2/27-3/3 SPY Weekly Plan

Recap from an amazing week last week followed by the weekly outlook and Monday's plan!

Readers,

The plan once again worked out as we anticipated! We are on a roll over here at Dark Matter Tradekeep up the good work! Lets take a look at what last weeks plan offered us. The market makers suggested that we were going to have roughly a $7.50 move on SPY, they got pretty close but we did sell down into that demand zone at 395-394 that we were watching on Friday.

Our bearish scenario played out very well, on Tuesday we got that sell down past the market makers expected move and then we started to form some balance at the 400 area. Bulls failed trying to take us back over 402 which lead us down to end the week right at our downside target of 396. I will get into how the volume profile played out when I go over the pre plan for the week.

Friday was a great day in terms of how the levels played out. With that 400 level being so key to price action we said this,

We gapped well under 400 and we noticed that price was coming back towards one of our key levels from the plan, 396.25 which presented a nice put opportunity. I also tweeted out the watch our demand zone at 395-394, it turned out to be the bottom for the session. We played calls back up and closed those for a profit on the retest of 396, this area was support for the rest of the session (395-394). I thought the bulls would maybe take us higher toward the 398 area based on the MMs expected move, but that didn’t happen.

—Weekly Pre Plan—

Lets start off by looking at the volume profile on a larger scale. As you can see we are balancing inside January’s value area and Feb’s VAL is still sitting up around 405.

The market makers are calling for a weekly range of $7.64. That puts us around 404.02 or 388.74. Notice how these values line up on the volume profile, the upper range for the MMs expectations put us around Feb’s VAL and the lower range has us around Jan’s POC. I don’t make these values up, but can you see how all of this comes into play?

Now we need to highlight the major monthly supply and demand zones so we know where those are going to be located. Keep these in mind because we will use them with the data that we find out later in the analysis.

Now we do the same thing for the weekly profile looking at the 4hr chart.

It is kind of hard to see here on this image but we ended the week Inside the value area (just above the VAL), I think these might be good for the bulls but we will have to see how it plays out. Looking at this I can say this, above last weeks VAL (396.25) I want to target the POC (400) and then the VAH (401.75). Under 396.25 I want to target 392 then 384 and 380. These are not my specific targets for tomorrow (384-380), but at some point if the bulls don’t start making higher highs I think we might be headed in that direction. We take it one day at a time, one profile at a time, we keep it simple!

Now let’s highlight the weekly supply and demand and see if we get any correlation with the monthly profile.

I understand that we have a lot going on so far in terms of lines on my charts, but trust me, it will all make since when you are watching it in real time. We are going to clean it up once we get to the Volland data next. I just want to show you why these levels are important. So stay with me here!

Jumping to the Volland data now and looking at the aggregate vanna first we can see that not much has changed from last week. Above spot we have the cluster of negative vanna, at spot we have a gap down to 395 where we have some negative vanna followed by a cluster of positive vanna from 394 to 390. There is a notable positive vanna at 420 but i’m not really concerned with that value unless we start making our way up over 410. Remember, at current IV levels, the negative vanna from 399-405 is going to be tough to push through unless we get a bigger IV crush, we will cover VIX later.

What is going on in this gap that we are currently sitting in? We look at gamma, and we can see that gamma is negative. We have a little positive at 398 and a bigger positive cluster 389-386. These will be key areas that I will be watching.

—Weekly Plan—

For this week I think the key areas we need to focus on are 388, 394, 395, 398, 400, 404. We keep track of the market makers move every week here because time and time again it holds weight for me as a trader, the lower (388) and upper (404) range both hold significants this week. If we look at the monthly volume profile from earlier you can see that we are pinned between supply at 396.62-397.57 and demand at 395.10-393.85, I think that as long as the bulls can keep us above 394 we have a chance to rally to the upper range 400-404, but we would need to get through 397.57-399 first. With the negative vanna from 399-405 I honestly don’t have any confidence in longs above 397.57 with the current levels in IV or the VIX, I want to see VIX back down in the 20s-18s in order to have a bullish bias. If VIX holds this 21.30ish level I want to see if back up into the 22s-24s to see if we can get a good sized sell in SPY.

