We had a nice trend day for the bulls with two trade ideas hitting in both SPX/ES/SPY and QQQ. I can’t stress enough how important it is to have a gameplan and setting yourself up for the best trading scenario. The QQQ trade was a prime example of paytience waiting until that trade came to us and avoiding the up and down chop as it filtered in the 300-301 range at the open.

Then QQQ breaks 302, retests it, holds it and good bye here comes 304. Similarly with SPX we had an open at 4097 followed by a bunch of chop and then 4100 came, retested it, and good bye.

While I won’t give you everyday plans that are 40-50+ rippers the market is just not setup for traders to consistently get the bottom or top. Consistent trading catching key levels from target A to target B will help you compound and grow your bank account allowing you to trade very similarly, but with a larger size.

From our trade plan:

Above 4100 target 4115 - we got to a high of 4132

$QQQ plan:

Above 301 target 304 - we got to a high of 304.70

I enjoy interacting and learning from other traders so continue to share your trades, ideas, and how you use this trade plan by messaging me on Twitter @DarkMatterTrade.

News Catalyst

The main event today is going to be CPI before market open at 8:30am est. Oh and there are a bunch of FED members speaking…

8:30am est - CPI

11am est - FOMC Member Logan Speaks

11:30am est - FOMC Member Harker Speaks

2:05pm est - FOMC Member Williams Speaks

For more information on these news events, visit the Economic Calendar

SPX/ES/SPY Notes:

Remember you can use this SPX trade plan to trade ES. Take roughly 9 pts off ES and you get these SPX levels. At Friday close ES traded 4099.75 and SPX 4090.45.

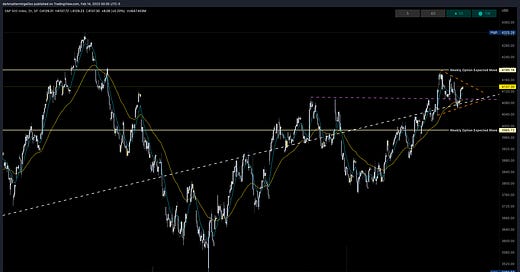

No major changes to any trendlines. The key trendlines I am watching are:

Orange - From our recent highs you can see this trendline is a clear resistance to price above and a triangle/wedge has formed where I can see price ping pong before CPI and post CPI waiting for a breakout up or down

Purple - This trendline was broken at FOMC around 4093 and where price was rejected on Friday at the end of the day - let’s see if the bulls take us back above

White - this is our trendline from the Covid 2020 low - while price broke below it, we were able to get back within it

Today is CPI and honestly anything can happen. We are all basically trading against one key data point so expect a lot of volatility. This and FOMC is probably one of the hardest days to trade and I can’t stress enough to go light tomorrow. There will be other trading days with much clearer trends and opportunities. React to the key levels and expect traps, breakouts, breakdowns and the potential to trade both sides of the range tomorrow.

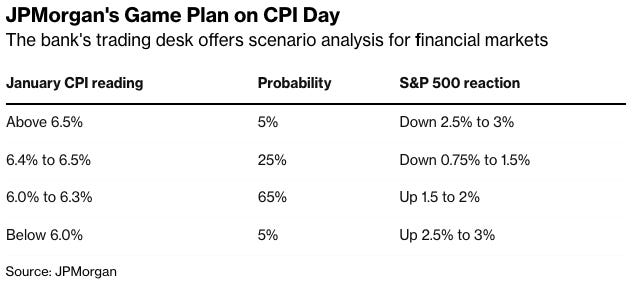

Looking into some CPI predictions, below is JPMorgan’s game plan and expectations of where CPI will come in.

Reminder here is our weekly options expected move on SPX.

