Today reared its ugly head into what happens when you do not stick to your trade plan and play level by level.

I took two trades and full disclosure and honesty finally ended my green trade streak. It’s ok, these will happen to the best trader, but we need to learn from our mistakes, correct them, and execute on the next trade.

Yesterday’s trade plan we said:

If there is a breakdown of 4125 target 4110 then 4100

At the open we gapped down to open at 4111 which was quickly bought up to 4121. It is here where price was rejected and consolidated until 10:10am est and finally broke down targeting 4110, 4100 and hitting a low of 4093. This was our trade and the mistake that occurred.

Looking at the charts couple of reason why you would have taken this trade:

On the 5 min chart we never got above our opening range high of 4121

Price flirted with the 10ema on the 5 min chart, but could never overcome

$VIX started to begin its rally after basing near its lows in futures

These are easily things we can fix in our execution and today was another day of traps to the upside and downside and where quick profit taking was needed.

With yesterday behind us let’s get into the levels and data and review tomorrow’s trade plan.

For those curious, yesterday’s poll ended with readers favoring a bullish week.

Trade Plan:

An update on our trendlines from yesterday. The resistance now turned support at 4093 came in big for the bulls and pushed price out of this level - bulls are firmly still in control in my opinion. The first signs of weakness will come on the break of this level.

The other trendline which has been used by the bulls to accumulate and continue this run was also tested and held nicely as well. act as support if tested - this level is 4093.

Both trendlines are on watch for any breaks or failed breakdowns of them.

Bullish bias:

Above 4130 target 4150

If there is a failed breakdown at 4115 target 4130 then 4150 (take profits quick could setup a bull trap balanced day)

If there is a failed breakdown of 4100 target 4115

Below 4115 target 4100

If there is a failed breakout at 4130 target 4115

If there is a breakdown of 4100 target 4085

News Catalyst

No major volatile news events today, but we do have FED Speaker Powell speaking today and President Biden giving the State of the Union Address Tuesday night. My immediate lean is Powell won’t drive the markets like it did last weeks FOMC press conference.

12pm est - Fed Chair Powell Speaks

9pm est - State of the Union Address by President Biden

Key earnings from Chipotle are due after hours tomorrow.

For more information on these events, visit the Economic Calendar

Vol.land Data

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

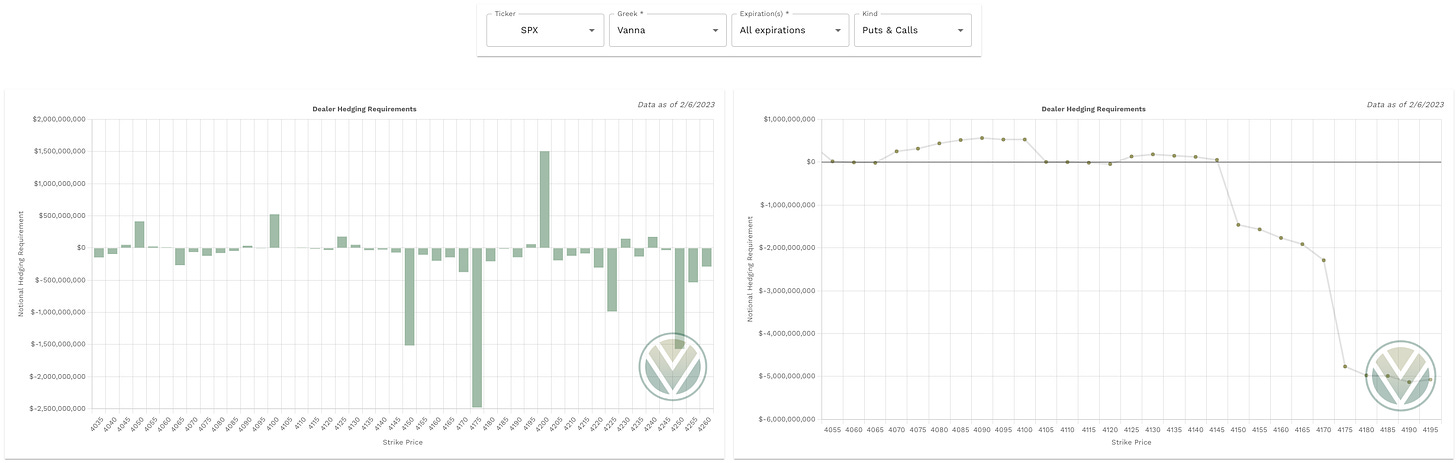

Vanna - Levels where price may repel or act as magnet

Above Spot:

4115 is a minor negative vanna - acting as repellent

4120 is a minor negative vanna - acting as repellent

4125 is a minor positive vanna - acting as magnet

4150 is a major negative vanna - acting as repellent

4175 is a major negative vanna - acting as repellent

4135-4190 is a cluster of negative vanna - acting as repellent

4200 is a major positive vanna - acting as magnet

IV should increase below 4105

Below Spot:

4100 is a medium positive vanna - acting as magnet

4090 is a minor positive vanna - acting as magnet

4085-4065 is a cluster of negative vanna - acting as repellent

4050 is a minor positive vanna - acting as magnet

IV should decrease above 4120

Vanna levels indicate another chop filled day unless 4100 is cracked targeting 4085

