11/25 QQQ Weekly Plan

Free weekly plan this week! We are also running promocode for some BIG time savings! Read for more details!

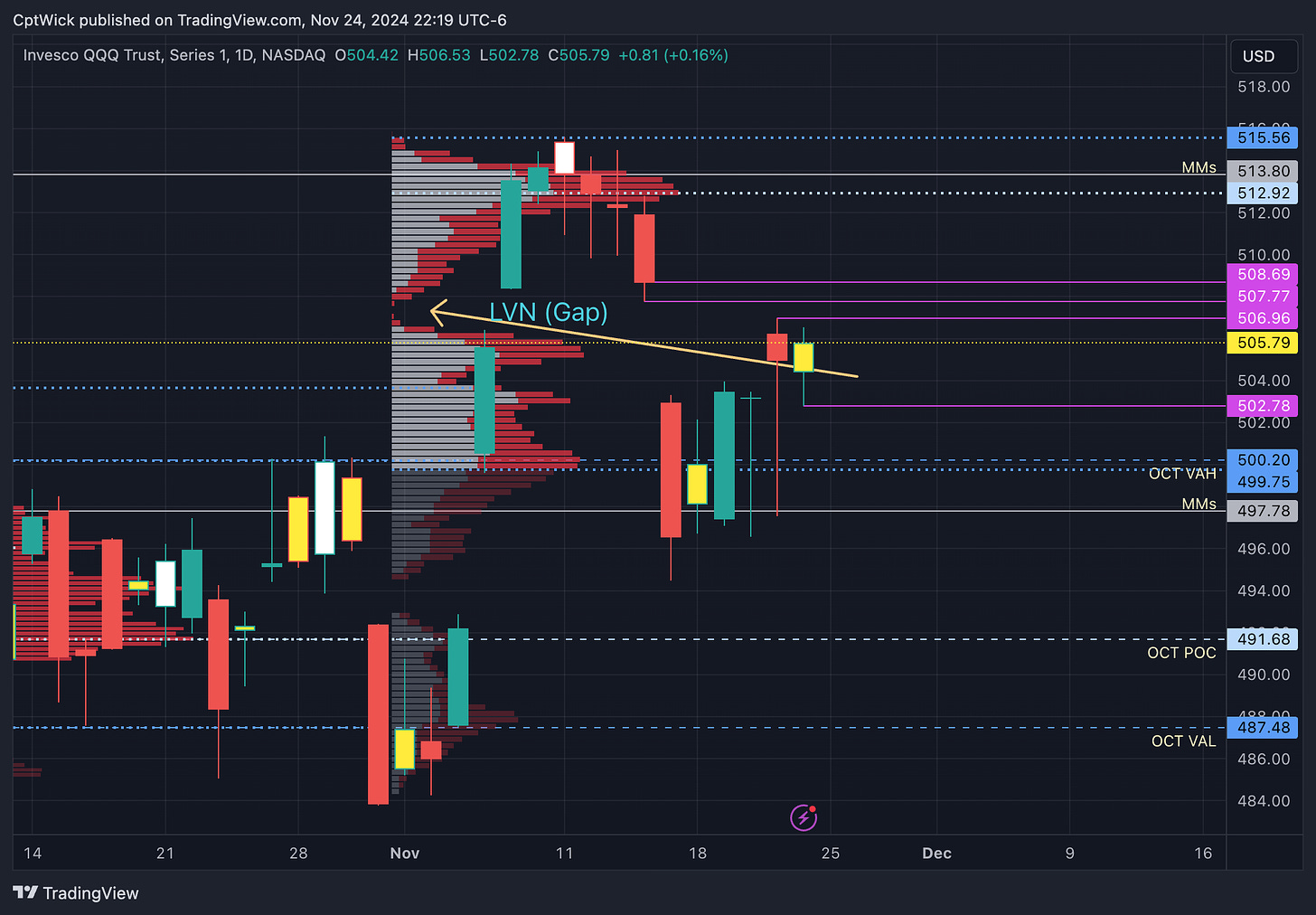

Key Support and Resistance Levels

Support Levels

506-505 depending on where the week opens, if we gap up, I want price to be supported around 505.

