2/2 SPX Trade Plan

After a bullish trend day following FOMC what does the market have in store...

Welcome to the first Dark Matter $SPX trade plan on substack. I will continue to update Twitter linking the trade plan back here. Substack’s format provides a cleaner view of the trade plan than Twitter and should provide you with a better experience.

With that said, let’s dig into the trade plan.

Overview:

After an intense bullish run yesterday in $SPX we can comfortably say that bulls are in control and some key critical levels need to hold in order for continuation towards 4200. I believe that today's action is going to be more balance and choppy - could be a scalpers type of game. With that said, review the key levels below, wait for confirmation, and take profits where you can. If you are holding any position and not scaling out above 20% it will be hard to compound your account. Take the wins, build the bank, and trade with a larger purse.

Trade Plan:

Bullish bias:

Above 4125 target 4150 then 4170/75

If there is a failed breakdown at 4120 target 4150

If there is a breakout of 4150 target 4170/75

Bearish bias:

Below 4120 target 4110 then 4100

If there is a failed breakout at 4150 target 4120 then 4110 then 4100

If there is a breakdown of 4100 target 4080

News Catalyst

We have a major news catalyst from the UK and EU - similar to FOMC - that will have an impact on the markets, but not as large as today's FOMC move. Don't forget after hours we have $AAPL, $AMZN, $GOOGL, $SBUX all reporting ER.

7-8:30am est - UK and EU Fed Statements

8:30am est - Unemployment Claims

Vol.land Data

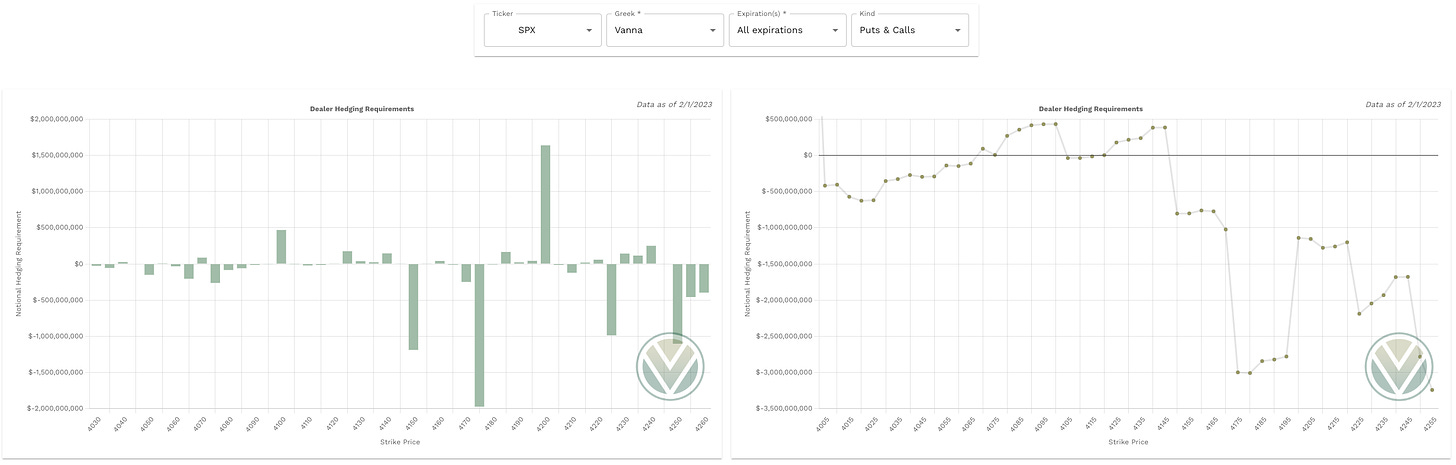

Vanna

What is Vanna? For details see the video, but at a high level positive vanna acts as a magnet pulling price to it and negative vanna acts as a repellent pushing price away from it. As we reach one of the vanna levels below in order to determine whether we will continue or reverse we keep a close eye to $VIX and the IV of the underlying ticker. In order to go past a negative vanna we need to see $VIX and IV decrease. For positive vanna if it stops here you will see an increase in $VIX or IV.

