Readers,

Apologies for the recent scarcity of updates; work commitments tied me up with year-end tasks. Fortunately, I anticipate a more open schedule in the upcoming months, allowing me to focus on both posting and trading and I am pretty excited about it!

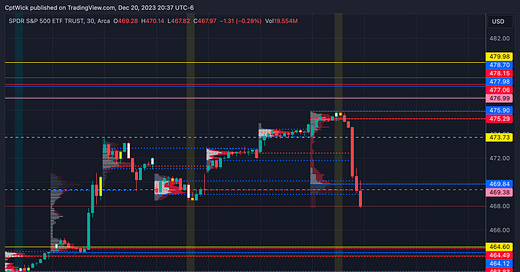

SPY

Today’s move was kind of impressive. Last week’s VAH was at 473.73. It was holding as support, we even rallied to almost 476 bouncing off this level. Late in the session we lost that value and headed back inside last week’s value area. We proceed to break and close under last week’s POC at 469.38. If we can stay under 469.38 I want to target 464.60 last week’s VAL. We have a lack of volume from about 470 to 474.

If price comes back into the 469.84 - 471, pay attention if we reject back under or if we are accepted. If we are accepted, we could run back up to 473.73-475.30. Above that we have one more weekly naked POC at 476.99. So if we can break and hold above that I think we see ATH’s.

If you’re bull here and want to find a spot to potentially buy the dip. I think a good spot could be the 464-462 zone. Under 464.60 the next weekly value level 458.43, basically where November’s VAH was at.

We are currently back inside December’s value area under the VAH at 469.64. The current POC is sitting at 456.14, meaning the most amount of volume has been traded at that level. Another way to look at it is this, majority of the participants this month got in or out at that level.

If we make our way to it. The bulls have to defend it. If we lost 454, the buyers above that level are now under water. Which could bring a retest of the Sep POC at 445.98.

With that being said, this 470 area is massive.

If you don’t hear from me again this week, I want you all the have a wonderful holiday!

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.