—2/13 Recap—

Our efforts in the Dark Matter Trade Substack have consistently paid off as we consistently execute our trade plan with precision. Last night, we invested a few hours in conducting thorough research to identify key levels. Our hard work paid off as we accurately identified the levels and established our trade plan. If the market trading was above 408, our target was set at 414 with stop-loss levels at 410, 411.50, and 413 to minimize any potential risks.

Here is a link to the Weekly SPY Plan if you have not read it yet. I will highlight a few key take aways down below.

—2/14 Pre Plan—

Let's dive in! Tomorrow holds a major event as the Consumer Price Index (CPI) will be released, with the potential to cause swift market movements. The data will be made public an hour before the opening bell, giving us a crucial hour to observe and respond to market developments. As options traders trading SPY, it's crucial that we stay alert and ready for any unexpected shifts in the market.

In this post, I will refrain from making any predictions and instead present a few possible scenarios that could unfold.

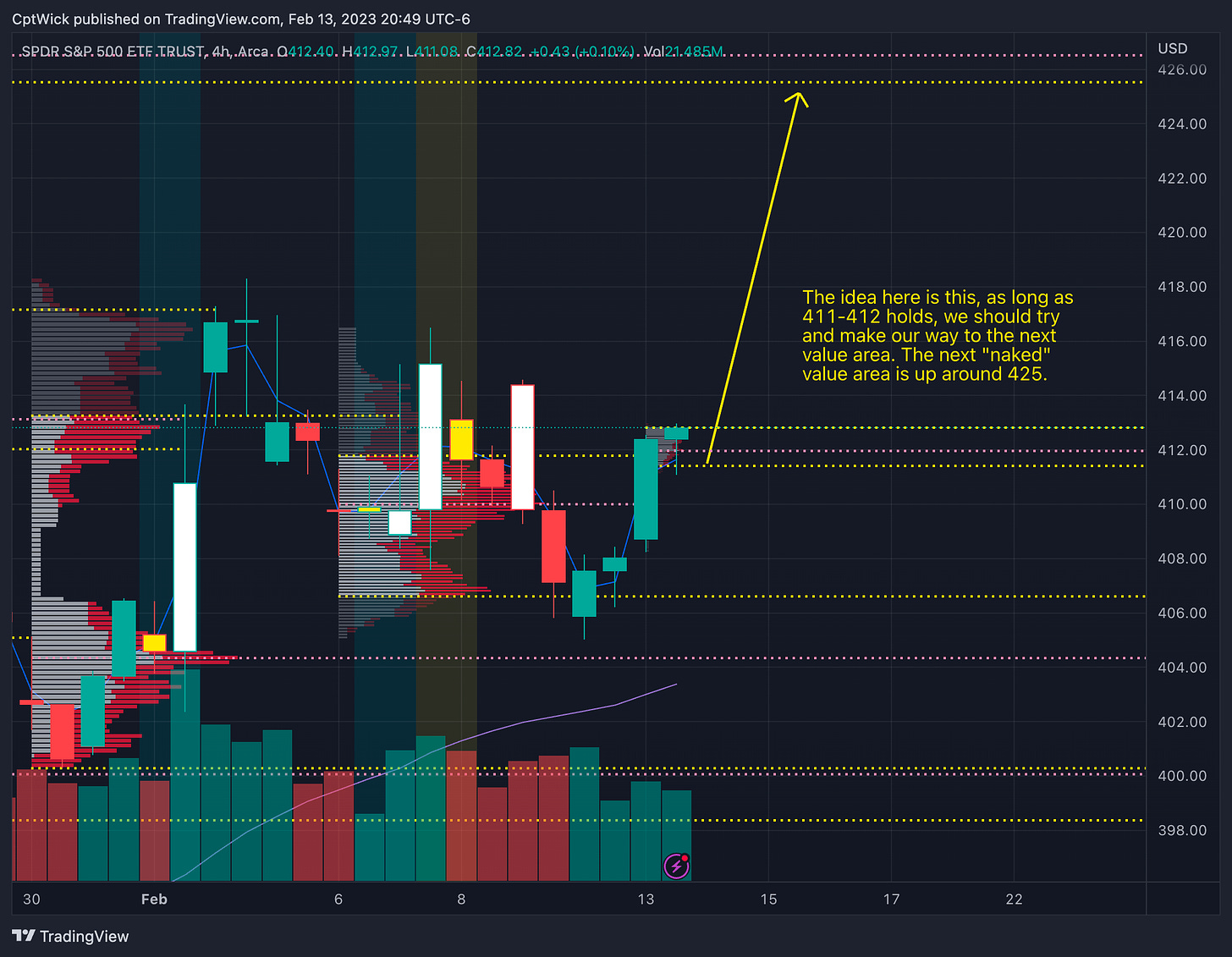

Let’s start by looking at the volume profile. Our weekly plan, stated that the bulls needed to take out last weeks POC around 410 in order to push up out of value around 411.75. Look at this 4hour chat, we did exactly that. Now you can see that we breached the VAH of last weeks session, we came back down into value and closed the day above that VAH from last week. Before even looking at the Volland data I can assume that this 410-412 area will more than likely show signs of support.

It's important to note that surpassing the VAH and moving towards 425 does not guarantee that we will easily reach that level. This is just an ideal scenario. As the price moves higher, it will seek to find value, whether that means accepting prices up to 425 or being rejected and falling back within the value area. If the price is unable to sustain the upward momentum and falls back under 411, it will try to find value below and may move towards the VAL around 406. This is precisely why we identify these critical levels before every trading session.

Lets take a snapshot of how the monthly is playing out so we know what is going on with that chart.

Comparing today's chart to the previous session, we can see that the bulls successfully drove the price above both the VAL and POC. In doing so, we managed to lift the POC from 410 to 412, which is a bullish indication. The next step we want to see is the POC holding as support while we move towards the VAH around 416. From there, we will assess whether we can continue pushing upward beyond the next value area at around 420.

