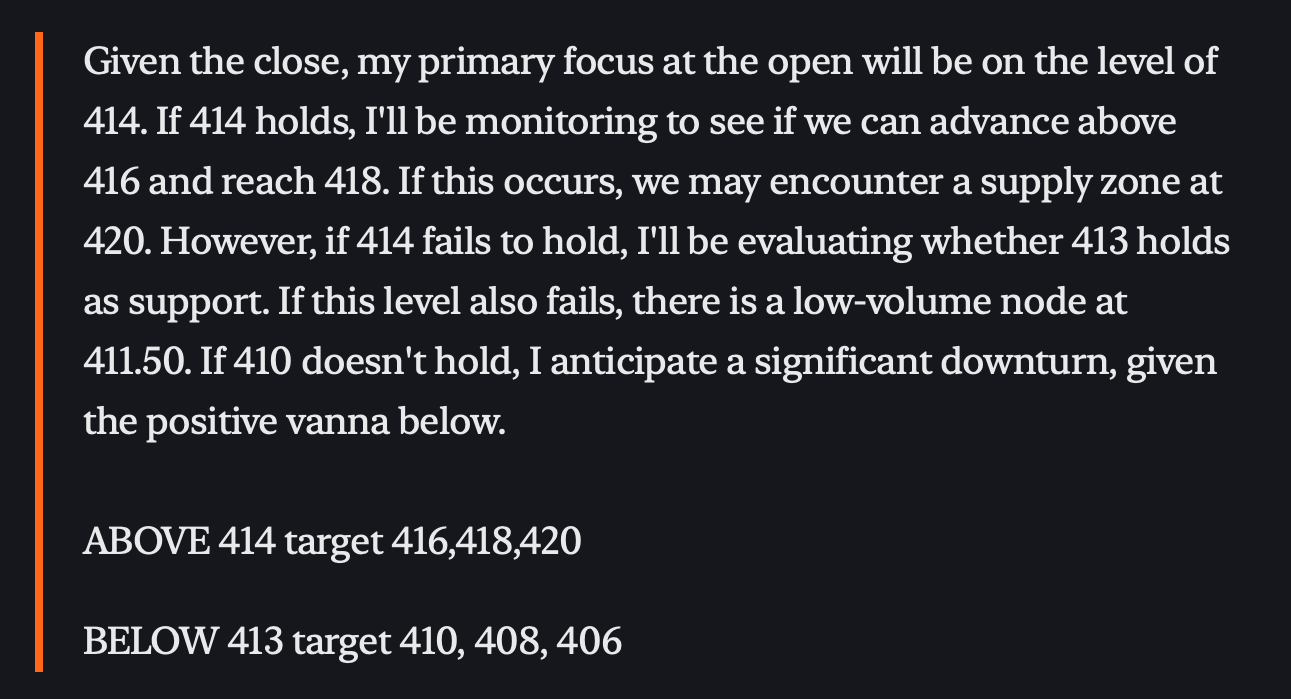

When I look at this first chart on SPY I can already see that we have a bigger size move coming soon, and tomorrow might be the start of it. Someone is going to get caught trapped here. This pattern usually produces amazing results. You can see that Tuesday was a outside day, mean that candle broke the upper and lower range of Monday’s candle, now today we ended inside, meaning we did not breach Tuesdays high or low, one side has to give. Also note that there wasn't much change in the volume profile, hence the inside day.

To trade these candles effectively, consider the following strategies:

Long position: Enter a long position after the price breaks and holds above 416.49 for a safer play.

Short position: If you anticipate a downward trend, consider going short after the price breaks below 407.57.

Long position with target: Start a long position above 414.53 with a target of 416.49 and hold onto any positive momentum if the price remains above this level.

Short position with target: Enter a short position after the price breaks below 409.93 with a target of 407.57 and hold onto any downward momentum if the price remains below this level.

Note: Always be cautious, as the market can sometimes fake out in one direction before suddenly reversing.

Keep a close watch on the VIX as it has proven to be a useful indicator for market trends today. Our aim is to break out, but if we encounter any setbacks, it may be wise to explore long positions. The VIX can play a critical role in determining our investment strategy, so stay vigilant.

