Readers,

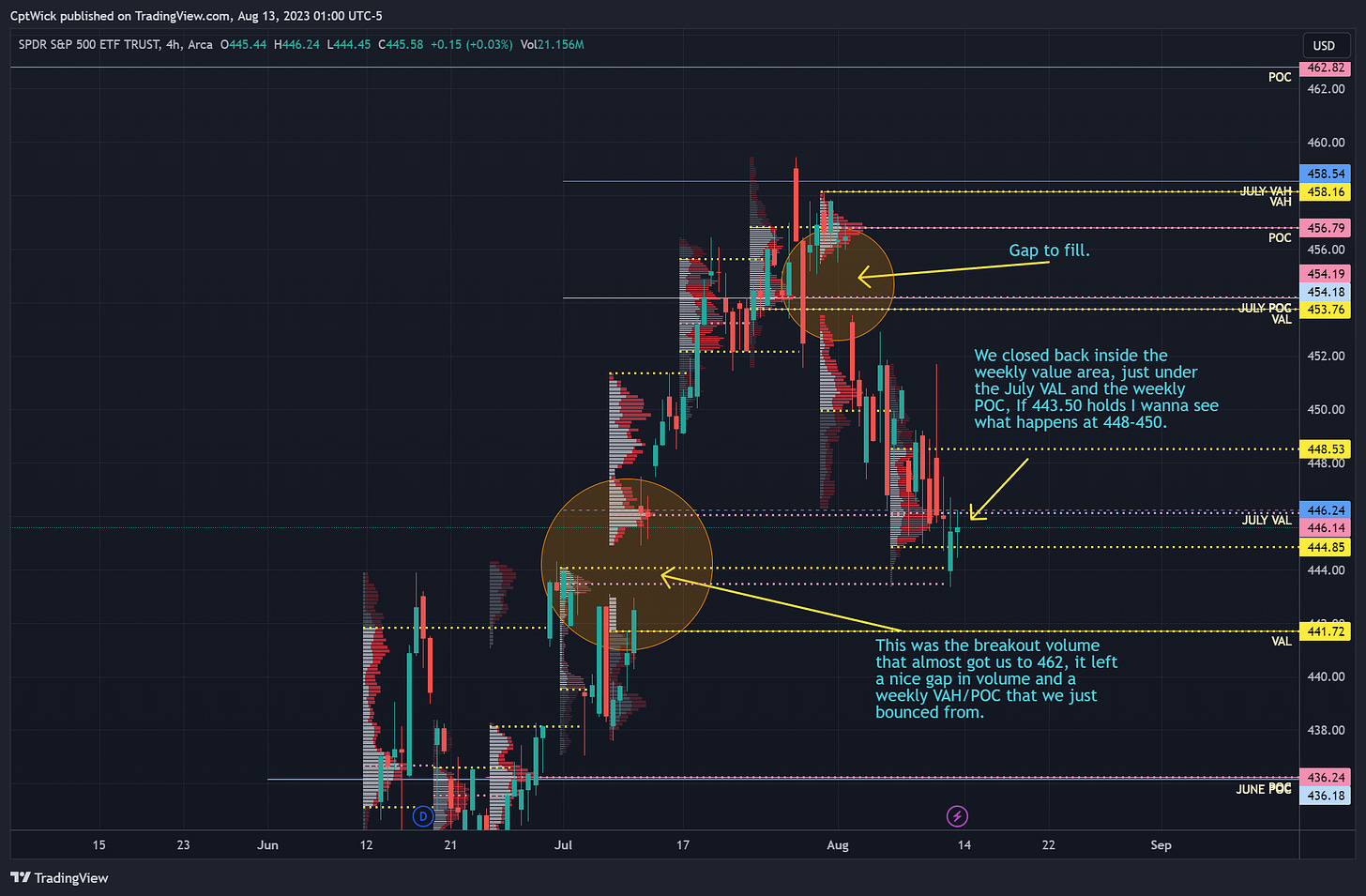

We got there! We have been asking for 444.08-443.48 for 2 weeks now and we finally got there on Friday. Last week I said this,

I still think that we could potentially have a nice rally early in the week, but we have to be careful because this week we have; Vixperation and FOMC Minutes. This could cause some weakness in the markets.