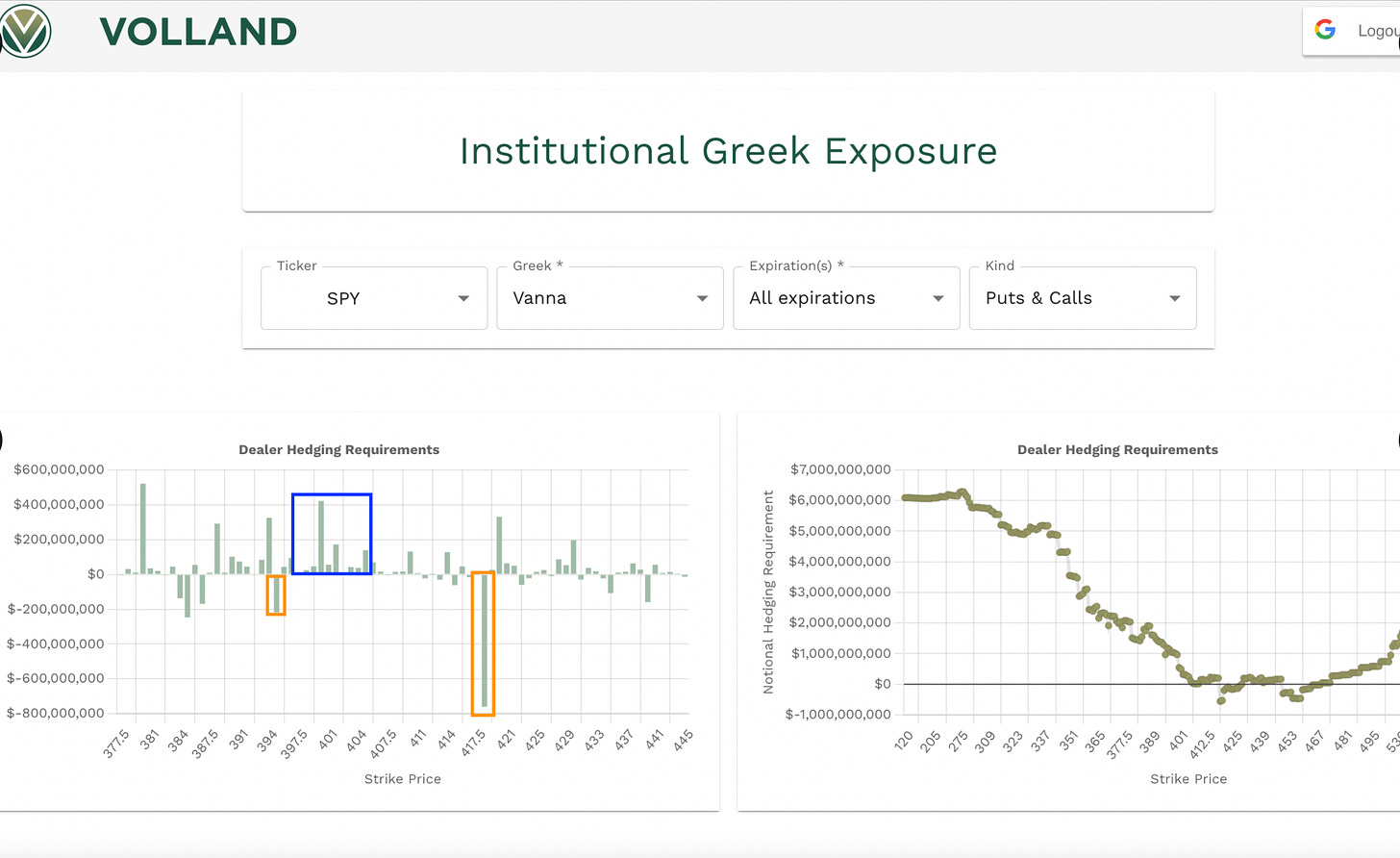

Let’s see if Volland agrees with what the volume profile is suggesting. First let’s see if aggregate vanna had any changes. Here is yesterday 2/13.

