Readers,

Last night, we came up with a plan that played out just as we had anticipated. The market followed our predicted price movement, as we had identified the key level of the day at 405. True to form, we opened with a gap down below that level, and for the first 30 minutes, we traded in the demand zone that we had previously identified at 403.94 to 402.70. As the day progressed, we continued to trend downwards, eventually breaking through the naked POC at 400. Additionally, we noted that we had opened outside of the established trading channel and failed to hold inside. Overall, it was an exceptional session that successfully executed our plan.

In the weekly plan we laid out the key levels via Volland and what we were seeing on the volume profile. Here is a link to the plan if you want to reference it!

—2/22 Pre Plan—

Let’s start off by looking at the weekly volume profile. Today price came down to the naked POC that was sitting around 400 and price continued to find balance in this area.

Now that price has found value again it needs to determine if it wants to stay here or find value somewhere else. Last weeks value area is still untested, so that could be a potential place of interest. We also have another VAL right below us at 398.40, and under that the next value area low is at 391.

I went ahead and highlighted some areas of current support and resistance that I will be watching tomorrow

Now we will review the data via Volland to try and determine what the dealer hedging requirements are for tomorrow.

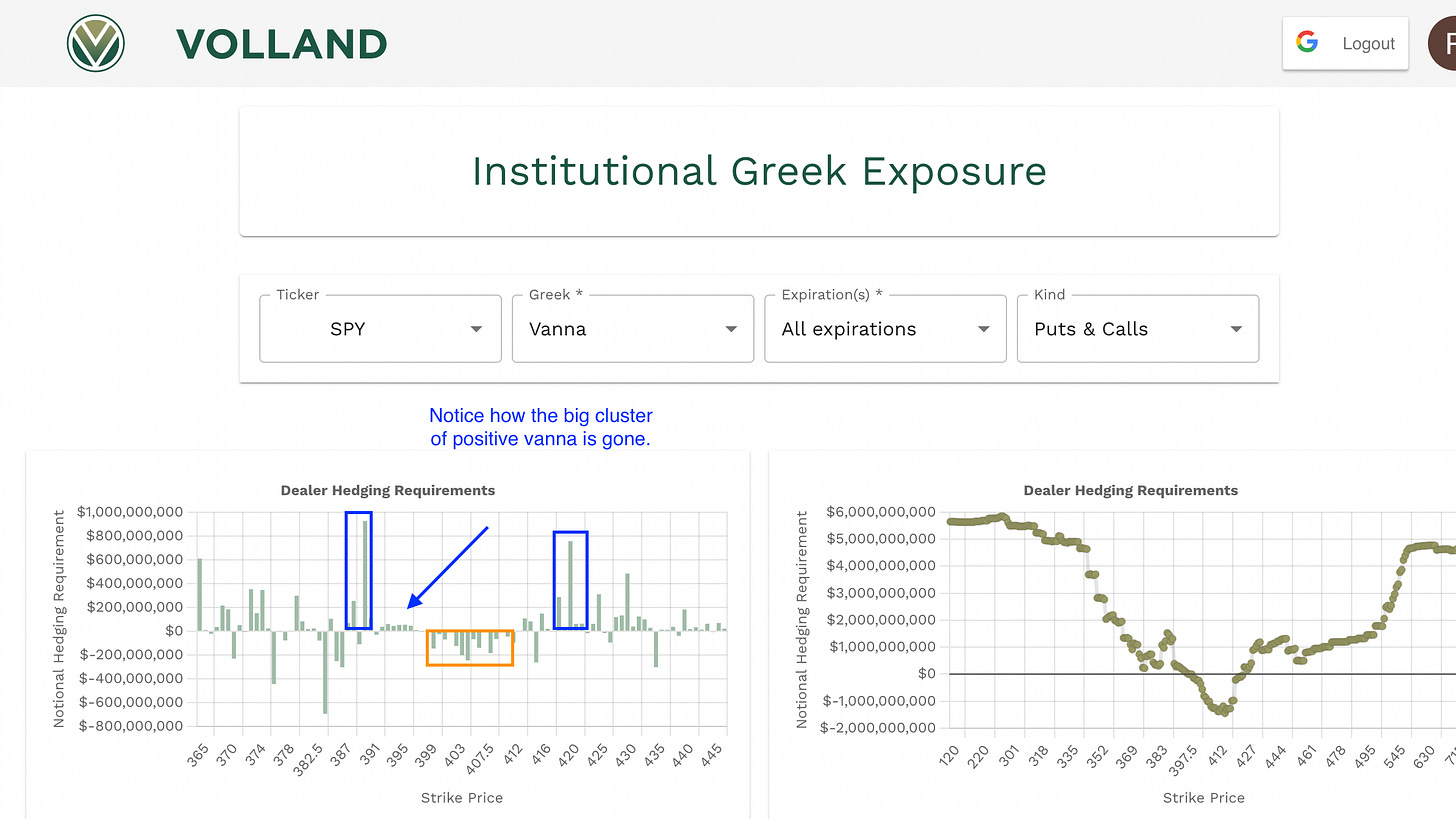

First thing I notice is the aggregate vanna, notice how different it looks from yesterday.

Notice that the big cluster of positive vanna has diminished and we now have a bigger cluster of negative vanna above us. This is telling me a few things, VIX needs to drop significantly if we are going to try and push up through this negative vanna, and the 390 magnet is really strong. If you remember, in our weekly plan we said that we might be shaping up for a test of the January monthly POC at 388. We are now setup for this. Let’s now look at gamma and see what that shows.

The gamma is heavily negative with some positive showing up at 392, 389, 387 to the downside. Moving to the 1dte vanna chart for tomorrow we can see that above spot we have a big cluster of negative vanna, this should act as resistance based on current prices in VIX. We have two positive areas at 397-396 and 3930-392. As we said up above it might be harder for price to push up with a scenario that looks like this.

Well, well, well, our little beautiful friend VIX, in the weekly plan we talked about this retest being significant and it playing a role in our bearish scenario. It is imperative that we continue to watch this ticker. Tomorrow if VIX drops back down to fill the gap and if we are up into the 400-405’s might want to see if we get a VIX bounce around this area for a put play.

—2/22 Trade Plan—

Now its time to put this information to use. Tomorrow could be a chop day, if we go back to the volume profile, we have clearly pushed away from last weeks value around 409-413, and we found balance down at a naked POC and VAL. That makes me think we could balance here maybe between 400-407, if 400 were to hold. My key level for tomorrow is 400. If the bulls can stay above 400 I think we can see 401.50- 403, this scenario would also support a dropping VIX maybe looking for a gap fill, if this plays out watch how price reacts on another channel retest seen in the chart below. That retest would put us right at the bottom of this channel.

If we get the VIX scenario, where it wants to gap fill, watch and see if it wants to hold and go, or if it falls. If it falls we will probably see price reclaim the channel and we could retest the 405 area. If VIX holds and wants to then climb higher and spot is under 400 I think we might test 397-396, we have a demand zone here as well, and under that we can see 394-392.

Above 400, target 401.50-403, if 403 holds 405-407 could trade.

Below 400, target 398-396, under 395 target 393-392.

Again, I think we could potentially have some balancing here between these value areas, also note that we already traded the market makers expected move on the first day of this short week.

Does this mean we can’t go lower? No it doesn’t, but I think I might want to see if we can push back up away from it. More times than not this market maker range is respected, and i’ve seen it hit both sides. Keep and eye on VIX and the 400 level.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.