The bulls continued their push to the upside today holding our key bullish bias levels of 4125 (gapped above it) and then in the first hour of trading held 4150, which began the slow ride up to 4175 and then 4195.

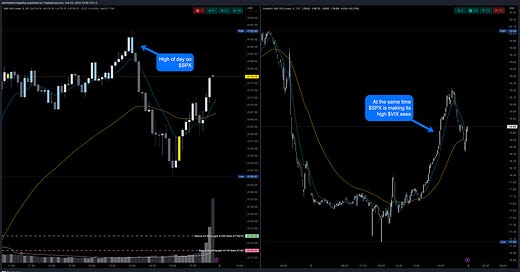

As shared on trader, I took a trade on the defense of the 4175 level going to 4195 a positive vanna level. Had there been any continuation we need to see $VIX continue down. As seen in the chart below $VIX actually increased…It is here where I entered a stop loss.

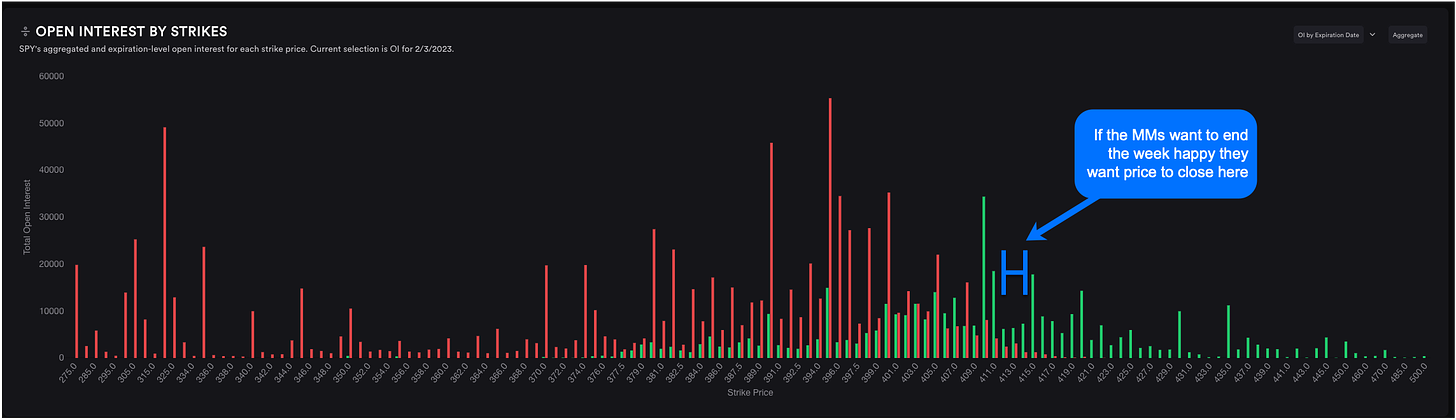

Before we kick into the trade plan while I hate making predictions we can’t ignore earnings, the gap down in futures already and looking at weekly expirations…If you are the money makers you want price to close below 415 and above 411.

Trade Plan:

Bullish bias:

Above 4175 target 4190 then 4205

If there is a failed breakdown at 4150 target 4175

If there is a breakout of 4205 target 4220

Bearish bias:

Below 4150 target 4125 but expect support to kick in at 4140/35. Break 4125 then 4110

If there is a failed breakout at 4175 target 4150 then 4125 then 4110

If there is a breakdown of 4100 target 4085/80

News Catalyst

Another jam packed news events premarket will determine whether bears keep pushing or bulls regain previous high.