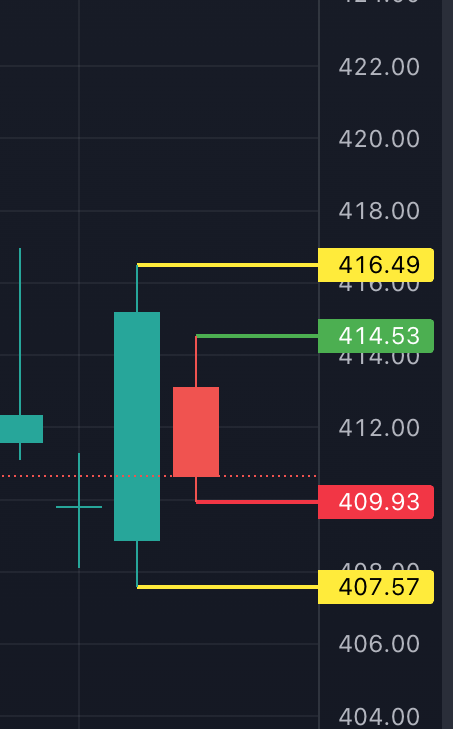

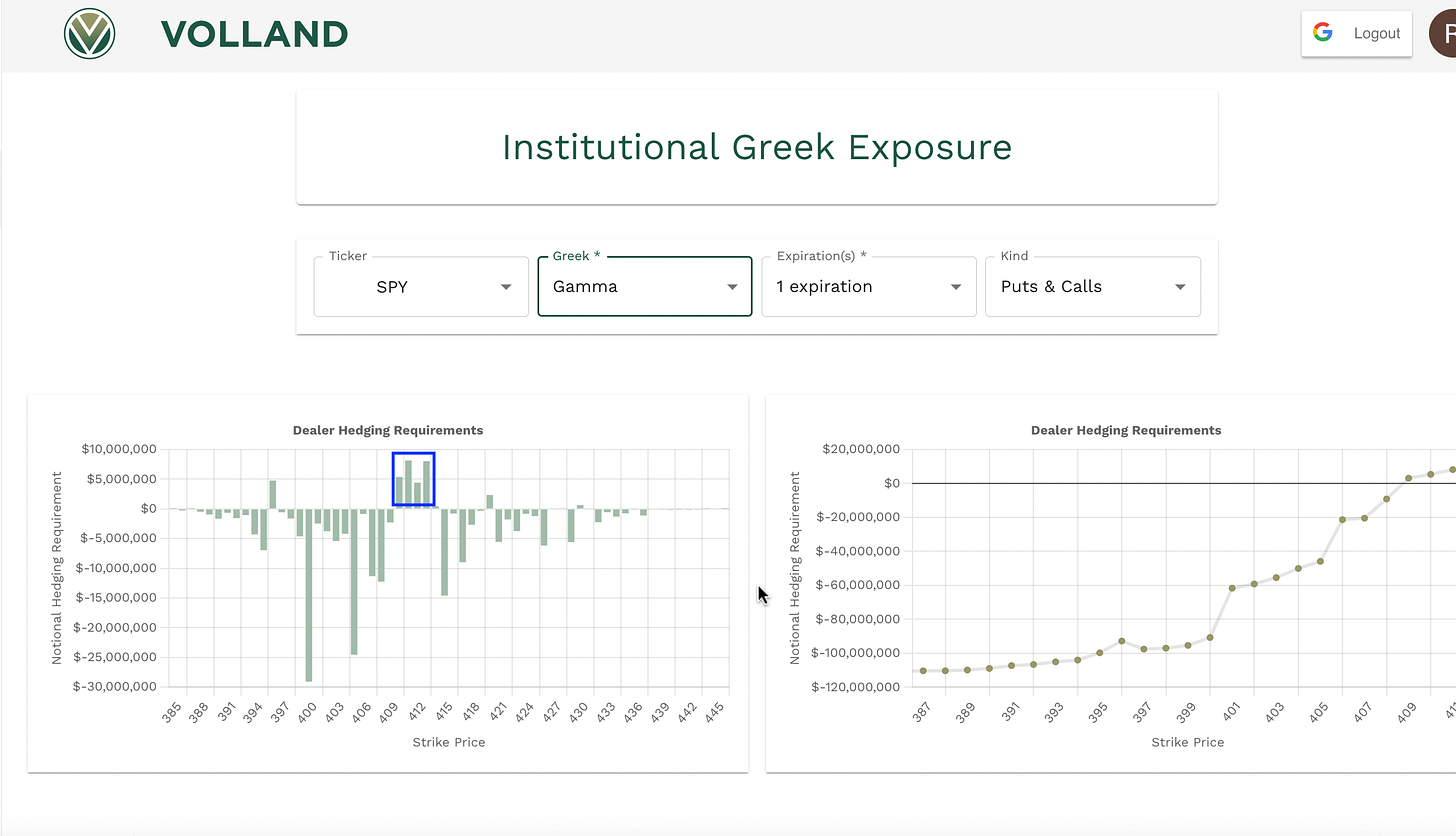

Upon examining the vanna and the aggregate, our plan remains largely unchanged from yesterday. A negative vanna was added at 415. The 1-day chart suggests that the market situation has not significantly altered. The majority of the upward momentum will likely be to the downside, but we need to monitor the VIX closely to determine if it will push us towards 420 or if the positive pull towards 410 will begin to drag us down. It's crucial to stay attuned to these key indicators as they will shape our investment strategy.

The gamma chart provides a clear picture of the current market situation. As long as the price remains between 410-413, we can expect support to hold, and a push towards 420 is likely. However, if 410 fails, we could experience a downward spiral.

—2/9 Trade Plan—

Tomorrow's market may require more patience and a level-headed approach. Traders are likely to be caught in a challenging position, which could lead to heightened emotions. It's important to stick to your plan. One potential strategy is to focus on a range break play based on the scenario outlined earlier. At the same time, keep a close eye on the vanna levels, particularly on the aggregate side. If the market drops below 410, there is a risk of significant downward movement, with targets of 408, 406, 405, and potentially even 400. On the other hand, if the market rises above 415 and the VIX shows a downward trend, we could see prices reach as high as 418-420 or even 422.

A few key levels I want to highlight, I won’t go into details but it might be good to see these in mind. If we are going to continue a bullish trend, I would like to see;

SPY > 415

QQQ > 302.50

TSLA > 200

AAPL > 155

MSFT > 266

Thank you for reading!

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.