Traders,

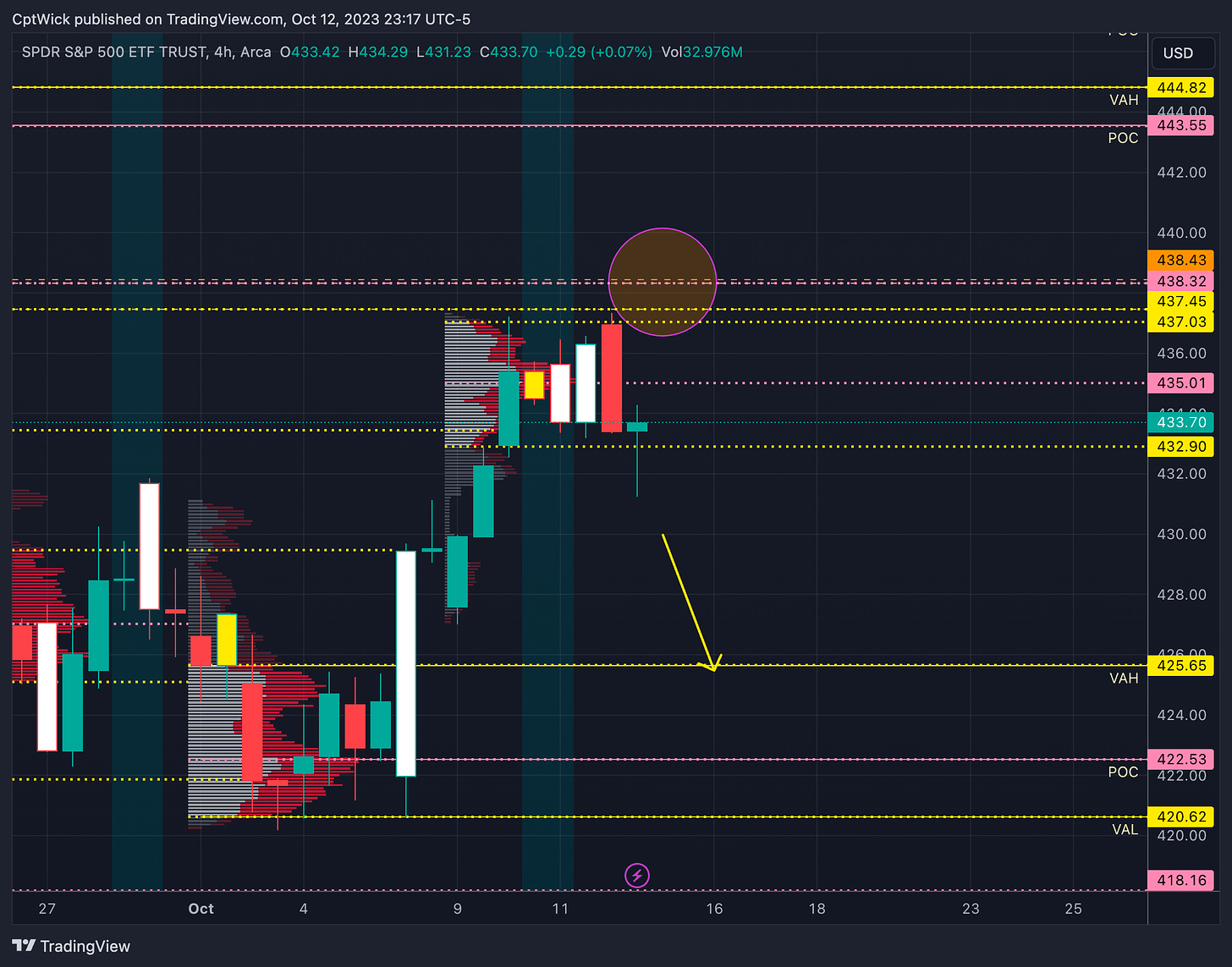

The 10/12 session was really good to us, we got the move to the downside that we were expecting. I said that if the bulls could not push past 438.43, we could fall back to September’s VAL at 431.70. Some of those puts went 1000%+. We knew about the premarket news, and during the PM session they failed to push above 438.43. I also stressed the importance of the open up at 436.95 and pushed up just shy of that weekly VAL at 437.45 (we did hit it in the PM session so I will keep it on my chart, I’ll just dash it out because its technically still naked during the RTH).

Bulls have to push up above the circle, above 438.43, if it happens tomorrow, I think we can maybe have a nice rally and it could be impressive. If they can’t, I expect 425.65 and possibly lower to trade soon.

If we lose 431.23 there is a chance that we could test the weekly open at 427.58, the bulls need to push price back above 435.69 and hold and I think we go and test the 437-438 area. If they can breakout from there, we can rally to 440.89 > 443.55. Under 427.58 it can get nasty and nasty fast. I would expect 425.65 - 425.13 to follow then 422.53.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.