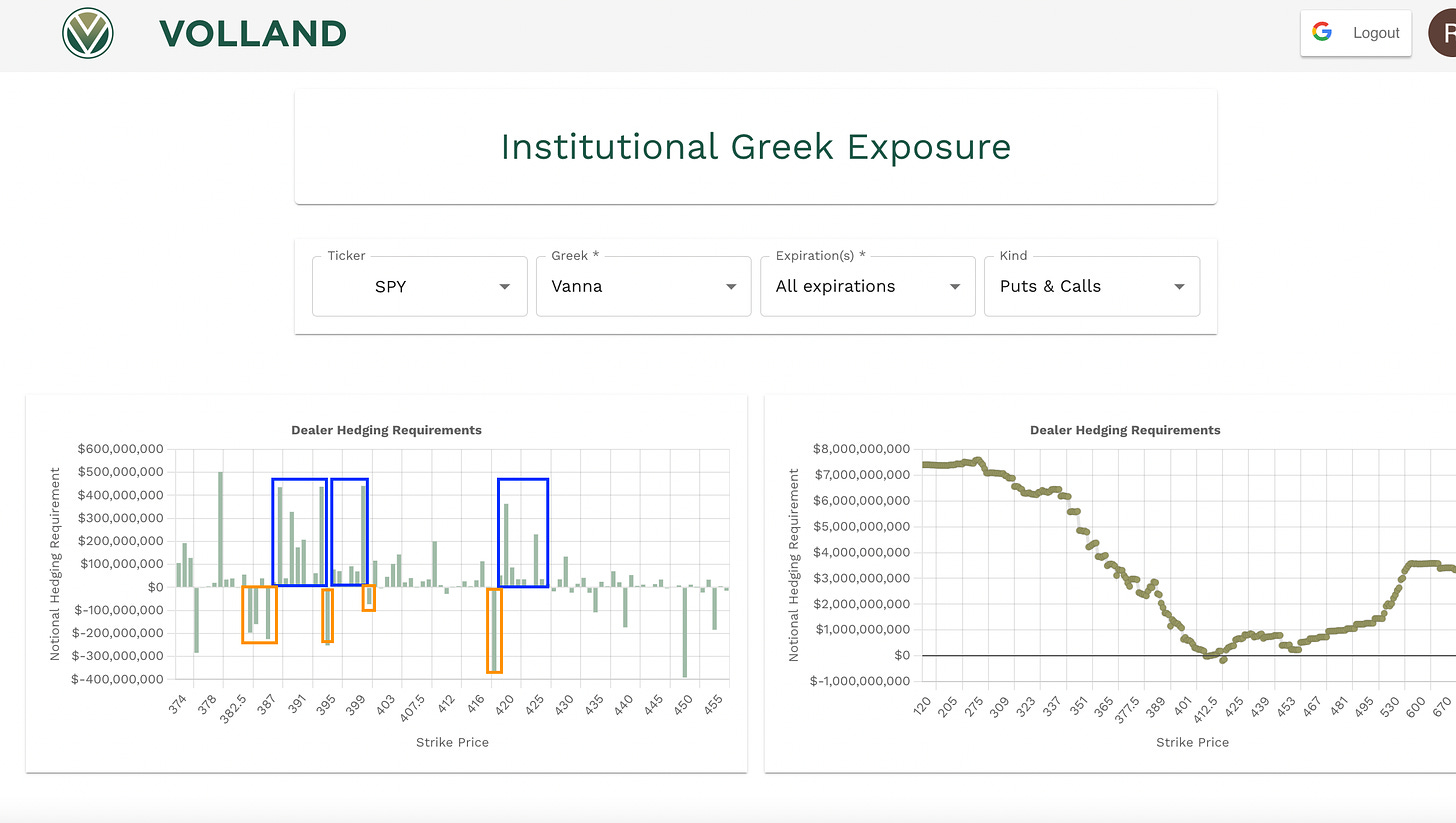

Now here is the current view. We can see that we have a lot more activity at some new levels. We have bigger clusters of positive vanna above 420 and below 401 and below 395, and then another new cluster. I think going into tomorrow, and looking at the data on the chart, I want to know the negative vanna levels. 418, 412(not highlighted in orange but its there), 401, 395, 387.

