Hello traders and welcome to another trade plan. A resounding 100% of you responded to the poll with more coaching content. While today I need to make the plan brief I will do my best to provide more content around how to trade, why I took the trade and so forth.

Quick recap though…two of our trade ideas panned out and any of them could have been taken to net you profit on the day. Those trades were:

Below 4150 target 4130

If there is a breakdown of 4130 target 4115

First trade yielding you 20 pts and the second trade 10-15pts depending on how long you held on to the trade. Hope you were able to partake and come away green on the day. On my end I came out green, but small on the PnL. I was busy this morning missing the initial breakdown of 4150 and then got into a late scalp after the breakdown of 4130.

Hope you all were able to take part and trade green. I would love to hear from those who did have a successful trade using the trade plan. If you did be sure to send a message on Twitter to me @DarkMatterTrade.

Let’s get into tomorrow’s trade plan.

News Catalyst

One news catalyst for the day…

8:30am est - Unemployment Claims

Key earnings from Pepsi, Abbvie and Hilton before the bell and PayPal, Lyft, Cloudflare, and Expedia all reporting after hours.

For more information on these news events, visit the Economic Calendar

Trade Plan:

Bulls held the 4110 negative vanna with a low of day at 4111 generating a quick rally to back towards 4135 before we faced resistance at 4136 and sold back down to close at 4117.

We did break our bullish trendline and then tried to retest it and failed. Will this be a failed breakdown and get sucked back in or will bears take over? The purple lines are multi-day trends that are critical. For bulls that means protecting that 4093 level - if broken this could start a major selloff.

Bullish bias:

Above 4125 target 4150

If there is a breakout of 4150 target 4175

If there is a failed breakdown at 4110 target 4125 then 4150 then 4175

Below 4100 target 4085

If there is a failed breakout at 4125 target 4115 then 4100 then 4085

If there is a breakdown of 4115 target 4100 then 4085

Vol.land Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

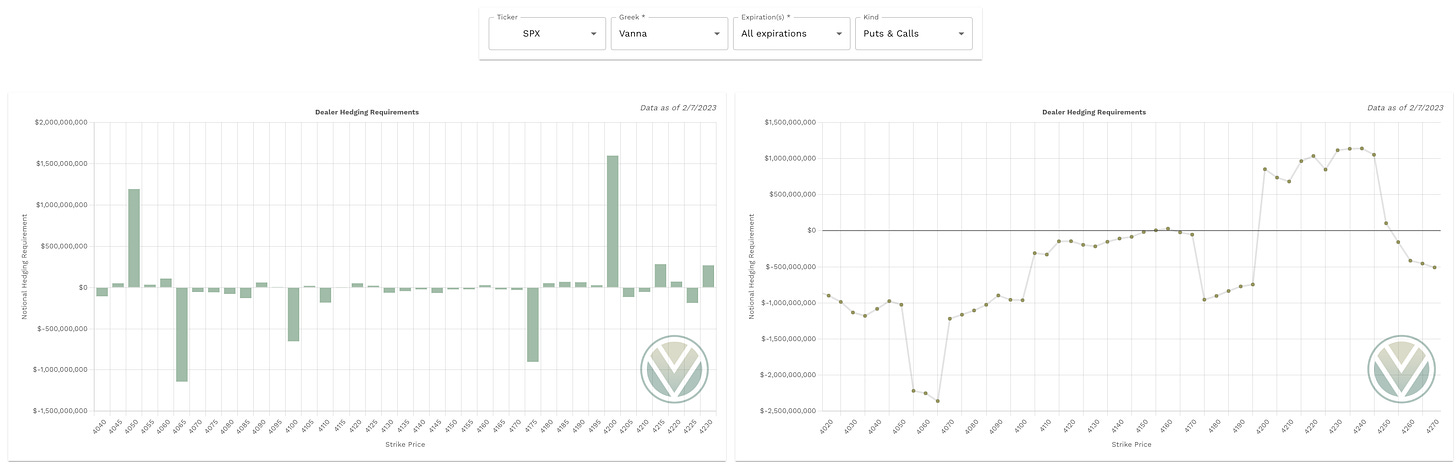

Vanna - Levels where price may repel or act as magnet

Above Spot:

4120 is a minor positive vanna - acting as magnet

4130-4155 are minor positive vanna - acting as repellent

4160 is a minor positive vanna - acting as magnet

4175 is a major negative vanna - acting as repellent

4200 is a major positive vanna - acting as magnet

4205/10 are minor negative vanna - acting as repellent

4215 is a minor positive vanna - acting as magnet

IV & $VIX need to decrease to get above 4120 to target 4150. To continue to 4175 we could see some basing near 4160 to target 4175 - again IV & $VIX need to decrease to support this move with bullish charm

Below Spot:

4110 is a minor negative vanna - acting as repellent

4100 is a major negative vanna - acting as repellent

4090 is a minor positive vanna - acting as magnet

4085-4065 (4065 major) are negative vanna - acting as repellent

IV needs to increase to get below 4105 to target 4090 and further increase to get in the cluster of negative vannas in 4065-4085