SPX/ES/SPY Trade Plan:

Bullish bias:

Above 4150 target 4175 then 4200

If there is a breakout at 4175 target 4200

If there is a failed breakdown at 4065 target 4080

Below 4125 target 4080

If there is a breakdown of 4100 target 4080

If there is a breakdown of 4065 target 4000

If there is a failed breakout at 4200 target 4180

Vol.land Data

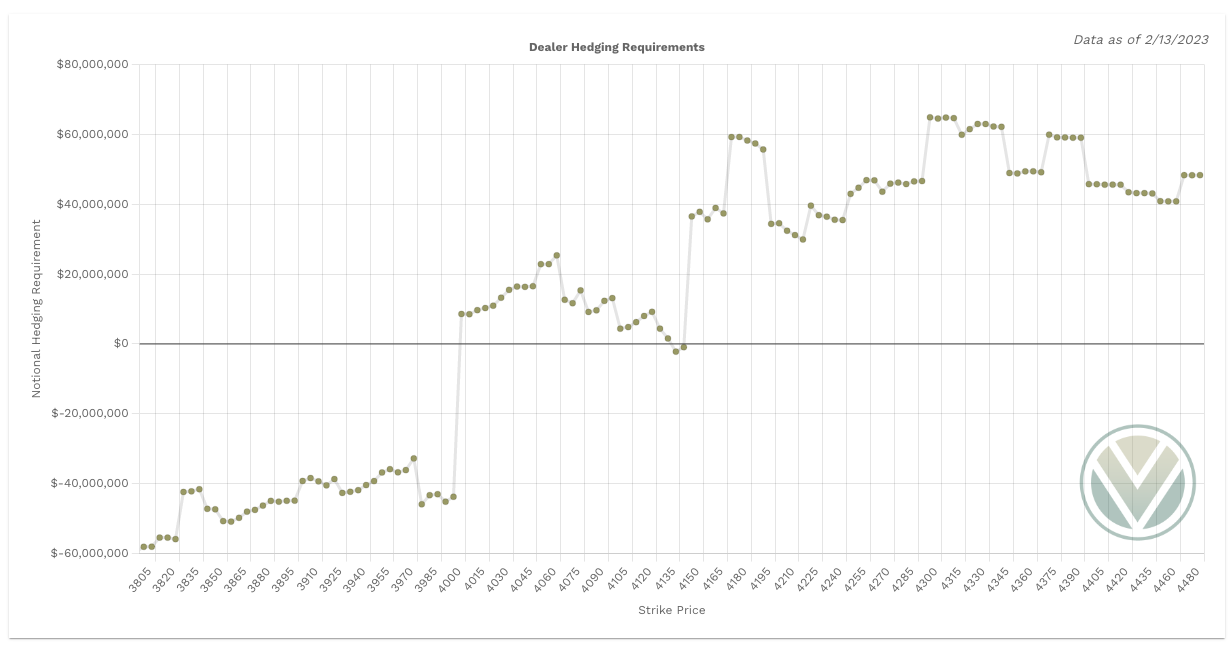

For a better understanding of the various greeks below I would suggest you visit the Volland YouTube Page. Volland provides unique data showing where dealers are positioned providing in my opinion a higher degree of conviction to where price may move to.