8:30am est - Avg Hourly Earnings

8:30am est - Non-farm Employment Change

8:30am est - Unemployment Rate

10am est - ISM Services PMI

For more information on these events, visit the Economic Calendar

Vol.land Data

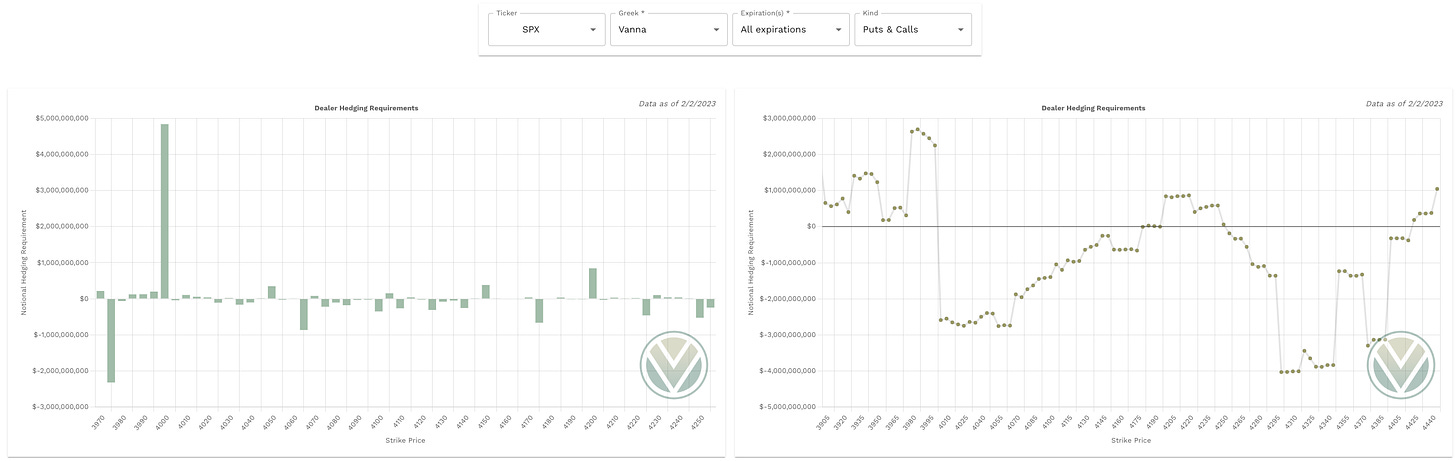

Vanna

What is Vanna? For details see the video, but at a high level positive vanna acts as a magnet pulling price to it and negative vanna acts as a repellent pushing price away from it. As we reach one of the vanna levels below in order to determine whether we will continue or reverse we keep a close eye to $VIX and the IV of the underlying ticker. In order to go past a negative vanna we need to see $VIX and IV decrease. For positive vanna if it stops here you will see an increase in $VIX or IV.

Above Spot:

4175 is a major negative vanna - acting as repellent

4200 is a medium positive vanna - acting as magnet

4205 is a minor negative vanna - acting as repellent

4225 is a major negative vanna - acting as repellent

Below Spot:

4150 is a minor positive vanna - acting as repellent

4140-4125 are minor negative vanna’s - acting as repellent (for price to rip through these levels we need to see $VIX go up)

4115 is a minor positive vanna - acting as magnet

4110 and 4100 are minor negative vanna’s - acting as repellent

4065 is a major negative vanna - acting as repellent

Vanna levels indicate a pull to the downside - our largest magnets to the upside face major negative vanna’s prior to them

Our range could be 4100-4175

Below 4175 and for a continued red trend day VIX needs to continue to increase with first stop at 4140

4140-4125 zone will provide some consolidation and if broken targets 4105

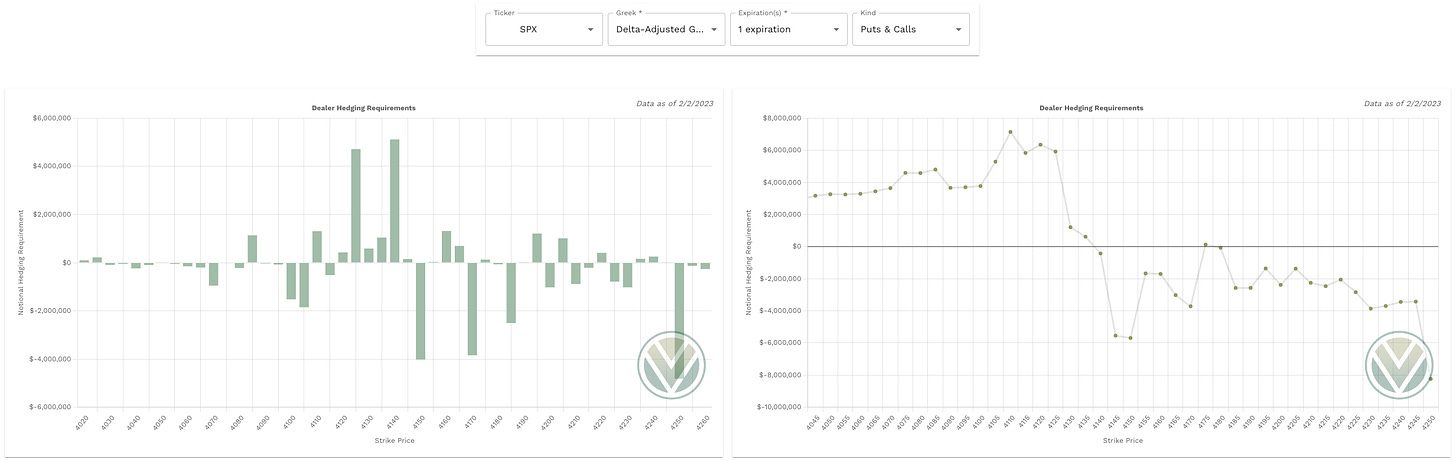

DAG

Above Spot:

4175 is a minor positive DAG - acting as resistance

4195 is a minor positive DAG - acting as resistance

Above 4180 will trigger dealer buying pressure targeting 4190

Below Spot:

4165/60 are minor positive DAG’s - acting as support

4140 is a major positive DAG - acting as support

4125 is a major positive DAG - acting as support

4110 and 4085 are minor positive DAG’s - acting as support

Below 4135 will trigger dealer selling pressure targeting 4105

Below 4175 support comes in at 4160 and 4140

If we lose 4140 we target 4125 then 4110

Vega - Key levels with highest volatility

4185 major

4165/60 minor

4140 major

4125 major

4110 minor

Stay #paytient and react to the key levels - no predictions! Good luck traders.

Love your analysis Darkmatter .... would you consider having a telegram channel or discord to build a community? You can also answer questions and post your intraday thoughts and entries. Thanks ... I am learning a lot