Traders,

Everything looks and feels bearish. Let’s not get too biased, trade price! I will go over the potential scenarios, and I’ll give you the levels that I am watching to determine my bias for my trade plan.

SPY

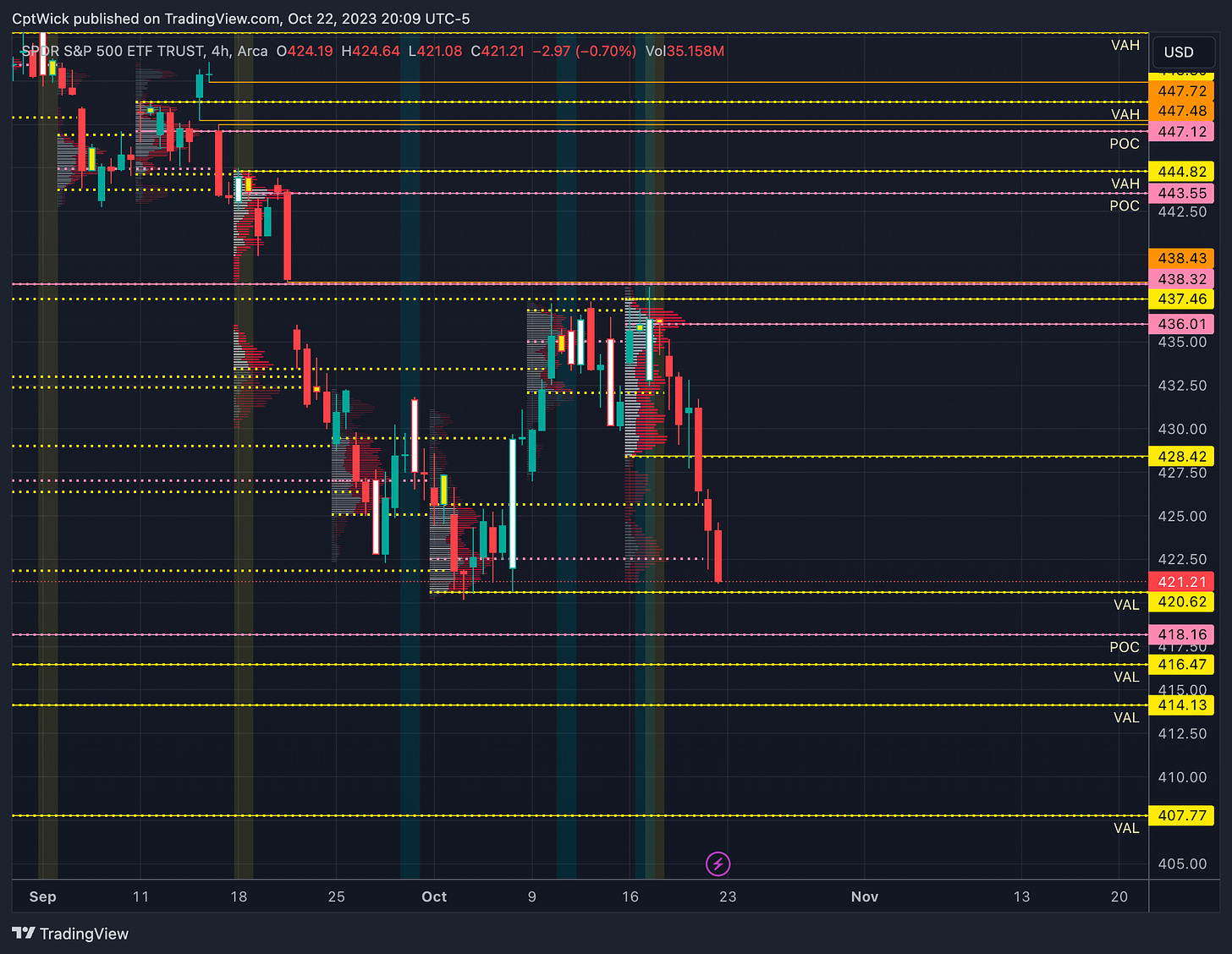

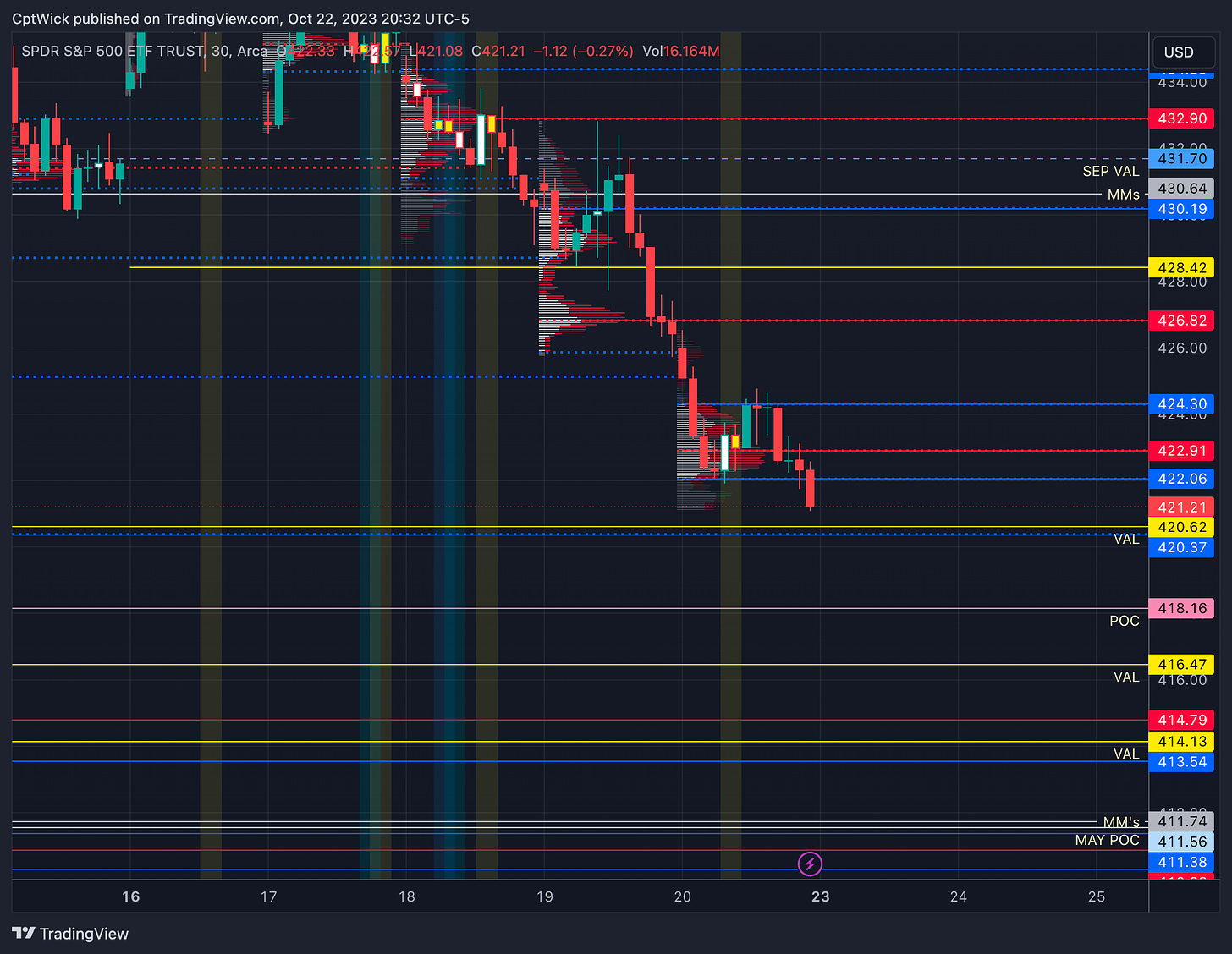

First things first, the MMs weekly expected range is $9.45. Giving us an upper range of 430.64 and a lower range of 411.74.