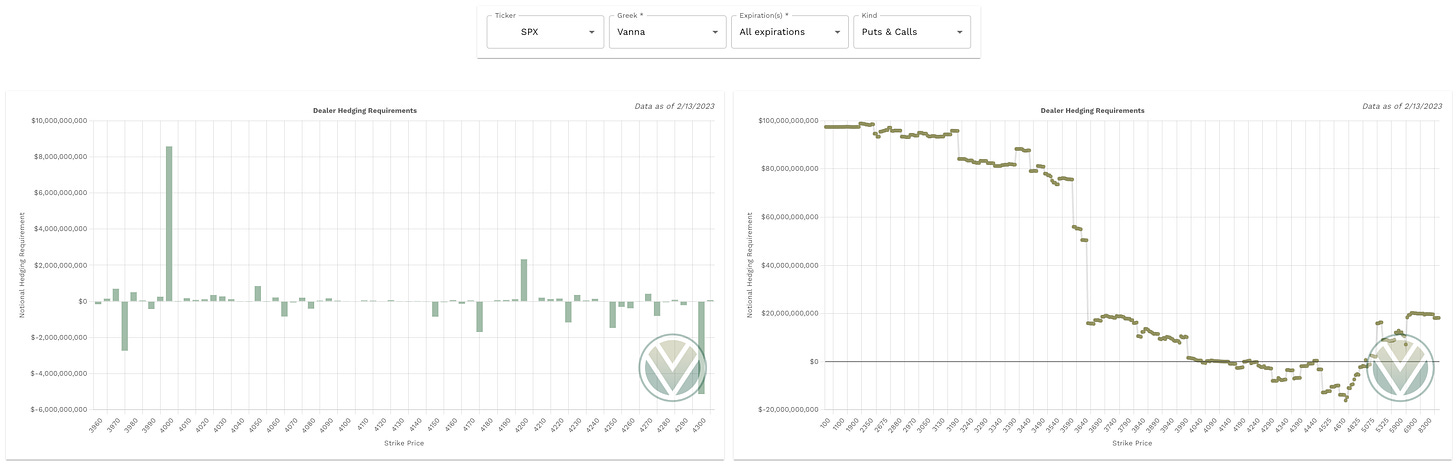

Vanna - Levels where price may repel or act as magnet

Remember for price to go above spot through a magnet or repel VIX and IV must decrease. For price to go below spot through a magnet or repel VIX and IV must increase.

Above Spot:

4150 is a medium negative vanna - acting as repellent

4175 is a major negative vanna - acting as repellent

4200 is a medium positive vanna - acting as magnet

4210-4220 are minor positive vanna - acting as magnet

4225 is medium negative vanna - acting as repellent

4250 is a medium negative vanna - acting as repellent

VIX needs to target towards 19.25-19.11 where a potential orderblock sits on the 2hr chart where it could find support - if VIX cannot get to these levels it will be difficult to get to these higher levels even with a cooler CPI print

Below Spot:

4130/35 are minor negative vanna - acting as repellent

Below 4125 we have positive vanna until 4080 - acting as magnet

4080 is a minor negative vanna - acting as repellent

4065 is a medium negative vanna - acting as repellent

4050 is a medium positive vanna - acting as magnet

4035-4010 is a cluster of minor positive vanna - acting as magnet

4000 is a major positive vanna - acting as magnet

3990 is a minor negative vanna - acting as repellent

3975 is a medium negative vanna - acting as repellent

Our range could be 4070-4220

This one is simple, CPI must print cooler to see upside numbers and vice versa to see downside

If 4065 breaks down, it targets 4000 and this is an area I would add size in puts

If we open with a cooler CPI and are in the 4175 level and break it this gives us a great opportunity to long until 4220

