SPY

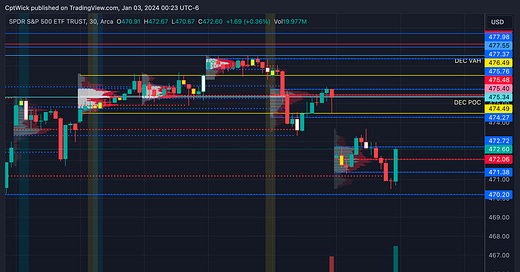

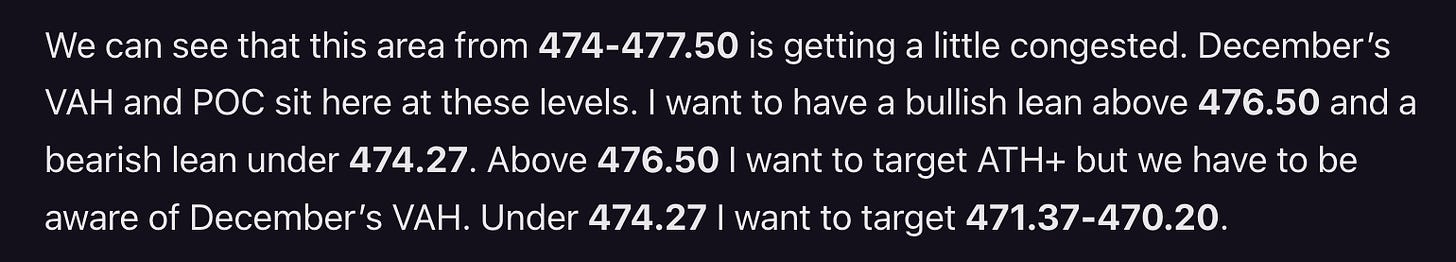

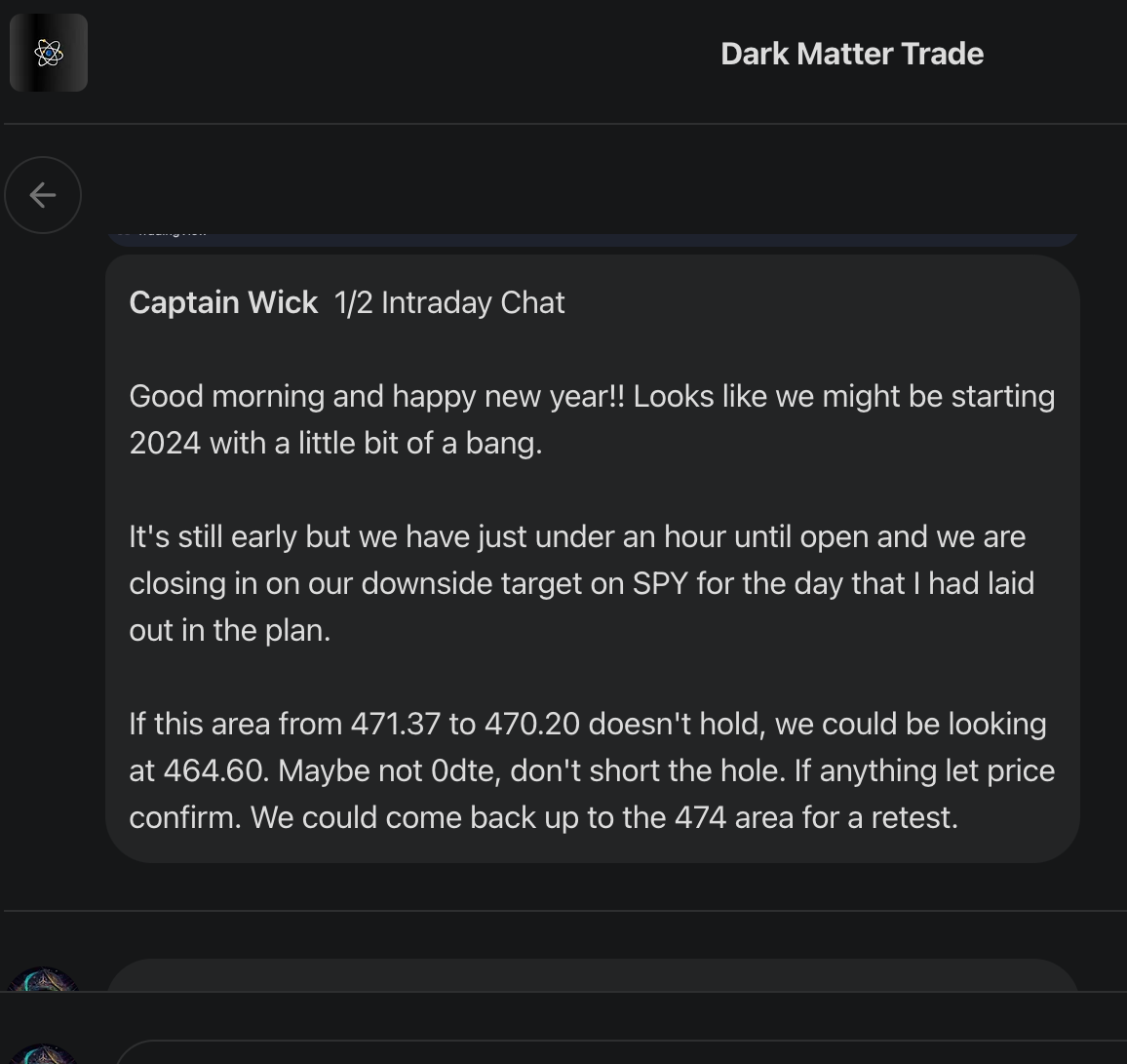

Yesterday’s levels were a success. I stated that I wanted to have a bearish lean under 474.27, we gapped under that at open and sold right down to my next key level at 471.37, in fact the initial balance low was 471.30. In the Substack chat I said this premarket.

The 471.37-470.20 is strong demand, therefore I wanted to wait for a push back into the 474 zone for a trip back down. Price ended up coming back to 473.67 before testing demand zone again towards the end of the day.

The bulls stepped back in right before price could get to 470.20. This level is still on watch.

Last week’s VAL sits at 474.49 and it is still untested. We gapped under it, and we are building value close to the VAL from two weeks ago. IF price comes back into 474.49, we need to make sure that it accepted before taking calls IMO. We also have December’s POC and VAH, I would look for this area to reject, or turn into support.

For tomorrow, above 472.72 I think we can make an attempt to see last week’s value area 474.49-476.49. If this area rejects it would confirm that we could head towards the 464 area. If it is accepted, we could see ATH’s. Under 470.20 I want to target 464.60. I think 468.50 could act as support and so could the lows from the week of 12/18 467.82.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.