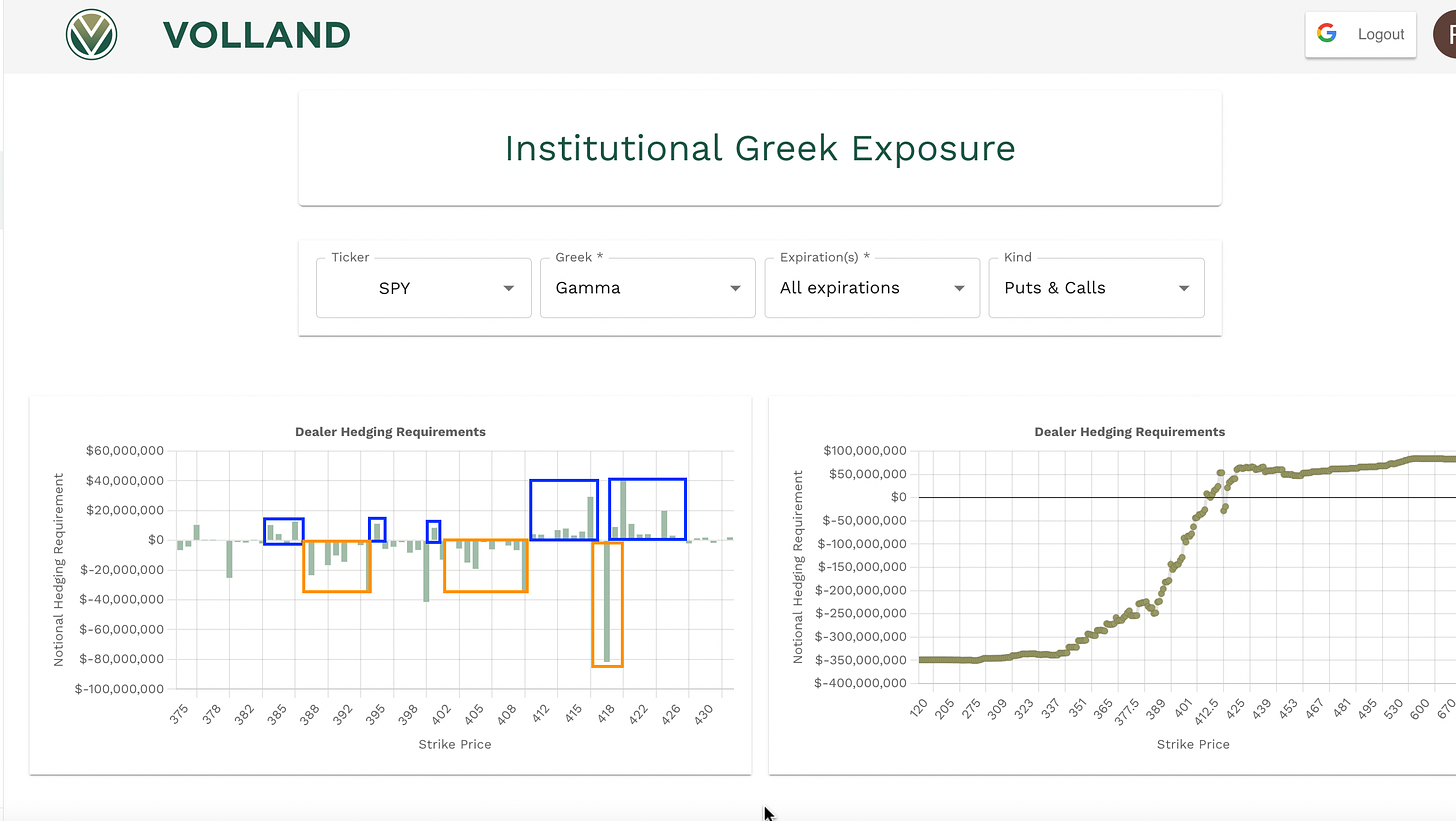

This is a visual representation of the aggregate gamma as of 2/13. The noteworthy point is the correlation between negative vanna levels mentioned earlier. Among those levels, 418 stands out due to its negative vanna and negative gamma, which is not the case with other negative vanna levels. They have positive gamma, indicating stronger support/resistance.