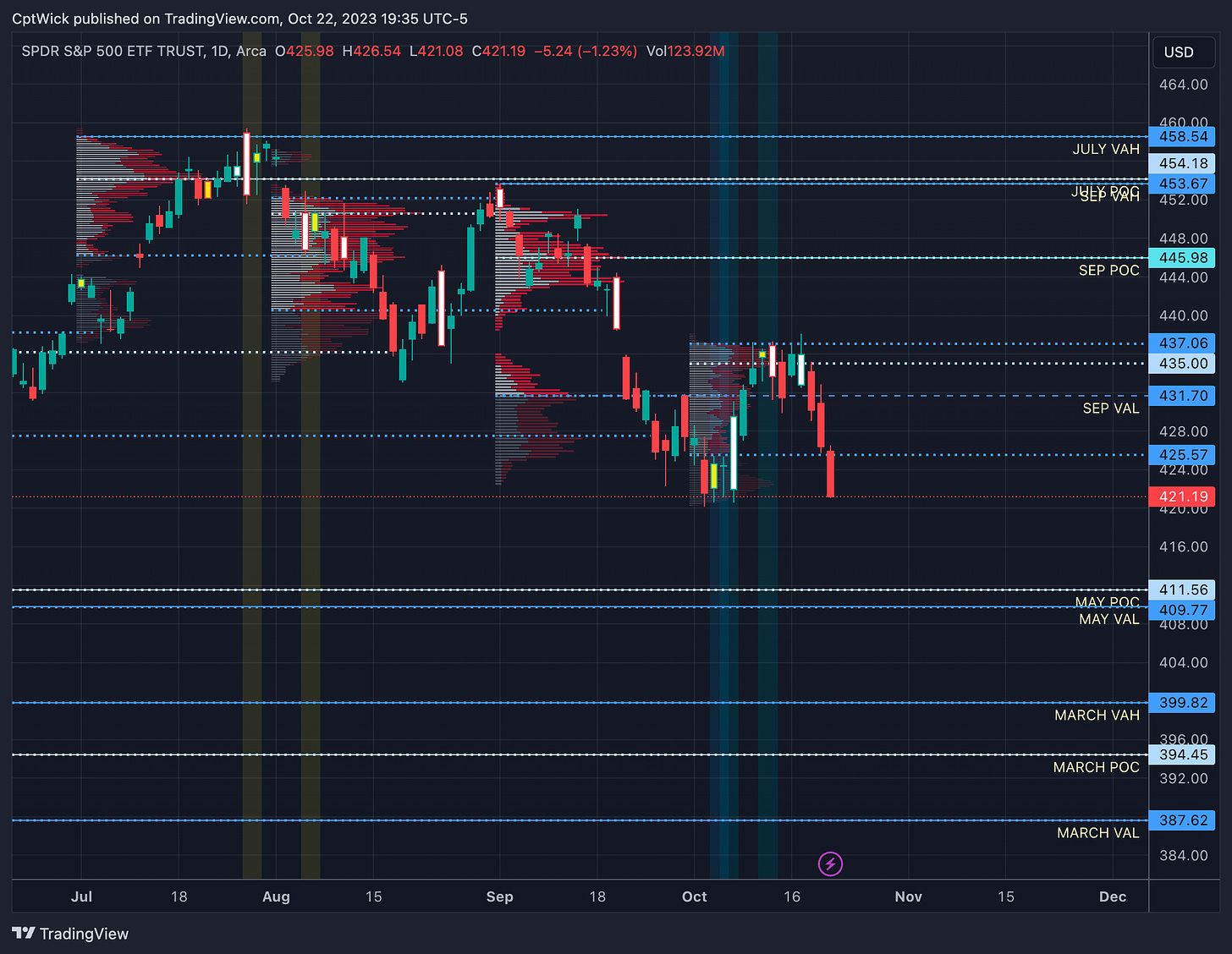

Complete rejection of September’s value area under 431.70, are we headed for May’s POC and VAL at 411.56-409.77? The MMs think it’s possible this week. Bulls, you need to take back 425.50 with VOLUME, but ultimately for me to get really serious about being a bull into end of year, I need to see some movement above 438. (more on that later)

IF we keep selling off here, I think we might see some intrady/intermediate support somewhere from 420.62 to 414.13. Big demand zone here. Last week’s value area is from 428.42 to 437.46. We could have a nice run up if price accepts back above the VAL at 428.42.

THE biggest level to the upside that you need to be aware of is 426.62, what is it? It’s the Quarterly and Monthly open, its BIG. Under that level we can keep a pretty strong bearish bias. If the bulls can reclaim that level and hold with volume, they can regain control.

Tomorrow, If price can get above 424.30 I think we can take a stab at the monthly open/naked POC sitting at 426.82. Last week’s VAL is 428.42, if bulls can hold above that level we can target 430-433 (not 0dte).

Under 420.37 target 418.16-416.47 then 414.80.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

Share this post