Market Makers (MMs) Weekly Expected Range

The MMs are expecting a weekly move in SPY of 6.67 this week.

452.32 High

438.98 Low

Monthly Volume Profile Levels

Current Value Area

450.30 Value Area High (VAH)

445.92 Point of Control (POC)

445.29 Value Area Low (VAL)

July’s Value Area

458.54 VAH

454.18 POC

446.24 VAL (Breached)

Notable Naked Levels

411.56 May POC

409.77 May VAL

On the monthly profile our current values all shifted down, which makes sense as price came down this past week. We closed on Friday within the current value area but below July’s VAL. If the bulls can maintain above 446.24, I think they can maybe push us back into 450-454.18. Either way, once we leave 445-446, we should have a nice move in that direction, up or down.

Weekly Volume Profile Levels

Last Week's Levels

448.53 VAH

446.18 POC

444.85 VAL

Notable Naked Levels

467.89 VAH

462.82 POC

454.19 POC

453.76 VAL

441.72 VAL

436.24 POC

432.37 VAL

The weekly profile moved down as well but it seems as if we caught support at the recent breakout level of 444 that sent us almost to 460. Will price go to 462? The answer is, I don’t know, I have no idea, I can only trade what the market gives me. As long as price stays above 444, I want to target those levels at 453.76-462 obviously knowing that we won’t go in a straight line. I will keep you guys updated via X on what happens throughout the week.

If price falls under 443.50, I think we see that naked VAL sitting at 441.72 with the potential to get nasty underneath.

