Traders,

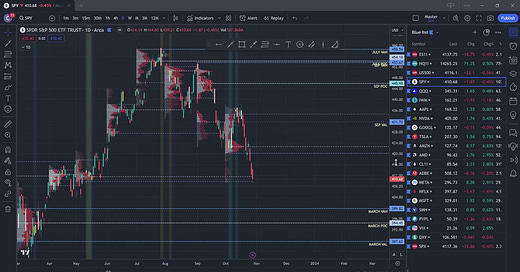

SPY

We have two trading sessions left in the month of October and it is pretty apparent who is in control. This week the MMs are expecting a range of $9.79. Giving us an upper range of 420.47 and a lower range of 400.89.

Last week we took out May’s POC and VAL, we are currently at a monthly imbalance to the downside, do we seek value back under 400? Or back up into Oct/Sept’s value area? We will have to see what happens.

On the weekly profile, our next big support levels come in at 407.77 and 403.54. Bulls need to defend these levels if they want to push back up into 412+. I think that if you are a bull here you want to see these levels trade before 411.55-422.17 (last week’s value area). I think a dip first could be bullish.

SPX (US500)

Very similar to SPY. We took out May’s POC and VAL and now we are sitting here with a monthly imbalance down, do we see 4000 before we see 4200 again? Or do we test 4200 first?

The key level for me to the upside is going to be 4161.9, last week’s VAL. If bulls can reclaim this level, we could run back up to the POC/VAH 4233-4255. A rejection could bring 4064-4033. The next weekly naked POC sits at 3982.3.

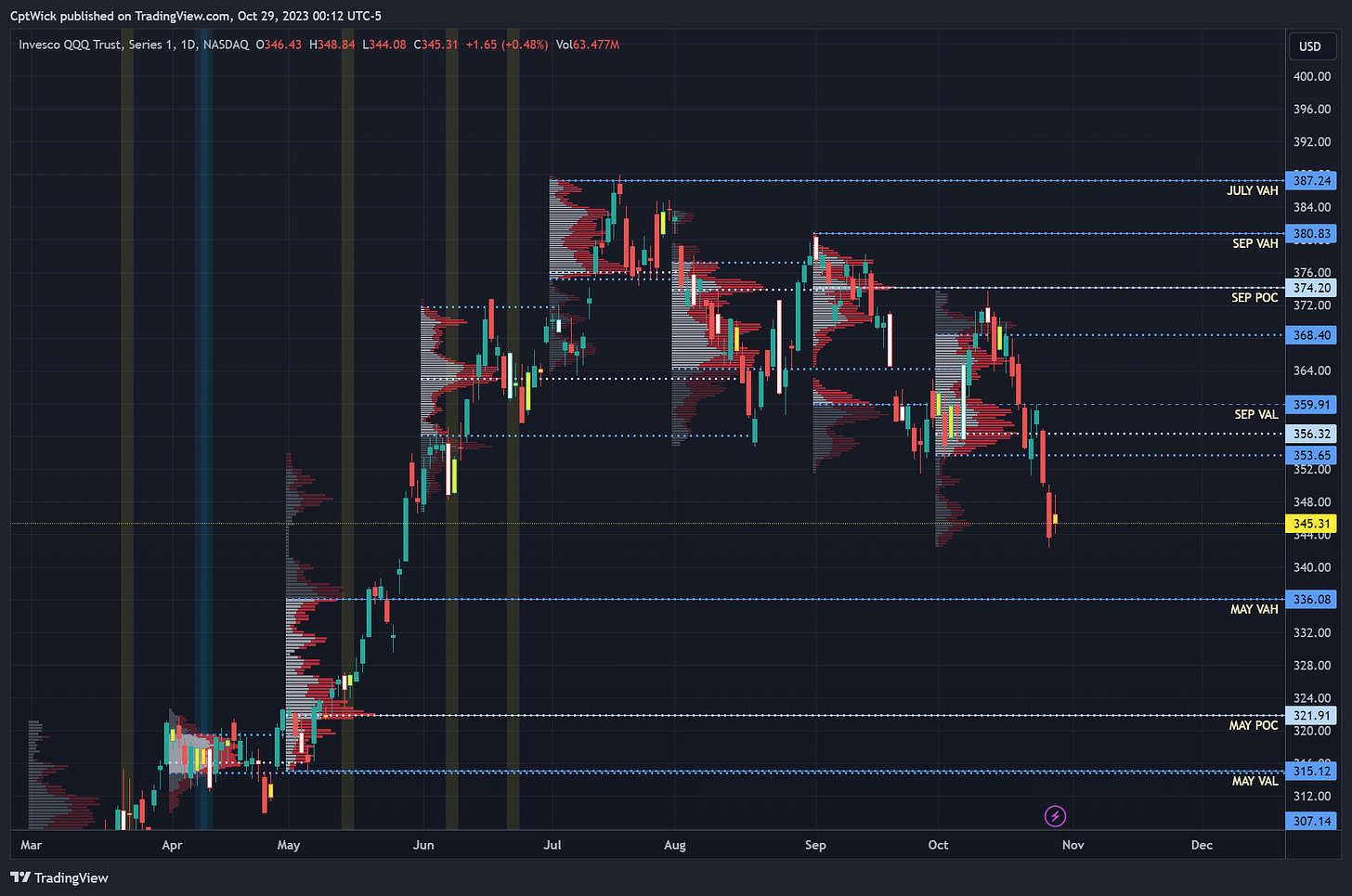

QQQ

Again, with two sessions left we are sitting at a monthly imbalance down. 336.08 is the next major support level. If we lose it, 321.91-315.12 would be next.

Bulls need to maintain above 345.07 at a chance to test 354.47. Under 341.17 I would expect to see 337.73 and May’s VAH 336.08. Under this we can go to 331.13-328.52.

Above 354.47 I think we could possibly get back to the 360-362 level.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

Share this post