Above 395 target 396.62, 397.57, 398, 399, 400-401.80 If the bulls can accomplish this and hold above 402 I think we can see 404, anything above 405 I will update throughout the week.

Below 394 target 393.23, 391.83, 391, 390.48, 390, 388.74, 387.45 If the bears can keep price below 394 I think we can see that 388.74 lower range.

It comes down to this value area highlighted above. If the bulls cannot over take the VAH 401.80ish, I think that would set up for a nice sell opportunity potentially a swing down under 390. My ideal setup going into the week would be for us to rally up into the 398-402 but fail to go higher, if this happens I want to target 392-388. If we were to gap down under 394 tomorrow and then 394-395 becomes resistance that would be another opportunity to target 388. In short, I am bearish as long as SPY stays under 402. If we do get the bearish scenario be careful for countertrend rallies, I think they would be likely in the demand zones we highlighted earlier.

—2/27 Pre Plan—

The Volland data for tomorrow is showing good confirmation for our bearish scenario. We have negative vanna at 399-400 and more negative vanna above 401, we also have the positive vanna at 398. This tells me that our bearish bias would support a move to the positive vanna at 398 and hit resistance at 399-400 and then sell back off to 398 - 394-393 (positive vanna). the negative vanna at 390-387 is showing that if we were to trade down to those levels the dealers should support the market and buy.

—2/27 Trade Plan—

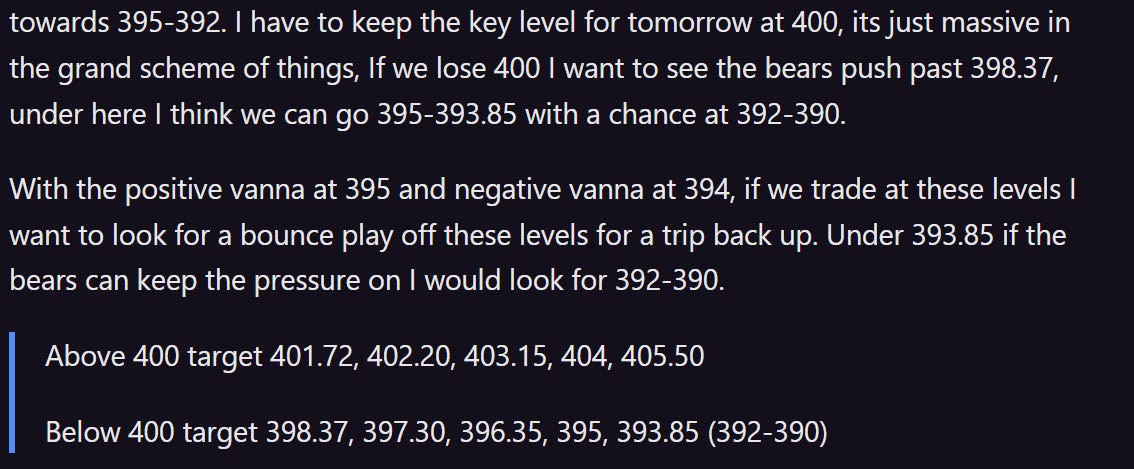

Tomorrow I am watching 394-395, 398, 400. If we open or bid above 395 I think we will retest 398, if we can push above 399-400 there is a chance we can see 401-402. I am bearish as long as SPY does not close above 402. Looking at the Volland data if we see 399-400 tomorrow with a increase in VIX I think think we can maybe sell down into 395. If we open or bid below 394 I want to target 392-390 and under 390 I think there is a chance for 388-387.50. I think 390 would be a good area of support.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.