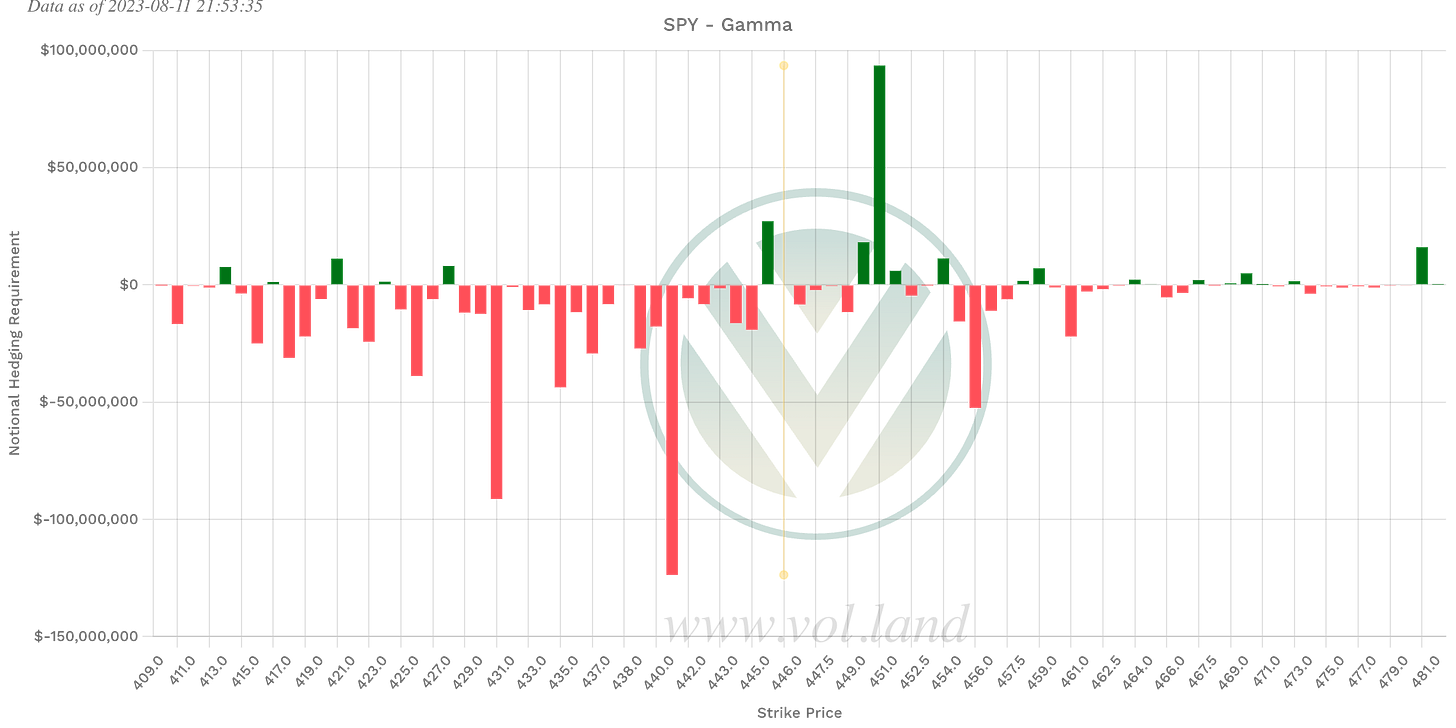

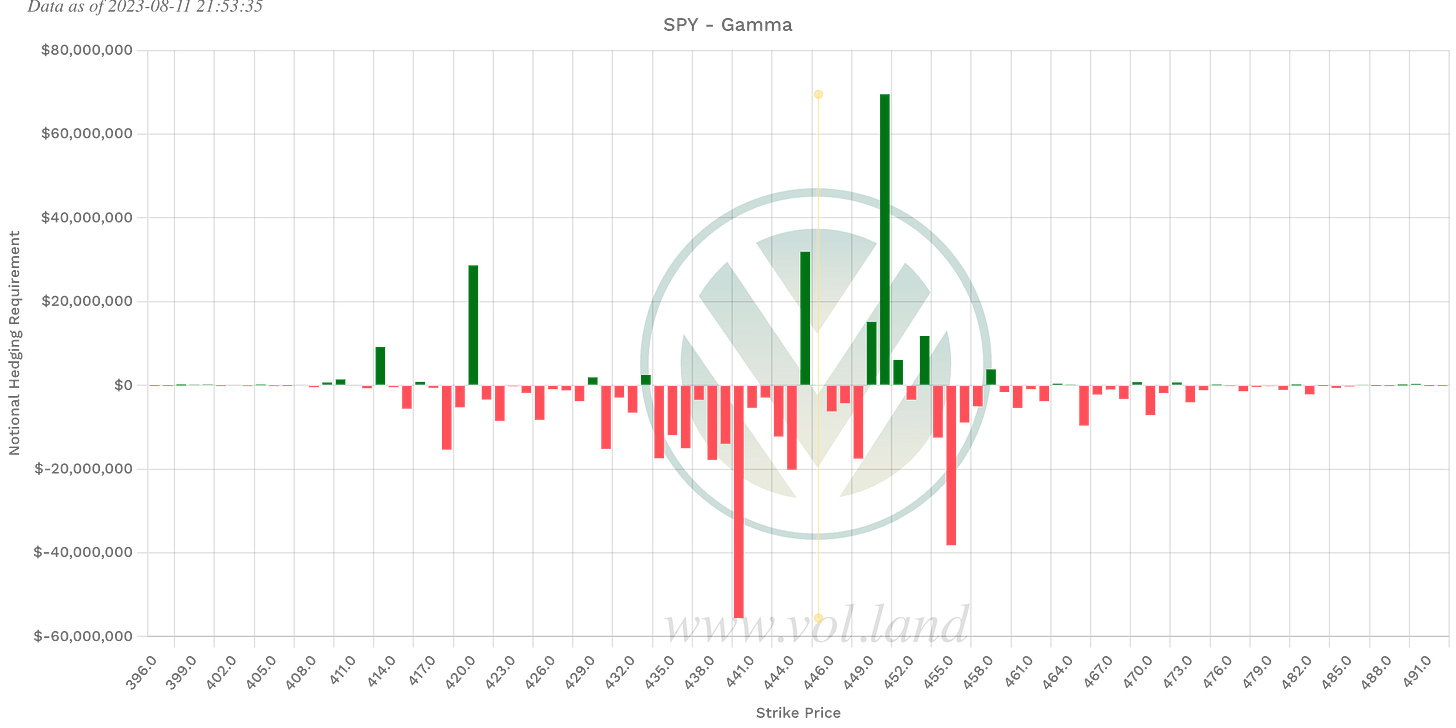

Positive Gamma

Aggregate

427, 445, 449, 450, 451, 453, 455, 458

This week

420, 433, 445, 449-451, 453, 458

My initial thoughts after seeing Gamma, it seems as if 445 has to hold or it can get ugly. The next positive gamma level is at 433, dealers might want to keep price above and take a shot at the 450 level.