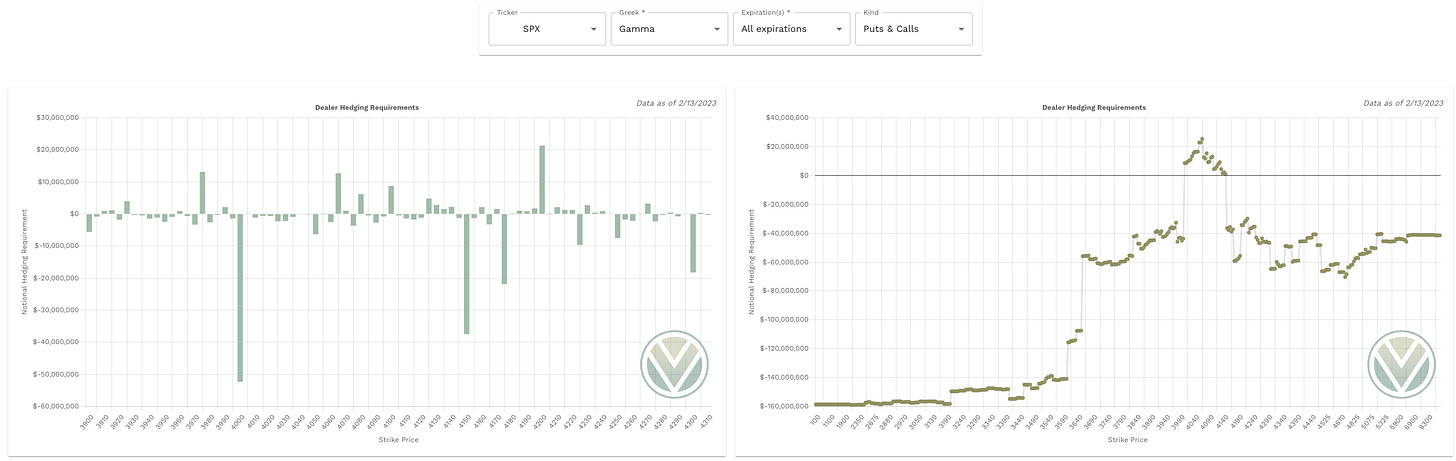

Gamma and Delta-Adjusted Gamma (DAG)

Above Spot:

4140 is a minor positive Gamma - acting as resistance

4160 is a minor positive Gamma - acting as resistance

4170 is a minor positive Gamma - acting as resistance

4185-4195 are minor positive DAG’s - acting as resistance

4200 is a MAJOR positive Gamma - acting as resistance

Above 4145 will trigger dealer buying pressure supporting price to 4200

Below Spot:

4135-4125 are minor positive Gamma - acting as support

4100 is a medium positive Gamma - acting as support

4080 is a medium positive Gamma - acting as support

4065 is a major positive Gamma - acting as support

3990 is a minor positive Gamma - acting as support

3975 is a major positive Gamma - acting as support

Below 4130 will trigger dealer selling pressure pushing price to 4065

4200 will be a major barrier to get past it and could bring us near the highs before a potential reversal

