SPY

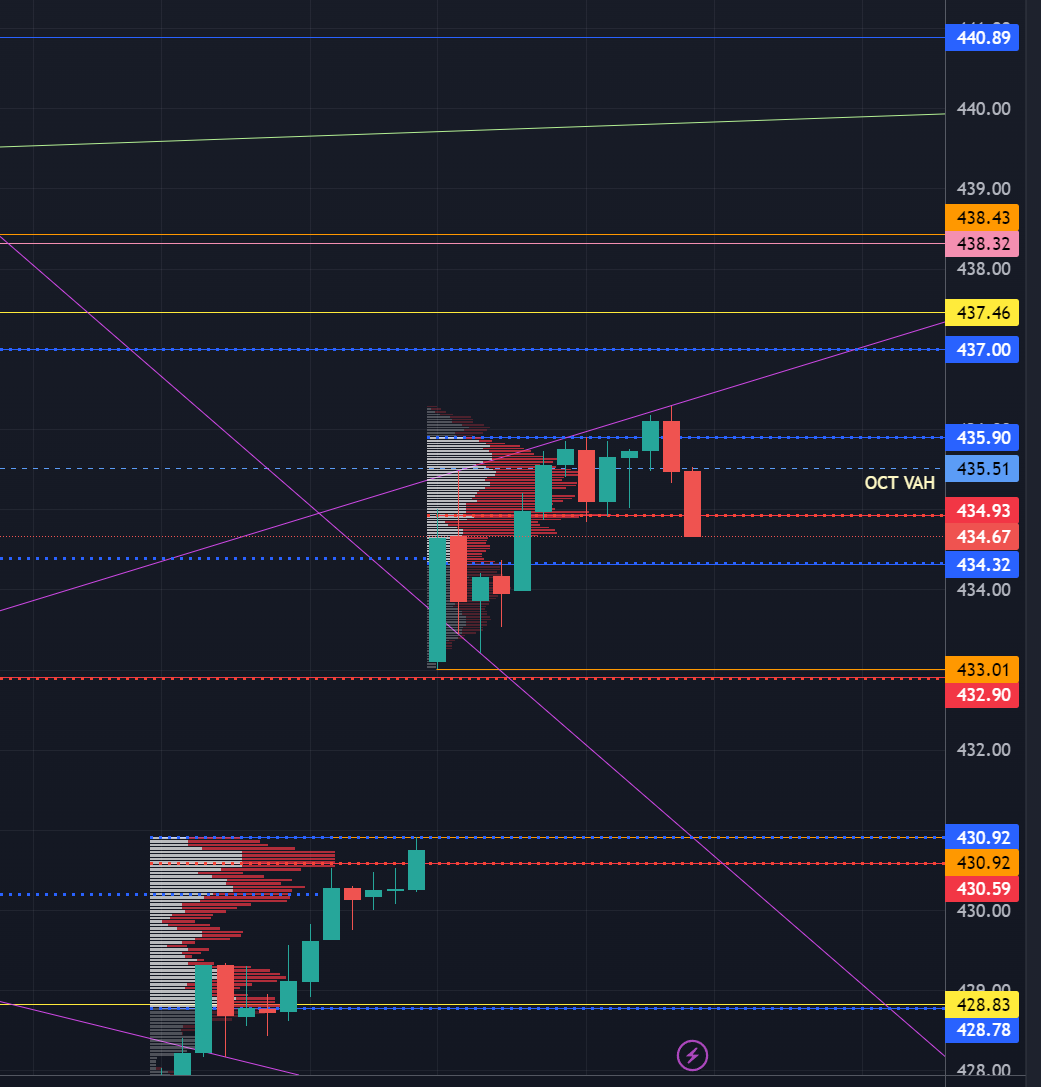

The MMs are expecting a move of $6.49 for this week. Giving us an upper range of 441.18 and a lower range of 428.20.

Last week we closed way outside of the MMs weekly expected move with some help from Mr. Powell. The weekly expected high last week was 420.47.

Can you believe that price fully rotated through October’s value area in just three sessions. This price action created some nice gaps we can target if price decides it wants to come down.

Last week’s VAH sits at 428.83, POC at 415.71, and VAL 412.22. We have one gap fill up at 438.43 and then the next fill above is at, 447.48.

Gaps to the downside are at 433.01-430.92 and at 426.58-423.50.

My plan is to see where we open, new weekly candle, new participants, let’s see what they do. Hypothetically, let’s say we open right where we closed on the week, 434.69.

First thing I noticed is, we attempted to close above October’s VAH but failed and got sucked back under. We are also very close to these upside targets that we were talking about a few weeks ago, 437-438.43. I think we if we can hold above 435 we can probably break through this and go and see 440+. This area coming up has been defended so far by the bears. If it breaks it can lead to more upside, and now the bears are looking weak.

Last week was hard, I only placed two trades last week both losers. I have rules and going long in that situation went against my rules. I missed it, but I don’t have fomo because of it.

Now, if we can come back to maybe the 431-428 level and find aggressive buyers there, that could be a bullish scenario I could get behind. Under 428.75, I want to target the gap at 426.58-423.50. If this gap cannot hold, I would be targeting 415-407.77.

Above 440 I want to target 443.55-446 (September’s POC).

For me personally, if we gap up, I am not interested in chasing calls.

SPX (US500)

On SPX I think that above 4380-4400 we will see 4450+. That area up there at 4453-4485 is a big area. I would expect sellers to be present there.

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.