Readers,

—2/15 Recap—

Yesterday's price action highlights the importance of having a plan. Initially, it seemed like the bears were going to push the price below 410, as we dipped to 409.50. However, the bulls managed to pull the price back up, which emphasizes the need to stay flexible and adjust our strategies accordingly.

In our plan from last night, we identified 413 as the key level due to the gamma level, and we also anticipated a potential bearish move below 410. However, the price ended up closing at our first bullish target of 414, which is a positive outcome for our strategy. This outcome further reinforces the significance of being adaptable and prepared for different scenarios in the market.

—2/16 Pre-Plan—

Firstly, let's discuss the volume profile. The current weekly profile shows that the bulls are in control as they managed to bring the price up and form a P-shaped profile, even closing above the value area high (VAH). I'll be keeping a close eye on this, particularly the current point of control (POC) to hold and continue moving up.

Also note, the price closed above the previous week's value area, suggesting that if the price keeps rising, it may attempt to find value above some notable areas, including candle wicks to the left (415, 416.50, 418.30), a potential gap fill, and then the next naked POC at 426.50. It's important to note that this may not happen immediately, but over the next few weeks, these scenarios could potentially play out if the price stays accepted in the current range.

Let's explore the bearish scenario for this profile. It's worth noting that the P-shaped profile could signal weak buyers, so if the price were to dip back below the VAL, currently around 411, I would for price to come back to the P(where most of the volume is) to get rejected back down. Such a scenario could present an excellent setup to the downside, especially if it happens tomorrow.

If the price continues to drop, I would expect it to reach last week's naked VAL at 406.60 and then the naked point of control (POC) at 404.30, as long as the price remains below the current week's POC. It's important to keep in mind that the "Current Weeks" profile levels are dynamic, and as the price and volume change, these levels will adjust. However, once the week is over, they become set in stone.

The monthly profile hasn’t changed stance yet, it’s still balanced between 415 and 408.50 and the POC is 412.

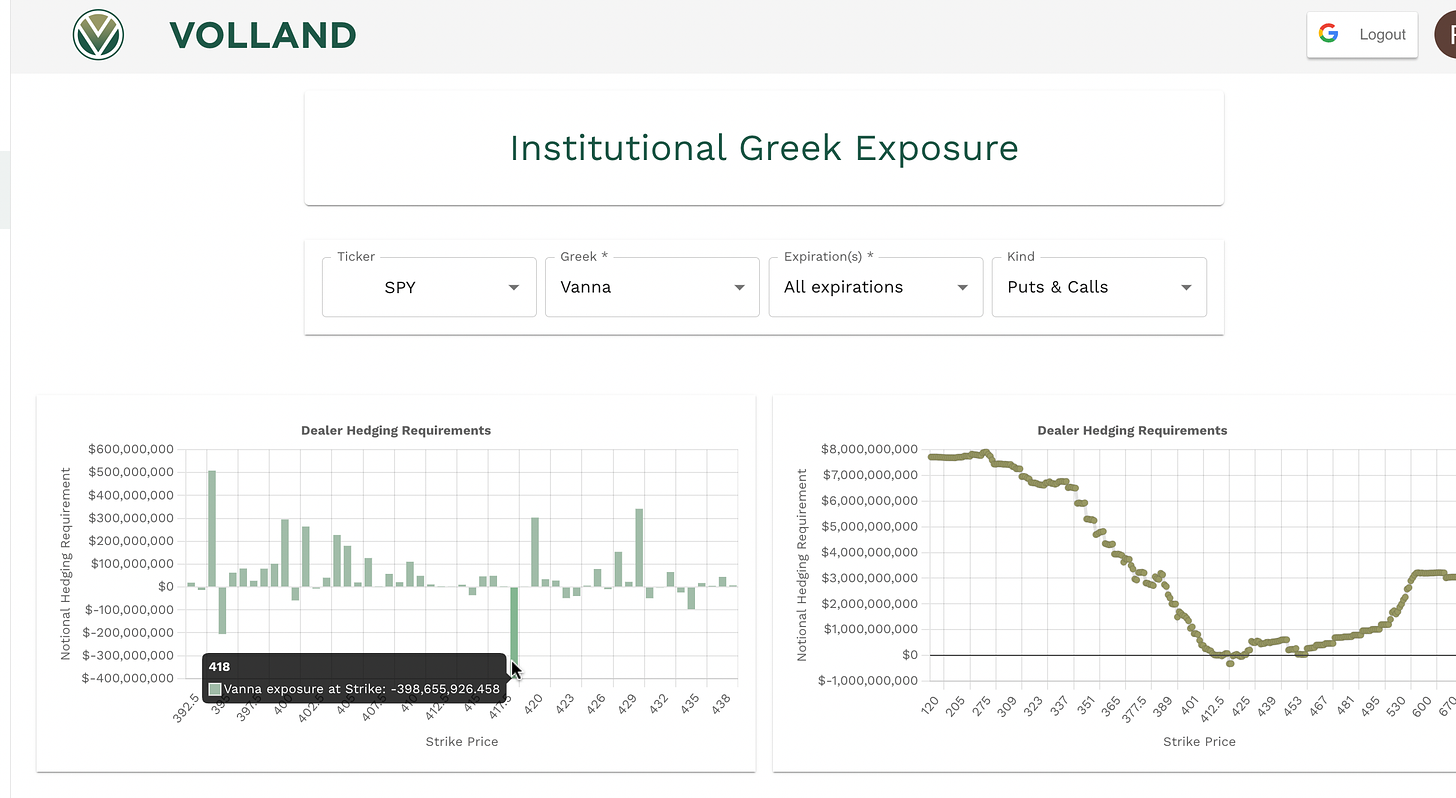

Now lets get into the Volland data to see if we can find a correlation in levels. I am going to review the aggregate data because it appears that the 1dte data is not showing for 2/16 at the time of me writing this post. If there are any significant changes or if Volland updates the data I will tweet here.