4085-65 levels are major repellents

Our range could be 4090-4130

4100 will be a key level for the bears to break to target 4090

4115 will be a key level to break to target 4130

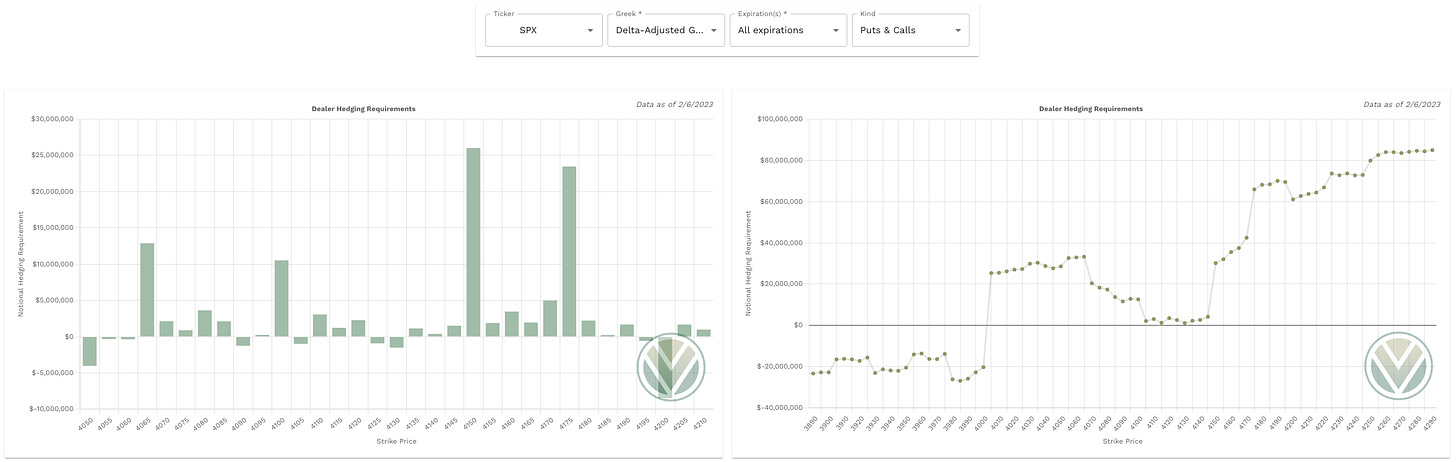

Delta-Adjusted Gamma (DAG)

Above Spot:

4115/20 are positive DAG - acting as resistance

4135-4190 is a cluster of positive DAG’s - acting as resistance

Above 4115 will trigger dealer buying pressure targeting 4130 then 4145

Below Spot:

4110 is a minor positive DAG - acting as support

4100 is a major positive DAG - acting as support

4085-4065 is a cluster of positive DAG’s - acting as support

Below 4100 will trigger dealer selling pressure targeting 4005

Below 4100 support comes in at 4080 then 4065

If we have a failed breakout of 4120 or 4130 target 4110 then 4000

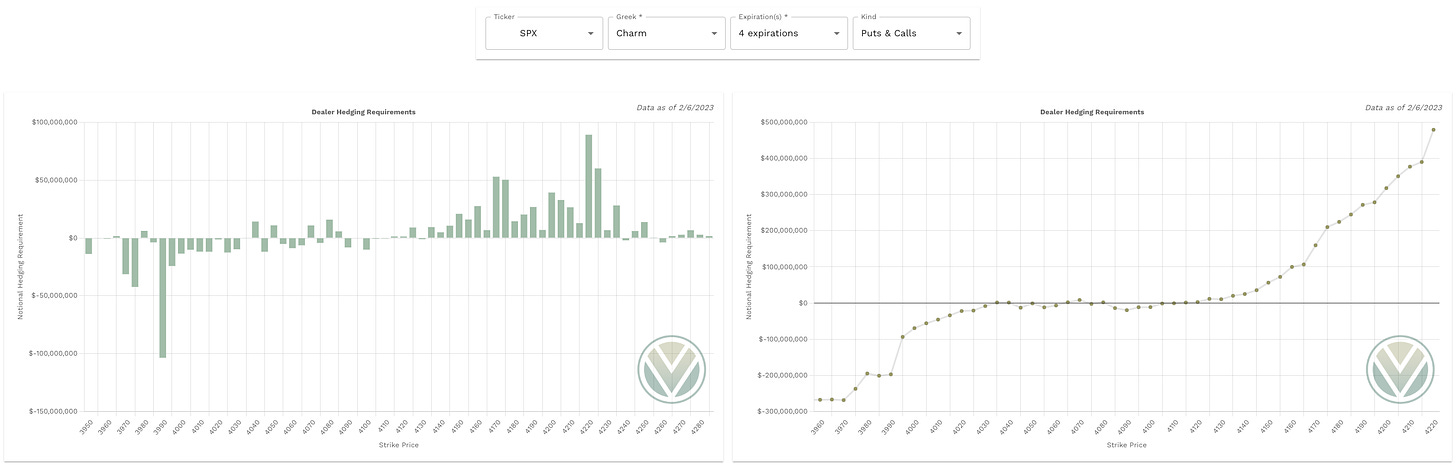

Charm - which direction will dealers be moving price

Negative aggregate charm will push price to the upside - positive aggregate charm will push price to the downside

As we look at the Charm data dealers are hedging more to the downside where we have more positive Charm levels to the upside and the total notional value of Charm is more positive than negative.

Above 4130 will trigger bullish charm

Below 4100 will trigger bearish charm to 4085

Final Take

I think we could have another balanced trap prone choppy day. Take profits when available and protect your risk with adequate management of your stop losses.

Stay #paytient and react to the key levels - no predictions! Good luck traders.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.