4065 is a major level and if lost takes us easily to 4000 then 3980

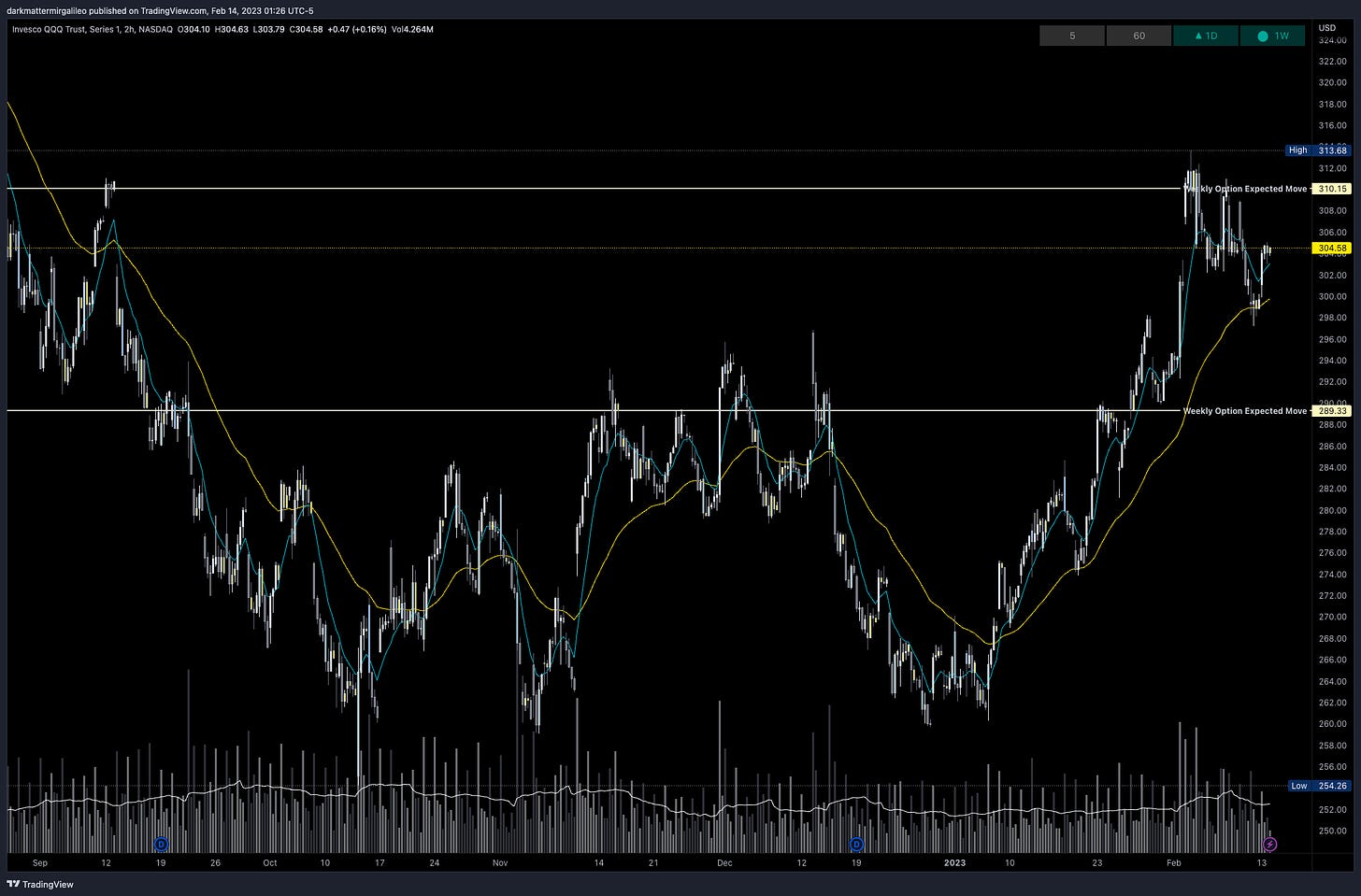

QQQ Trade Plan

Here is our weekly options expected move:

Bullish bias:

Above 305 target 307

If there is a breakout at 307 target 310

If there is a failed breakdown at 295 target 300

Bearish bias:

Below 304 target 301

If there is a failed breakout at 310 target 307

If there is a breakdown of 300 target 296

Vanna:

Above Spot:

307-309 is minor negative vanna - acting as repellent

310 is a major positive vanna - acting as magnet

311/312 are minor negative vanna - acting as magnet

313-319 are positive vanna’s - acting as magnet

315 is a major positive vanna - acting as magnet

Below Spot:

301 is a minor negative vanna - acting as resistance

300 is a medium negative vanna - acting as resistance

299-296 are minor positive vanna - acting as magnet

295 is a medium negative vanna - acting as resistance

Gamma:

Above Spot:

310 is a major positive Gamma - acting as resistance

313-319 are positive Gamma - acting as resistance

Below Spot:

304 is minor positive Gamma - acting as support

301/300 are medium positive Gamma - acting as support

295/294 are minor positive Gamma - acting as support

292 is minor positive Gamma - acting as support

Final Take

Tomorrow is going to be a volatile day and it starts 1 hour prior to regular trading hours. It will set the course for the day and I highly suggest that you react to the key levels and develop your own trading plan to ensure you trade with the most R/R and manage your risk.