502.78, for me this is the most important level to the downside, this is Friday’s low and I think it opens the door down for a retest of last week’s lows around 497-496.

500 big psyche level, this strike also has significant delta exposure that will require hedging.

497.78 weekly MMs implied low.

494.49, this is the weekly low from 2 weeks ago, this is another MAJOR level. This can lead to 486-483 I will update if we head this way.

Resistance Levels

506.96, last week’s high, I think that if bulls can keep price above this level, they have a good shot of retesting the recent ATH.

507.77-508.69, this would be a gap fill to the upside. Currently this a pretty profound LVN which can act as strong resistance. The Gamma here is positive, which adds weight to its resistance. I would be very cautious around this area. If we reject here it could send us back to 500.

510, if price is then supported above the gap fill, this is the next area I would expect price to head to, I would even say 511.91-513.80.

The current November POC is at 512.92 and the MMs weekly implied high is at 513.80.

515.58 most recent ATH.

Market Makers' Weekly Implied Move

Implied Move: $8.01

Upper Range: 513.80

Lower Range: 497.78

Overview

Here is a look at the current monthly volume profile for November. Notice how price came right into the LVN where we have a gap in price. This price area is very important to both sides imo. So far the bears have kept the bulls out. The Friday session was also inside Thursday’s range. This tells me that traders are trapped and that usually causes a decent move, we ar e either going to break range and go, or we are going to break range and fail, leading to a retest of the other side. More on this later.

The 1W chart is inside the previous week as well, this is now setting up for a swing play imo since the weekly participates are now trapped. Last week’s high and low will play a critical role in the price action going forward.

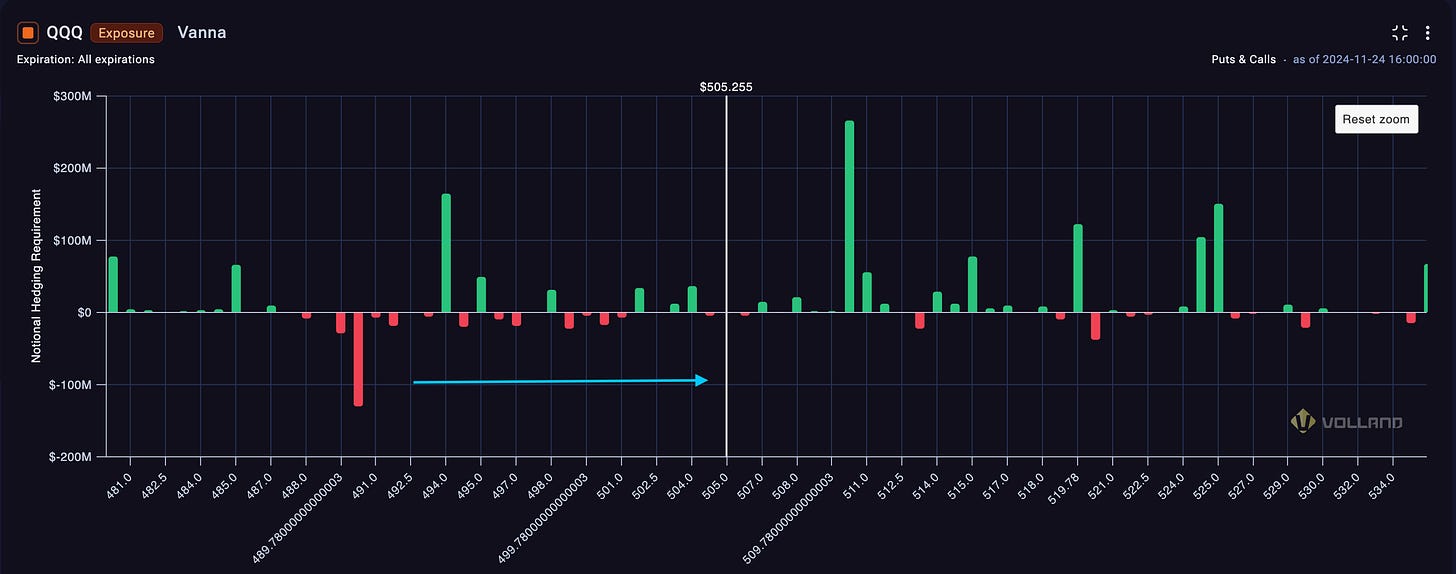

Aggregate Vanna

The current look is building some negative vanna below spot, I would expect dips to be bought if we dip down into the negative vanna. Above current spot price, we have a nice sized magnet sitting at the 510 strike.