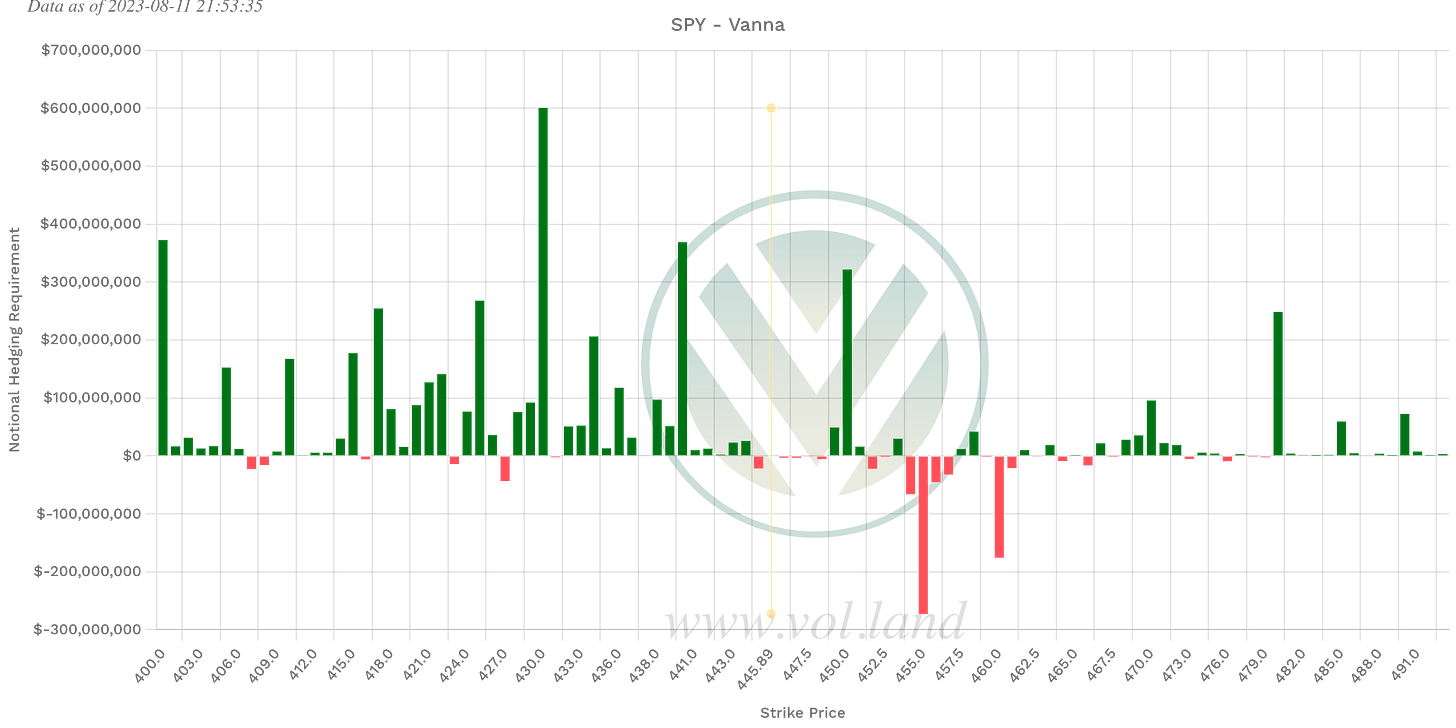

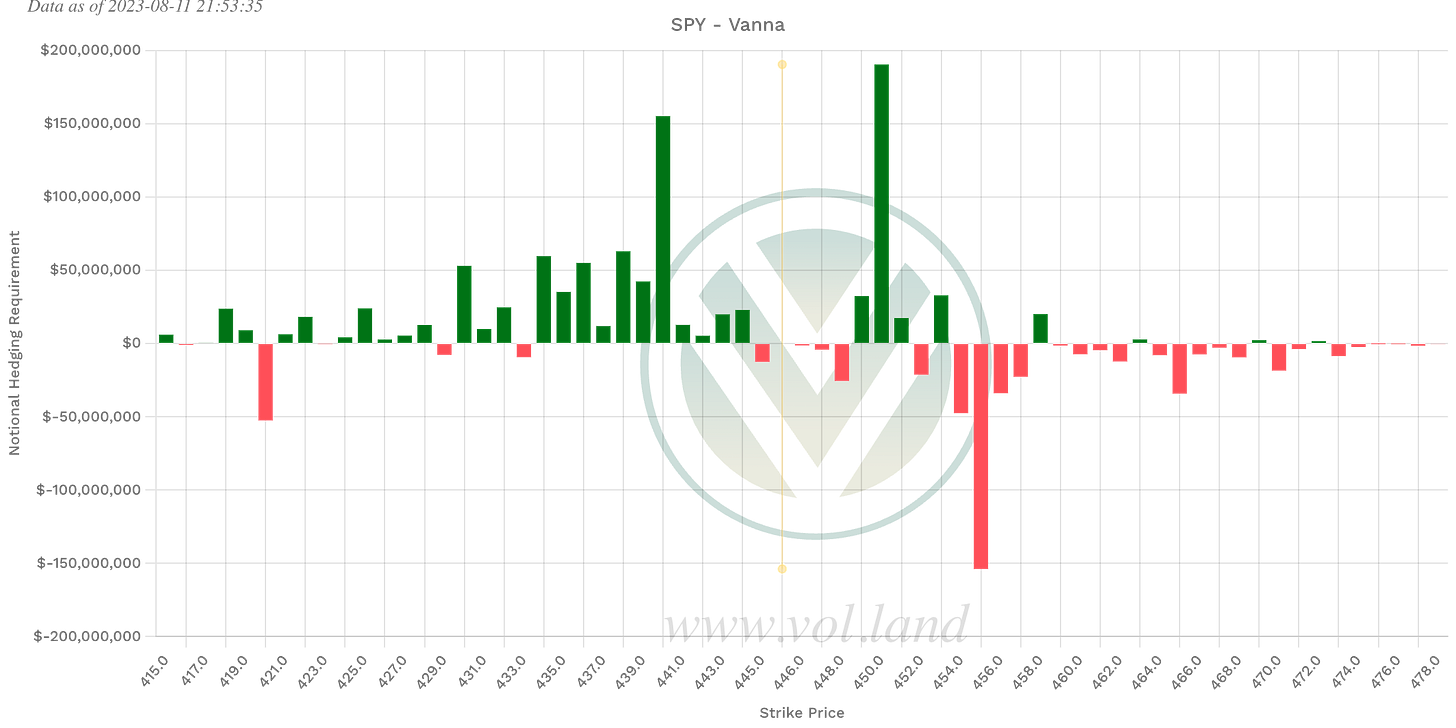

Negative Vanna

Aggregate

427, 445, 452, 454-457, 460, 461

This week

420, 429, 433, 445, 447, 448, 452, 454-457+

After mowing it all over I still think there could be some more upside potential. Although I think the bears have a good case to send this down if they want to. I think that 444-443 level is important, under 443 I wanna see what happens at 441.50-440, I think under that the selloff could get a little out of hand.

Keep an eye on volatility. If VIX gets going we can have some wild swings kinda like last week where it feels like the market as a whole is going nowhere but if you trade your levels, it can be very profitable. Stay safe out there.

Happy Trading,

—WICK—

To cover our basis…

Welcome to my Substack where I provide a daily SPY trading plan to help guide my intraday trading. The purpose of this letter is not to advise you on your trading or investment decisions. I am simply documenting my daily trading plan for myself to help with planning and execution. These are simply my opinions and the data sourced from the likes of vol.land, TradingView, Quantdata.us and others. The stock market is risky, gains are not guaranteed. This is not about getting rich quick, but learn to educate yourself and make the necessary financial decisions on your own. This is not financial advice.

Hey man, My name is Erick Salgado, I am the CEO of Griffin Bank in Brazil, I would like to talk to you about a possible partnership. If you have 5 minutes to talk about business, please send me an email to contato@griffinbank.com.br and we can schedule a quick call... looking forward to talk to you!