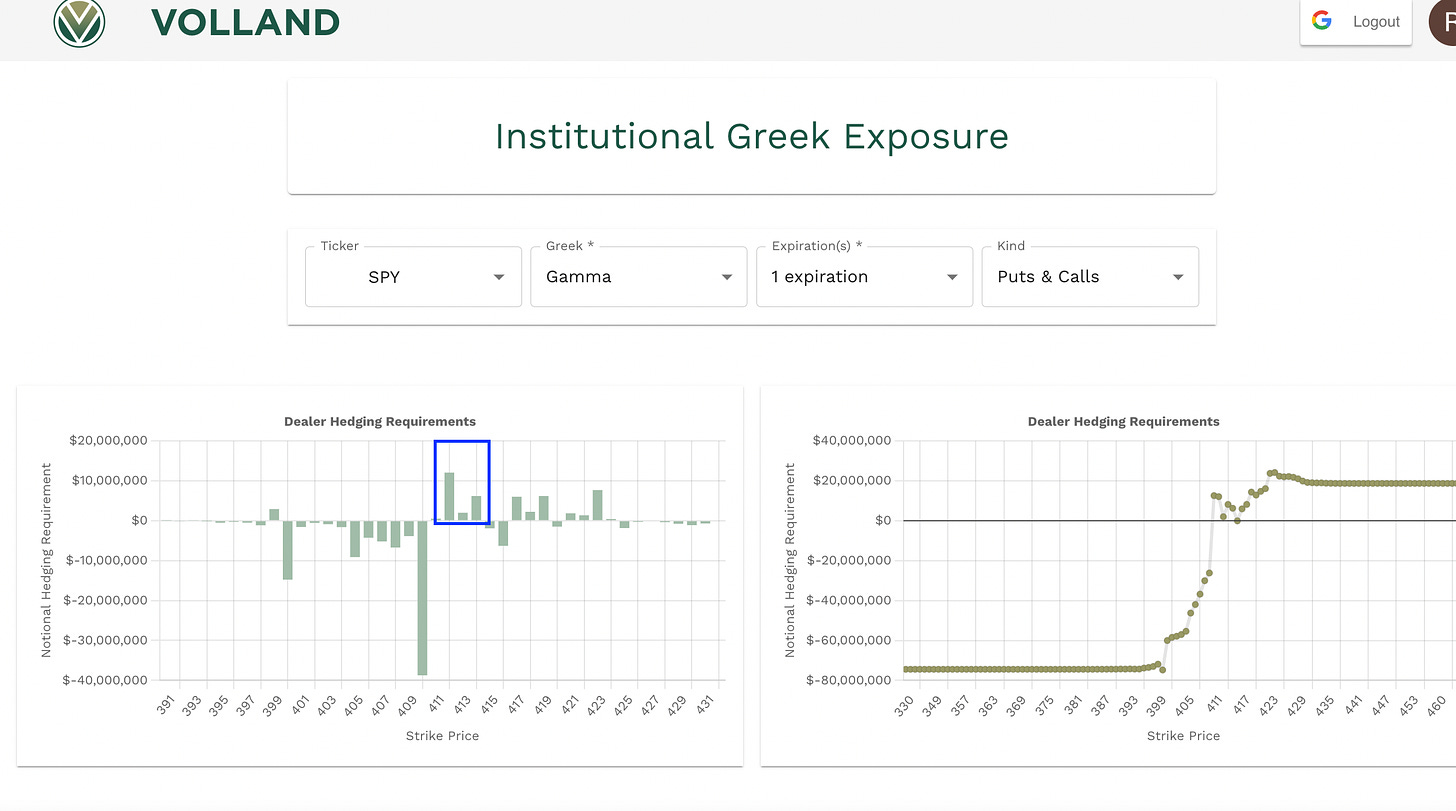

When we narrow down to the 1dte chart, first looking at vanna we can see it is painting a similar picture. We have clusters of positive vanna above and below spot. I want to take a closer look at the vanna gap from around 411-416 by looking at gamma.

The gamma at these levels is positive, so I will be watching this area to figure out it price is going to trade above or below, I will go into further detail in the next section.

—2/14 Trade Plan—

I don't intend to follow a typical trade plan as these days are unpredictable due to numerous variables. I cannot speculate whether CPI will be 5% or 6.5% or X%, for more information on hot or cold CPI reads, please check out the SPX daily plan by @DarkMatterTrade, However, here's what I am focusing on:

I am interested in positive gamma levels on the 1dte chart, particularly the gap in vanna levels between 412-414. I plan to be bullish above these levels and bearish under them. However, we need to consider that the market may open 10 handles away from these levels, so it's difficult to predict if these levels will be significant at open.

Another level to watch out for is 418. If the market opens or bids above 418, I anticipate a possibility of 420-425. If the market trades below 418, it will act as a significant resistance level.

Under 410 key levels are 405, 400, 395.

Not only do we have CPI, we also have fed speakers;

11am est - FOMC Member Logan Speaks

11:30am est - FOMC Member Harker Speaks

2:05pm est - FOMC Member Williams Speaks

Something that I am going to rely heavily on tomorrow is VIX. We have a big day tomorrow so there is a chance we get volatility expansion or a volatility crush. VIX as of this post is 20.34, under 20 I think VIX will be beneficial for the bulls and vice versa.

Before I sign off here I want you guys to know that I can’t predict tomorrow. Tomorrow is one of those days that can really hurt your account if you are trading big size, or it can be extremely rewarding. I urge you to trade with caution, and to use VIX as a guide to what price might do tomorrow. Any updates to this plan I will tweet here.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.