Our range could be 4065-4200

4130-4155 will bring chop and a slow elevator up if bulls are able to break through - $VIX and IV must decrease to support this move

4175 will be a key level to break for the bulls to target 4200

4200 is our largest positive vanna and will be a key level to target

4100 continues to be the largest negative vanna near spot and must be taken out for any bearish continuation

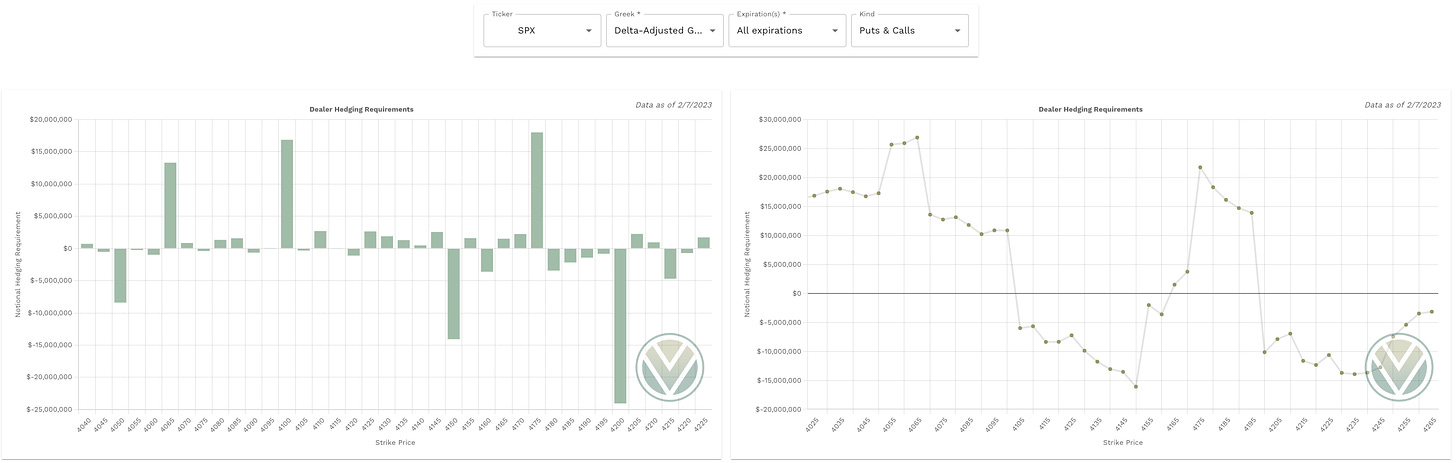

Delta-Adjusted Gamma (DAG)

Above Spot:

4125-4145 are minor positive DAG - acting as resistance - if bulls push this will need to be supported by vanna and/or charm

4175 is a major positive DAG - acting as resistance

Above 4150 will trigger dealer buying pressure supporting price to 4175

Below Spot:

4110 is positive DAG - acting as support

4100 is positive DAG - acting as support

4085-4065 are positive DAG’s - acting as support

Below 4100 will trigger dealer selling pressure taking price to 4085

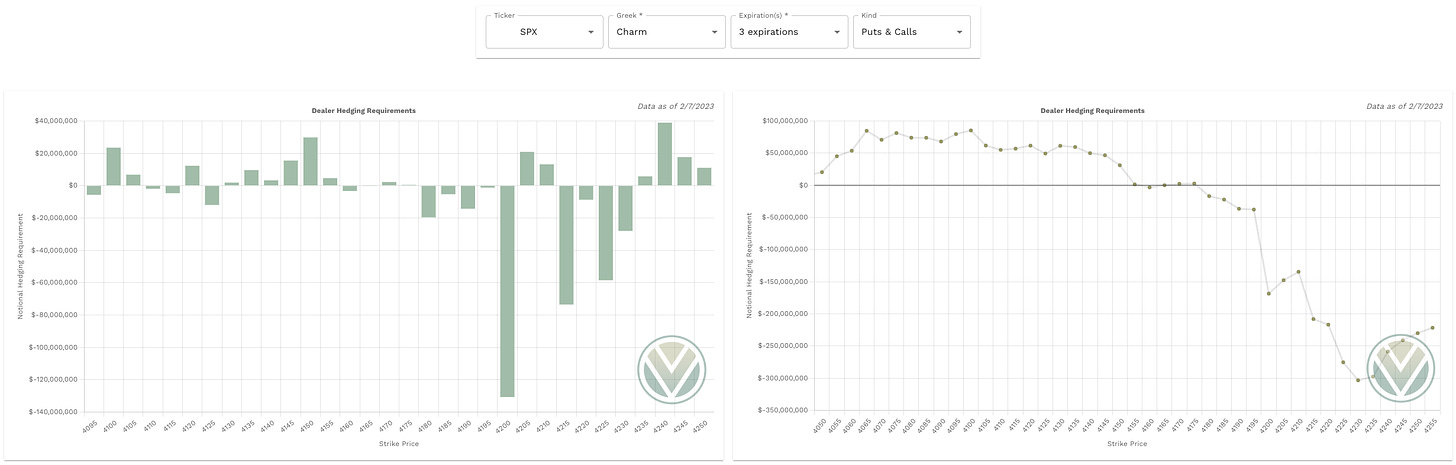

Charm - which direction will dealers be moving price

Negative aggregate charm will push price to the upside - positive aggregate charm will push price to the downside