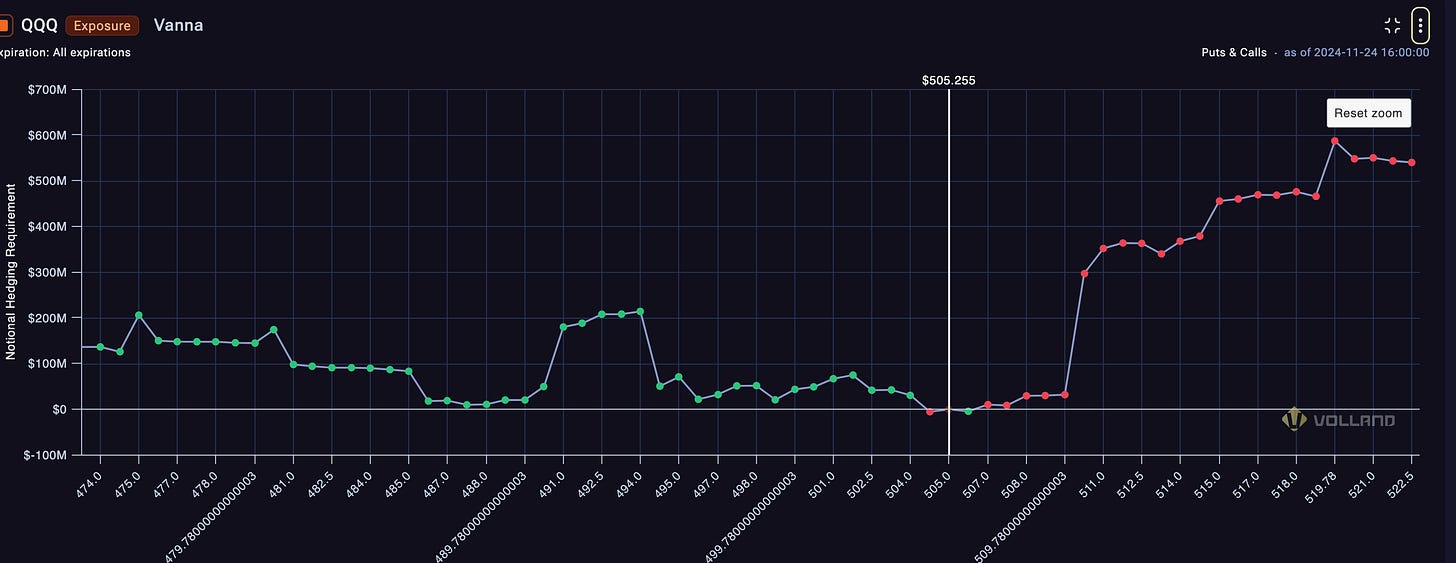

The cumulative chart is currently suggesting dips getting bought as we near 494, and 509-510 is where I would expect some sellers.

With code DMLIVE200 you can get $200 off Volland Live for 3 months! Coupon is good through Cyber Monday, 12/2 at 11:59 p.m. Eastern

With code DMLIVE200 you can get $200 off Volland Live for 3 months! Coupon is good through Cyber Monday, 12/2 at 11:59 p.m. Eastern

With code DMLIVE200 you can get $200 off Volland Live for 3 months! Coupon is good through Cyber Monday, 12/2 at 11:59 p.m. Eastern

With code DMLIVE200 you can get $200 off Volland Live for 3 months! Coupon is good through Cyber Monday, 12/2 at 11:59 p.m. Eastern

Seriously! I have not seen Volland offer these kind of savings! If you have been on the fence about testing out this service. NOW IS THE TIME!

