Readers,

Let’s start off with a little recap. My weekly levels worked out better than my levels for today simply because we gapped right into 400-401 at open. Here is how the day played out with our levels. Even though we gapped up above these supply and demand levels they still hold weight. Demand can become supply and supply can become demand. I took puts at the open and held too long, got stopped out when we broke back above 400, I waited for another entry as I was eyeing puts if we could stay under 402.

If we go back and look at our weekly plan this is what we said.

Todays high of day was 401.29, and we sold off into 396.75. Last night I also said this;

And here is the 4hr chart showing that we are still stuck inside last weeks value area. So we need to to #paytiently wait for a good setup, this is the chop zone. Bulls want 402, bears want 396.26.

—2/28 Pre Plan—

In terms of levels… not much is changing going into tomorrow. If I am a bull I am still looking for a break and hold of 402, and if I want to continue being bearish I need to see the bears take out 396 and to keep price under 402. I do think that todays price action was bearish but let’s not count the bulls out yet, key word, yet.

We are still trading within last weeks value area, so until we break one side… stay nimble.

Here are some levels I am watching tomorrow based on the weekly profile.

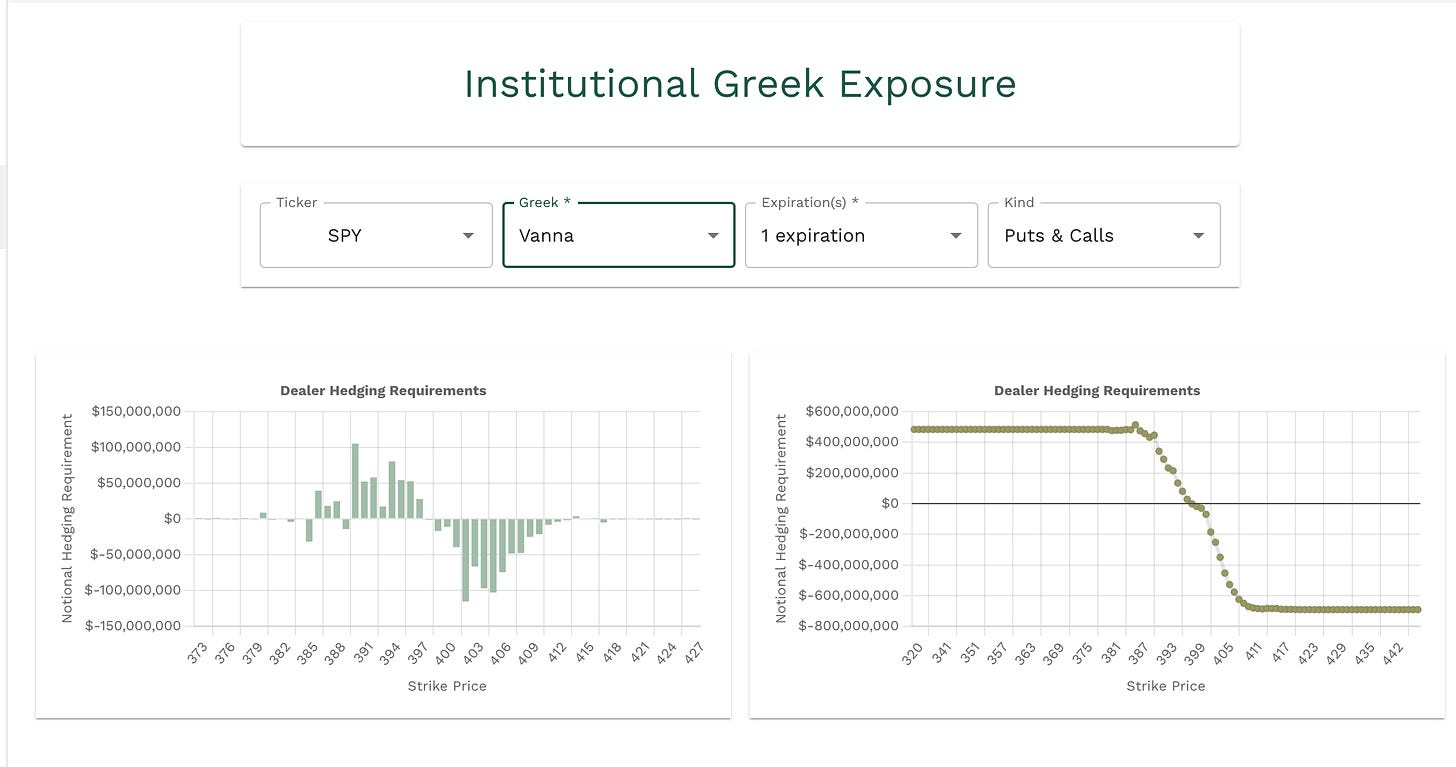

No big change in Volland data for tomorrow we are seeing the same picture with the negative vanna above us and the positive below.

Remember in a perfect world the negative vanna will try and mush price towards the positive vanna, looking at this alone I would think 400 is still going to be tough to push through.

—2/28 Trade Plan—

To minimize potential losses, it may be wise to wait for a clear break either above 402 or below 396 tomorrow. Trading within the range between these two levels could be risky and result in choppy waters, potentially leading to losses.

Downside targets 397, 396.26, 395, 394.77, 393.23, 392.36, 391.40

Upside targets 398.78, 399.57, 400.10, 401,75, 403.10, 404

I think that if we can get above 400 there is a chance we break 402 and head towards 404. If we stay under 400 I think we target 396.36 again and under 396 I think 395 comes pretty fast, followed buy 393-390.

Be safe out there, although the Volland SPY data isn’t showing much upside in terms of vanna, we should also keep in mind that SPX looks a little different and we need to know that a bullish move can still happen. Check out Dark’s daily post on SPX plan here.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.