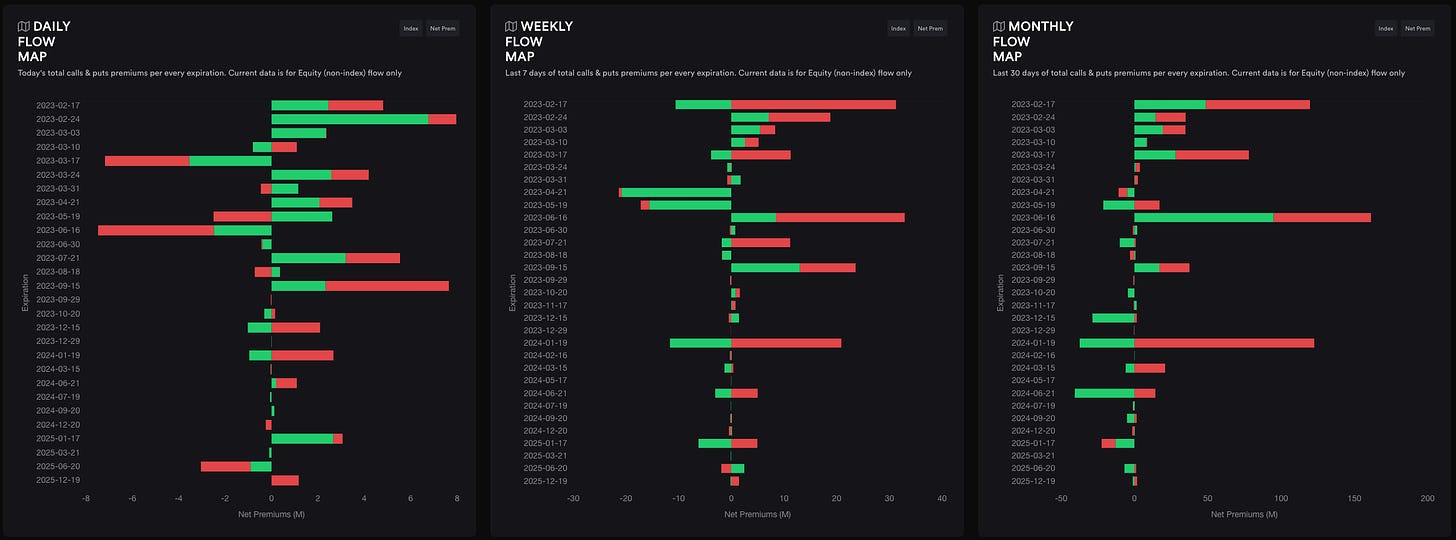

Below is an update on our options flow. Calls increased today, yet we are still leaning more heavily to the bearish side with put flows. Again, I find it difficult that money makers will pay all these put holders or the highest premium possible so my general lean is a cooler CPI print pushing price up, but hitting those max levels before a selloff the rest of the week.