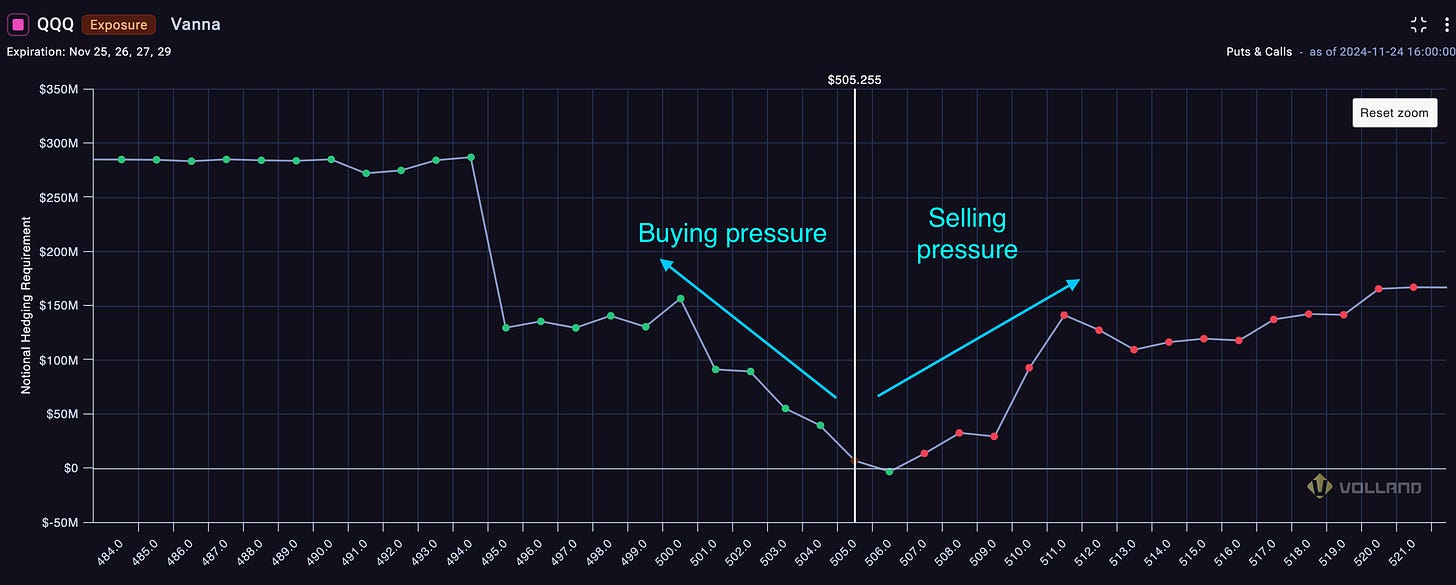

Weekly Vanna

This week is a short week and we are coming off a previous inside week. Meaning we have trapped traders and possibly some potential to find a multi week trend.

Key Strikes

Above - 506, 509, 512, 513

Below - 502, 501, 499, 497, 494

Here is a 1W on NQ, notice the gap up above last week’s highs, 20,905 - 20,875. I want to see bulls hold this area, if they do, I am expecting a retest of 21,250, but if we fail here under 20,875, I think we will go and test last week’s lows, first at 20,504 then 20,380.

Looking at QQQ, if we gap above last week’s high at 506.96, I think that it is imperative that the bulls then hold that level if we dip. If they cannot hold it, I want to target the lower side of the range at 496.56 - 494.49.

This jives with what vanna is saying for the key levels. If we can stay above the negative vanna at 506, I am expecting a move to 509–510 first, and then a possible retest of recent highs 513-516.

The cumulative weekly vanna chart is suggesting dips being bought into 500 and rallies sold into 509-511.

The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

If you want updates for this plan as the week unfolds. I would love to see you in the Volland discord! If you join, please say hello! Don’t be shy!

USE PROMO CODE: DARKMATTER10 for 10% off your first month!

IF you are interested in some BIG time savings and you want to test out Volland Live for 3 months.

With code DMLIVE200 you can get $200 off Volland Live for 3 months! Coupon is good through Cyber Monday, 12/2 at 11:59 p.m. Eastern