We can see that there is still a larger negative bar located at 418, and 415 still has a small amount of negative vanna. With have the larger cluster of positive vanna down under spot and we have the next negative value at 401. We still have the risk to the downside if we get a increase in IV or the VIX, if this happens the positive values below spot will have a heavier weight. On the flip side if VIX keeps going down we are more than likely going to see 415-418, I think 418 might be a bit of an issue to get over maybe at the first go, but we do have positive vanna above at 420-422.

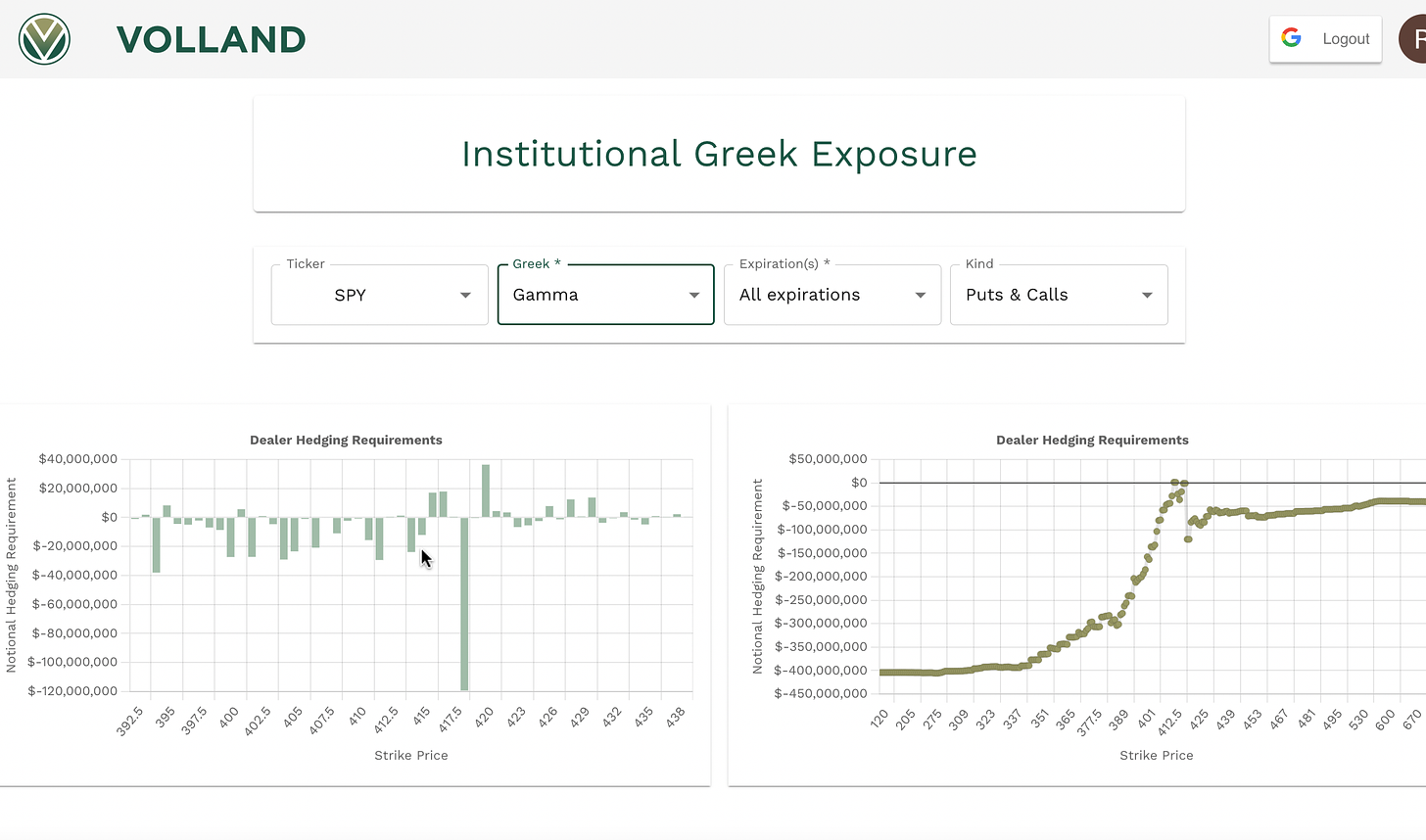

If we note the gamma, we can see that right here at 414-415 and down to 402 we have negative gamma, the two bars at 416 and 417 that are positive could be resistance and price could potentially move pretty freely to the downside so we need to be mindful.

—2/16 Trade Plan—

My main area of focus tomorrow is going to be 415-418 and 412-410. If we were to open or bid above 415 I think we have a chance to see 418 and possibly into 420. If we open or bid below 410 I would want to target 408-407, 405, 402. Im going to be watching how we react to price. If we get the bearish scenario I would love to see a retest of value on the profile for a continued move down. For a bullish move I want to see price hold the vah and the POC of the current profile to see if we can make our way to 418.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.