Above Spot:

4125-4140 are minor positive vanna's - acting as magnet

4150 is a major negative vanna - acting as repellent

4170-4175 are major negative vanna's - acting as repellent

4185 is a minor positive vanna - acting as magnet

4200 is a major positive vanna - acting as magnet

Below Spot:

4115-4110 are minor negative vanna's - acting as repellent

4100 is a major positive vanna - acting as magnet

4090-4075 are minor negative vanna's - acting as repellent

4070 is a minor positive vanna - acting as magnet

4065-50 are minor negative vanna's - acting as repellent

From a vanna perspective our range could be 4100-4150 with a potential overshoot to 4165.

Above 4125 vanna should cause VIX to decrease.

Below 4105 is an interesting spot to see if VIX increases or decreases as it holds.

In order for 4110-4115 to hold we need to see VIX decrease.

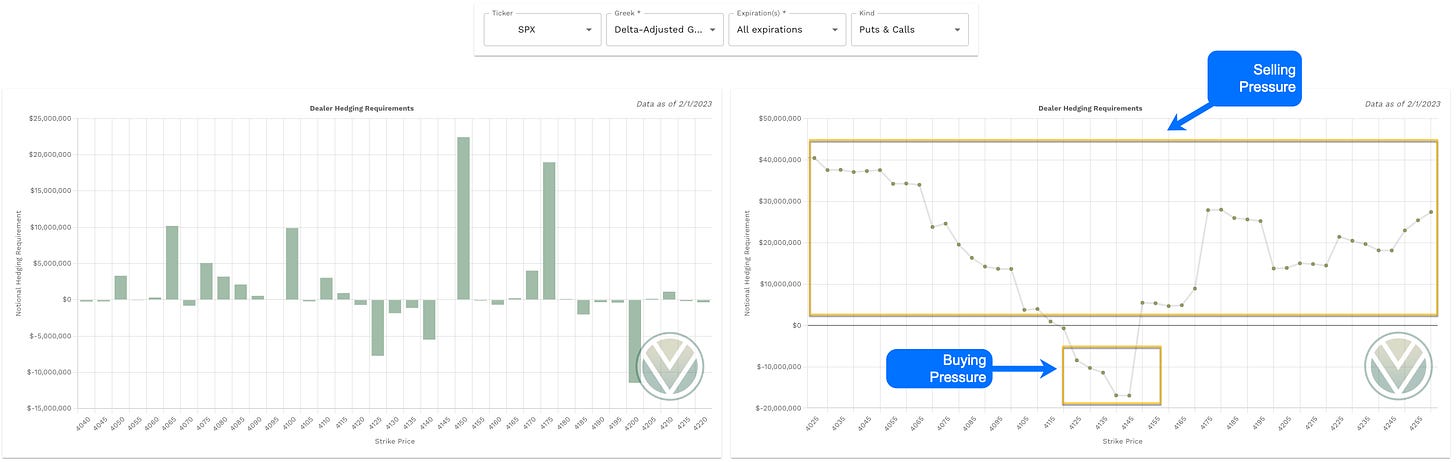

DAG

Above Spot:

4150 is a major and first positive DAG - acting as resistance

4170/75 are major positive DAG - acting as resistance

Above 4120 will trigger dealer buying pressure targeting 4150 with a speed bump at 4135

Below Spot:

4115/10 are minor positive DAG - acting as support

4100 is a major positive DAG - acting as support

Below 4120 will trigger dealer selling pressure targeting 4105 then 4075

From a DAG perspective if price can hold above 4110 we ride until 4150 where we start to face resistance.