I am keeping the Charm analysis from yesterday as it typically provides future trend in price. Below it I have added today’s charm chart so we can continue to test this theory and add its analysis into our trade plan

2/7 Charm:

As we look at the Charm data dealers are hedging more to the upside where we have more negative Charm levels and the largest levels are to the upside.

The total notional value of Charm is more negative than positive

Above 4175 will trigger bullish charm

Below 4150 will trigger bearish charm

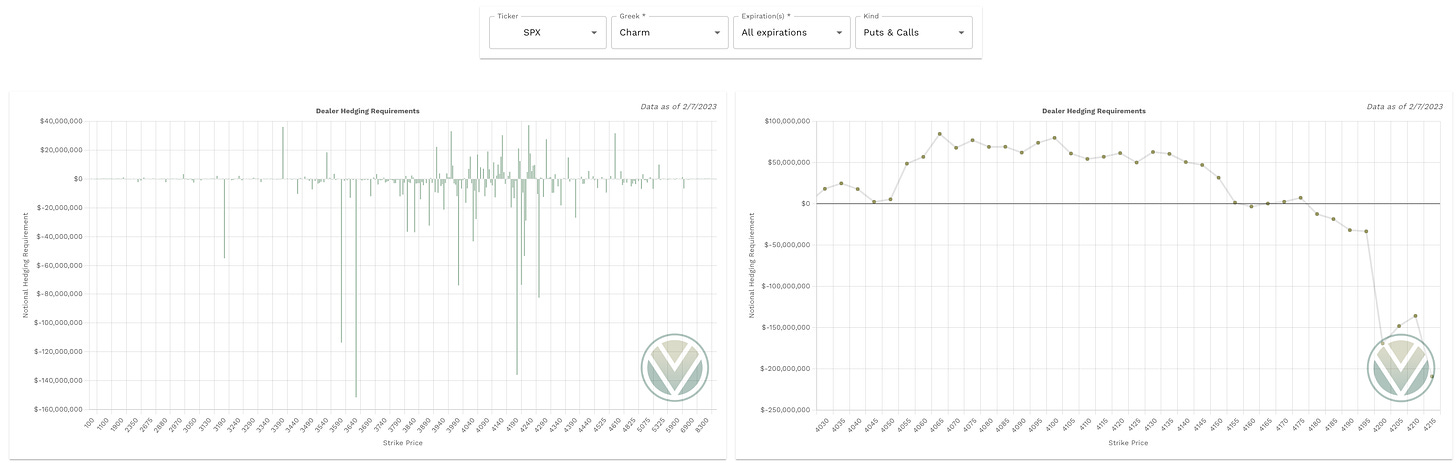

2/8 Charm:

Final Take

I think we could have a bounce tomorrow as the bulls defended 4110 and 4115 zones. Dark Pool levels are growing in the 4150 level so it will be tough for the bulls to get above this. Again let’s not predict - this is fun to “guess” - but when trading let’s just react to the levels.

Stay #paytient and react to the key levels - no predictions! Good luck traders.

I am going to share my key rules to intraday trading in the end of the plan moving forward to build better habits and allowing you to grow as a better trader.

My Intraday Trading Rules

I do not trade within the first half hour UNLESS I am in a trade from the prior session and looking to close the trade or we have a major gap or a key level already broken - key level today would have been 4130 and 4150 and will explain below why these were important levels

I let the initial balance do its thing - I am just a small fish in a large ocean of traders so let's let them fight it out

I then wait for key levels targeting one level to the next and taking profits at each one.

If there are key levels that are 10pts apart that is when I have scalping mindset and anything above 10pts I want to give it the room to hit the price target with a 5 pt buffer to take profits once we reach within 5 pts of a target - I also tighten my stop loss once at 10-20% profit with the goal of never allowing trades to go red when I have a nice profit)

I supply options greeks with OB (order blocks) and FVG (fair value gaps) otherwise known as Smart Money Concepts

When I am scalping - ie targeting 10pt trade levels I will take profits and never go more than 10% red. Simple as that, know your trade plan strategy and the risk. When you are wrong you are wrong and reset

For 20pt trade level targets I will increase my stop losses to 20% and allow more of the trade to play in the event I entered too early

I try - key word try ha - avoid trading lunch hours defined as 12pm to 2 pm est. Money for the most part unless you are scalping - is made in the first 2 hours of the trading day and the last 2 hours

There are more we could discuss including volume profile, low volume nodes that I think are great strategies to compliment option greeks. Maybe in the future we can include more details.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.