Traders,

We are going to use this page for plays that we think have high probability setups. These plays are going to be on names with high liquidity, and more specifically, liquid options. So more than likely the names that I choose are going to be big caps such as AAPL, TSLA, NVDA, MSFT, NFLX, AMD, META, etc. I will also sprinkle in some SPY and QQQ.

Thank you for being a part of this journey with us! If you have any questions don’t be afraid to reach out. I will have a video being posted within the next 48 hours that is full of educational content on this strategy that will be used in this trade plan. With that being said, lets jump in.

—QQQ—

The names that I will be covering this week are mostly if not all tech stocks, so it only makes sense to start with QQQ.

—Overview—

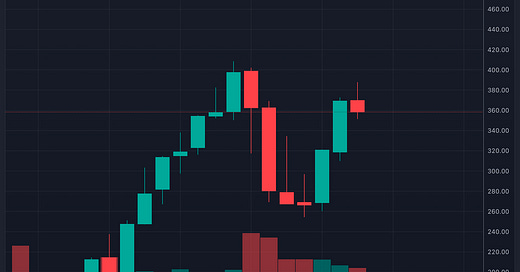

I want you to look at this chart on QQQ with nothing on it, what does it tell us? We have a new candle starting tomorrow and that candle will take us all the way into the new year. It appears the sellers are showing back up, but let’s break it down.

Notice that back in January 22, we had a big spike in selling volume paired with big red candles. We have since corrected but notice the rally volume that started in October 22/January 23 it has been declining. I want you to mark the above levels on your chart and keep them on there for the duration of the quarter. These levels are going to be extremely important going forward and I will continue to come back to these levels as we push on. The are the quarterly high, low, open, and close.

High = 387.98 Low = 300.89 Open = 370.07 Close = 358.27

We also want to mark the previous quarter’s open and low. The reason I only want to know the open and low is because the previous close and high were already breached.

Open = 318.77 Low = 309.89

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.