If we lose 4110 we target 4100 then 4090

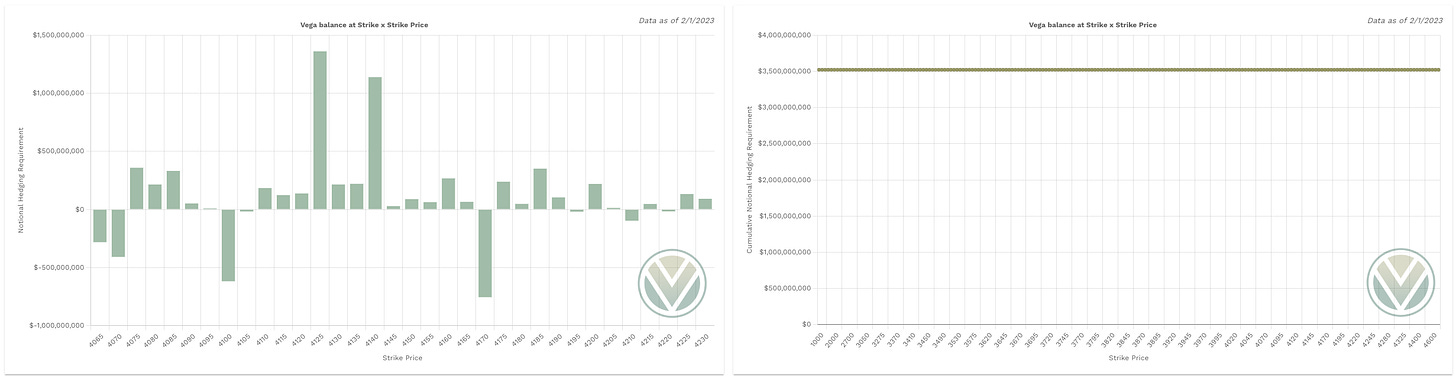

Vega - Key levels with highest volatility

4110/20 minor

4125 major

4150 major

4160 medium

Total notional value on Vega is positive - suggesting a bullish trend

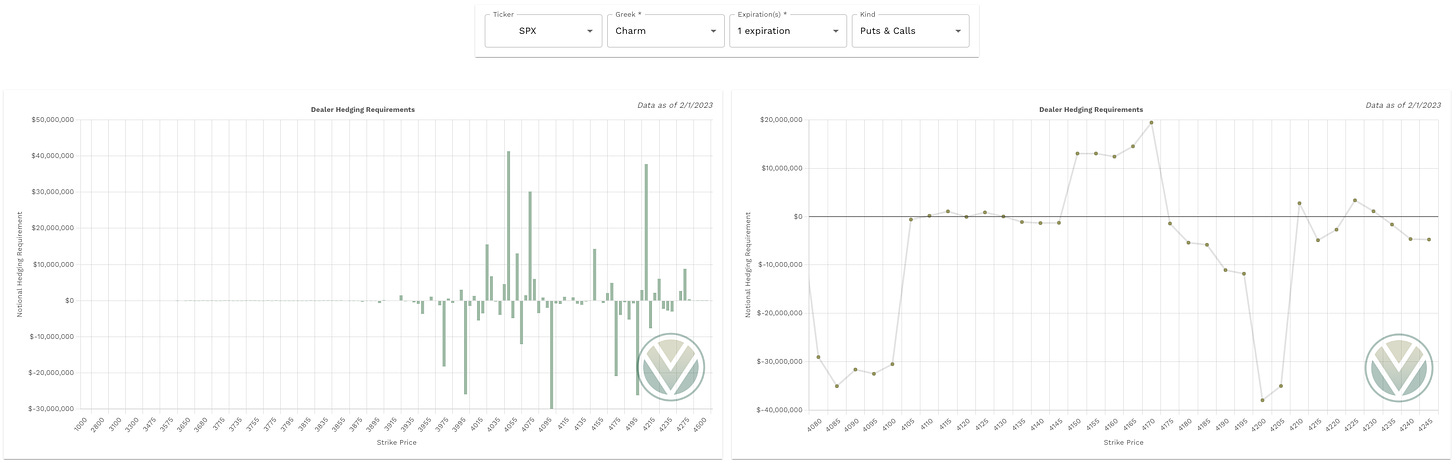

Charm

Charm will push price until 4150

Charm will support price until 4105

Charm will go into overdrive above 4175

Stay #paytient and react to the key levels - no predictions! Good luck traders.