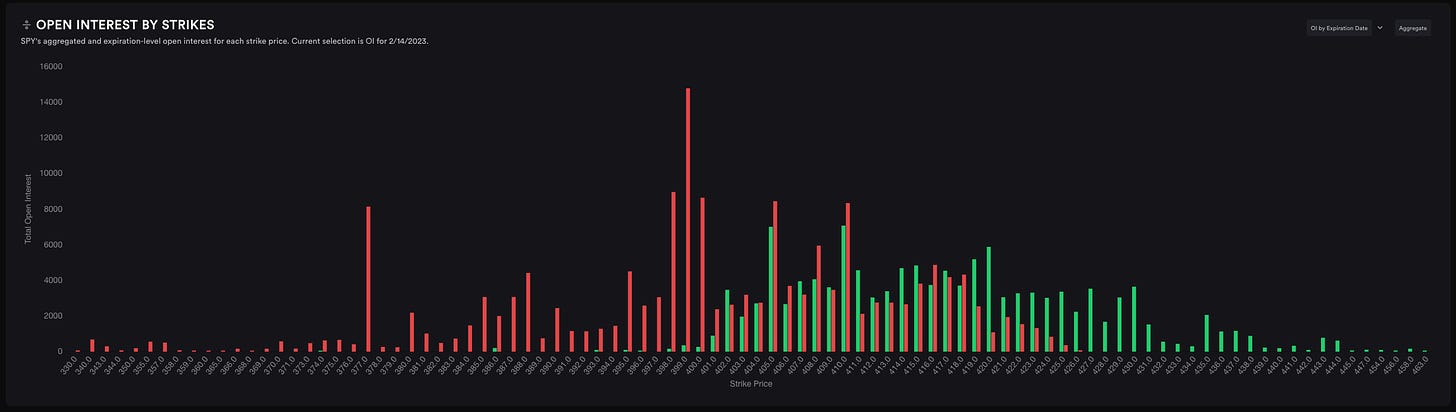

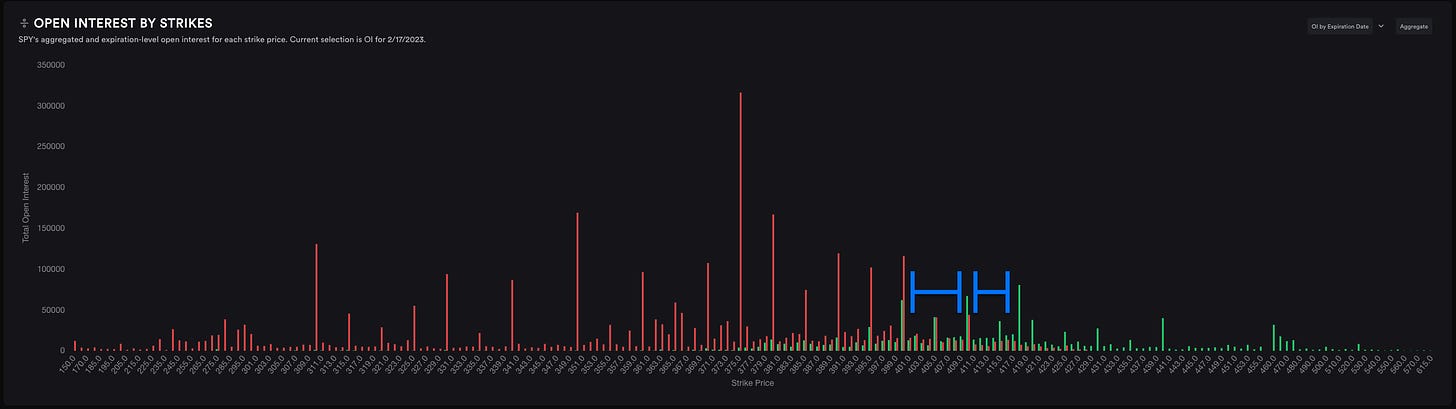

Here is a view of the OI held on tomorrow’s SPY 2/14 expiry options. Again leaning very bearish and money makers will want price to float higher towards 420 for the least amount of payout.

Similarly, if we take a look at the OI on the weekly, very heavily sided on puts. Most money makers will want the week to end somewhere between 410-401 or 411-418.

Stay #paytient and react to the key levels - no predictions! Good luck traders.

I am going to share my key rules to intraday trading in the end of the plan moving forward to build better habits and allowing you to grow as a better trader.

My Intraday Trading Rules

I do not trade within the first half hour UNLESS I am in a trade from the prior session and looking to close the trade or we have a major gap or a key level already broken - key level today would have been 4130 and 4150 and will explain below why these were important levels

I let the initial balance do its thing - I am just a small fish in a large ocean of traders so let's let them fight it out

I then wait for key levels targeting one level to the next and taking profits at each one.

If there are key levels that are 10pts apart that is when I have scalping mindset and anything above 10pts I want to give it the room to hit the price target with a 5 pt buffer to take profits once we reach within 5 pts of a target - I also tighten my stop loss once at 10-20% profit with the goal of never allowing trades to go red when I have a nice profit)

I supply options greeks with OB (order blocks) and FVG (fair value gaps) otherwise known as Smart Money Concepts

When I am scalping - ie targeting 10pt trade levels I will take profits and never go more than 10% red. Simple as that, know your trade plan strategy and the risk. When you are wrong you are wrong and reset

For 20pt trade level targets I will increase my stop losses to 20% and allow more of the trade to play in the event I entered too early

I try - key word try ha - avoid trading lunch hours defined as 12pm to 2 pm est. Money for the most part unless you are scalping - is made in the first 2 hours of the trading day and the last 2 hours

I always stick to two EMA’s on my chart and that’s the 10/50 EMA’s

When the 10ema is above 50ema we are bullish

When the 10ema is below the 50ema we are bearish

Go put these on your charts and when you view them on timeframes less than the daily timeframe you will see the power they provide

For scalpers out there the smaller timeframes provide great opportunities to scalp 5-10pt moves

There are more we could discuss including volume profile, low volume nodes that I think are great strategies to compliment option greeks. Maybe in the future we can include more details.

Trading is not for the unprepared. It is critical you abide to a strategy and checklist and walk into every trade with a plan. Without a plan you are simply gambling and have a better chance at the slot machines. There are more nuances to my weekly and daily checklists, but I think this provides a good read for now and we will/can continue adding to it.

To cover our basis…

Welcome to my Substack where I provide a daily SPX trading plan to help guide my intraday trading. The purpose of this letter is not to advice you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Tradytics and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.