Traders,

I want to share some thoughts that I have on a few other tickers. I won’t get into heavy detail like my SPY analysis, this will be more for intraday trading and possibly small swings.

QQQ

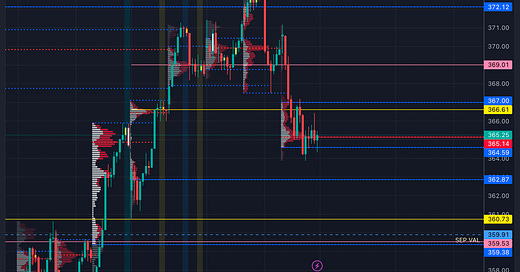

The important thing to note on QQQ is that its very similar to SPY in that it closed under last week’s value area and it’s a P like profile. So ideally, we want to come back up above 366.61 and either accept to go higher or reject to get the party started to the downside.

Key levels to note, 1. Tomorrow’s open (mark it on your chart) 2. Last week’s low 360.78 and 3. The quarterly open at 358.54.

This is the setup I am most interested in, we can and will play the upside if that setup presents itself, but I think if the selling picks up this week it can be the easier play.

The other tickers I am going to share also have very similar setups (keep that in mind).

So, I am looking for price to come back into last week’s value area and reject. If price rejects my first area of entry to the downside is going to be this week’s open. Let’s say we open at 367, and we then push up to 370, if we come back down and lose the open (in this example its 367), I will want to target puts to last week’s low at 360.78. If we break that level, I want to target the quarterly open at 358.54, if the bulls lose that level the pressure is now on. Everyone that bought above the October open is now under water. The next target would be 353.28. (This scenario might take a few days to complete, it will not do this in one day)

For tomorrow my plan is this,

Friday’s session was a b (weak sellers); therefore, I want to see if we can push out of 367. Above 367 target 369 then 372. Last week’s POC is 369, this is a heavy volume level, above it we can see 373.50 last week’s VAH.

Under 366.61, I want to target 365.14-364.59 then 360.73.

If I see something happening in real time, I will put it in the session chat.

AMZN

Keep reading with a 7-day free trial

Subscribe to Dark Matter Trade to keep reading this post and get 7 days of free access to the full post archives.